Strategic Frameworks: The Definitive Guide for Consultants and Strategists

Master 30+ strategic frameworks across competitive analysis, problem diagnosis, prioritization, strategic planning, and execution with real consulting examples.

Strategic frameworks are the operating system of management consulting. As McKinsey's problem-solving methodology demonstrates, they turn ambiguous business problems into structured analyses that lead to defensible recommendations. Whether you are diagnosing why profitability declined, evaluating a market entry, or deciding which initiatives to fund, the right framework determines whether your analysis is comprehensive or riddled with gaps.

After applying these frameworks across 150+ strategy engagements, due diligence projects, and transformation programs at McKinsey and Deloitte, we have identified a consistent pattern: the consultants who deliver the sharpest recommendations are not the ones who know the most frameworks. They are the ones who pick the right 2-3 strategic frameworks for the specific question and populate them with data precise enough to drive a decision.

This guide covers 30+ strategic frameworks organized by the type of question they answer. Each section explains when a framework applies, where it falls short, and links to detailed companion guides with worked examples. For the presentation methodology that ties these frameworks together on slides -- pyramid structure, MECE logic, action titles -- see our Consulting Presentations Guide.

Key Takeaways:

- Match framework to question -- diagnostic frameworks first, directional frameworks second, prioritization frameworks third

- 2-4 frameworks per strategy project -- more signals a lack of focus, not thoroughness

- Populate with specifics -- "Strong brand" is a placeholder; "72% aided recall, 15pts above nearest competitor" is analysis

- Frameworks are tools, not deliverables -- the recommendation matters, the framework is the vehicle

- Sequence matters -- understand the current state before proposing the future state

- Test with MECE logic -- every framework's categories must be mutually exclusive and collectively exhaustive

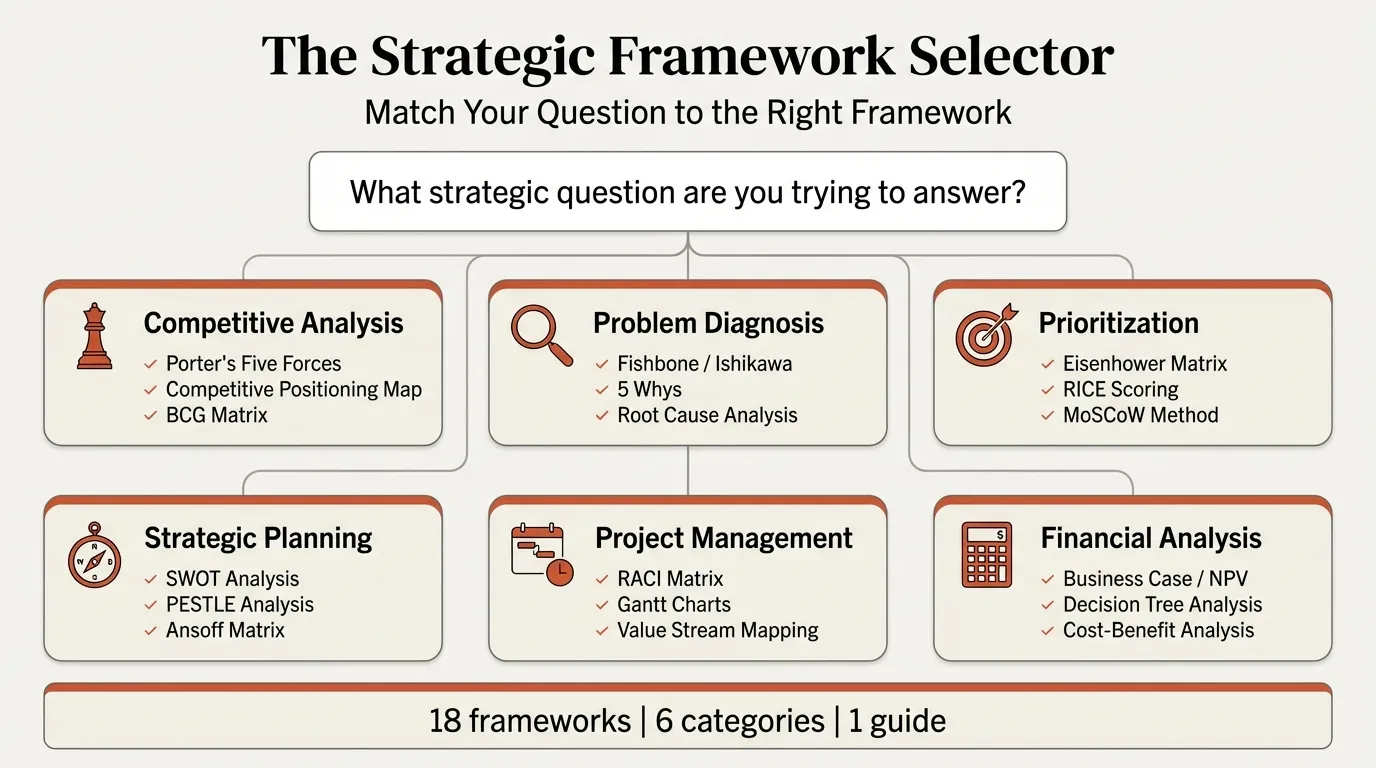

The Strategic Framework Decision Matrix#

Before diving into individual frameworks, use this table to match the strategic question to the right analytical tool. Most strategy engagements involve 2-4 questions from this list.

| Strategic Question | Recommended Framework | Best For | Output |

|---|---|---|---|

| Where do we stand competitively? | SWOT Analysis | Due diligence, strategic reviews | 2x2 matrix of internal/external factors |

| How attractive is this industry? | Porter's Five Forces (HBR original) | Market entry, competitive strategy | Hub-and-spoke intensity map |

| How do we compare to competitors? | Competitive Analysis | Board updates, vendor evaluation | Positioning map, spider chart, or feature table |

| Which products deserve investment? | BCG Matrix | Portfolio strategy, capital allocation | Bubble chart on growth-share grid |

| Which business units should we prioritize? | GE-McKinsey Matrix | Multi-business portfolio decisions | 9-box grid with weighted scoring |

| What is causing this problem? | Issue Tree | Problem diagnosis, hypothesis testing | Horizontal tree diagram with MECE branches |

| What is the root cause of this failure? | Root Cause Analysis | Process improvement, incident review | Fishbone diagram or fault tree |

| Why did this happen (iterative depth)? | 5 Whys | Quick diagnosis, operational issues | Linear cause chain |

| Which path should we choose? | Decision Tree | Investment decisions, scenario planning | Branching probability-weighted outcomes |

| What should we work on first? | Eisenhower Matrix | Personal and team prioritization | 2x2 urgency-importance grid |

| Where will we get the most impact? | Impact-Effort Matrix | Initiative screening, resource allocation | 2x2 grid with initiative bubbles |

| How should we evaluate these options? | Decision Matrix | Vendor selection, site evaluation | Weighted scoring table |

| What are our growth options? | Ansoff Matrix | Annual planning, growth strategy | 2x2 risk-gradient grid |

| How does this business model work? | Business Model Canvas | Pitch decks, strategy sessions | 9-block asymmetric grid |

| Is our organization aligned? | McKinsey 7S | Transformation, post-merger integration | 7-element diagnostic wheel |

| Where do we create value operationally? | Value Chain Analysis | Cost optimization, competitive advantage | Chevron arrow diagram |

| What macro forces shape this market? | PESTLE Analysis | Market entry, regulatory risk assessment | 2x3 color-coded grid |

| Who is responsible for what? | RACI Matrix | Project kickoff, role clarity | Responsibility assignment table |

| What is the project timeline? | Gantt Chart | Implementation planning, transformation | Horizontal bar timeline with milestones |

| Who are the key stakeholders? | Stakeholder Analysis | Change management, communications | Influence-interest grid or power map |

| How does the customer experience unfold? | Customer Journey Map | CX transformation, service design | Stage-by-stage touchpoint timeline |

Most strategy decks use 2-4 frameworks from this table. If you find yourself using more, you are likely answering multiple strategic questions and should split the analysis into distinct workstreams.

Competitive and Market Analysis Frameworks#

These strategic frameworks answer the foundational question every strategy engagement starts with: "Where are we now, and what does the competitive landscape look like?" Getting the diagnostic phase right determines whether everything that follows is built on solid ground or wishful thinking.

The frameworks in this cluster work in sequence. Start with PESTLE or Five Forces to understand the market environment, use SWOT to assess your position within that environment, and deploy the BCG or GE-McKinsey Matrix to evaluate your portfolio against the competitive dynamics you have identified. For a deeper dive into structuring competitive intelligence on slides, see our guide on competitive analysis examples and the competitive analysis framework methodology.

SWOT Analysis#

The SWOT analysis remains the most widely used strategic framework in business because it forces a structured assessment of internal capabilities (Strengths and Weaknesses) against external dynamics (Opportunities and Threats). Its simplicity is both its strength and its risk. A lazy SWOT produces generic observations like "Strong brand" and "Increasing competition" that could apply to any company. A rigorous SWOT includes quantified evidence in every cell: "72% gross margin, 15pts above category average" as a Strength; "3 new entrants captured 8% combined share in 18 months" as a Threat.

The consulting-grade approach treats SWOT not as an exercise in brainstorming but as a synthesis tool. You run the detailed analyses first -- financial benchmarking, customer research, competitive intelligence -- and then distill the findings into the four quadrants. The action title on the SWOT slide should state the strategic implication, not just "SWOT Analysis." For a walkthrough of this process with worked industry examples, see our guides on how to do a SWOT analysis and SWOT analysis examples.

Porter's Five Forces#

Porter's Five Forces evaluates industry attractiveness by mapping five competitive pressures: competitive rivalry, threat of new entrants, threat of substitutes, bargaining power of suppliers, and bargaining power of buyers. Each force is rated by intensity (high, medium, low), and the composite picture tells you whether an industry is structurally attractive or structurally challenging.

The framework is most valuable for market entry decisions and explaining margin pressure. If three of five forces rate "high," the industry is structurally difficult regardless of your company's capabilities. The common mistake is treating Five Forces as a static snapshot. Industries evolve: digital disruption lowers barriers to entry, platform economics shifts buyer power, and vertical integration changes supplier dynamics. Update the analysis annually.

Competitive Analysis#

Competitive analysis goes beyond any single framework to become a discipline. Three formats serve different purposes: 2x2 positioning maps for strategic narrative, spider charts for multi-dimensional capability comparison, and feature tables for specific capability evaluation. Choose the format based on whether the audience needs to understand positioning, capability breadth, or feature specifics.

The axes of a 2x2 positioning map carry your strategic argument. Generic dimensions like "Quality" and "Price" produce generic insights. Dimensions that reflect actual purchase criteria -- "Deployment Flexibility" or "Data Integration Depth" -- produce actionable positioning. See competitive analysis examples for worked industry cases across technology, healthcare, and financial services.

BCG Matrix#

The BCG Growth-Share Matrix, created by Bruce Henderson in 1970, classifies business units or products into Stars (high growth, high share), Cash Cows (low growth, high share), Question Marks (high growth, low share), and Dogs (low growth, low share). The consulting-grade version uses a bubble chart overlay where bubble size represents revenue, turning the conceptual 2x2 into a three-dimensional decision tool.

Where the BCG Matrix excels is forcing explicit resource allocation conversations. A Question Mark with $20M revenue is a small experiment. A Question Mark with $200M revenue is a strategic imperative requiring a dedicated investment thesis. The framework breaks down when market definitions are unclear or when growth rate and market share are not the dimensions that actually drive competitive advantage. For industries where innovation speed or network effects matter more than share, consider supplementing with additional dimensions. See BCG Matrix examples for application across consumer goods, technology, and industrial portfolios.

GE-McKinsey Matrix#

The GE-McKinsey Matrix addresses the BCG Matrix's biggest limitation: reducing strategic decisions to two variables. The 9-box grid plots business units on Industry Attractiveness (vertical) versus Competitive Strength (horizontal), with each axis scored using weighted criteria specific to the company's context.

Industry Attractiveness might weight market size (30%), growth rate (25%), profitability (20%), competitive intensity (15%), and regulatory risk (10%). Competitive Strength might weight market share (25%), brand equity (20%), cost position (20%), technology capability (20%), and distribution reach (15%). The weighted scoring makes the framework more rigorous than the BCG Matrix but also more subjective -- the weights themselves embed strategic assumptions that should be debated and agreed upon by the leadership team. For a detailed walkthrough of the scoring methodology, see our GE-McKinsey Matrix guide.

Problem Diagnosis and Root Cause Frameworks#

These strategic frameworks answer "Why is this happening?" -- the diagnostic work that must precede any recommendation. Jumping to solutions before properly diagnosing the problem is the most expensive mistake in consulting. A misdiagnosed problem leads to a well-executed wrong answer, which is worse than no answer at all.

The frameworks here range from broad problem structuring (issue trees) to deep causal analysis (5 Whys, fishbone diagrams). Use issue trees first to map the problem landscape, then deploy root cause tools on the branches that your data suggests are most significant. For the thinking methodology that underpins all problem structuring -- ensuring your branches do not overlap and cover all possibilities -- see our guide on the MECE framework and broader problem-solving frameworks.

Issue Trees#

Issue trees are the backbone of consulting problem diagnosis. They decompose a complex question into smaller, answerable sub-questions arranged in a hierarchical tree structure. The root node poses the central question ("Why has EBITDA margin declined by 400bps?"), and each level of branches breaks it into mutually exclusive, collectively exhaustive components.

The discipline is in the structure: every branch must pass the MECE test. Revenue and cost branches are MECE for a profitability question. "Marketing" and "Sales" are not MECE for a revenue question because both contribute to the same revenue line in overlapping ways. Limit to 3 levels per slide -- a 4-level tree with 3 branches per level produces 40+ nodes, which is a poster, not an analytical tool. The real power of issue trees is what they enable: hypothesis-driven analysis where each branch becomes a workstream with a testable hypothesis.

Fishbone Diagrams (Ishikawa)#

Fishbone diagrams, also known as Ishikawa diagrams, organize potential causes of a problem into categories arranged along a central spine. The standard manufacturing categories (Man, Machine, Method, Material, Measurement, Environment) can be adapted to any context: for a service delivery problem, you might use People, Process, Technology, Policy, Communication, and External Factors.

The fishbone excels when multiple root causes might be contributing simultaneously and the team needs to ensure comprehensive brainstorming before narrowing to the most likely causes through data. It is less useful when the problem has a clear single cause or when the team needs to quantify the relative contribution of each cause. For worked examples across manufacturing, healthcare, and technology contexts, see our guide on fishbone diagram examples.

5 Whys#

The 5 Whys technique asks "Why?" repeatedly until you drill past symptoms to the root cause. It is the simplest diagnostic framework and often the most revealing. A service outage might surface as a technical failure, but five iterations of "Why?" might reveal that the root cause was an understaffed QA team due to a hiring freeze that no one escalated because the escalation process was unclear.

The framework's strength is its simplicity and speed -- you can run a 5 Whys analysis in a 30-minute team meeting. Its weakness is that it follows a single causal chain and can miss parallel causes. Use it for operational issues with relatively linear causation. For complex problems with multiple interacting causes, combine 5 Whys with a fishbone diagram to ensure you are not following a single thread while ignoring others. See 5 Whys examples for practical applications.

Root Cause Analysis and Decision Trees#

Root cause analysis is the umbrella discipline that encompasses fishbone diagrams, 5 Whys, fault tree analysis, and Pareto analysis. The choice of tool depends on the problem's complexity and the rigor required. For a detailed methodology comparison, see root cause analysis examples.

Decision trees serve a different but related purpose: they map decision pathways and their probable outcomes. Each branch represents a choice, each node represents a decision point, and terminal nodes show the expected outcome (often with probability weights and financial values). Decision trees are invaluable for investment decisions, make-vs-buy analyses, and any situation where sequential choices lead to different outcomes. The expected monetary value (EMV) calculation at each node transforms qualitative judgment into quantified analysis. See decision tree examples for worked applications in product strategy and M&A.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Prioritization and Decision-Making Frameworks#

These strategic frameworks answer "What should we do first?" -- the resource allocation decisions that determine whether strategy gets executed or stalls. Every organization has more initiatives than capacity. The frameworks below force explicit trade-off conversations that prevent the "everything is a priority" trap.

The common thread is that all prioritization frameworks require two things: clearly defined evaluation criteria and honest assessment of each option against those criteria. The framework structure prevents the loudest voice in the room from dominating resource allocation. For a comprehensive overview of prioritization methodology, see our guide on how to prioritize tasks.

Eisenhower Matrix#

The Eisenhower Matrix sorts tasks and initiatives into four quadrants based on urgency and importance. Urgent + Important items get done immediately. Important + Not Urgent items get scheduled (and this is where most strategic work lives). Urgent + Not Important items get delegated. Neither Urgent nor Important items get eliminated.

The framework's real value is not sorting tasks -- it is exposing how much time organizations spend in the Urgent + Not Important quadrant at the expense of the Important + Not Urgent quadrant where strategic progress happens. When we run this exercise with leadership teams, the resulting conversation about time allocation is consistently more valuable than the matrix itself. For application examples across personal productivity and team planning, see our guides on the Eisenhower Matrix and Eisenhower Matrix examples.

Prioritization Matrix and Impact-Effort Matrix#

The prioritization matrix generalizes the Eisenhower concept to any two evaluation dimensions. In practice, the most common variant is the impact-effort matrix, which plots initiatives on a 2x2 grid with Impact (vertical) and Effort (horizontal). The resulting four quadrants produce a clear action sequence:

| Quadrant | Impact | Effort | Action |

|---|---|---|---|

| Quick Wins | High | Low | Execute immediately |

| Major Projects | High | High | Plan and resource carefully |

| Fill-Ins | Low | Low | Do if capacity allows |

| Time Sinks | Low | High | Eliminate or defer |

The framework works because it makes trade-offs visible and removes emotion from prioritization. When a stakeholder's pet initiative lands in the Time Sinks quadrant, the data speaks louder than hierarchy. The key is defining "impact" and "effort" specifically for the context: impact might be revenue, customer satisfaction, or risk reduction; effort might be cost, time, or organizational change required. Generic definitions produce generic prioritization.

Decision Matrix (Weighted Scoring)#

The decision matrix brings quantitative rigor to multi-criteria decisions. It works by defining evaluation criteria, assigning percentage weights to each criterion, scoring each option against every criterion, and multiplying scores by weights to produce a composite ranking.

This framework is essential for vendor evaluations, site selection, technology platform decisions, and any choice involving 4+ options with 5+ criteria. The discipline is in the weighting: criteria weights should be debated and agreed upon before scoring begins. If the leadership team adjusts weights after seeing the results to favor a preferred option, the exercise has failed. The decision matrix works only when the criteria and weights represent genuine strategic priorities.

Strategic Planning and Growth Frameworks#

These strategic frameworks answer "Where should we go?" -- the directional choices that define strategy. They come into play after diagnostic frameworks have established where you are and what the competitive landscape looks like.

The frameworks in this cluster range from focused (Ansoff Matrix for growth direction) to comprehensive (Business Model Canvas for business design). Use them in the strategy development phase, after diagnosis and before execution planning. For the discipline of communicating strategic recommendations effectively, see our consulting slide standards and the Pyramid Principle.

Ansoff Matrix#

The Ansoff Matrix maps growth options across two dimensions: products (existing vs. new) and markets (existing vs. new). The four resulting strategies -- Market Penetration, Product Development, Market Development, and Diversification -- represent a risk gradient from lowest (selling existing products to existing markets) to highest (developing new products for new markets).

The consulting-grade version goes beyond labels: each quadrant contains named, costed initiatives with revenue estimates. "Market Penetration: Launch loyalty program targeting top 20% of customers, projected $4.2M incremental revenue" is actionable. "Market Penetration: Sell more to existing customers" is a placeholder. The color gradient from light (low risk) to dark (high risk) makes the trade-off structure visible at a glance. See Ansoff Matrix examples for worked applications across SaaS, consumer goods, and financial services.

Business Model Canvas#

The Business Model Canvas fits nine building blocks of a business model onto a single page: Key Partners, Key Activities, Key Resources, Value Propositions, Customer Relationships, Channels, Customer Segments, Cost Structure, and Revenue Streams. It is particularly valuable for startups defining their model, established companies evaluating business model innovation, and M&A teams understanding acquisition targets.

The common mistake is treating it as a brainstorming canvas rather than an analytical tool. Each block should contain specific, verifiable statements. "Customer Segments: Enterprise SaaS companies with 500-5000 employees, $10M-$100M ARR, using Salesforce as primary CRM" is analysis. "Customer Segments: Medium to large businesses" is a guess. For worked examples across technology, healthcare, and marketplace businesses, see our guide on Business Model Canvas examples.

McKinsey 7S Framework#

The McKinsey 7S Framework evaluates organizational alignment across seven elements: Strategy, Structure, Systems (hard elements) and Shared Values, Skills, Style, Staff (soft elements). The framework's power is in exposing misalignment: a company might have a digital-first strategy but a hierarchical structure, legacy systems, and a risk-averse culture that make execution impossible.

The 7S Framework is most valuable during transformation programs, post-merger integration, and organizational redesign. The diagnostic reveals which elements are aligned with the strategy and which are creating friction. The visual representation places Shared Values at the center, connected to all six other elements, reflecting the framework's thesis that culture underpins everything. See our McKinsey 7S Framework guide for application methodology and common diagnostic patterns.

Value Chain Analysis#

Value chain analysis maps how a company creates value across primary activities (inbound logistics, operations, outbound logistics, marketing and sales, service) and support activities (infrastructure, HR, technology development, procurement). The framework forces a systematic comparison of competitive position across the entire operation.

Building the value chain slide in PowerPoint is one of the more challenging formatting exercises because there is no SmartArt preset for Porter's arrow diagram: five connected chevron shapes for primary activities, four horizontal bars for support activities, and a margin arrow on the right. The analytical value comes from highlighting the 2-3 activities where the company has genuine advantage (color-coded green) and the 2-3 where it should cut costs or outsource (color-coded red). See value chain analysis for the template and our companion guide on value stream mapping for the process-level extension of this framework.

PESTLE Analysis#

PESTLE analysis scans the macro-environment across six dimensions: Political, Economic, Social, Technological, Legal, and Environmental. It is the broadest scanning framework in this guide and serves as the starting point for any market entry analysis or industry-level strategy.

The critical discipline is weighting. Not all six PESTLE factors carry equal relevance. A pharmaceutical market entry is dominated by Legal and Regulatory factors. A consumer technology play cares most about Technological and Social trends. The consulting-grade approach rates each factor by impact (H/M/L) and uses visual emphasis on the 2-3 dimensions that genuinely shape the strategic decision. A flat grid with no priority signal forces the audience to do analytical work you should have done for them. For worked examples across energy, healthcare, technology, and financial services, see PESTLE analysis examples.

Project Management and Execution Frameworks#

These strategic frameworks answer "How do we execute?" -- the operational planning that transforms strategy from a slide deck into organizational action. The best strategy recommendation is worthless if it cannot be implemented. These frameworks bridge the gap between "what we should do" and "who does what by when."

The frameworks here focus on role clarity, timeline management, and stakeholder alignment. They appear most frequently in transformation programs, post-merger integration, and any engagement where the consulting team is responsible for implementation planning, not just recommendation. For frameworks that address the human side of execution, see our guide on change management models.

RACI Matrix#

The RACI matrix clarifies roles for every key activity or decision: who is Responsible (does the work), Accountable (makes the final call), Consulted (provides input before the decision), and Informed (needs to know after the decision). The framework eliminates the ambiguity that causes duplicate work, missed handoffs, and the "I thought someone else was handling that" conversations that derail projects.

The most important rule: every row must have exactly one "A." If two people are Accountable for the same decision, no one is. The second most important rule: minimize the number of "C" entries. Excessive consultation slows every decision to a crawl. For worked examples across product launches, organizational restructures, and technology implementations, see RACI matrix examples. Related organizational clarity tools include the org chart template for visualizing reporting structures.

Gantt Charts and Project Plans#

Gantt charts visualize project schedules with tasks as horizontal bars against a timeline, making duration, overlap, and dependencies immediately visible. They are essential for transformation programs, implementation roadmaps, and any engagement where multiple workstreams run in parallel.

The consulting-grade Gantt chart includes milestones at key decision gates (diamonds on the timeline), dependencies between tasks (so the audience can see which delays cascade), a "today" marker showing current progress, and workstream groupings with clear labels. For building Gantt charts specifically in PowerPoint, see our step-by-step guide on how to create a Gantt chart in PowerPoint. For the broader project planning discipline, including scope definition, resource allocation, and risk registers, see project plan examples and the project plan template.

Stakeholder Analysis and Mapping#

Stakeholder analysis identifies the people and groups who can influence or are affected by a strategic initiative, then maps them by two dimensions: their level of influence (power to affect outcomes) and their level of interest (degree to which they care about the initiative). The resulting grid produces four engagement strategies:

| Quadrant | Influence | Interest | Strategy |

|---|---|---|---|

| Key Players | High | High | Manage closely, involve in decisions |

| Keep Satisfied | High | Low | Keep informed, address concerns proactively |

| Keep Informed | Low | High | Regular communication, leverage as advocates |

| Monitor | Low | Low | Light-touch updates, minimal effort |

Stakeholder mapping is non-negotiable for change management, organizational restructures, and any initiative that requires buy-in across multiple departments or levels. The analysis typically reveals 2-3 stakeholders in the "Key Players" quadrant whose opposition would sink the initiative and whose support makes it possible. For comprehensive methodology, see our guides on stakeholder mapping and stakeholder management.

Customer and Product Frameworks#

These strategic frameworks answer "How do our customers experience our product, and where is it in its lifecycle?" -- the customer-centric analysis that grounds strategy in market reality rather than internal assumptions.

The frameworks here shift perspective from the company outward. While competitive analysis frameworks ask "Where do we stand relative to competitors?", customer and product frameworks ask "How does the customer experience us, and what stage is our product in?" Both perspectives are necessary for complete strategic analysis.

Customer Journey Mapping#

Customer journey mapping visualizes every stage of the customer's experience from initial awareness through purchase, use, and advocacy (or churn). The framework identifies touchpoints, emotions, pain points, and moments of truth across the entire lifecycle.

The consulting-grade approach goes beyond the generic awareness-consideration-purchase funnel. It incorporates quantitative data at each stage: conversion rates between stages, NPS scores at key touchpoints, support ticket volumes, and time-to-value metrics. This transforms the journey map from a qualitative wall poster into an analytical tool that identifies exactly where the experience breaks down and what fixing it is worth. For worked examples across B2B SaaS, e-commerce, and healthcare, see customer journey mapping and customer journey map examples.

Product Lifecycle Management#

Product lifecycle analysis tracks where a product sits across four stages: Introduction (low revenue, negative margins, heavy investment), Growth (accelerating revenue, improving margins, competitive entry), Maturity (peak revenue, margin pressure, market saturation), and Decline (falling revenue, cost management focus, harvest or exit decisions). Each stage demands a different strategic posture and different resource allocation.

The framework is most valuable for portfolio strategy, capital allocation, and M&A screening. A company with 80% of revenue in Maturity and Decline stage products has a fundamentally different strategic challenge than one with 60% in Growth. The visual representation -- typically an S-curve with products plotted along it -- makes the portfolio's lifecycle distribution immediately clear to a board audience. For detailed stage characteristics and strategic implications, see our guides on product lifecycle management and product life cycle stages.

Customer Segmentation#

Customer segmentation divides a market into distinct groups that share common characteristics and respond similarly to marketing strategies. The four primary segmentation approaches -- demographic (who they are), behavioral (what they do), psychographic (what they value), and needs-based (what problem they solve) -- serve different analytical purposes.

Behavioral and needs-based segmentation are the most actionable for strategy because they group customers by what drives their decisions rather than superficial characteristics. A B2B SaaS company might segment by company size (demographic) or by buying behavior: self-serve users who optimize for speed, committee buyers who optimize for risk reduction, and strategic adopters who optimize for platform extensibility. The latter segmentation produces genuinely different go-to-market strategies. Customer segmentation connects directly to the Customer Segments block of the Business Model Canvas and informs the market development quadrant of the Ansoff Matrix.

Connecting Frameworks: The Strategic Analysis Sequence#

Individual frameworks become most powerful when combined in a logical sequence. Here is the pattern we use on most strategy engagements:

Phase 1 -- Understand the environment. Start with PESTLE for macro factors and Porter's Five Forces for industry structure. These external scans establish the playing field before you assess your position on it.

Phase 2 -- Diagnose the current position. Use SWOT to synthesize internal capabilities against external dynamics. Deploy issue trees to break down the specific strategic question into analysable components. Run root cause analysis on the branches that data suggests are most significant.

Phase 3 -- Identify strategic options. Use the Ansoff Matrix for growth direction, the BCG Matrix or GE-McKinsey Matrix for portfolio allocation, and the Business Model Canvas if the question involves business model design.

Phase 4 -- Prioritize and decide. Apply the impact-effort matrix or a decision matrix to evaluate options against weighted criteria. Use decision trees for sequential choices with quantifiable outcomes.

Phase 5 -- Plan execution. Build the RACI matrix for role clarity, the Gantt chart for timeline, the stakeholder map for change management, and OKRs for tracking progress.

This sequence follows the Pyramid Principle: diagnose before prescribing, structure before solving, and recommend before planning. Each phase builds on the previous one, and the frameworks at each phase answer the natural next question.

Building Strategic Framework Slides#

The analytical rigor behind your frameworks matters only if the slides communicate clearly. A few principles apply across all framework slides.

Action titles, not labels. "SWOT Analysis" is a label. "Strong digital capabilities and brand equity offset supply chain concentration risk" is a strategic conclusion. Every framework slide should state the insight the framework revealed, not the name of the framework used.

Specific metrics in every cell. Frameworks populated with generic observations ("Increasing competition," "Strong team") signal that the analysis was a fill-in-the-blank exercise rather than genuine investigation. Every bullet should include a number, a comparison, or a specific fact that could not apply to a different company.

Color coding signals judgment. Red, amber, and green are not decoration. They communicate analytical conclusions about intensity, risk, or priority. Use them consistently across the deck and define what they mean.

One framework per slide. If a framework does not fit on a single slide, either the framework is too detailed for the audience or you need drill-down slides with navigation breadcrumbs back to the overview.

For the complete presentation methodology, including MECE logic, pyramid structure, and consulting slide standards, see our Consulting Presentations Guide. For building frameworks that include data visualization, see our guides on business case examples and the business case template guide.

Summary#

Strategic frameworks are tools for reaching decisions, not deliverables in themselves. The framework's job is finished when it produces a specific, defensible recommendation.

- Match framework to question -- use the decision matrix table above to select the right tool for the strategic question you are answering

- Sequence your analysis -- environment scanning first, then diagnosis, then strategic options, then prioritization, then execution planning

- Populate with data, not placeholders -- every cell, bubble, and branch should contain information specific enough that it could not apply to a different company

- Limit to 2-4 frameworks per project -- more frameworks signals analytical wandering, not thoroughness

- Use action titles -- the slide title states the strategic conclusion the framework revealed, not the name of the framework

- Test with MECE logic -- every framework's categories must be mutually exclusive and collectively exhaustive

- Connect frameworks to decisions -- if a framework does not change or validate a recommendation, it does not belong in the deck

Browse ready-made framework layouts across SWOT, Porter's Five Forces, BCG Matrix, Ansoff Matrix, Eisenhower Matrix, RACI, and 30+ other templates in Deckary's template library. For the presentation methodology that ties these frameworks together, see our Consulting Presentations Guide. To explore visual structuring tools like mind maps and Venn diagrams, visit our full template gallery.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free