Free Porter's Five Forces PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Place Competitive Rivalry in the center (largest box)

- 2Arrange four other forces in diamond pattern around it

- 3Rate each force as High, Medium, or Low

- 4Color-code by intensity (red=high, amber=medium, green=low)

- 5Add 2-3 evidence bullets per force with specific data

- 6Write a title that synthesizes the strategic implication

When to Use This Template

- Industry analysis presentations

- Market entry assessments

- Investment due diligence

- Strategic planning sessions

- Competitive strategy development

- MBA case studies

Common Mistakes to Avoid

- Rating forces without supporting data

- Ignoring interdependencies between forces

- Treating the analysis as static

- Rating everything as Medium

- Writing descriptive titles instead of action titles

Use This Template in PowerPoint

Get the Porter's Five Forces Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Porter's Five Forces Template FAQs

Common questions about the porter's five forces template

Related Templates

Understanding Industry Structure Through Five Forces

Porter's Five Forces is one of the most enduring frameworks in strategic analysis. Developed by Harvard Business School professor Michael Porter in 1979, it provides a systematic way to analyze the competitive forces that shape industry profitability.

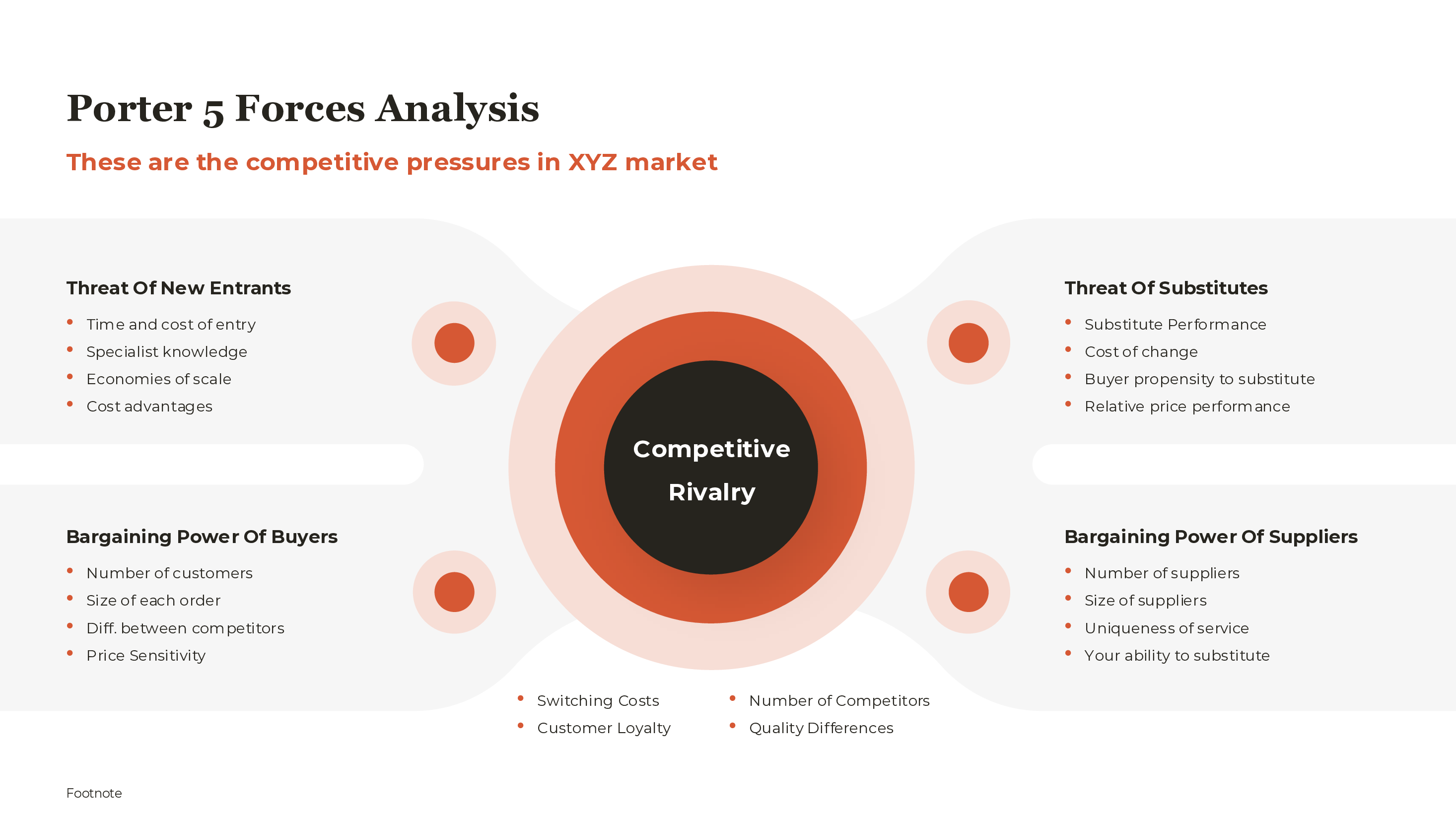

The five forces are: Competitive Rivalry (the intensity of competition among existing players), Threat of New Entrants (how easily new competitors can enter), Bargaining Power of Suppliers (how much leverage suppliers have), Bargaining Power of Buyers (how much leverage customers have), and Threat of Substitutes (what alternative solutions exist).

Our template uses a hub-and-spoke layout with Competitive Rivalry at the center—reflecting that the other four forces all influence the level of central rivalry. Color-coding by intensity (red for high, amber for medium, green for low) lets executives scan the slide in seconds.

The Hub-and-Spoke Layout

The center position of Competitive Rivalry is deliberate. The other four forces flow into and influence the level of rivalry. Your layout should reflect this hierarchy:

- Center (largest box): Competitive Rivalry

- Top: Threat of New Entrants

- Bottom: Threat of Substitutes

- Left: Bargaining Power of Suppliers

- Right: Bargaining Power of Buyers

Arrows point from each peripheral force toward the center, indicating the direction of influence. This isn't decorative—it represents the causal flow that Porter's framework describes.

Rating Forces with Evidence

Each force should be rated as High, Medium, or Low based on specific industry evidence. Generic ratings without data are worthless. Every force box needs 2-3 evidence bullets with specific metrics or facts.

Strong evidence examples:

- "Top 3 suppliers control 70% of input materials"

- "12 new entrants funded at Series A+ in the last 18 months"

- "Average annual churn of 18-22% indicates frequent switching"

Weak evidence examples:

- "Moderate supplier power" (no data)

- "Some barriers to entry" (vague)

- "Competitive market" (obvious)

If you cannot find data to support a High or Low rating, "insufficient data" is more honest than defaulting to "Medium."

Avoiding the "Medium" Trap

When three or more forces are rated Medium, the analysis isn't adding value. "Medium" often means "we didn't dig deep enough." Challenge each rating: What specific evidence pushed you away from High or Low? If you can't articulate that, you need more research, not a safer rating.

The best Five Forces analyses show differentiation—some forces are clearly high, others clearly low. The asymmetry is the insight. An industry where all forces are "Medium" either hasn't been analyzed rigorously or is genuinely undifferentiated (rare).

Interdependencies Between Forces

The five forces are not independent assessments. They interact and reinforce each other:

- High threat of new entrants often intensifies competitive rivalry

- Strong buyer power can encourage new entrants (buyers invite alternatives)

- Substitutes reduce buyer dependence on any single industry

- Supplier power can create barriers to entry (if suppliers favor incumbents)

Your analysis should call out these connections. When you rate New Entrants as High and Rivalry as High, explain the causal link—"12 new entrants in 18 months have intensified price-based competition among incumbents."

Writing Action Titles

Your slide title should synthesize the strategic implication, not name the framework.

Weak titles:

- "Porter's Five Forces Analysis"

- "Industry Analysis"

- "Competitive Forces"

Strong titles:

- "High rivalry and low switching costs pressure margins despite strong barriers to entry"

- "Low supplier power and fragmented buyers create favorable industry structure"

- "Threat of substitutes is reshaping the competitive landscape"

The title tells the executive what the analysis means for strategy. They should understand the key insight without reading a single bullet.

Industry-Specific Considerations

Five Forces analysis must be calibrated to industry context:

Tech/SaaS industries:

- Supplier power often low (commodity cloud infrastructure)

- Threat of substitutes often high (alternatives proliferate rapidly)

- Barriers to entry often low (capital-light business models)

Manufacturing industries:

- Supplier power varies by input specialization

- Threat of new entrants often moderate (capital requirements)

- Buyer power depends on concentration

Regulated industries:

- Barriers to entry often high (licensing requirements)

- Supplier power shaped by regulatory framework

- Substitutes may be limited by regulation

Tailor your analysis to industry-specific dynamics rather than applying generic templates.

Beyond Static Analysis

Five Forces is often presented as a snapshot, but industry structure changes. Show how forces are trending:

- Use directional arrows (↑ ↓ →) to indicate whether forces are strengthening, weakening, or stable

- Note emerging threats that may shift force ratings

- Consider how technology or regulation might reshape the industry

An analysis that addresses trajectory is more useful for strategy than one that only captures current state.

For related strategy frameworks, see our SWOT analysis template, competitive analysis template, and PESTLE analysis template. For more on structuring strategy presentations, explore our Strategic Frameworks Guide.