Ansoff Matrix Examples: 4 Worked Growth Strategies by Industry

Ansoff matrix examples across SaaS, retail, professional services, and manufacturing. Filled-in 2x2 matrices with risk assessment for each growth strategy.

The Ansoff Matrix is the simplest growth strategy framework that still gets used in boardrooms. Igor Ansoff published it in the Harvard Business Review in 1957 as a 2x2 grid mapping products against markets, and six decades later it remains the starting point for any serious growth strategy discussion.

Simple does not mean easy to apply. After using the Ansoff Matrix in 40+ growth strategy engagements, we have found that the framework's value depends on filling each quadrant with specific, costed initiatives rather than vague aspirations, and honestly assessing the risk gradient from penetration through diversification.

This guide provides four worked Ansoff matrix examples across industries, explains the risk logic behind each quadrant, compares the Ansoff Matrix to other portfolio frameworks, and covers the execution mistakes that derail growth strategies. For broader context, see our Strategic Frameworks Guide.

How the Ansoff Matrix Works#

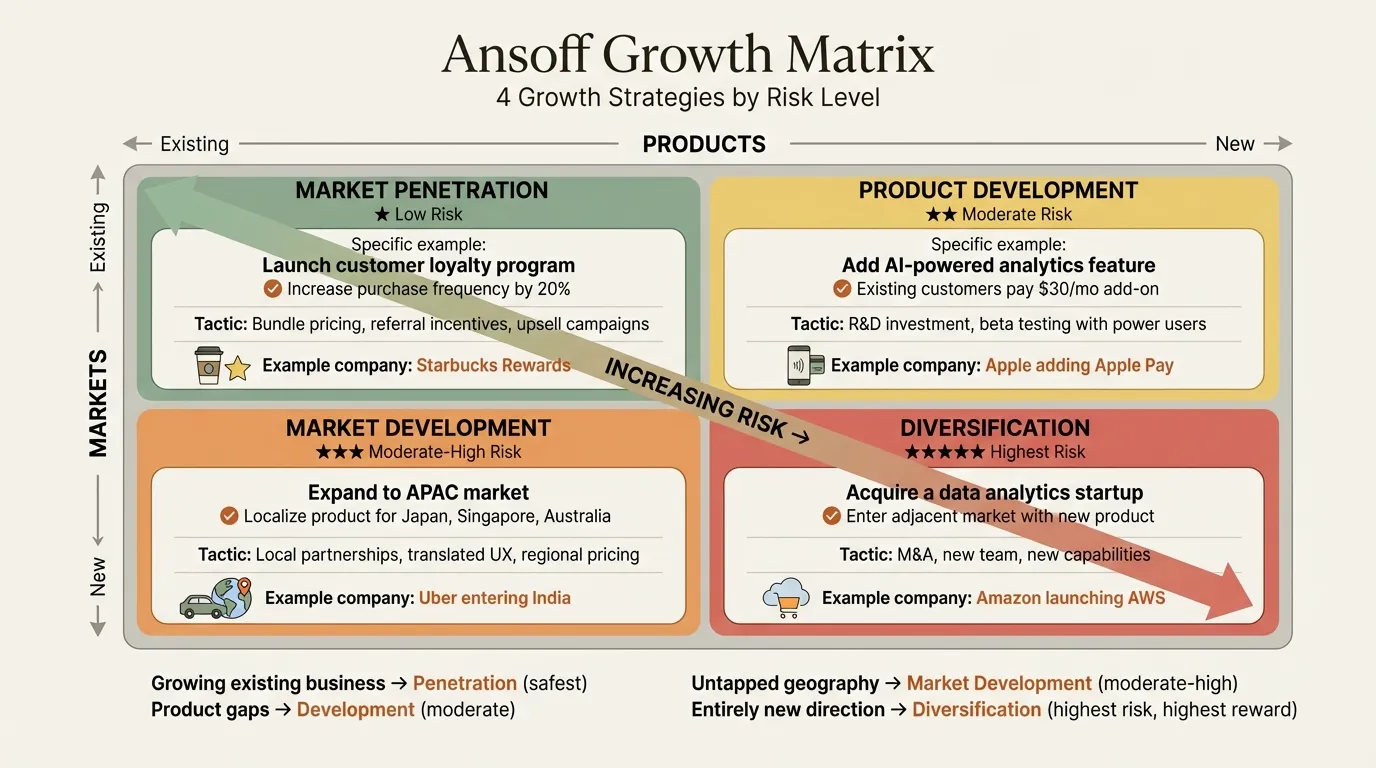

The framework divides growth strategies along two dimensions: products (existing vs. new) and markets (existing vs. new). The four resulting quadrants each represent a distinct strategic path with escalating risk.

| Existing Products | New Products | |

|---|---|---|

| Existing Markets | Market Penetration | Product Development |

| New Markets | Market Development | Diversification |

Market Penetration targets deeper share in current markets with current products. Lowest risk because you understand both the customer and the offering. Tactics include pricing optimization, loyalty programs, and competitive displacement.

Market Development takes existing products into new geographies, segments, or channels. Risk increases because you must learn new customer behaviors and distribution requirements.

Product Development introduces new offerings to existing customers. Risk comes from R&D uncertainty and the possibility that customers do not want what you build. The advantage is existing distribution and relationships.

Diversification combines new products with new markets. Highest risk because both dimensions are unfamiliar. As Ansoff noted in his original work, diversification requires capabilities the company may not possess. Pursue it only when other quadrants are genuinely exhausted or when strategic logic is compelling.

Ansoff Matrix Example 1: SaaS Company (Project Management Platform)#

A project management SaaS company with $30M ARR, 2,000 B2B customers, serving marketing teams at mid-size companies.

| Existing Product (Project Management) | New Products | |

|---|---|---|

| Existing Market (Mid-Market Marketing Teams) | Penetration: Increase seats per account from avg 15 to 25 through team-wide licensing discounts. Launch annual contracts with 20% discount to reduce churn from 8% to 5%. Target 400 net-new mid-market accounts through outbound sales. Revenue impact: +$8M ARR. | Product Development: Launch resource planning module for $15/seat/mo add-on. Build client-facing dashboards for agency teams. Introduce AI-powered workload balancing. Revenue impact: +$6M ARR. |

| New Markets | Market Development: Enter enterprise segment (5,000+ employees) with SSO, audit logs, and dedicated CSM. Expand to UK and DACH markets with localized billing and support. Target IT and engineering teams with vertical templates. Revenue impact: +$10M ARR. | Diversification: Build standalone time-tracking product for freelancers. Acquire a design collaboration tool to create a marketing operations suite. Revenue impact: +$4M ARR. |

Risk Assessment:

- Penetration (Low): Known customers, known product. Win rate data exists. Payback: 3-6 months.

- Market Development (Medium): Enterprise requires longer sales cycles and security certifications. Geographic expansion needs legal and localization investment. Payback: 12-18 months.

- Product Development (Medium): Resource planning module requires 6-9 months of engineering before revenue. Risk of feature bloat if poorly scoped.

- Diversification (High): Freelancer time-tracking targets a different buyer persona. Acquisition integration compounds risk. Payback: 24+ months.

Recommended sequence: Exhaust penetration first (fastest payback), then pursue market development into enterprise in parallel with the resource planning module. Defer diversification until core business exceeds $50M ARR.

Ansoff Matrix Example 2: Retail Chain (Specialty Coffee)#

A specialty coffee retailer with 85 locations across the Northeast US, $120M annual revenue, strong brand recognition in urban markets, and an established wholesale channel supplying 300 restaurants.

| Existing Products (Coffee, Retail, Wholesale) | New Products | |

|---|---|---|

| Existing Markets (Northeast Urban Consumers) | Penetration: Increase same-store sales 8% through mobile ordering and loyalty program (target 40% digital orders). Grow wholesale accounts from 300 to 500 through dedicated sales rep. Launch subscription program for retail customers (2 bags/month). Revenue impact: +$15M. | Product Development: Introduce ready-to-drink bottled cold brew for retail locations. Launch branded merchandise line (mugs, brewing equipment). Develop corporate catering service for office clients. Revenue impact: +$10M. |

| New Markets | Market Development: Open 20 locations in Mid-Atlantic markets (DC, Philadelphia). Launch DTC e-commerce for national wholesale bean sales. Enter grocery channel through partnership with regional chains. Revenue impact: +$25M. | Diversification: Open co-working spaces integrated with coffee shops. Launch coffee education academy (barista certification, cupping courses). Develop private-label tea line for grocery distribution. Revenue impact: +$8M. |

Risk Assessment:

- Penetration (Low): Digital ordering and loyalty are proven tactics. Subscription models work with existing brand affinity. Modest capital requirements.

- Product Development (Medium-Low): Ready-to-drink is natural but requires different production and shelf-life management.

- Market Development (Medium-High): Retail expansion is capital-intensive ($400K-600K per location) with 18-month payback risk. DTC and grocery require different distribution capabilities.

- Diversification (High): Co-working spaces require real estate expertise and compete with established players.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Ansoff Matrix Example 3: Professional Services Firm (Management Consulting)#

A 200-person management consulting firm with $80M revenue, focused on operational improvement for healthcare clients in the US. Core capabilities include process optimization, cost reduction, and performance management.

| Existing Services (Ops Improvement) | New Services | |

|---|---|---|

| Existing Market (US Healthcare) | Penetration: Increase wallet share at top 20 accounts from $800K to $1.2M avg through multi-workstream engagements. Build CEO-level relationships at 15 new health systems through thought leadership and conferences. Improve realization rate from 85% to 92%. Revenue impact: +$12M. | Product Development: Launch digital transformation practice (EHR optimization, telehealth implementation). Build analytics-as-a-service offering with recurring revenue model. Develop M&A integration capability for hospital consolidation. Revenue impact: +$15M. |

| New Markets | Market Development: Enter pharmaceutical and life sciences vertical with existing ops methodology. Expand to UK and Middle East healthcare markets through local partnerships. Target payer organizations (health insurers) in addition to providers. Revenue impact: +$18M. | Diversification: Build proprietary SaaS benchmarking platform for hospital operations. Launch staffing/interim management division. Enter financial services vertical with ops improvement. Revenue impact: +$10M. |

Risk Assessment:

- Penetration (Low): Account expansion with known clients has the highest close rate in professional services. Risk is limited to partner bandwidth.

- Product Development (Medium): Digital transformation requires new technical talent at different compensation levels. Analytics-as-a-service changes the revenue model from project-based to recurring.

- Market Development (Medium): Pharmaceutical ops improvement requires regulatory knowledge (FDA, GMP) the firm lacks. Geographic expansion needs local credentialing.

- Diversification (High): Building a SaaS product requires fundamentally different capabilities than consulting. Staffing carries different margin and liability profiles.

Ansoff Matrix Example 4: Manufacturing Company (Industrial Pumps)#

A $200M industrial pump manufacturer serving the water treatment and chemical processing industries in North America. Core products include centrifugal pumps, positive displacement pumps, and aftermarket parts/service.

| Existing Products (Pumps, Parts, Service) | New Products | |

|---|---|---|

| Existing Markets (NA Water/Chemical) | Penetration: Increase aftermarket capture rate from 35% to 55% of installed base through proactive service contracts. Win 5 competitive displacement accounts per year through total-cost-of-ownership selling. Grow parts e-commerce from 12% to 30% of aftermarket revenue. Revenue impact: +$20M. | Product Development: Develop IoT-enabled smart pumps with predictive maintenance sensors. Launch energy-efficient pump line meeting new EPA standards. Create turnkey pump-station packages (pump + controls + instrumentation). Revenue impact: +$25M. |

| New Markets | Market Development: Enter mining and oil/gas midstream markets with existing pump lines. Expand into Latin American water infrastructure through distributor partnerships. Target municipal contracts in addition to industrial customers. Revenue impact: +$30M. | Diversification: Acquire a valve manufacturer to offer integrated flow control solutions. Develop water treatment chemicals division. Build engineering services business for plant design. Revenue impact: +$15M. |

Risk Assessment:

- Penetration (Low): Aftermarket capture is the highest-margin growth lever in industrial equipment. Installed base is known. Execution requires field service expansion and digital ordering, both manageable investments.

- Product Development (Medium): IoT-enabled pumps require embedded systems engineering the company lacks. Development cycles are 18-24 months.

- Market Development (Medium-High): Mining and oil/gas have different duty cycles, corrosion requirements, and safety standards. Latin American expansion requires trade regulation navigation and extended payment terms.

- Diversification (High): Valve acquisition brings integration risk. Water treatment chemicals is an entirely different business model with different supply chain and regulatory dynamics.

The Risk Gradient Across Quadrants#

The Ansoff Matrix is fundamentally a risk framework. Each move away from the core business compounds uncertainty.

| Strategy | Risk Level | Success Rate* | Key Risk Factor | Typical Payback |

|---|---|---|---|---|

| Market Penetration | Low | 70-80% | Competitive response | 3-12 months |

| Market Development | Medium | 40-60% | Market learning curve | 12-24 months |

| Product Development | Medium | 35-55% | R&D execution | 12-36 months |

| Diversification | High | 20-35% | Dual unfamiliarity | 24-48 months |

*Approximate initiative success rates based on strategy research and engagement experience.

The practical implication is sequencing. Ansoff's original framework was designed to help executives make the risk trade-off explicit rather than defaulting to whatever growth idea sounds most exciting.

This does not mean diversification is always wrong. Amazon's move into AWS was a diversification play that became its most profitable business. But Amazon had exhausted lower-risk growth paths and had a genuine capability advantage (infrastructure at scale) that translated to the new market. Most companies pursuing diversification lack both conditions.

Ansoff Matrix vs BCG Matrix vs GE-McKinsey Matrix#

These three frameworks serve different purposes.

| Dimension | Ansoff Matrix | BCG Matrix | GE-McKinsey Matrix |

|---|---|---|---|

| Primary question | Where should we grow? | Where should we allocate capital? | Which business units deserve investment? |

| Grid structure | 2x2 (product vs. market) | 2x2 (growth vs. share) | 3x3 (attractiveness vs. strength) |

| Orientation | Forward-looking (growth options) | Diagnostic (current portfolio) | Diagnostic (current portfolio) |

| Unit of analysis | Growth initiatives | Business units/products | Business units |

| Risk assessment | Built-in (quadrant = risk level) | Implied (Question Marks = risk) | Requires separate analysis |

| Complexity | Low | Low | High (multi-factor scoring) |

| Best for | Single-business growth planning | Quick portfolio screening | Diversified portfolio prioritization |

Use the Ansoff Matrix for single-business growth planning. Use the BCG Matrix to screen a multi-product portfolio. Use the GE-McKinsey Matrix when portfolio decisions require multi-factor scoring. The three complement each other: Ansoff for growth direction, BCG for portfolio position, GE-McKinsey for investment depth.

Common Mistakes When Using the Ansoff Matrix#

Jumping to diversification before exhausting penetration. This is the most frequent error we see. Teams gravitate toward new-market, new-product ideas because they sound innovative. Meanwhile, penetration initiatives offer 2-3x better risk-adjusted returns with shorter payback periods. Always pressure-test the penetration quadrant first.

Underestimating market development execution risk. "We will just sell our product in Europe" sounds straightforward until you confront regulatory differences, local competitors, and the cost of building a sales presence from scratch. Market development typically requires 18-24 months of investment before meaningful revenue.

Confusing feature additions with product development. Adding a feature to an existing product is penetration, not product development. Product development means creating a genuinely new offering that serves a different need. A CRM company adding a reporting dashboard is penetration. That same company launching a marketing automation platform is product development.

Ignoring the capability gap. Each quadrant requires different capabilities. Penetration needs sales execution. Market development needs localization and market research. Product development needs R&D discipline. Diversification needs all of the above. Audit capabilities before committing to a quadrant.

Building the Ansoff Matrix in Presentations#

Two formatting choices determine whether the slide drives a decision or just fills space. First, include specific initiatives and revenue estimates in each quadrant rather than generic labels. Second, use color coding to reinforce the risk gradient: green for penetration, yellow for development quadrants, red for diversification.

For a pre-formatted slide with the 2x2 grid and risk indicators, use our Ansoff Matrix Template. For competitive context that informs quadrant prioritization, see our Competitive Analysis Framework. Deckary handles the grid formatting and layout alignment that make the matrix presentation-ready in minutes.

Summary#

The Ansoff Matrix remains the most practical framework for structuring growth strategy decisions. Its value is in the risk logic: each step from the core compounds uncertainty, forcing teams to evaluate lower-risk options first.

- Four quadrants, escalating risk -- Penetration (lowest) through Diversification (highest)

- Fill quadrants with specifics -- named initiatives, revenue estimates, and payback periods

- Sequence matters -- exhaust penetration before development, development before diversification

- Revisit quarterly -- the matrix is a living tool, not a one-time artifact

- Complement with portfolio frameworks -- use BCG or GE-McKinsey for multi-business decisions

For a ready-to-use slide layout, start with our Ansoff Matrix Template. For the full toolkit, see our Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free