SWOT Analysis Examples: 5 Real-World Templates With Data

SWOT analysis examples across tech, retail, healthcare, manufacturing, and consulting. Filled-in matrices with real metrics and strategic implications.

Most SWOT analysis examples you find online list "strong brand" as a strength and "increasing competition" as a threat. That is not analysis. That is a placeholder disguised as strategy.

A useful SWOT analysis includes specific metrics, concrete competitive data, and bullets that an executive can act on without asking "what does this actually mean?"

After building SWOT analyses across 150+ strategy engagements and annual planning sessions, we have identified the patterns that separate partner-approved frameworks from revision requests. This guide provides five worked SWOT analysis examples with real metrics across industries, shows what makes each one effective, and explains how to convert a completed SWOT into actionable strategy. For the broader framework context, see our Strategic Frameworks Guide.

What Makes a Good SWOT Analysis Example#

Before walking through examples, we need to establish what separates a useful SWOT from a generic one. The framework, originally developed in the 1960s at the Stanford Research Institute by Albert Humphrey, was designed as a decision tool. The standard taught in business school -- list four quadrants, fill them with observations -- misses the point. A consulting-grade SWOT is a decision tool, not a brainstorming artifact.

Three rules separate effective SWOT analysis examples from filler:

Every bullet includes a metric. "Strong customer loyalty" tells an executive nothing. "NPS of 72 vs. industry average of 41; 89% annual renewal rate" tells them exactly where the company stands and how defensible that position is.

Internal and external factors are clearly separated. Strengths and Weaknesses are things the organization controls (margins, talent, IP, processes). Opportunities and Threats are external forces it responds to (market trends, regulation, competitor moves). Mixing these undermines the framework's analytical value.

The action title states the strategic implication. The slide title should never be "SWOT Analysis." It should be "Strong unit economics and R&D pipeline offset regulatory headwinds in core market" -- a conclusion that tells the reader what the SWOT means before they read a single bullet. This follows the Pyramid Principle that underpins all consulting communication.

SWOT Analysis Examples by Industry#

The five examples below use realistic company scenarios with specific data points. Each includes a filled-in SWOT matrix, the strategic context, and the key implication. For a blank version you can customize, see our SWOT Analysis Template.

Example 1: Mid-Size SaaS Company (B2B Project Management)#

Context: A Series C project management platform with $48M ARR competing against Asana, Monday.com, and Jira. The company has strong product-market fit in mid-market but is losing enterprise deals to incumbents.

| Strengths | Weaknesses |

|---|---|

| 130% net dollar retention in mid-market segment | Enterprise win rate of 18% vs. 42% for top competitor |

| $14K average ACV with 78% gross margin | Sales cycle of 94 days, 2.3x industry median for segment |

| NPS of 68 among mid-market users (vs. 45 industry avg) | Engineering team 40% below headcount plan; 6-month avg time-to-fill |

| Native AI features shipped 8 months ahead of Asana/Monday | No SOC 2 Type II certification; blocks 35% of enterprise pipeline |

| Opportunities | Threats |

|---|---|

| Mid-market PM software TAM growing 19% CAGR through 2029 | Microsoft Project integration with Teams (140M monthly active users) |

| 72% of ICP companies still using spreadsheets for project tracking | Asana launched enterprise tier at 30% price discount in Q3 |

| AI-powered workflow automation demand up 3.4x YoY in segment | Series D funding environment tight; 14-month runway at current burn |

| Channel partnership pipeline with 3 major SI firms in late-stage negotiation | Open-source alternative (Plane) reached 20K GitHub stars in 12 months |

Key insight: Mid-market dominance (130% NDR, NPS of 68) is a genuine moat, but the lack of SOC 2 certification blocks upmarket expansion. The SO strategy: double down on mid-market AI differentiation while using SI partnerships to access enterprise deals indirectly. The WT risk -- running out of runway before enterprise traction -- requires immediate burn reduction or accelerated SOC 2.

Example 2: Regional Retail Chain (Specialty Grocery)#

Context: A 42-store specialty grocery chain in the Pacific Northwest with $310M annual revenue. The chain has built a loyal following around local sourcing and premium quality but faces margin pressure from national competitors expanding into organic/specialty.

| Strengths | Weaknesses |

|---|---|

| 67% of products sourced from within 200 miles; strongest local brand equity in region | Operating margin of 3.1% vs. 5.8% Whole Foods regional average |

| Customer repeat visit rate of 3.2x/week vs. 1.8x industry avg | E-commerce only 4% of revenue vs. 12% for Whole Foods |

| Average basket size of $62 vs. $47 category average | Inventory shrinkage at 2.8%, nearly double the 1.5% industry benchmark |

| Zero long-term debt; $18M cash reserves | IT infrastructure running on 12-year-old ERP; no real-time inventory visibility |

| Opportunities | Threats |

|---|---|

| Pacific NW organic food market growing 11% annually | Amazon Fresh expanding to 3 new metro areas in the region by 2027 |

| Local sourcing legislation (HB 2847) offers 2.4% tax incentive for qualifying retailers | Whole Foods opened 4 stores in the chain's core markets in the past 18 months |

| Meal kit delivery partnership with regional meal prep service (180K subscribers) | Labor costs rising 8.2% YoY; minimum wage increase to $18.50 in 2027 |

| Corporate catering segment ($2.1B regional TAM) underserved by specialty grocers | Supply chain disruption risk: 3 key local suppliers have no backup sources |

Key insight: Repeat visit rate and basket size prove customers will pay a premium for local sourcing. But 3.1% operating margins leave no buffer against national competitors. The critical WO strategy: use the $18M cash reserve and tax incentives to modernize the ERP and launch e-commerce before Amazon Fresh captures digital-first specialty shoppers. The aging IT infrastructure is the root cause behind both the shrinkage problem and the e-commerce gap.

Example 3: Regional Healthcare System (Multi-Hospital Network)#

Context: A 5-hospital healthcare network in the Midwest with $1.8B annual revenue and 12,000 employees. Strong reputation for cardiac care but struggling with nurse retention and outpatient volume migration to retail clinics.

| Strengths | Weaknesses |

|---|---|

| Top 5% nationally in cardiac outcomes (CMS star rating: 4.7/5) | RN turnover at 24% vs. 18% national average; $62K avg cost per turnover |

| Largest employer in 3 of 5 service area counties | Outpatient visit volume down 11% YoY as patients shift to retail clinics |

| $420M in annual research grants; 3 active clinical trials in cardiology | Average patient wait time 34 minutes vs. 18-minute benchmark |

| Payer mix: 38% commercial insurance (above 31% regional average) | EHR integration incomplete; 2 of 5 hospitals still on legacy system |

| Opportunities | Threats |

|---|---|

| Telehealth reimbursement parity legislation passed in state (effective 2027) | CVS/Walgreens opened 28 retail clinics in service area in past 24 months |

| Aging population: 65+ cohort growing 4.1% annually in service area | Medicare reimbursement rates declining 1.2% annually in real terms |

| Rural hospital closure in adjacent county creates referral vacuum (85K population) | Competing system invested $200M in new ambulatory surgery center 12 miles away |

| Value-based care contracts could increase revenue 8-12% with current quality metrics | Cybersecurity: 3 peer systems experienced ransomware attacks in past 18 months |

Key insight: Quality metrics (4.7 CMS star rating, $420M research grants) position the network perfectly for value-based care contracts. But 24% nurse turnover costs roughly $35M annually. The SO strategy: leverage telehealth legislation and quality reputation to capture the rural referral vacuum without new physical infrastructure. The ST priority: retention-focused investment to protect the quality outcomes that make every other strategy viable.

Example 4: Mid-Size Manufacturer (Industrial Components)#

Context: A $190M revenue precision components manufacturer supplying automotive and aerospace OEMs. Family-owned for three generations with strong engineering capability but aging facilities and workforce.

| Strengths | Weaknesses |

|---|---|

| 99.7% quality acceptance rate; zero product recalls in 15 years | Average employee age of 52; 30% of workforce eligible for retirement within 5 years |

| 22 active patents in precision machining processes | Factory utilization at 91% with no expansion capacity at current site |

| Sole-source supplier to 3 Tier 1 automotive OEMs (long-term contracts) | R&D spending at 2.1% of revenue vs. 4.8% industry median |

| $28M in net cash; zero debt | Digital capabilities: no IoT sensors, no predictive maintenance, manual quality inspection |

| Opportunities | Threats |

|---|---|

| EV powertrain components TAM growing 28% CAGR; precision tolerances favor existing capabilities | Automotive OEM consolidation: top 3 customers represent 68% of revenue |

| Reshoring trend: 47% of US manufacturers plan to nearshore by 2028 (NAM survey) | Chinese competitors offering 35-40% lower pricing on comparable components |

| Industry 4.0 adoption could reduce scrap rate from 3.2% to under 1% (projected $4.2M annual savings) | New OSHA regulations on metalworking fluids increase compliance costs by $1.8M annually |

| Adjacent market entry: medical device components share 80% of process capability | Key customer announced dual-sourcing policy; exclusive contracts expire in 2028 |

Key insight: The 99.7% quality rate and patent portfolio are genuine advantages, but maintained by a workforce 5 years from a retirement cliff. The 2.1% R&D spend means the company is living off past innovation. The critical SO strategy: use the $28M cash reserve and reshoring tailwind to invest in Industry 4.0 automation that reduces labor dependence while capturing EV components. The WT scenario -- losing sole-source contracts while losing institutional knowledge to retirements -- is the existential risk.

Example 5: Boutique Strategy Consulting Firm#

Context: A 65-person strategy consulting firm specializing in healthcare and life sciences, headquartered in Boston with $24M annual revenue. Founded by former McKinsey partners, the firm competes against both MBB firms and niche healthcare consultancies.

| Strengths | Weaknesses |

|---|---|

| 92% client retention rate; average client tenure of 4.3 years | Revenue per consultant of $369K vs. $520K at comparable firms |

| Deep domain expertise: 85% of staff have healthcare industry background | No proprietary data assets or technology platform; all analysis done manually |

| Partner-led delivery model: partners on every engagement (not just the pitch) | Pipeline concentration: top 5 clients represent 58% of revenue |

| Alumni network of 140+ executives across 45 health systems | Brand recognition limited to Northeast; zero inbound leads from West Coast |

| Opportunities | Threats |

|---|---|

| Healthcare M&A advisory TAM: $3.2B and growing 9% CAGR | MBB firms launching dedicated healthcare practices with 200+ consultants each |

| Demand for value-based care transformation consulting up 34% YoY | AI-powered strategy tools (e.g., AlphaSense, Gartner) reducing demand for basic research work |

| Digital health regulatory consulting: new FDA guidance creates 18-month advisory window | Key competitor acquired by Big 4 firm; can now offer integrated audit + strategy |

| Three health systems in alumni network exploring CEO succession planning engagements | Two senior partners approaching retirement; no formal succession plan |

Key insight: The 92% retention rate demonstrates quality that justifies premium pricing, but $369K revenue per consultant signals overstaffing or underpricing. The SO strategy: use the alumni network and domain depth to capture the digital health regulatory window -- a time-limited opportunity where generalist firms cannot compete. The WT risk of partner succession is existential for a firm whose client relationships are personally held by two founding partners.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Common Mistakes in SWOT Analysis#

After reviewing hundreds of SWOT slides, the same errors appear repeatedly:

Confusing internal and external factors. As Harvard Business Review has noted in its guide to SWOT analysis, "Increasing competition" appears in the Weaknesses quadrant constantly. Competition is external -- it belongs in Threats. If the team cannot change it directly, it is not a weakness.

Writing observations instead of analysis. As MindTools' guide to SWOT analysis emphasizes, "Large customer base" is an observation. "4.2M active users with 89% monthly retention rate, 3.1x higher than freemium industry average" is analysis. The second tells you the customer base is sticky and defensible. The first tells you nothing.

Ignoring cross-quadrant connections. A SWOT is not four independent lists. A strength that counters a threat is a strategic asset. A weakness that amplifies a threat is a crisis. If your quadrants could be shuffled randomly without losing meaning, you have not done the analytical work. For more on how to do SWOT analysis with proper cross-quadrant logic, see our dedicated guide.

Listing too many items. A SWOT with 8-10 bullets per quadrant is less useful, not more thorough. Three to four bullets forces prioritization. The discipline of limiting items is what makes the framework a decision tool rather than a brainstorming dump.

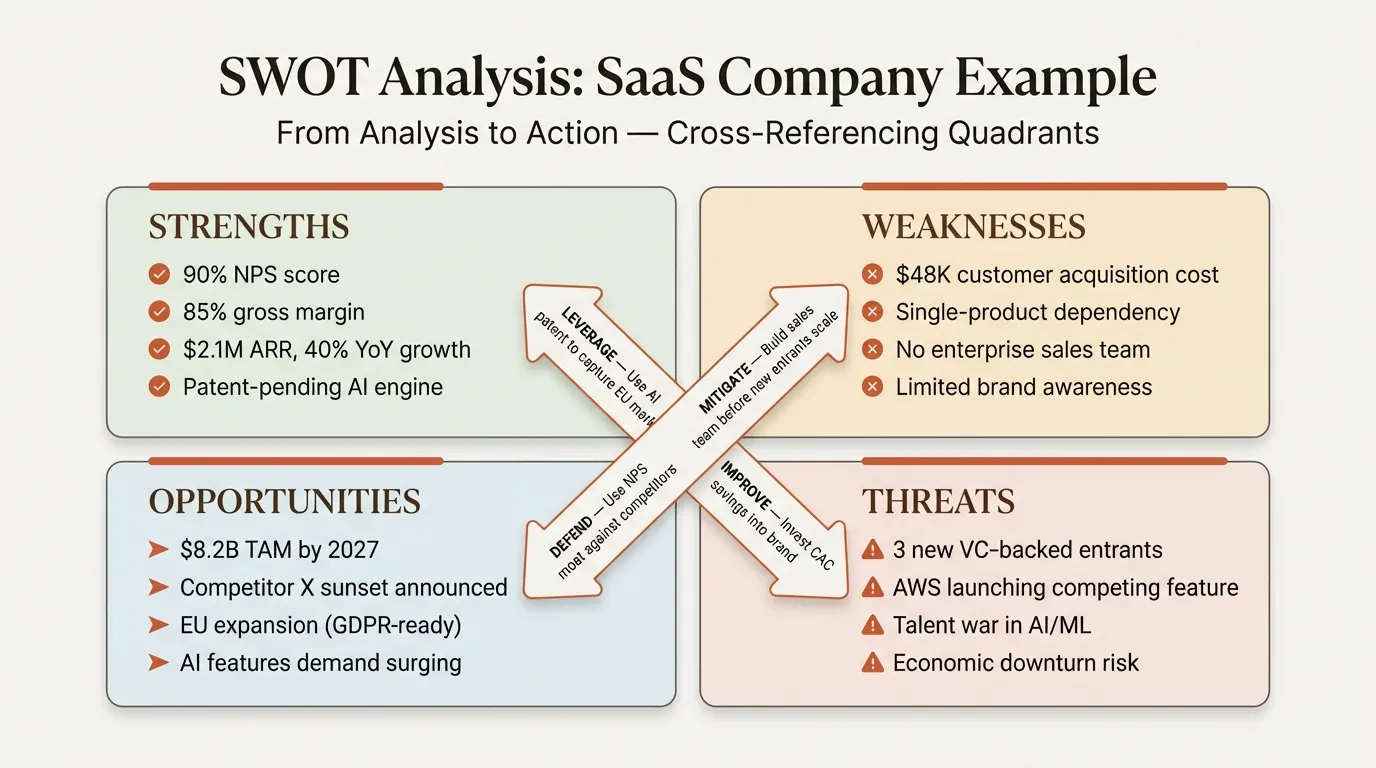

From SWOT to Strategy: The TOWS Matrix#

A completed SWOT matrix is diagnostic, not prescriptive. To move from analysis to strategy, cross-reference the quadrants using the TOWS framework:

| Strategy Type | Combination | Question | Example (from SaaS Example Above) |

|---|---|---|---|

| SO (Maxi-Maxi) | Strengths + Opportunities | How do we use strengths to capture opportunities? | Leverage AI feature lead to capture mid-market TAM growth through product-led expansion |

| WO (Mini-Maxi) | Weaknesses + Opportunities | How do we fix weaknesses to exploit opportunities? | Fast-track SOC 2 certification to unlock SI channel partnerships for enterprise access |

| ST (Maxi-Mini) | Strengths + Threats | How do we use strengths to defend against threats? | Use 130% NDR and NPS advantage to retain mid-market base against Asana price cuts |

| WT (Mini-Mini) | Weaknesses + Threats | How do we minimize weaknesses to avoid threats? | Reduce burn rate to extend runway beyond 14 months while enterprise sales cycle remains long |

The TOWS matrix typically generates 8-12 strategic initiatives. Prioritize by impact and feasibility -- connecting to competitive analysis for understanding which moves competitors will counter, and PESTLE analysis for understanding which macro forces accelerate or constrain each initiative.

Most SWOT exercises die here. Teams invest 2-3 hours building the matrix, then never generate the SO/WO/ST/WT strategies that convert analysis into a plan. Build the TOWS matrix in the same session -- not as a follow-up that never happens.

Presenting SWOT Analysis Effectively#

A well-built SWOT loses impact if the slide fails to communicate clearly:

Use a 2x2 matrix with color-coded quadrants. Green for Strengths, blue for Weaknesses, amber for Opportunities, red for Threats. Color coding lets an executive scan the slide in five seconds. Download a pre-formatted version from our SWOT Analysis Template.

Write an action title, not a framework label. "SWOT Analysis" tells the reader nothing. "Strong digital capabilities offset regulatory headwinds in core market" tells them the conclusion. Partners review decks by reading titles only -- make yours state the strategic implication.

Include a "So What?" row below the matrix. One sentence summarizing the cross-quadrant insight that makes the SWOT actionable rather than descriptive.

Tools like Deckary accelerate this formatting with consulting-grade templates and alignment shortcuts. A Competitive Analysis Template or Porter's Five Forces Template can complement the SWOT with deeper external analysis.

Summary#

Effective SWOT analysis examples share three characteristics that generic ones lack:

- Specific metrics in every bullet -- "89% renewal rate" beats "strong customer loyalty" in every boardroom

- Clear internal/external separation -- Strengths and Weaknesses are controllable; Opportunities and Threats are environmental

- Cross-quadrant analysis via TOWS -- the SO/WO/ST/WT strategies are where the SWOT becomes a decision tool, not a diagram

- 3-4 bullets per quadrant maximum -- forced prioritization is the discipline that makes frameworks useful

- Action titles that state the conclusion -- the strategic implication, not the framework name

The five examples above demonstrate how different industries produce fundamentally different SWOT matrices. A SaaS company's SWOT centers on growth metrics and feature gaps. A manufacturer's revolves around capacity constraints and workforce demographics. The framework is constant; the data that fills it must be specific to the business reality.

For a blank version you can fill in with your own data, start with our SWOT Analysis Template. For the broader strategic framework toolkit, see our Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free