Business Case Template: How to Build Cases That Get Approved

Learn how to build a business case that wins executive approval. Covers financial analysis, risk assessment, the one-page format, and common mistakes.

A business case template structures the analysis that determines whether an initiative is worth funding. As the Project Management Institute's standard on business case development describes, it is the document that sits between a good idea and an approved budget -- the bridge that translates strategic intent into financial justification.

Most business cases fail not because the underlying idea is weak, but because the case itself is poorly constructed. Vague benefits, missing risk analysis, or financial projections that collapse under scrutiny give decision-makers a reason to say no -- or to say "come back with more detail," a polite rejection that delays projects by months.

After reviewing business cases across 120+ strategy and transformation engagements, we have found that the cases that get approved share six structural elements, use conservative financial assumptions, and address executive objections before they arise. This guide covers each element, the financial metrics that matter, and the mistakes that kill otherwise strong proposals. For a broader view of how business cases fit within strategic planning, see our Strategic Frameworks Guide.

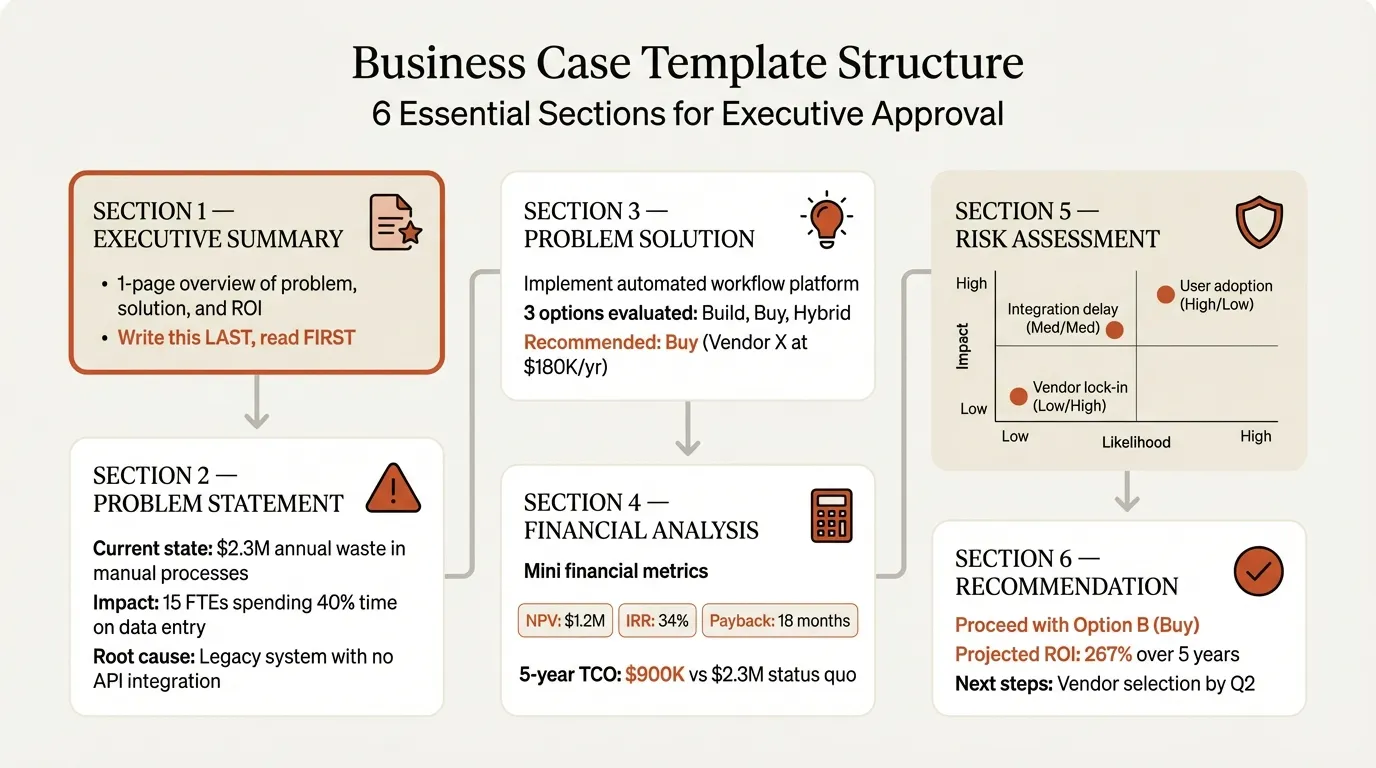

What a Business Case Template Includes#

A complete business case has six sections. Each serves a distinct purpose, and skipping any of them gives decision-makers a reason to delay.

| Section | Purpose | Typical Length |

|---|---|---|

| Executive summary | Summarize the recommendation and financial impact | 1 page |

| Problem statement | Define the business problem or opportunity | 1-2 pages |

| Options analysis | Evaluate 3-4 alternatives including "do nothing" | 2-3 pages |

| Financial analysis | Quantify costs, benefits, NPV, IRR, payback | 2-4 pages |

| Risk assessment | Identify risks and mitigation strategies | 1-2 pages |

| Recommendation | State the preferred option with implementation plan | 1-2 pages |

Executive summary: The most important page. State the problem, recommended solution, total investment, expected return, and key risks -- all on one page. Write it last. For structure guidance, see our executive summary slides guide.

Problem statement: Define the problem in terms executives care about. "Our onboarding process is slow" is a complaint. "Our 14-day onboarding cycle causes 23% of new customers to churn, representing $3.2M in annual lost revenue" is a problem statement that demands action.

Options analysis: Always present at least three options:

| Option | Description | When to Include |

|---|---|---|

| Do nothing | Maintain current state | Always -- it is the baseline |

| Minimum viable | Lowest-cost solution that addresses the core problem | When budget is constrained |

| Recommended | Balanced cost and impact | Always -- this is your proposal |

| Maximum scope | Comprehensive solution with highest cost and return | When the organization has appetite for larger investment |

The "do nothing" option is critical. It establishes the cost of inaction and frames every other option as a comparison. Executives who see only one option suspect they are being sold to, not advised.

Financial analysis: This section carries the most weight. We cover the specific metrics below.

Risk assessment: Identify 5-7 risks, rate likelihood and impact, and propose mitigation strategies. Risks without mitigations signal problems you cannot solve. Risks with mitigations signal thoroughness.

| Risk | Likelihood | Impact | Mitigation |

|---|---|---|---|

| Implementation takes 6+ months longer than planned | Medium | High | Phase rollout; deliver core features in Phase 1 |

| Adoption rate below 60% in Year 1 | Medium | High | Dedicated change management lead; pilot with 2 teams first |

| Vendor pricing increases after Year 1 | Low | Medium | Negotiate 3-year fixed pricing; identify backup vendor |

Recommendation: State the preferred option, tie it to the financial analysis, and provide an implementation timeline.

Business Case vs. Business Plan#

These two documents serve different purposes but are frequently confused.

| Dimension | Business Case | Business Plan |

|---|---|---|

| Purpose | Justify a specific investment decision | Describe how a business will operate |

| Scope | Single initiative or project | Entire company or business unit |

| Audience | Internal decision-makers (C-suite, board) | Investors, lenders, partners |

| Time horizon | 1-5 years for the initiative | 3-10 years for the business |

| Financial depth | NPV, IRR, payback for one investment | Full P&L, balance sheet, cash flow |

| Length | 5-15 pages | 30-100 pages |

A business case asks "should we do this specific thing?" A business plan asks "how will this business succeed overall?" If you are seeking internal funding for a new CRM system, you need a business case. If you are raising Series A capital, you need a business plan -- and likely a financial projections slide to go with it.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

The One-Page Business Case Format#

Not every decision requires a 15-page document. For initial screening, a one-page business case captures what executives need for a preliminary yes or no. Use it when the investment is under $500K, the timeline is compressed, or you need buy-in before building the full analysis.

One-Page Structure#

Problem (2-3 sentences): What business problem are we solving? What is the cost of inaction?

Solution (2-3 sentences): What do we propose? How does it address the problem?

Financial Summary (table):

| Metric | Value |

|---|---|

| Total investment | $X |

| Annual benefit | $Y |

| Payback period | Z months |

| 3-year NPV | $W |

Key Risks (2-3 bullets): Top risks with one-line mitigations.

Recommendation: Approve / Reject / Investigate further.

For a ready-to-use layout, our budget table template provides a structured format for presenting financial summaries, and the executive summary template works well for the one-page format.

Financial Metrics for Business Case Analysis#

Financial analysis is where business cases succeed or fail. Decision-makers need to see four metrics at minimum. Each tells a different part of the story.

Net Present Value (NPV)#

NPV, a concept central to corporate finance theory taught at leading business schools, calculates the total value an investment creates in today's dollars by discounting future cash flows back to present value. A positive NPV means the initiative creates value above the cost of capital. A $5M project generating $2M annually for 5 years looks attractive until you discount those future cash flows at 10% -- the NPV is $2.58M, not $5M.

Internal Rate of Return (IRR)#

IRR is the discount rate at which NPV equals zero -- the percentage return the project generates. Compare IRR to your company's hurdle rate (typically 10-15% for corporate investments). If IRR exceeds the hurdle rate, the project is financially viable. If below, the project destroys value relative to alternative uses of capital.

Payback Period#

How long until you get your money back? It is the number of months or years before cumulative benefits equal the initial investment.

| Payback Period | Typical Executive Reaction |

|---|---|

| Under 12 months | Strong approval signal |

| 12-24 months | Acceptable for most initiatives |

| 24-36 months | Requires strong strategic rationale |

| Over 36 months | Faces significant resistance |

Payback period ignores the time value of money, so never use it as your sole metric. But executives love its simplicity -- it is often the first number they ask about.

Return on Investment (ROI)#

ROI expresses the return as a percentage: (Net Benefit / Total Cost) x 100. An ROI of 150% means you get $1.50 back for every $1 invested.

Present all four metrics together. A CFO may focus on NPV and IRR. A business unit leader may care most about payback period. Presenting all four covers the room.

Sensitivity Analysis: Stress-Testing Your Business Case#

A business case built on a single set of assumptions is a business case waiting to be challenged. Sensitivity analysis shows how your results change when assumptions shift.

Identify the 3-5 assumptions with the largest impact (typically revenue growth rate, cost estimates, adoption rate, and timeline). Define base case, upside (+20-30%), and downside (-20-30%) scenarios, then recalculate NPV and IRR:

| Scenario | Revenue Growth | Implementation Cost | NPV | IRR |

|---|---|---|---|---|

| Downside | -20% | +25% | $1.2M | 12% |

| Base case | As projected | As projected | $3.8M | 22% |

| Upside | +15% | -10% | $5.6M | 31% |

If the downside scenario still shows a positive NPV and IRR above the hurdle rate, your business case is robust. If the downside shows negative returns, executives will ask what makes you confident the base case will hold.

Common Business Case Mistakes#

After reviewing hundreds of business cases, these five mistakes appear most frequently.

1. Overestimating Benefits#

The most damaging mistake. Projected benefits in business cases average 40-60% higher than actual outcomes in our experience. Teams anchor to the numbers needed to justify the investment rather than the numbers supported by evidence.

Fix: Use conservative estimates. If your vendor says implementation takes 3 months, plan for 5. If market research suggests 30% adoption, model 20%. Decision-makers trust conservative projections -- and they remember when your actuals beat the forecast.

2. Ignoring Opportunity Cost#

Every dollar spent on your initiative is a dollar not spent elsewhere. Your CRM upgrade competes against the sales team expansion, the product development sprint, and the three other business cases on the CFO's desk.

Fix: Explicitly state what alternatives the funding could support and why your initiative delivers higher returns.

3. Treating "Do Nothing" as Free#

The status quo has a cost. If your current process loses $500K annually in inefficiency, "do nothing" costs $2.5M over five years. Many business cases fail to quantify this, making the investment look like pure cost rather than cost avoidance.

Fix: Calculate the cumulative cost of inaction and include it in your options analysis.

4. Skipping the Risk Assessment#

Presenting a business case without risks signals either naivety or dishonesty. Every executive knows projects carry risk. What they want to see is that you have identified the risks and have a plan.

Fix: Include 5-7 risks with likelihood, impact, and specific mitigation actions.

5. Writing for Approval Instead of Decision#

Business cases should inform a decision, not manipulate one. When teams write to get a "yes," they cherry-pick data, minimize risks, and present unrealistic scenarios. Executives can tell.

Fix: Present the analysis honestly, including scenarios where the initiative should not proceed. A business case that says "this works under conditions A and B but not under condition C" builds more trust than one that claims certainty.

How to Present a Business Case to Executives#

The document is half the work. How you present it determines whether it gets approved.

Structure Using the Pyramid Principle#

Lead with the recommendation, not the problem. The pyramid principle applies directly: state your conclusion first, then provide supporting evidence.

Recommended flow (10-15 minutes):

| Section | Time | Content |

|---|---|---|

| Recommendation | 2 min | What we propose, total investment, expected return |

| Financial summary | 3 min | NPV, IRR, payback, ROI with sensitivity range |

| Options considered | 3 min | Why this option beats the alternatives |

| Key risks | 2 min | Top 3 risks with mitigations |

| Decision required | 1 min | What you need from the room today |

| Q&A buffer | 4 min | Reserved for executive questions |

Anticipate the Five Questions Executives Always Ask#

- "What happens if we do nothing?" -- Have the cost of inaction quantified

- "What assumptions drive these numbers?" -- Know every input to your model

- "What alternatives did you consider?" -- Show you evaluated at least 3 options

- "What is the biggest risk?" -- Name it, quantify it, explain the mitigation

- "When do we see results?" -- Have the payback period and milestones ready

Prepare for Objections#

| Objection | Response Strategy |

|---|---|

| "The numbers look too optimistic" | Show sensitivity analysis; highlight the downside scenario |

| "Why now?" | Quantify the cost of delay per month/quarter |

| "Can we do this cheaper?" | Present the minimum viable option as an alternative |

| "Who else has done this?" | Provide 2-3 relevant case studies or benchmarks |

| "What if priorities change?" | Show how the initiative aligns with 2-3 strategic priorities |

Summary#

A business case that gets approved shares six elements: a one-page executive summary, a quantified problem statement, an options analysis that includes "do nothing," financial metrics (NPV, IRR, payback, ROI) with sensitivity analysis, a risk assessment, and a clear recommendation.

Key principles:

- Lead with the recommendation -- executives want the answer first

- Quantify everything -- the cost of inaction, the benefits, the risks

- Be conservative -- projections that beat expectations build trust; missed targets destroy it

- Include sensitivity analysis -- show your case holds under pessimistic assumptions

- Present alternatives -- evaluating options builds confidence in your recommendation

- Address risks honestly -- hiding risks signals inexperience; mitigating them signals competence

The difference between approval and rejection is rarely the underlying idea. It is the rigor of the analysis, the honesty of the assumptions, and the clarity of the presentation.

For building business case presentations quickly, Deckary's AI Slide Builder generates consulting-grade slides from a text description, and our budget table template provides structured layouts for financial summaries.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free