Competitive Analysis Examples: 5 Worked Frameworks With Real Data

Competitive analysis examples across SaaS, consumer goods, professional services, and healthcare. Filled-in frameworks with metrics and strategic takeaways.

Competitive analysis examples found online tend to be empty frameworks with placeholder text. They show you the shape of a 2x2 matrix but not how to fill one in with data that drives an actual strategic decision.

A useful competitive analysis includes specific metrics, honest positioning assessments, and conclusions an executive team can act on without asking for clarification. The framework you choose matters less than the rigor of the data inside it.

After conducting competitive analyses across 120+ strategy engagements — market entries, due diligence, annual planning, and growth strategy projects — we have identified which frameworks produce actionable insight and which produce slides that get politely skipped. This guide provides five worked competitive analysis examples across different industries, compares the major frameworks, and covers the mistakes that turn competitive analysis into competitive decoration. For the broader strategic toolkit, see our Strategic Frameworks Guide.

What Separates Useful Competitive Analysis Examples From Generic Ones#

Before walking through the examples, three principles separate a consulting-grade competitive analysis from a business school exercise.

Metrics replace adjectives. "Strong market position" is not analysis. "34% market share in mid-market segment, up from 28% two years ago, with 91% logo retention" is analysis. Every cell in a framework should contain a number, a percentage, or a verifiable fact.

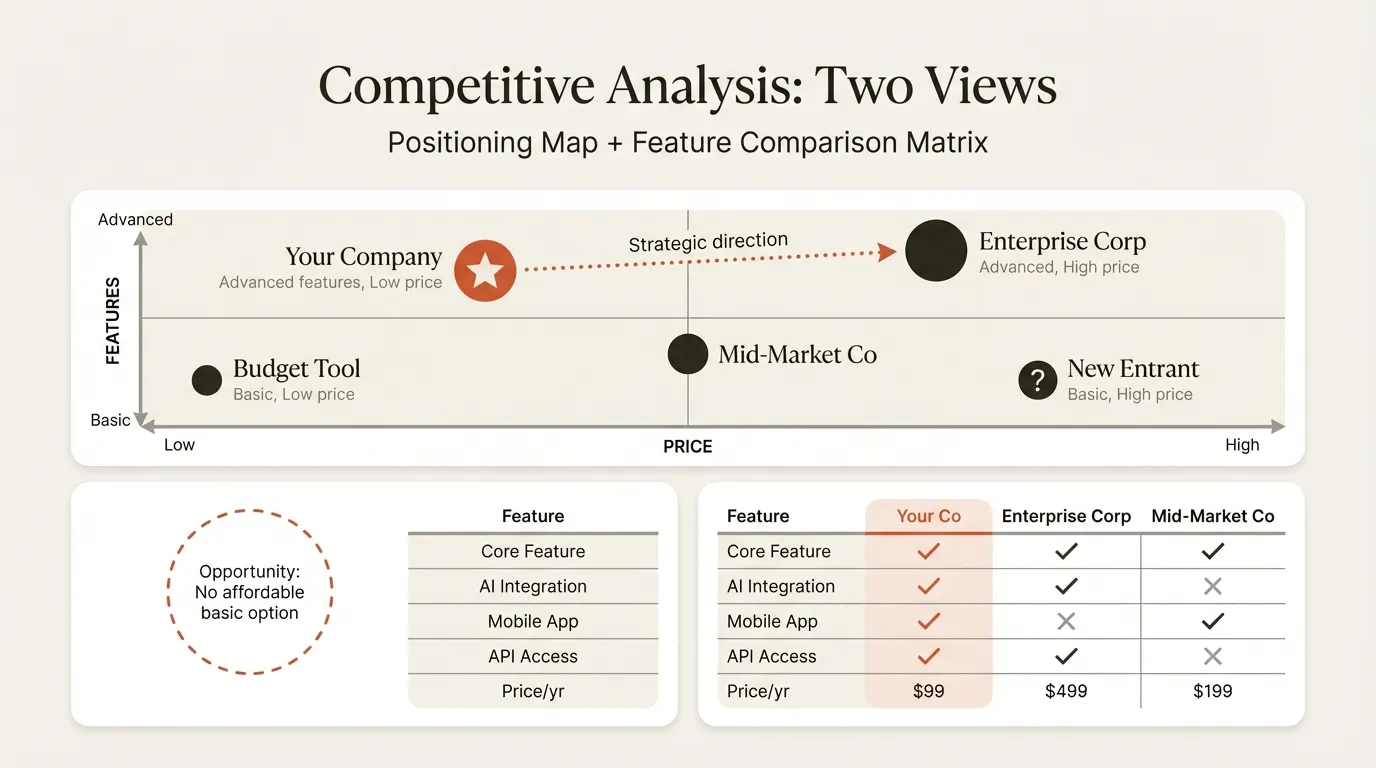

The framework matches the question. A feature comparison matrix answers "How does our product stack up?" A strategic group map answers "Where are the clusters of competition and white space?" Porter's Five Forces, first published in Harvard Business Review in 1979, answers "Is this industry attractive to compete in?" Using the wrong framework for the question produces impressive slides and useless conclusions.

The output is a decision, not a diagram. The slide title should never read "Competitive Analysis." It should state the strategic implication: "Price-led competitors dominate enterprise but leave mid-market underserved" or "Feature parity across top 4 players shifts competition to distribution and brand." If you cannot write an action-oriented title, the analysis is not finished.

Competitive Analysis Frameworks Compared#

Different strategic questions require different frameworks. Here is when each applies and what it does not cover.

| Framework | Best For | Dimensions | Output | Limitation |

|---|---|---|---|---|

| Feature Comparison Matrix | Product-level assessment | Capabilities, pricing, platform | Strengths and gaps by feature | Does not capture positioning or industry dynamics |

| Strategic Group Map | Industry structure analysis | 2 strategic dimensions (e.g., price vs. breadth) | Clusters, white space, mobility barriers | Requires judgment on which dimensions matter most |

| Competitive Positioning Map | Executive communication | 2 value dimensions | Visual differentiation story | Oversimplifies to 2 axes |

| Porter's Five Forces | Industry attractiveness | Suppliers, buyers, substitutes, entrants, rivalry | Profitability outlook | Does not compare specific competitors |

| SWOT Analysis | Single-company deep dive | Strengths, weaknesses, opportunities, threats | Internal + external assessment | Analyzes one company at a time, not the competitive set |

Our recommendation: Start with a feature comparison matrix to understand the product landscape, then build a strategic group map or positioning map to identify where to compete. Layer Porter's Five Forces on top when assessing whether the market is worth entering at all.

Competitive Analysis Examples by Industry and Framework#

The five examples below use different frameworks and industries to show how the same underlying discipline — comparing competitors on specific, measurable dimensions — adapts to different strategic contexts. For a blank version you can populate with your own data, see our Competitive Analysis Template.

Example 1: Feature Comparison Matrix — B2B SaaS (Marketing Automation)#

Context: A Series B marketing automation platform ($18M ARR) evaluating its competitive position against Hubspot, Marketo, and ActiveCampaign to inform product roadmap prioritization.

| Capability | Our Platform | HubSpot Marketing Hub | Marketo (Adobe) | ActiveCampaign |

|---|---|---|---|---|

| Email automation | Advanced (behavioral triggers, 12 workflow types) | Advanced (comparable breadth) | Advanced (strongest in enterprise workflows) | Intermediate (6 workflow types) |

| CRM integration | Native + 45 third-party connectors | Native (HubSpot CRM) | Native (Adobe ecosystem) | Native + 22 connectors |

| AI lead scoring | Proprietary model (82% accuracy on test set) | Basic (rule-based scoring) | Advanced (Sensei AI integration) | Basic (rule-based) |

| Mid-market pricing (500 contacts) | $299/mo | $890/mo (Professional tier) | Custom ($1,200+/mo typical) | $149/mo |

| Enterprise pricing (50K contacts) | $1,800/mo | $3,600/mo | Custom ($4,500+/mo typical) | $687/mo |

| Implementation time | 2-3 weeks avg | 4-6 weeks | 8-14 weeks | 1-2 weeks |

| SOC 2 Type II | Yes | Yes | Yes | No |

| Multi-touch attribution | Yes (7 models) | Yes (5 models) | Yes (8 models) | No |

Strategic insight: The feature matrix reveals that AI lead scoring and mid-market pricing are the two genuine differentiators. Feature parity exists across email automation and CRM integration — competing on those dimensions is a losing strategy against HubSpot's brand advantage. The product roadmap should double down on AI capabilities (where only Marketo competes) while maintaining the 65-70% price discount versus HubSpot that makes the platform viable for mid-market buyers priced out of enterprise tools.

Action title for slide: "AI scoring accuracy and mid-market pricing create defensible position between HubSpot's brand and ActiveCampaign's low cost"

Example 2: Strategic Group Map — Regional Professional Services#

Context: A 120-person management consulting firm mapping competitive dynamics in the Southeastern US market to identify positioning opportunities after losing three pitches to the same competitor.

Strategic groups were plotted on two dimensions: service breadth (specialist vs. generalist) and average engagement size (measured by typical project fee).

Group A — Large Generalists (High breadth, $500K+ engagements): McKinsey, BCG, Bain, Deloitte Strategy. These firms compete on brand, global reach, and cross-functional capability. They rarely pursue engagements under $400K. Mobility barrier: brand reputation and alumni networks built over decades.

Group B — Mid-Market Generalists (High breadth, $100-400K engagements): Regional offices of Accenture Strategy, Kearney, and two local firms. They offer broad capabilities but win on relationship depth and lower rates than Group A. Mobility barrier: established client portfolios and local partner networks.

Group C — Domain Specialists (Low breadth, $150-500K engagements): Healthcare-focused consultancies (3 firms), fintech advisory boutiques (2 firms). They compete on deep domain expertise and typically win when the problem requires specialized knowledge Group A and B firms lack. Mobility barrier: credentialed subject matter experts with industry operating experience.

Group D — Implementation Firms (Medium breadth, $50-200K engagements): Smaller firms focused on execution support — project management, change management, process optimization. They compete on cost and availability. Mobility barrier: low, which keeps pricing compressed.

Strategic insight: The firm that won the three lost pitches sits in Group C (domain specialist) while our firm competes in Group B (mid-market generalist). We lost because the clients valued domain depth over breadth. Two strategic options emerge: develop a vertical specialization in one or two industries to move into Group C territory, or explicitly target engagements where cross-functional breadth is the buying criterion. Trying to be both is the positioning mistake the analysis reveals.

Example 3: Competitive Positioning Map — Consumer Packaged Goods (Premium Snacks)#

Context: A natural snack brand ($42M revenue) preparing a board presentation on competitive positioning ahead of a retail expansion into 1,200 new stores. The positioning map uses two dimensions most correlated with purchase decisions in this category: perceived health positioning (indulgent to health-forward) and price per serving.

| Brand | Price/Serving | Health Positioning | Distribution (Store Count) | YoY Growth |

|---|---|---|---|---|

| Our Brand | $1.85 | Health-forward (organic, under 5g sugar) | 4,200 | 28% |

| KIND Snacks | $1.65 | Health-moderate (natural but 8-12g sugar) | 48,000 | 6% |

| RXBar | $2.10 | Health-forward (clean label, protein) | 32,000 | 11% |

| Nature Valley | $0.75 | Health-moderate (natural positioning, higher sugar) | 85,000+ | 2% |

| Hu Kitchen | $2.40 | Health-forward (paleo, organic) | 12,000 | 19% |

| Clif Bar | $1.30 | Health-moderate (performance nutrition) | 60,000+ | 4% |

Strategic insight: The positioning map reveals that the health-forward, mid-price quadrant ($1.50-2.00, low sugar, organic) contains only our brand. KIND occupies the health-moderate, mid-price position with 10x the distribution. RXBar and Hu Kitchen are health-forward but at premium price points ($2.10+). The retail expansion strategy should target the 1,200 stores where KIND has shelf space but no direct health-forward competitor exists at a comparable price — our brand fills that gap. The risk: KIND can reposition with a low-sugar product line faster than we can scale distribution.

Example 4: Porter's Five Forces — Telehealth Industry#

Context: A healthcare system evaluating whether to build a proprietary telehealth platform or partner with an existing vendor. Porter's Five Forces assessment of the telehealth industry:

| Force | Intensity | Key Evidence | Strategic Implication |

|---|---|---|---|

| Threat of New Entrants | High | VC funding in telehealth: $4.2B in 2025. Low technical barriers (WebRTC, cloud infrastructure). 14 new platforms launched in past 18 months. | New competitors continuously enter; technology alone is not a moat |

| Supplier Power | Moderate | Cloud providers (AWS, Azure) have moderate pricing power. EMR vendors (Epic, Cerner) control integration access and charge $50-200K for API partnerships. | EMR integration costs create a hidden barrier. Vendor lock-in risk. |

| Buyer Power | High | Health systems evaluate 3-5 platforms per procurement cycle. Switching costs are moderate (6-9 month implementation). Top 50 health systems represent 35% of total market spend. | Buyer concentration means pricing pressure. Retention depends on integration depth, not features. |

| Threat of Substitutes | Moderate | In-person visits remain the baseline. Phone consultations handle 30-40% of use cases without a platform. Retail clinics (CVS, Walgreens) expanding in-store services. | Telehealth must prove outcomes equivalence to justify platform cost over simpler alternatives. |

| Competitive Rivalry | High | Top 5 platforms hold 52% market share. Price competition compressing margins (ARPU down 12% YoY across industry). Feature parity across platforms for core video visit functionality. | Differentiation shifting from features to workflow integration, specialty support, and patient engagement. |

Overall assessment: High rivalry, high buyer power, and high new entrant threat make this an unattractive industry for a new proprietary platform. The analysis recommends partnering with an established vendor (reducing capital risk) while investing in EMR integration depth (the one supplier-side barrier that creates switching costs). Building proprietary is only justified if the health system's scale (20,000+ monthly visits) makes the unit economics work despite the competitive dynamics.

Example 5: Multi-Framework Analysis — Fintech Payments (Competitive Deep Dive)#

Context: A B2B payments startup preparing competitive analysis for Series A fundraising ($8M round). The analysis combines a feature matrix with a positioning map to tell the full competitive story.

Feature comparison (core capabilities):

| Capability | Our Platform | Stripe | Square | Adyen | PayPal Commerce |

|---|---|---|---|---|---|

| Cross-border payments | 42 countries | 46 countries | 8 countries | 37 countries | 35 countries |

| B2B invoicing | Native (net-30/60/90 terms) | Basic (via Stripe Billing) | Limited | Advanced | Basic |

| Interchange optimization | AI-driven (avg 18bps savings) | Manual tier selection | None | Rule-based (avg 8bps) | None |

| Integration time | 3-5 days (pre-built ERP connectors) | 1-2 weeks | 1-3 days | 3-6 weeks | 2-4 weeks |

| Effective rate (mid-market B2B) | 2.1% + $0.15 | 2.9% + $0.30 | 2.6% + $0.10 | 2.2% + $0.20 | 2.59% + $0.49 |

| Fraud detection | ML model (0.03% false positive rate) | Radar (industry standard) | Basic rules | Risk engine (strong) | Basic + Simility acquisition |

Positioning map dimensions: B2B payment specialization (horizontal axis) vs. global coverage (vertical axis).

The positioning map places Stripe and Adyen in the high-coverage, moderate-B2B-specialization quadrant. Square occupies low-coverage, low-B2B-specialization (consumer/SMB focused). Our platform claims the high-B2B-specialization, moderate-coverage position — the quadrant no major player occupies.

Strategic insight for investors: The feature matrix proves that interchange optimization (18bps average savings) and native B2B invoicing are genuine differentiators, not marketing claims. The positioning map shows these differentiators place us in an uncontested quadrant — specialized B2B payments with competitive global coverage. Stripe could enter this space but historically prioritizes developer tools over B2B-specific workflows. The Series A thesis: capture B2B mid-market before Stripe builds dedicated invoicing and interchange optimization, using integration speed (3-5 days vs. Stripe's 1-2 weeks for comparable B2B setups) as the wedge.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Competitive Intelligence vs. Competitive Analysis#

Teams routinely conflate these two disciplines, a distinction that organizations like the Strategic and Competitive Intelligence Professionals (SCIP) have worked to formalize. Competitive intelligence is data collection — monitoring pricing changes, tracking product launches, reviewing job postings for hiring signals, analyzing earnings calls and filings. Competitive analysis is interpretation — using frameworks to convert that raw data into strategic insight about positioning, vulnerabilities, and market opportunities.

Intelligence without analysis produces a filing cabinet. Analysis without intelligence produces frameworks filled with assumptions. You need both, in sequence. Teams that skip the intelligence step and go straight to filling in a positioning map produce analysis that looks rigorous but rests on guesswork.

Common Competitive Analysis Mistakes#

After reviewing competitive analysis slides across hundreds of engagements, the same errors recur:

Analyzing only direct competitors. The most dangerous competitors are often substitutes and new entrants, not the companies you already track. In the telehealth example above, retail clinics and phone consultations are more immediate threats than another telehealth platform.

Using subjective assessments instead of data. Rating competitors as "strong," "moderate," or "weak" without underlying metrics is opinion, not analysis. Replace adjectives with numbers: market share percentages, pricing data, growth rates, customer counts.

Treating the analysis as static. A competitive analysis from six months ago reflects a market that no longer exists. SaaS competitors ship features monthly. CPG brands launch line extensions quarterly. Build a refresh cadence into your process — quarterly for fast-moving markets, semi-annually for slower ones.

Ignoring your own weaknesses. Competitive analysis that makes your company look superior in every dimension is not analysis — it is advocacy. Acknowledging where competitors genuinely outperform you builds credibility with executives and investors and produces strategies that address real gaps rather than imagined ones.

Presenting Competitive Analysis Examples Effectively#

The analysis is only as valuable as its communication. For slides that survive partner review:

Use an action title that states the conclusion. "Competitive Analysis" wastes the most valuable real estate on the slide. "Interchange optimization creates 18bps cost advantage in underserved B2B mid-market" tells the reader the strategic implication before they examine the data.

Match the framework to the audience. Feature matrices work for product teams who need granular capability comparisons. Positioning maps work for executives and investors who need the strategic narrative. Porter's Five Forces works for board-level industry attractiveness discussions. Using the wrong framework for the audience guarantees the analysis gets ignored.

Include a "So What?" on every slide. Below every framework, add one sentence summarizing the strategic implication. The five examples above each end with a strategic insight — that is the sentence that belongs on the slide.

For building these frameworks in PowerPoint, tools like Deckary provide consulting-grade templates with alignment shortcuts and formatting that meets consulting slide standards. For stakeholder-facing presentations where the competitive analysis sits within a broader strategic narrative, see our Stakeholder Mapping guide for ensuring the right audience sees the right level of detail.

Key Takeaways#

- Choose the framework based on the strategic question — feature matrices for product comparisons, strategic group maps for industry positioning, Porter's Five Forces for market attractiveness, positioning maps for executive communication

- Fill frameworks with metrics, not adjectives — market share, pricing, growth rates, and retention data make analysis actionable

- Separate intelligence gathering from analysis — collect data first, then interpret through structured frameworks

- Combine frameworks for comprehensive analysis — the fintech example shows how a feature matrix plus positioning map tells a richer story than either alone

- Update regularly — quarterly in fast-moving markets, semi-annually in slower ones, and always after major competitor moves

- State the conclusion in the slide title — the strategic implication, not the framework name

For a blank framework you can populate with your own competitive data, start with our Competitive Analysis Template. For related strategic frameworks, see our SWOT Analysis Examples and Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free