BCG Matrix Examples: 4 Worked Portfolio Analyses Across Industries

BCG matrix examples with real data across tech, consumer goods, financial services, and media. Learn methodology, calculations, and strategic actions.

Bruce Henderson created the growth-share matrix at BCG in 1970 to solve a specific problem: how should a diversified company allocate cash across its portfolio of businesses? The framework he built -- plotting relative market share against market growth rate -- became one of the most widely used BCG matrix examples in corporate strategy, and it remains relevant because the underlying logic still holds. Market leaders generate disproportionate cash through experience curve advantages, and high-growth markets consume cash to fund expansion.

After applying the BCG matrix in 35+ portfolio reviews and corporate strategy engagements, we have found that the framework's value depends on getting the methodology right. Most BCG matrix examples you find online use absolute market share instead of relative, define markets too broadly, or skip the calculations entirely. This guide walks through four fully worked examples with real data, covers the calculation methodology, compares the BCG matrix to alternative frameworks, and highlights the mistakes that lead to bad portfolio decisions. For a broader view of where the BCG matrix fits alongside other strategy tools, see our Strategic Frameworks Guide.

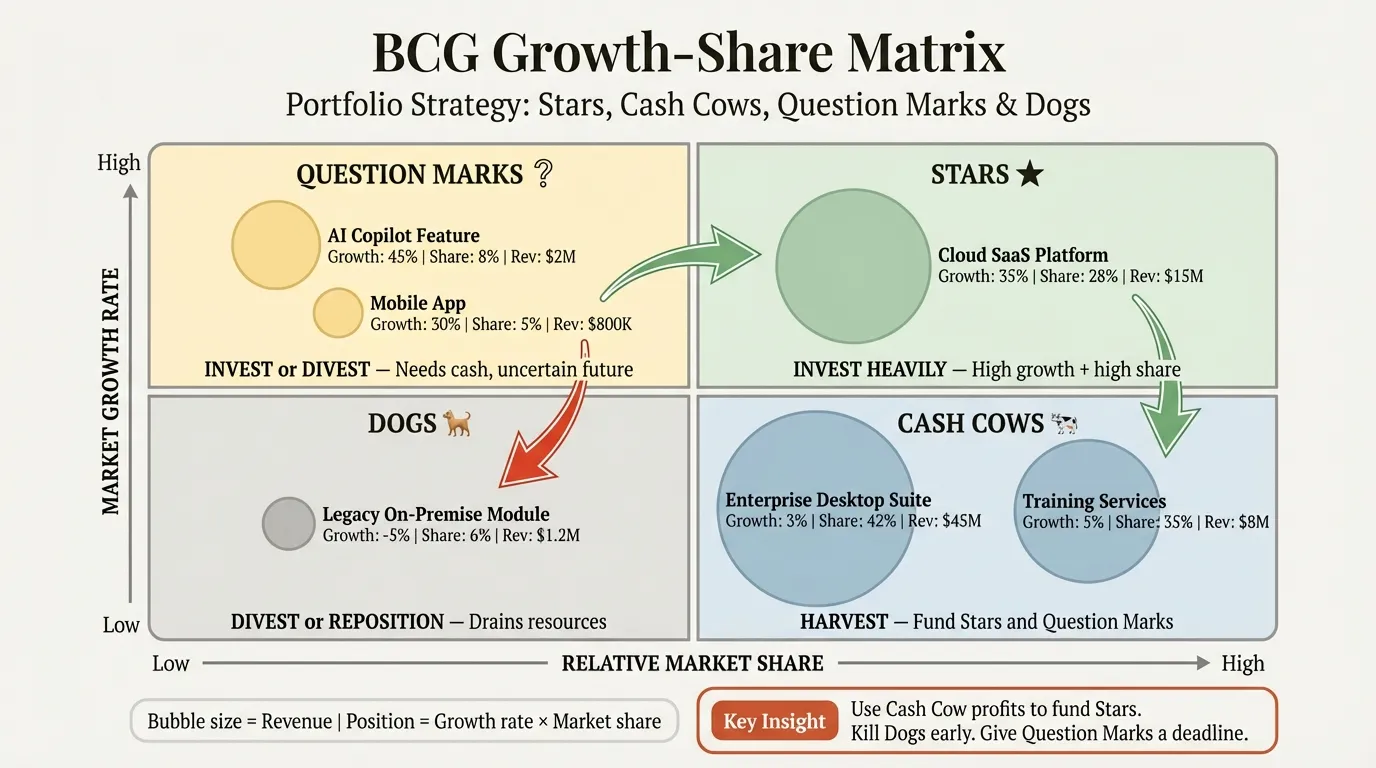

How the BCG Matrix Works#

The BCG matrix plots business units or product lines on a 2x2 grid using two variables:

- Y-axis: Market growth rate -- the annual growth rate of the market in which the business unit competes. This serves as a proxy for market attractiveness and cash consumption. Higher growth markets require more investment.

- X-axis: Relative market share -- the business unit's market share divided by the market share of its largest competitor. This serves as a proxy for competitive advantage and cash generation. A value above 1.0 means you are the market leader.

The intersection creates four quadrants:

| Quadrant | Growth | Relative Share | Cash Flow | Strategic Action |

|---|---|---|---|---|

| Stars | High | High (>1.0) | Roughly neutral | Invest to maintain leadership |

| Cash Cows | Low | High (>1.0) | Strong positive | Harvest for cash generation |

| Question Marks | High | Low (below 1.0) | Negative | Selectively invest or divest |

| Dogs | Low | Low (below 1.0) | Modest or negative | Divest or reposition |

The underlying theory, rooted in the experience curve that Henderson also developed at BCG, is that the market leader in a given industry achieves lower unit costs through cumulative production volume, creating a self-reinforcing cost advantage. Cash Cows fund Stars and selected Question Marks. Dogs drain resources that should flow elsewhere.

Calculating the Axes#

Relative market share is the metric most people get wrong. The formula is straightforward:

Relative Market Share = Your Market Share / Largest Competitor's Market Share

If your unit holds 30% share and the leader holds 20%, your relative share is 1.5 -- you are the leader. If you hold 15% and the leader holds 30%, your relative share is 0.5. The original BCG framework uses a logarithmic scale for the x-axis, with 1.0 as the dividing line between high and low.

Market growth rate is typically measured as the annual real growth rate of the market. The traditional dividing line is 10% annual growth, though this varies by industry and era. Some practitioners use the weighted average growth rate of the company's portfolio as the divider, which adjusts for industry context. In technology, where 10% growth may be below average, a higher threshold makes sense.

BCG Matrix Examples: Technology Portfolio#

Consider a hypothetical technology company with four major product lines:

| Product Line | Market Share | Leader's Share | Relative Share | Market Growth | Quadrant |

|---|---|---|---|---|---|

| Cloud Platform | 32% | 33% | 0.97 | 22% | Question Mark |

| Enterprise SaaS | 28% | 18% | 1.56 | 15% | Star |

| On-Premise Software | 35% | 22% | 1.59 | 3% | Cash Cow |

| Hardware Division | 8% | 40% | 0.20 | 2% | Dog |

Strategic implications:

- Enterprise SaaS (Star): Market leadership in a fast-growing segment. Invest aggressively in sales capacity and product development to maintain share. This unit consumes cash now but will become a Cash Cow as growth decelerates.

- On-Premise Software (Cash Cow): Dominant position in a mature market. Minimize investment beyond maintenance and use the cash flow to fund the Cloud Platform and Enterprise SaaS.

- Cloud Platform (Question Mark): High growth but nearly matched by the leader. If the company can push relative share above 1.0, it becomes a Star. If not, it becomes a Dog as growth slows. Requires a focused investment thesis with clear milestones.

- Hardware Division (Dog): Low share in a stagnant market with a dominant competitor. Divest, wind down, or reposition into a niche.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

BCG Matrix Examples: Consumer Goods Brand Portfolio#

A consumer goods company with four brand categories:

| Brand Category | Market Share | Leader's Share | Relative Share | Market Growth | Quadrant |

|---|---|---|---|---|---|

| Plant-Based Snacks | 12% | 25% | 0.48 | 18% | Question Mark |

| Breakfast Cereals | 34% | 20% | 1.70 | 1% | Cash Cow |

| Energy Drinks | 22% | 15% | 1.47 | 14% | Star |

| Frozen Dinners | 9% | 28% | 0.32 | -1% | Dog |

Strategic implications:

- Energy Drinks (Star): Market leader in a rapidly growing segment. Invest in distribution expansion and marketing to defend leadership before larger competitors scale their entries.

- Breakfast Cereals (Cash Cow): Strong leadership in a flat category. Optimize trade spending, reduce SKU proliferation, and generate maximum cash flow. Focus innovation on protecting share rather than chasing growth the category will not deliver.

- Plant-Based Snacks (Question Mark): Attractive growth but weak position. Evaluate whether the investment required to reach leadership is justified. If well-funded competitors already hold stronger positions, the path to leadership may be uneconomic.

- Frozen Dinners (Dog): Low share in a declining market. Divest or harvest aggressively -- every dollar here has higher returns if redirected elsewhere.

BCG Matrix Examples: Financial Services Product Lines#

A mid-sized bank evaluating its product portfolio:

| Product Line | Market Share | Leader's Share | Relative Share | Market Growth | Quadrant |

|---|---|---|---|---|---|

| Wealth Management | 6% | 14% | 0.43 | 12% | Question Mark |

| Commercial Lending | 18% | 15% | 1.20 | 4% | Cash Cow |

| Digital Payments | 15% | 12% | 1.25 | 20% | Star |

| Branch Banking | 10% | 22% | 0.45 | -2% | Dog |

Strategic implications:

- Digital Payments (Star): Market leader in a fast-growing segment. Invest in technology infrastructure and merchant partnerships to maintain share.

- Commercial Lending (Cash Cow): Mature segment, stable margins. Optimize operations and use cash flow to fund Digital Payments.

- Wealth Management (Question Mark): Attractive growth but weak position against established players. The decision hinges on whether existing commercial lending relationships can credibly feed a wealth offering.

- Branch Banking (Dog): Declining market, weak share. Rationalize the network, shift transactions to digital, and redeploy capital.

BCG Matrix Examples: Media Company Content Portfolio#

A media conglomerate analyzing its content divisions:

| Division | Market Share | Leader's Share | Relative Share | Market Growth | Quadrant |

|---|---|---|---|---|---|

| Streaming Platform | 8% | 30% | 0.27 | 16% | Question Mark |

| News Broadcasting | 24% | 18% | 1.33 | 1% | Cash Cow |

| Podcast Network | 20% | 16% | 1.25 | 25% | Star |

| Print Publishing | 12% | 20% | 0.60 | -5% | Dog |

Strategic implications:

- Podcast Network (Star): Strong position in the fastest-growing segment. Invest in exclusive content deals and advertising technology while the market remains fragmented enough to defend leadership.

- News Broadcasting (Cash Cow): Established audience in a flat market. Optimize advertising yields and harvest cash. Avoid chasing digital transformation investments that exceed the segment's growth potential.

- Streaming Platform (Question Mark): At 0.27 relative share against a dominant leader, the path to leadership requires massive investment with uncertain returns. A partnership, niche strategy, or exit may be more rational than continuing to burn cash chasing a distant leader.

- Print Publishing (Dog): Declining market, weak position. Managed wind-down -- extract remaining value through price increases on the loyal subscriber base while reducing editorial investment.

BCG Matrix vs. Alternative Frameworks#

The BCG matrix is one of several portfolio and strategy frameworks. Choosing the right one depends on the decision you are making.

| Dimension | BCG Matrix | GE-McKinsey Matrix | Ansoff Matrix | Product Life Cycle |

|---|---|---|---|---|

| Purpose | Portfolio cash allocation | Portfolio investment prioritization | Growth strategy selection | Product strategy over time |

| Axes | Relative market share vs. market growth | Competitive strength vs. industry attractiveness | Products (existing/new) vs. markets (existing/new) | Time vs. sales volume |

| Complexity | Low (2 metrics, 4 quadrants) | High (multiple weighted factors, 9 cells) | Low (2 dimensions, 4 strategies) | Low (4 sequential stages) |

| Best for | Quick portfolio screening | Nuanced multi-business analysis | Identifying growth paths | Timing strategic decisions |

| Weakness | Oversimplifies competitive dynamics | Subjective factor weighting | Does not assess competitive position | Stages are hard to identify in real time |

The BCG matrix works best as a first-pass screening tool. When portfolio decisions require more nuance -- especially when competitive advantage depends on capabilities beyond market share -- the GE-McKinsey matrix provides a richer analytical framework. When the question shifts from "where to allocate" to "how to grow," the Ansoff Matrix is more directly useful.

Common Mistakes in BCG Matrix Analysis#

Using Absolute Instead of Relative Market Share#

Absolute market share (e.g., "we have 25% of the market") tells you nothing about competitive position. A 25% share where the leader holds 50% is fundamentally different from 25% where the next competitor holds 15%. Relative market share captures this distinction -- the entire basis of the experience curve logic underlying the framework.

Defining the Market Too Broadly or Too Narrowly#

Market definition determines everything. Define a software company's market as "enterprise technology" and every product line has low relative share. Define it as "cloud-based HR analytics for mid-market manufacturing" and the share numbers look great but the market is too narrow to be strategically meaningful. The right definition should match the competitive arena where your unit actually competes for the same customers.

Ignoring Synergies Between Business Units#

The BCG matrix evaluates each unit in isolation, but a "Dog" may provide capabilities, distribution channels, or customer relationships that support a "Star." Before divesting, assess whether removing it weakens the portfolio. Henderson himself acknowledged this -- the matrix is a starting point for allocation discussions, not a mechanical decision rule.

Treating the Matrix as Static#

Markets and competitive positions change. A Star can become a Cash Cow as growth decelerates, and a Question Mark can become a Dog if investment is insufficient. The BCG matrix should be updated at least annually, and the most valuable insight often comes from tracking how business units move across quadrants over time rather than from a single snapshot.

Building a BCG Matrix for Your Portfolio#

- Define markets carefully. Each business unit should compete in a clearly bounded market with identifiable competitors and measurable share data.

- Gather share data. Collect market share for your unit and the market leader from industry reports, analyst estimates, or internal sales data.

- Calculate relative market share. Divide your share by the leader's share. If you are the leader, divide by the second-largest competitor.

- Determine market growth rates. Use the most recent 2-3 year CAGR or forward-looking analyst estimates.

- Set dividing lines. Use 1.0 for relative share and either 10% or your portfolio's weighted average growth rate for the growth axis.

- Plot and analyze. Place each unit on the grid and develop strategic actions aligned with each quadrant.

For presenting BCG matrix analyses in client-ready slides, our BCG Matrix Template provides a pre-formatted layout with quadrant labels. You can also build framework slides in PowerPoint using Deckary's slide builder.

Key Takeaways#

- The BCG matrix plots business units on relative market share (x-axis) vs. market growth rate (y-axis), creating four strategic quadrants

- Always use relative market share (your share divided by the leader's share), not absolute share -- this is the most common error

- Cash Cows fund Stars and selected Question Marks; Dogs should typically be divested unless they provide critical portfolio synergies

- Market definition is the highest-leverage decision in the analysis -- too broad or too narrow renders the framework useless

- The BCG matrix is best used as a first-pass screening tool, complemented by the GE-McKinsey matrix for nuanced multi-factor analysis

- Track quadrant movement over time rather than relying on a single static snapshot

Related Guides#

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free