PESTLE Analysis Examples: 4 Worked Templates by Industry

PESTLE analysis examples for fintech, healthcare, renewable energy, and retail. Filled-in tables with specific factors, metrics, and strategic implications.

PESTLE analysis examples found online typically list "government regulations" under Political and "economic downturn" under Economic. That level of generality helps no one make a decision. A useful PESTLE identifies specific macro forces, quantifies their impact, and connects them to strategic choices the organization actually faces.

After applying PESTLE analysis across 80+ strategy engagements — market entry assessments, regulatory risk reviews, and annual strategic planning cycles — we have identified what separates a partner-approved macro-environment scan from a generic checklist exercise. This guide provides four worked pestle analysis examples with specific factors across industries, explains how PESTLE relates to SWOT and other frameworks, and covers the mistakes that undermine most analyses. For the broader strategic toolkit, see our Strategic Frameworks Guide.

What Is PESTLE Analysis?#

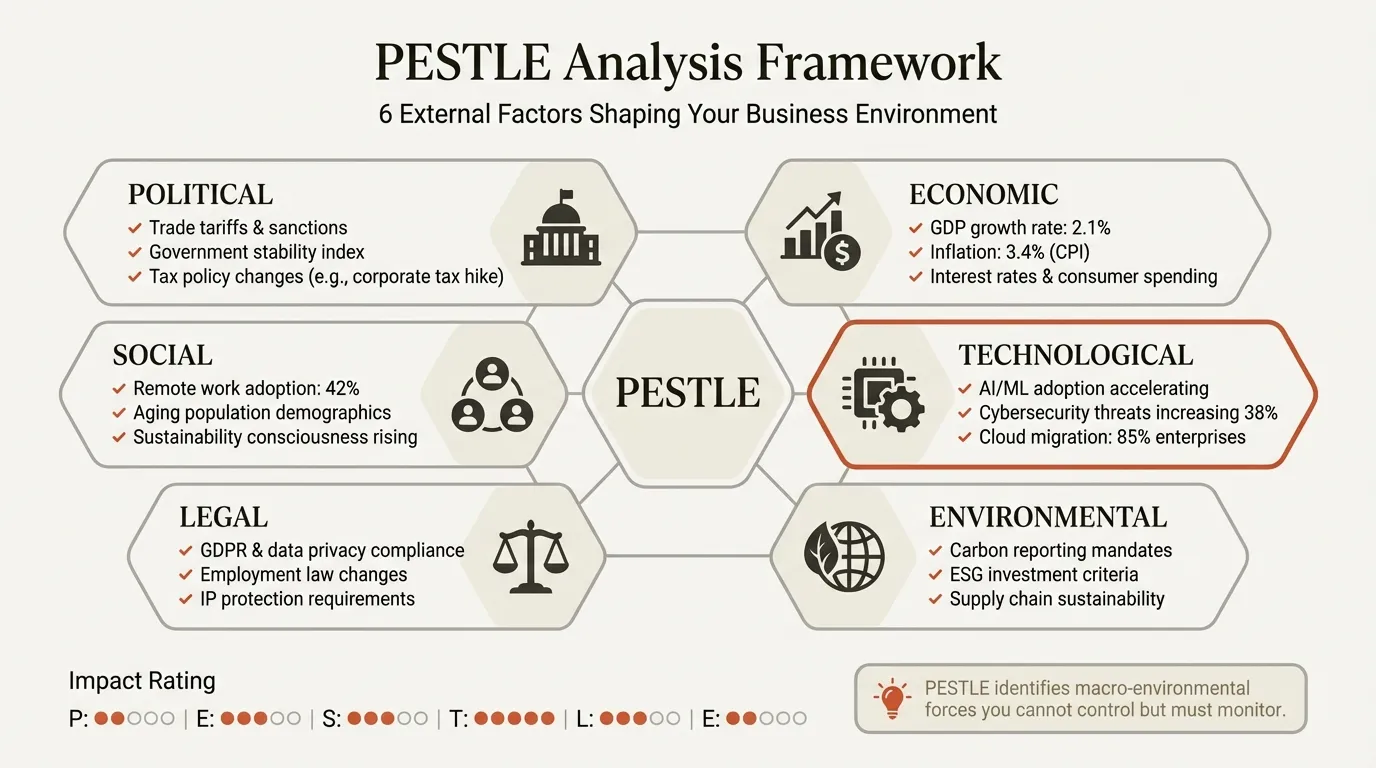

PESTLE is a macro-environmental scanning framework that categorizes external forces into six dimensions:

| Factor | Covers | Example Questions |

|---|---|---|

| Political | Government policy, trade relations, political stability | How do upcoming elections or trade policies affect our market? |

| Economic | GDP growth, inflation, interest rates, exchange rates | How do macroeconomic trends affect customer spending and our cost base? |

| Social | Demographics, cultural trends, consumer behavior shifts | How are changing preferences or population dynamics reshaping demand? |

| Technological | Innovation, R&D trends, automation, digital infrastructure | Which emerging technologies create opportunities or disrupt our model? |

| Legal | Regulations, compliance requirements, employment law | Which current or pending laws constrain operations or create barriers to entry? |

| Environmental | Climate impact, sustainability mandates, resource scarcity | How do ESG expectations and physical climate risks affect operations? |

The critical distinction: PESTLE examines only external, macro-level forces. Unlike SWOT analysis, which includes internal strengths and weaknesses, PESTLE maps the landscape the organization operates within but cannot directly control. This makes it a prerequisite exercise — the PESTLE output feeds directly into the Opportunities and Threats quadrants of a SWOT.

The framework originated as PEST (without Legal and Environmental) in Francis Aguilar's 1967 work Scanning the Business Environment on business environment scanning. Legal and Environmental were added as separate categories in the mid-2000s, as organizations like CIPD recognized that regulatory complexity and sustainability pressures made them too significant to subsume under Political or Social.

PESTLE Analysis Examples by Industry#

Each example below uses a realistic company scenario with specific, quantifiable factors. For a blank version you can customize, see our PESTLE Analysis Template.

Example 1: European Fintech (Digital Payments)#

Context: A Series B digital payments platform with 2.4M active users expanding from the UK into the EU market. Annual transaction volume of $1.8B.

| Factor | Key Forces | Strategic Implication |

|---|---|---|

| Political | EU open banking mandate (PSD3) expected 2027; UK-EU financial services divergence post-Brexit; political push for digital euro pilot | PSD3 creates API access to incumbent banks but fragments compliance across UK and EU regimes |

| Economic | ECB base rate at 3.25% compressing margins on float income; eurozone GDP growth of 1.1% limiting consumer spending; SME insolvency rates up 14% YoY | Float revenue model under pressure as rates stabilize; SME payment volume at risk from insolvencies |

| Social | Mobile payment adoption at 78% among 18-34 demographic in target markets; consumer trust in fintechs at 52% vs. 81% for traditional banks (EY survey) | Growth ceiling exists until trust gap narrows; marketing must address security perception, not just convenience |

| Technological | Real-time payment rails (SEPA Instant) reaching 92% coverage across eurozone; AI fraud detection reducing false positives by 40% industry-wide | SEPA Instant commoditizes speed advantage; AI fraud capabilities become table stakes, not differentiators |

| Legal | GDPR enforcement fines up 68% YoY; EU AI Act classifying credit-scoring algorithms as high-risk; PSD2 strong customer authentication requirements | Cross-border data handling costs rising; AI-powered features require conformity assessments before EU launch |

| Environmental | EU Corporate Sustainability Reporting Directive (CSRD) applies to fintechs above 250 employees by 2026; growing investor demand for ESG-aligned portfolio companies | ESG reporting infrastructure needed before Series C; adds $200-400K in annual compliance cost |

Key insight: The regulatory environment is the dominant force. PSD3, GDPR enforcement trends, and the EU AI Act collectively create a compliance burden that favors well-capitalized fintechs and disadvantages smaller entrants. The strategic response: treat regulatory readiness as a competitive moat rather than a cost center.

Example 2: US Healthcare Provider (Telehealth Expansion)#

Context: A mid-size healthcare system with 8 hospitals and $2.6B annual revenue evaluating a $45M investment in a telehealth platform to serve rural communities across three states.

| Factor | Key Forces | Strategic Implication |

|---|---|---|

| Political | Telehealth reimbursement parity legislation permanent in 2 of 3 target states; CMS expanding Medicare Advantage telehealth coverage; state-level licensure compacts allowing cross-state practice | Parity legislation de-risks the revenue model; licensure compacts reduce provider hiring constraints |

| Economic | Healthcare labor costs up 6.8% YoY; rural hospital closures creating 12 underserved counties in service area; employer-sponsored telehealth benefit adoption at 89% | Labor arbitrage: telehealth providers can serve rural areas from urban centers at lower cost per visit |

| Social | Patient telehealth satisfaction scores at 4.1/5 but drop to 3.2/5 for patients over 65; broadband access in target rural areas at 71% vs. 94% national average; 62% of rural residents report travel time as barrier to care | Broadband gap limits addressable population by 29%; digital literacy programs needed for elderly cohort |

| Technological | Remote patient monitoring devices projected to reach 34M US users by 2028; EHR integration standards (FHIR R4) enabling interoperability; 5G rural coverage expanding to 68% by 2027 | RPM integration creates recurring engagement model; 5G expansion progressively closes the connectivity gap |

| Legal | HIPAA compliance requirements for telehealth platforms; FDA regulation of clinical decision support software; malpractice liability for cross-state telehealth still unsettled in courts | Malpractice ambiguity in cross-state delivery is the highest unresolved legal risk for the investment |

| Environmental | Telehealth reduces patient travel emissions by estimated 1,800 kg CO2 per 1,000 visits; extreme weather events increasing rural care access disruptions by 23% over past 5 years | Climate resilience becomes a secondary justification for telehealth investment; supports ESG narrative for bond investors |

Key insight: The political environment is favorable (reimbursement parity, licensure compacts), but the social and technological infrastructure gaps in rural areas constrain the addressable market. The 71% broadband figure means nearly a third of the target population cannot use the service. The strategic response: phase the rollout by connectivity readiness and invest in partnerships with broadband expansion programs.

Example 3: Renewable Energy Developer (Utility-Scale Solar)#

Context: A renewable energy company developing utility-scale solar farms across the US Southwest, with 2.4 GW in its development pipeline and $380M in project finance commitments.

| Factor | Key Forces | Strategic Implication |

|---|---|---|

| Political | Inflation Reduction Act (IRA) providing 30% investment tax credit through 2032; state renewable portfolio standards mandating 50-80% clean energy by 2035; local permitting opposition increasing in 34% of project applications | IRA provides 8+ years of subsidy certainty; local opposition, not federal policy, is the primary political risk |

| Economic | Solar module costs down 42% since 2020 but supply chain concentrated in China (82% of global polysilicon); interest rates increasing project finance costs by $8-12M per GW; power purchase agreement (PPA) rates rising 18% YoY | Module cost savings partially offset by higher financing costs; PPA rate increases improve project economics |

| Social | Public support for solar energy at 84% nationally but NIMBY opposition in 40% of rural project sites; workforce shortage of 12,000 skilled solar installers projected by 2028; environmental justice requirements for disadvantaged community engagement | NIMBY opposition delays projects 8-14 months on average; workforce shortage constrains installation timelines |

| Technological | Bifacial panel efficiency gains of 5-7% improving project yields; battery storage costs declining 15% annually; grid interconnection queue backlog averaging 5 years nationally | Storage cost declines enable solar-plus-storage projects; interconnection delays are the largest bottleneck |

| Legal | Endangered Species Act reviews required for 60% of Southwest project sites; evolving grid interconnection rules (FERC Order 2023); property tax treatment varies across 4 target states | ESA reviews add 6-12 months to timelines; FERC reforms may reduce but not eliminate interconnection delays |

| Environmental | Water scarcity in Southwest affecting panel washing schedules; increasing dust storm frequency reducing panel efficiency by 2-4% annually; fire risk requiring vegetation management on 100% of project sites | Water scarcity is an operational cost driver; climate impacts ironically affect the economics of climate solutions |

Key insight: The economic and political factors are broadly favorable (IRA subsidies, rising PPA rates), but the binding constraints are infrastructure and process bottlenecks: 5-year interconnection queues, ESA review timelines, and workforce shortages. The strategic response: invest in interconnection queue positions early and develop workforce training partnerships, because policy and economics favor the company that can actually build fastest.

Example 4: Omnichannel Retail (Fashion and Apparel)#

Context: A mid-market fashion retailer with 180 stores and $1.2B annual revenue, with e-commerce representing 28% of sales. The company is evaluating expansion into Southeast Asian markets.

| Factor | Key Forces | Strategic Implication |

|---|---|---|

| Political | ASEAN trade agreements reducing import tariffs by 5-8% for apparel; political instability in Myanmar disrupting regional supply chains; Vietnam's government offering FDI incentives for retail infrastructure | Tariff reductions favor sourcing shifts; Vietnam offers the most stable entry point among ASEAN markets |

| Economic | Southeast Asian middle class projected to reach 350M by 2030; regional e-commerce growing 22% CAGR; currency volatility (Thai baht fluctuated 12% against USD in past 18 months) | Growing middle class supports demand thesis; currency hedging costs will erode 2-3% of margins |

| Social | Fast fashion backlash growing among 18-30 demographic (42% report preferring sustainable brands); social commerce (shopping via Instagram, TikTok) at 34% of e-commerce in Southeast Asia; average purchase frequency 2.1x higher than Western markets | Social commerce channels are mandatory, not optional; sustainability positioning required for younger demographic |

| Technological | Mobile-first markets (91% of e-commerce via mobile in region); logistics infrastructure fragmented across island geographies; AI-powered size recommendation reducing return rates by 26% in pilot markets | Mobile-native UX non-negotiable; logistics partnerships more important than owned infrastructure |

| Legal | Indonesia's data localization law requiring local server infrastructure; varying consumer protection standards across ASEAN; textile labeling requirements differ by country | Data localization adds $1.5-2M in infrastructure costs for Indonesia entry specifically |

| Environmental | EU supply chain due diligence directive affecting sourcing from Southeast Asian factories; consumer demand for supply chain transparency up 38% YoY; monsoon season disrupting logistics for 3-4 months annually | Supply chain traceability systems needed for both EU compliance and consumer trust; monsoon seasonality affects inventory planning |

Key insight: The economic opportunity (350M middle class, 22% e-commerce CAGR) is clear, but the operational complexity is the real challenge. Social commerce dominance, mobile-first behavior, fragmented logistics, and data localization laws mean the company cannot simply replicate its Western playbook. The strategic response: enter via marketplace partnerships (Shopee, Lazada) before investing in owned infrastructure, and pilot in Vietnam or Thailand before expanding to Indonesia's more complex regulatory environment.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

PESTLE vs. SWOT vs. Other Frameworks#

A common question is when to use PESTLE versus other strategic frameworks. The answer is that they serve different analytical purposes and often work in sequence rather than as alternatives.

| Framework | Scope | Focus | Best For | Limitation |

|---|---|---|---|---|

| PESTLE | External only | Macro-environment (6 categories) | Market entry, regulatory risk, strategic planning | Ignores internal capabilities and competitive dynamics |

| SWOT | Internal + External | Strengths, Weaknesses, Opportunities, Threats | Holistic strategic assessment, annual planning | External analysis often too shallow without a preceding PESTLE |

| Porter's Five Forces | External only | Industry-level competition | Competitive positioning, pricing strategy, market attractiveness | Misses macro forces (regulation, demographics) that reshape industry structure |

| STEEP | External only | Same as PESTLE minus Legal (5 categories) | Simpler macro scan where legal factors are minor | Insufficient for regulated industries (healthcare, financial services, energy) |

The practical workflow for a thorough strategic assessment: start with PESTLE to map the macro environment, use Porter's Five Forces to analyze industry-level competition, then integrate both into a SWOT that connects external forces to internal capabilities. For competitive dynamics specifically, see our Competitive Analysis Examples.

PESTLE is not a substitute for SWOT — it is a prerequisite. The Opportunities and Threats in a SWOT analysis should be informed by the PESTLE output. When they are not, teams end up with vague external factors like "regulatory changes" instead of specific forces like "GDPR enforcement fines up 68% YoY, adding $200-400K in annual compliance cost."

When to Use PESTLE Analysis#

PESTLE adds the most value in four scenarios:

Market entry decisions. When evaluating a new geography or industry, the macro environment determines whether the business model is viable before competitive analysis matters. The Southeast Asian retail example above illustrates how political stability, data localization laws, and social commerce adoption fundamentally shape the entry strategy.

Strategic planning cycles. Annual or quarterly strategy reviews benefit from a refreshed PESTLE to identify which macro forces have shifted. A PESTLE from 2024 that assumed a low interest rate environment is misleading in 2026. The framework's value depends entirely on current data.

Regulatory risk assessment. Industries with heavy regulatory exposure — healthcare, financial services, energy — need systematic tracking of legal and political factors. A dedicated PESTLE surfaces interdependencies that ad hoc regulatory monitoring misses (such as how the EU AI Act intersects with GDPR for fintech companies using algorithmic credit scoring).

M&A due diligence. Acquiring a company in an unfamiliar market requires understanding the macro forces that affect its future performance. A target with strong financials but exposure to adverse regulatory trends (tightening data privacy laws, shifting subsidy regimes) may be overvalued. For structured due diligence frameworks, stakeholder mapping complements PESTLE by identifying who influences the regulatory and political environment.

Common PESTLE Analysis Mistakes#

After reviewing PESTLE outputs across dozens of engagements, three errors appear consistently:

Treating it as a one-time exercise. A PESTLE completed during a strategy offsite in January and never updated is a historical document by June. Macro forces shift — elections happen, regulations pass, economic conditions change. The framework's value comes from regular updates, not the initial analysis. Set quarterly review cadences for fast-moving industries and semi-annual reviews at minimum.

Listing obvious factors without strategic implications. "Technology is advancing rapidly" belongs nowhere in a consulting deliverable. Every PESTLE factor should answer two questions: What specifically is happening? And what does it mean for our strategy? Compare "AI is growing" with "AI fraud detection reducing false positives by 40% industry-wide, making it table stakes rather than a differentiator for our payment platform." The second is analysis. The first is filler.

Ignoring interdependencies between factors. PESTLE categories are not independent silos. Political decisions affect economic conditions. Technological changes create legal questions. Environmental pressures drive social shifts. In the renewable energy example, political support (IRA subsidies) intersects with economic factors (financing costs), legal requirements (ESA reviews), and social dynamics (NIMBY opposition). The most valuable insight from a PESTLE often sits at the intersection of two or three categories. Map these connections explicitly rather than treating each column as a standalone list.

Two additional mistakes worth noting: geographic over-aggregation (a single PESTLE for "Europe" when Germany and Romania have fundamentally different regulatory and economic landscapes) and recency bias (overweighting factors that are in the news while ignoring slower-moving demographic or environmental trends that will matter more over a 5-year horizon).

Presenting PESTLE Analysis Effectively#

A well-researched PESTLE loses impact if the slide does not communicate clearly:

Use an action title that states the conclusion. "PESTLE Analysis" tells the reader nothing. "Favorable regulatory tailwinds offset by infrastructure bottlenecks in target market" tells them the strategic implication before they read a single cell. This follows the same Pyramid Principle that drives all effective consulting communication.

Use a single-page table format, not six separate sections. A 6-row table (one per PESTLE category) with columns for Factor, Key Force, and Strategic Implication fits on one slide and allows executives to scan the full picture. Six slides with one category each lose the cross-category view that makes PESTLE valuable.

Bold the 2-3 factors that matter most. Not all six categories carry equal weight for every analysis. In regulated industries, Legal and Political dominate. In consumer markets, Social and Economic may matter more. Visual emphasis guides the audience to the factors that shape the strategic decision.

Tools like Deckary accelerate the formatting with consulting-grade templates and alignment shortcuts. A pre-formatted PESTLE Analysis Template saves the 30-45 minutes typically spent on table formatting and layout.

Summary#

Effective PESTLE analysis examples share four characteristics:

- Specific, quantified factors — "GDPR enforcement fines up 68% YoY" beats "increasing regulation" in every strategy discussion

- Strategic implications per factor — each row answers "what does this mean for our decision?" not just "what is happening?"

- Cross-category interdependencies mapped explicitly — the most valuable insights sit at the intersection of Political and Economic, or Technological and Legal

- Regular updates on a defined cadence — a PESTLE older than 12 months is a historical document, not a strategic input

PESTLE works best as the first step in a broader strategic analysis. Map the macro environment with PESTLE, analyze competitive dynamics with Porter's Five Forces, then integrate both into a SWOT analysis that connects external forces to internal capabilities. For the full strategic framework toolkit, see our Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free