Free Ansoff Matrix PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Define what counts as 'existing' vs 'new' for products and markets

- 2List specific initiatives in each quadrant

- 3Add revenue estimates for each initiative

- 4Use color gradient to show risk (light=safe, dark=bold)

- 5Highlight recommended growth path with arrows or bolding

- 6Write action title stating recommended strategy

When to Use This Template

- Growth strategy planning

- Annual strategic planning

- Board strategy presentations

- M&A strategy discussions

- Product roadmap prioritization

- Market expansion planning

Common Mistakes to Avoid

- Misplacing initiatives in wrong quadrants

- Treating all quadrants as equally valid options

- Revenue estimates without underlying logic

- Not defining 'existing' and 'new' precisely

- Missing recommended growth path

Use This Template in PowerPoint

Get the Ansoff Matrix Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Ansoff Matrix Template FAQs

Common questions about the ansoff matrix template

Related Templates

Mapping Growth Options Systematically

The Ansoff matrix is the framework that turns growth conversations from "we have lots of ideas" to "here are our strategic options, ranked by risk." Developed by Igor Ansoff in 1957, it remains one of the most practical tools for organizing growth strategy discussions.

The framework plots growth options across two dimensions: Are we selling existing or new products? And are we targeting existing or new markets? The resulting four quadrants—Market Penetration, Product Development, Market Development, and Diversification—each represent different risk/reward profiles.

Understanding the Four Quadrants

Market Penetration (Existing Products, Existing Markets) The safest growth path. You're selling what you already sell to customers you already know. Initiatives include: increasing share of wallet, improving retention, raising prices, expanding distribution within your current market.

Risk level: Lowest. You're leveraging everything you already know.

Product Development (New Products, Existing Markets) Building new offerings for customers you already serve. You understand the market but must execute on product development. Initiatives include: launching add-on products, expanding to adjacent categories, developing premium tiers.

Risk level: Moderate. You know your customers but must build something new.

Market Development (Existing Products, New Markets) Taking your proven product to unfamiliar markets. The product works, but you must learn new customer segments, channels, or geographies. Initiatives include: international expansion, entering new customer segments, adding new distribution channels.

Risk level: Moderate. Your product is proven but the market is new.

Diversification (New Products, New Markets) The boldest bet. You're building something new for customers you don't yet serve. This requires developing new capabilities for unfamiliar markets.

Risk level: Highest. Maximum uncertainty on both dimensions.

The Risk Gradient Visualization

The Ansoff matrix should communicate risk visually. Use a color gradient from light (Market Penetration, lowest risk) to dark (Diversification, highest risk).

A cool blue palette works well: pale blue for Penetration, medium blues for the moderate-risk quadrants, navy for Diversification. The eye should immediately read top-left as "safe" and bottom-right as "bold."

If your corporate colors are warm, a yellow-to-red gradient achieves the same effect.

Defining "Existing" and "New"

The most common error in Ansoff analysis is misclassifying initiatives. Before filling quadrants, define your boundaries precisely:

What counts as your "existing market"?

- Current geographic regions?

- Current customer segments?

- Current distribution channels?

What counts as a "new product"?

- Feature additions to existing products? (Usually not new)

- Adjacent categories? (Usually new)

- Different price tiers? (Depends on how different)

Selling an existing product to a slightly different buyer persona is not Market Development if they share the same geography and channel—that's Market Penetration. True Market Development means a structurally different market.

Populating with Costed Initiatives

Generic content produces generic strategy. Each quadrant needs:

- Named initiatives: Specific projects, not directions

- Revenue estimates: Backed by traceable logic

- Confidence indicators: How certain are you?

Weak content: "Expand to new markets" "Develop new product offerings"

Strong content: "Expand to UK and Australian construction markets: $4M potential in Year 1" "Launch AI-powered scheduling module as paid add-on: $5M potential"

When board members see revenue estimates, their first question is "where do these numbers come from?" Each estimate should trace to a calculation in your appendix.

Writing Strategy Titles

The slide title should state the recommended growth path, not name the framework.

Weak titles:

- "Ansoff Growth Matrix"

- "Strategic Growth Options"

Strong titles:

- "Prioritize penetration and product development ($18.5M) to reach $50M; pursue market development selectively"

- "Fill US distribution gaps ($27M) before investing in international or adjacent categories"

The title quantifies the recommendation and signals priority. It should answer: "What should we do?"

Signaling Priority

The whole point of the Ansoff matrix is to show that growth paths have different risk profiles. If your slide presents four quadrants with equal visual weight, you've built a list, not a strategy.

Ways to signal priority:

- Bold text for recommended initiatives

- Arrows showing the suggested sequence

- Revenue totals per quadrant (makes prioritization obvious)

- Recommendation callout in the title or subtitle

A strategy slide that doesn't recommend anything is not a strategy slide.

When to Use the Ansoff Matrix

The Ansoff matrix works best when:

- You have multiple growth options to evaluate

- The team needs to see risk trade-offs clearly

- Resource allocation decisions require prioritization

- Board or investors want a structured view of growth strategy

It's particularly powerful at annual planning offsites and board-level strategy reviews where you need to frame the growth conversation around clear strategic choices.

For real-world examples across different industries, see our Ansoff Matrix Examples.

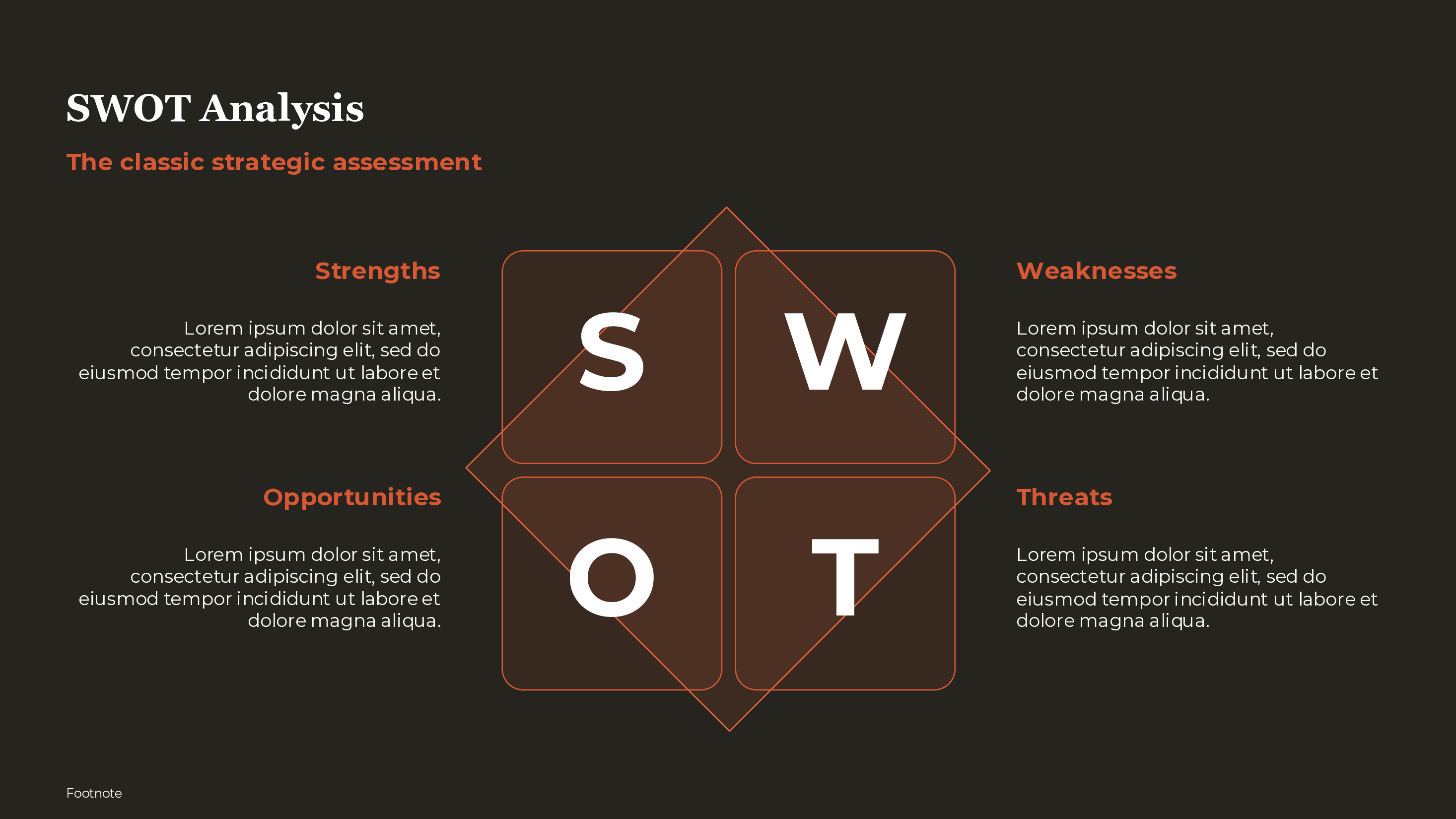

For related growth strategy frameworks, see our BCG matrix template, competitive analysis template, and SWOT analysis template. For more on strategy presentations, explore our Strategic Frameworks Guide.