Includes 6 slide variations

Free Competitive Analysis PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Start by listing your key competitors

- 2Choose dimensions for the 2x2 matrix (e.g., price vs. quality)

- 3Position each competitor on the matrix

- 4Create a comparison table for detailed features

- 5Add market share data if available

- 6Summarize key competitive insights

When to Use This Template

- Strategic planning sessions

- Market entry analysis

- Investment due diligence

- Product positioning decisions

- Sales battlecards

- Board strategy presentations

Common Mistakes to Avoid

- Comparing on too many dimensions at once

- Using unreliable competitor data

- Positioning yourself too favorably (be honest)

- Ignoring indirect competitors

- Not updating as the market changes

Use This Template in PowerPoint

Get the Competitive Analysis Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Competitive Analysis Template FAQs

Common questions about the competitive analysis template

Related Templates

Why Competitive Analysis Matters

Understanding your competition is essential for strategy. Whether you're developing a market entry plan, preparing for an investor meeting, or equipping your sales team, competitive analysis provides the context needed for smart decisions.

Our competitive analysis template pack gives you multiple ways to visualize competitive dynamics: landscape matrices, comparison tables, market share charts, and positioning maps. These follow the frameworks used by McKinsey, BCG, and Bain consultants for strategy engagements.

The 2x2 Competitive Landscape Matrix

The 2x2 matrix is the workhorse of competitive analysis. By plotting competitors on two dimensions, you reveal strategic positions that aren't visible in feature lists or market share data.

Choosing your axes: The axes should represent dimensions that:

- Matter to customers (drive purchase decisions)

- Differentiate competitors (show meaningful variation)

- Are relevant to your strategy (inform your positioning)

Common axis pairs:

- Price vs. Quality/Features

- Breadth (product range) vs. Depth (specialization)

- Enterprise vs. SMB focus

- Innovation vs. Reliability

- Self-service vs. High-touch

Positioning honestly: Resist the temptation to place your company in the ideal quadrant with competitors in unfavorable positions. Board members and investors will challenge biased positioning. Be honest about where you stand—credibility matters more than optimism.

Feature Comparison Tables

While the 2x2 shows strategic positioning, a feature comparison table provides detailed analysis for product decisions and sales enablement.

Structure:

- Rows: Features or capabilities

- Columns: Competitors (including your company)

- Cells: Yes/No, checkmarks, or ratings

Best practices:

- Group features into categories (Core functionality, Integration, Pricing, Support)

- Lead with features where you're strong

- Include features where you're weak—omitting them looks suspicious

- Use consistent rating scales (1-5, Poor/Good/Excellent)

For sales teams: Add a "talking points" column that suggests how to address competitor strengths. "Yes, Competitor X has this feature, but our approach differs because..."

Market Share Visualization

Market share data adds credibility to competitive analysis. If you have reliable data, visualize it clearly.

Pie charts work for:

- Showing relative size of 3-5 competitors

- Emphasizing that one player dominates

- Audiences who quickly grasp percentages

Bar charts work better for:

- Comparing more than 5 competitors

- Showing change over time (clustered bars)

- Precise comparison of similar-sized players

Data quality warning: Market share data is often unreliable for private companies. If you're estimating, say so. "Estimated based on employee count and average revenue per employee" is more credible than presenting estimates as fact.

Gathering Competitive Intelligence

Good competitive analysis requires good data. Here's where to find it:

Public sources:

- Company websites and blog posts

- Press releases and news articles

- Industry analyst reports (Gartner, Forrester, CB Insights)

- Financial filings (10-K, 10-Q for public companies)

- Job postings (reveal priorities and tech stack)

- LinkedIn (team size, hiring patterns)

- G2, Capterra, TrustRadius (customer reviews)

Semi-public sources:

- Product demos and free trials

- Pricing pages and sales conversations

- Conference presentations and webinars

- Patent filings

Customer sources:

- Win/loss interviews

- Customer feedback on competitors

- Sales team intelligence

What's not acceptable:

- Industrial espionage

- Misrepresenting yourself to get information

- Accessing confidential information through improper means

Keep your competitive intelligence gathering ethical. Beyond being wrong, unethical practices create legal and reputational risk.

Competitive Analysis Frameworks

Beyond the 2x2, several frameworks structure competitive thinking:

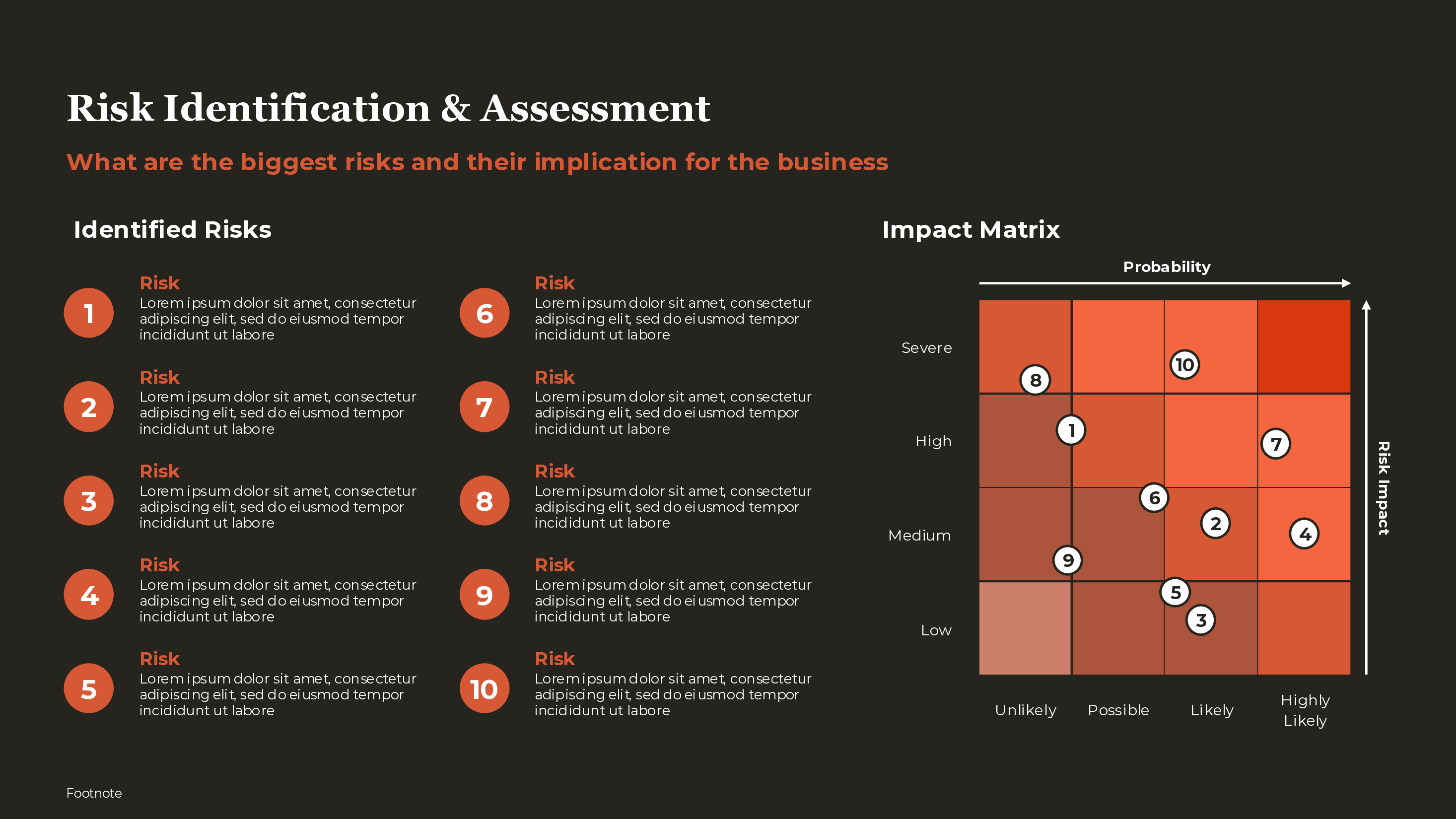

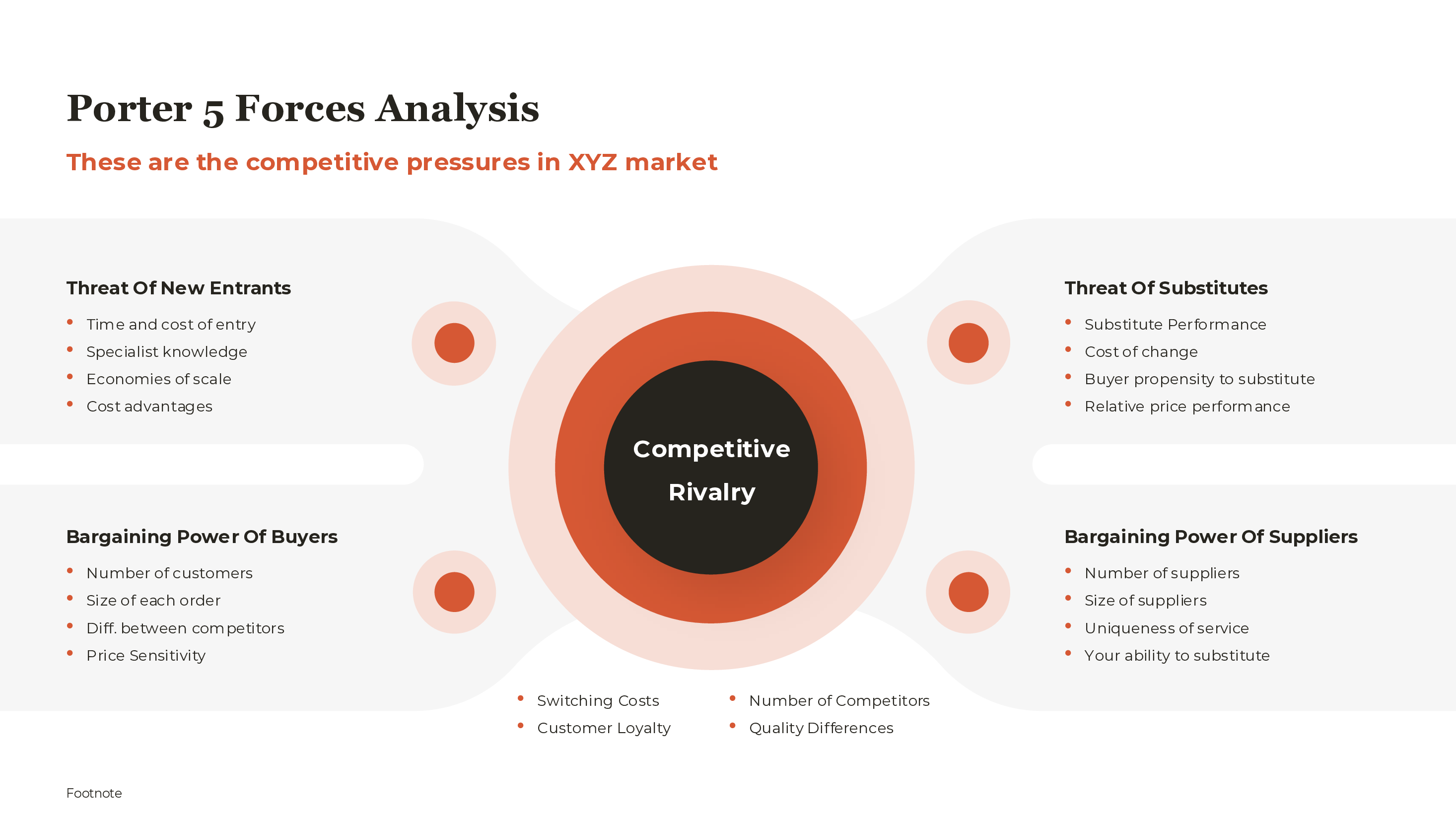

Porter's Five Forces: Analyzes industry-level competitive dynamics—rivalry, new entrants, substitutes, buyer power, supplier power. See our Porter's Five Forces template.

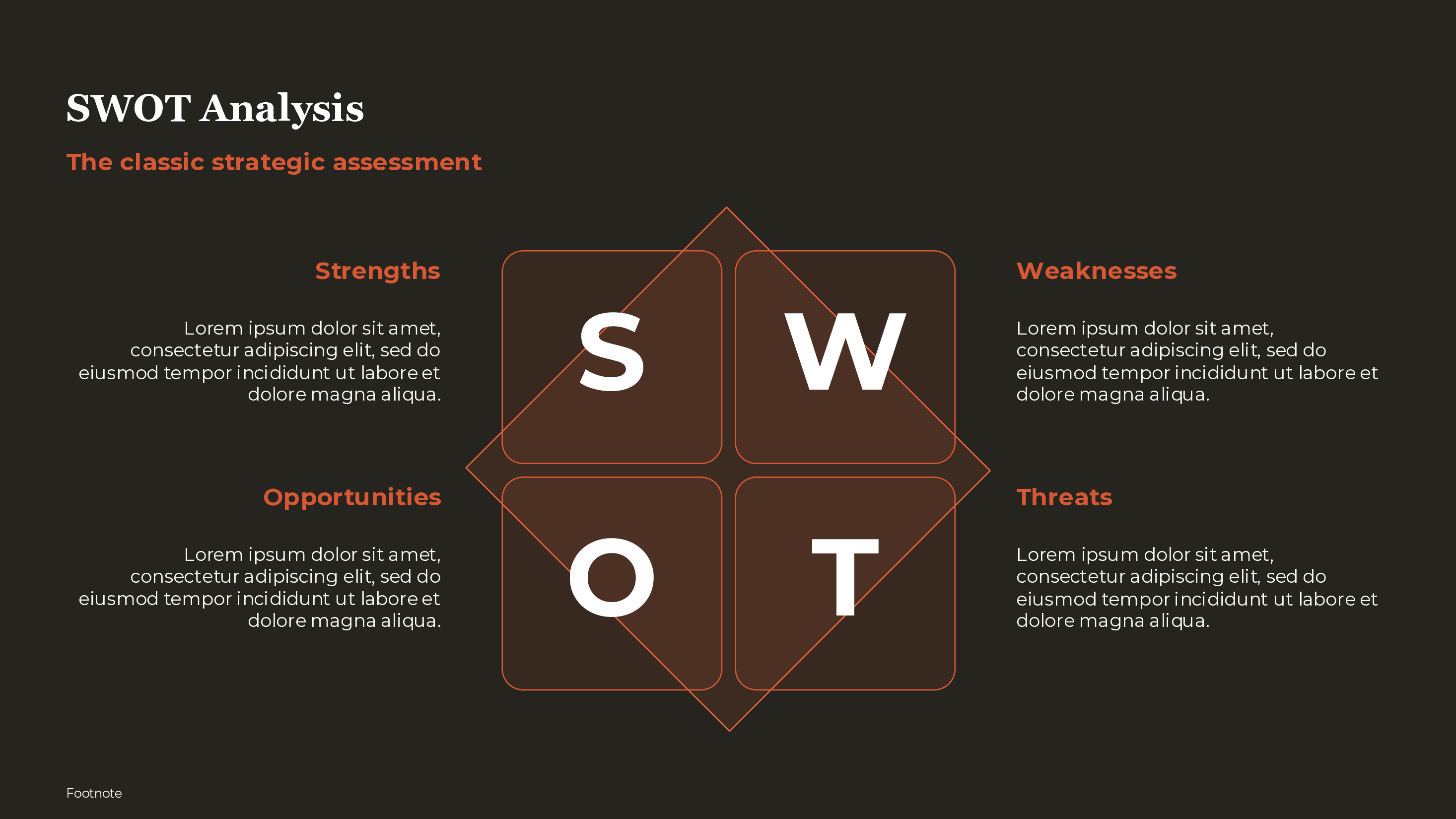

SWOT: Analyzes your competitive position through strengths, weaknesses, opportunities, and threats. See our SWOT analysis template.

BCG Matrix: Portfolio view when you have multiple products competing in different markets. See our BCG matrix template.

Blue Ocean Strategy: Identifies uncontested market space by mapping which factors to eliminate, reduce, raise, or create.

Each framework answers different questions. The 2x2 landscape answers "where do competitors position?" Porter's Five Forces answers "what shapes industry profitability?" SWOT answers "what's our competitive position?" Choose based on the strategic question at hand.

Keeping Analysis Current

Competitive landscapes shift constantly. New entrants emerge, incumbents pivot, markets consolidate. An outdated competitive analysis is worse than none—it creates false confidence.

Maintenance practices:

- Review quarterly for fast-moving markets

- Update when significant news breaks (funding, acquisitions, major launches)

- Assign competitive intelligence ownership

- Create alerts for competitor mentions

Version control: Date your analysis slides and archive previous versions. Being able to show how the competitive landscape evolved over time is valuable for strategy discussions.

Tailoring for Different Audiences

Board/Investor audience:

- Focus on market position and trajectory

- Include market share and growth data

- Emphasize strategic implications

- 2-3 slides maximum

Sales team (battlecards):

- Feature-by-feature comparison

- Handling objections

- Win themes and talk tracks

- Updated monthly or quarterly

Product team:

- Feature gap analysis

- Roadmap implications

- User experience comparison

- Technical architecture insights

Executive team:

- Strategic positioning

- Threat assessment

- Opportunity identification

- Competitive response options

The underlying research is the same, but the presentation should match the audience's needs and decision context.

For real-world examples and detailed frameworks, see our Competitive Analysis Examples and Competitive Analysis Framework.

For related strategy templates, see our SWOT analysis, Porter's Five Forces, and BCG matrix. Deckary's AI Slide Builder can generate competitive analysis slides from a description of your market.