Competitive Analysis Framework: 6 Methods and When to Use Each

Competitive analysis framework guide covering Porter's Five Forces, positioning maps, strategic groups, and more. Match the right framework to your question.

Choosing the right competitive analysis framework determines whether your output drives a strategic decision or produces a slide that gets politely skipped. The hard part is not the framework itself — it is matching the right one to the right question. This guide covers six frameworks, goes deep on the three most teams underuse (Win/Loss Analysis, Competitive Benchmarking, and Competitive Intelligence Systems), and includes a decision tree so you never pick the wrong one. For the broader strategic toolkit, see our Strategic Frameworks Guide.

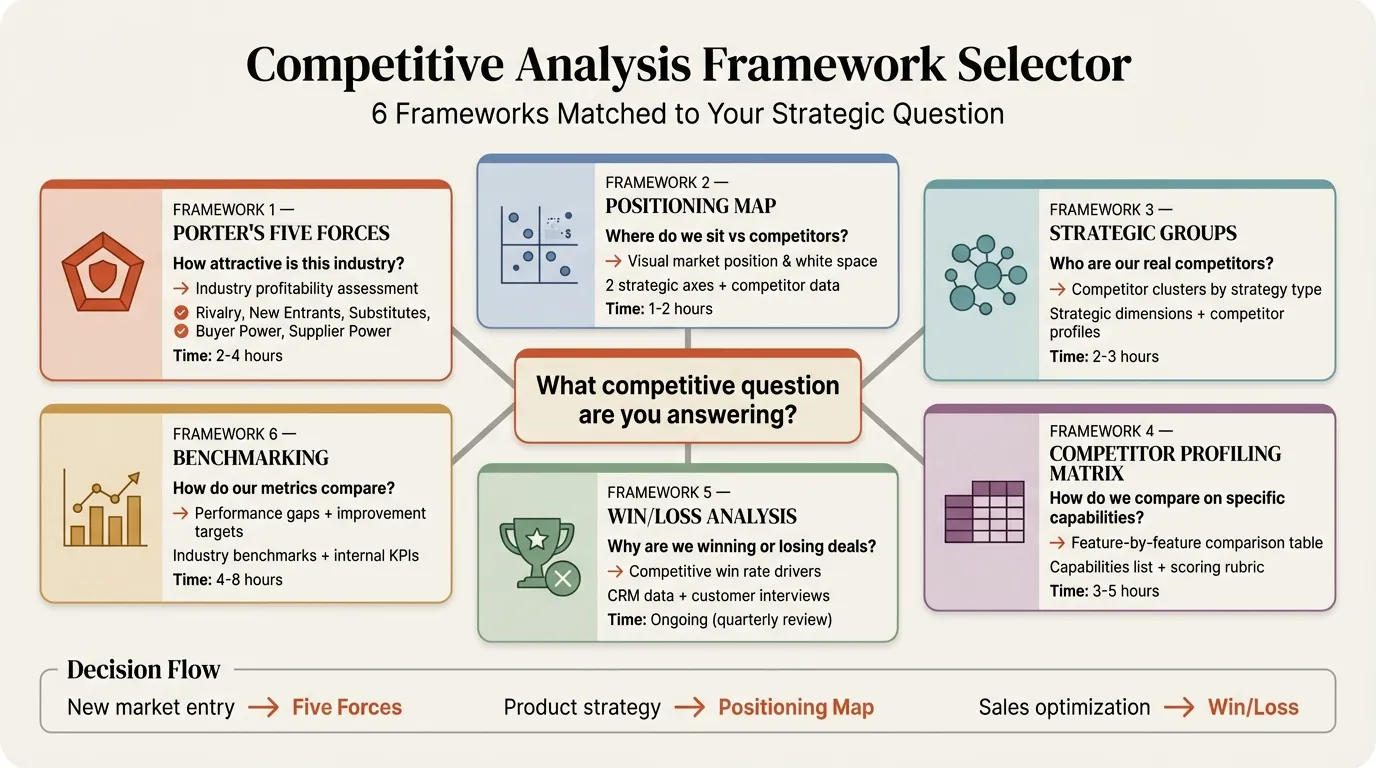

Framework Selection Decision Tree#

Start with the question you need to answer.

Is the question about the industry or about specific competitors?

If the industry — "Should we enter this market?" — use Porter's Five Forces. To understand competitor clusters and white space, add Strategic Group Analysis.

If specific competitors — ask next: capabilities or outcomes?

If capabilities — "How does our product compare?" — use a Competitor Profiling Matrix. To communicate it visually to executives, build a Competitive Positioning Map.

If outcomes — "Why are we losing deals?" — use Win/Loss Analysis. "How do our metrics compare?" — use Competitive Benchmarking.

To keep it all current, build a Competitive Intelligence System.

| Strategic Question | Framework | Output |

|---|---|---|

| Is this industry attractive to enter or invest in? | Porter's Five Forces | Industry profitability outlook |

| Where do we sit relative to competitors on key dimensions? | Competitive Positioning Map | 2-axis visual differentiation |

| Which competitors share similar strategies? | Strategic Group Analysis | Cluster map with mobility barriers |

| How do we compare on specific capabilities? | Competitor Profiling Matrix | Feature-by-feature comparison |

| Why are we winning or losing specific deals? | Win/Loss Analysis | Tactical sales and product insights |

| How do our operational metrics compare? | Competitive Benchmarking | Performance gaps and targets |

Industry and Positioning Frameworks (Quick Reference)#

Four frameworks are well documented and covered with full worked examples in our Competitive Analysis Examples. Here is when each applies.

Porter's Five Forces evaluates rivalry, new entrants, substitutes, buyer power, and supplier power to determine whether an industry is structurally attractive. Use it before entering a new market or assessing an acquisition. Porter's original HBR article remains the definitive reference. It is a static snapshot, so pair it with a competitor-level framework.

Competitive Positioning Maps plot competitors on two axes reflecting buyer criteria. They communicate more in one competitive landscape slide than three pages of text. Avoid axes where every competitor clusters in the same quadrant.

Strategic Group Analysis clusters competitors following similar strategies, revealing mobility barriers between groups. Use it to identify white space and understand why firms in the same industry earn different returns.

Competitor Profiling Matrix compares features, pricing, and service levels. Limit to 3-5 competitors and 8-10 dimensions weighted by customer importance. Use our Competitive Analysis Template as a starting point.

The rest of this guide focuses on the three frameworks most teams underinvest in.

Win/Loss Analysis: Why You Actually Lose Deals#

Win/loss analysis captures what happens at the point of decision by collecting feedback from prospects about why they chose you or a competitor. Sales self-reports are inaccurate 40-60% of the time — reps overweight "price" and underweight product gaps.

Worked Example: SaaS Platform Win/Loss (Q3 Analysis)#

Context: A mid-market project management SaaS ($22M ARR) analyzed 30 enterprise deals in Q3 — 16 wins and 14 losses — across three competitors. Third-party interviews were completed with 24 of 30 decision-makers within 15 days of each deal closing.

Win rate by competitor:

| Competitor Faced | Deals | Wins | Losses | Win Rate |

|---|---|---|---|---|

| Competitor A (established incumbent) | 12 | 5 | 7 | 42% |

| Competitor B (newer entrant) | 11 | 7 | 4 | 64% |

| Competitor C (enterprise heavyweight) | 7 | 4 | 3 | 57% |

| Total | 30 | 16 | 14 | 53% |

Top 3 loss reasons (14 losses):

| Loss Reason | Frequency | % of Losses | Primary Competitor |

|---|---|---|---|

| Lack of SOC 2 Type II certification | 6 | 43% | Competitor A (5 of 6) |

| Weaker reporting and analytics suite | 4 | 29% | Competitor C (3 of 4) |

| No native ERP integration (SAP, Oracle) | 3 | 21% | Competitor A (2 of 3) |

Top 3 win reasons (16 wins):

| Win Reason | Frequency | % of Wins |

|---|---|---|

| Faster implementation (3 weeks vs. 8-12 weeks) | 9 | 56% |

| More intuitive UI requiring less training | 5 | 31% |

| 38% lower total cost of ownership over 3 years | 4 | 25% |

What the sales team believed vs. reality: Sales attributed 8 of 14 losses to "price." Interviews found price was the deciding factor in only 1 loss. In 5 of those 8 deals, the actual blocker was the SOC 2 gap — buyers used price as a polite rejection reason.

Strategic actions taken:

- SOC 2 certification escalated to Q4 priority — 43% of all losses traced to this single gap. Estimated recoverable pipeline: $1.8M.

- Reporting roadmap accelerated — custom dashboard builder and scheduled report delivery pulled into next sprint to close the gap against Competitor C.

- Implementation speed became the lead sales message — the strongest win driver appeared in only 30% of sales decks. Battle cards updated within two weeks.

How to build your own: Use three tiers — CRM loss reasons for all deals, post-deal surveys for deals above a revenue threshold, and third-party interviews for your 20-30 most strategic deals per quarter.

Limitations: Win/loss is backward-looking and misses prospects who never considered you.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Competitive Benchmarking: Measuring the Performance Gap#

Competitive benchmarking compares operational metrics against the best in your industry — not features, but outcomes like customer acquisition cost, churn, and expansion revenue. It answers: where are we underperforming, by how much, and which gaps matter most?

Worked Example: SaaS Operational Benchmarking#

Context: A B2B analytics platform ($35M ARR, 180 employees) benchmarked five metrics against three competitors using public filings, industry surveys (OpenView, KeyBanc), and intelligence from recent hires.

| Metric | Our Company | Competitor A | Competitor B | Competitor C | Industry Median |

|---|---|---|---|---|---|

| Customer acquisition cost | $28,400 | $19,200 | $32,100 | $22,500 | $24,000 |

| Time to value (days to first ROI) | 47 days | 21 days | 58 days | 34 days | 35 days |

| Net promoter score | 38 | 52 | 29 | 61 | 42 |

| Annual gross churn | 14.2% | 8.1% | 16.7% | 6.9% | 10.5% |

| Net revenue retention | 104% | 118% | 97% | 122% | 110% |

Gap analysis and prioritization:

| Metric | Gap vs. Best | Priority | Rationale |

|---|---|---|---|

| Time to value | 26 days slower | 1 (Critical) | Customers reaching ROI within 30 days retain at 2.1x the rate of those taking over 45 days |

| Net revenue retention | 18 pts below best | 2 (High) | Each NRR point equals ~$350K ARR; closing half the gap adds $3.15M |

| CAC | $9,200 above best | 3 (Medium) | Partially offset by higher ACV ($48K vs. $36K median), but 19-month payback exceeds 14-month benchmark |

| NPS | 23 pts below best | 4 (Monitor) | Improving NPS requires fixing root causes (time to value, support), not the score itself |

| Gross churn | 7.3 pts above best | Linked to #1 | Churn improvement is an outcome of fixing time to value, not a separate initiative |

Strategic actions: (1) Onboarding overhaul targeting 30-day time to value — mapped Competitor A's flow and identified three bottlenecks: manual data import, delayed CSM assignment, and a 12-step configuration reducible to 5. (2) Dedicated expansion AE role modeled on Competitor C's 122% NRR approach — usage-based triggers and expansion quota at the 6-month mark, projected to add 8-10 NRR points in three quarters. (3) Channel partner pilot targeting three healthcare system integrators to reduce CAC, mirroring Competitor A's partner channel that generates 35% of their pipeline.

Limitations: Benchmarking reveals the gap but not the root cause. It also risks encouraging imitation over differentiation.

Building a Competitive Intelligence System#

A competitive analysis framework is a point-in-time exercise. A competitive intelligence system makes it continuous. McKinsey's research finds that companies fail not because they lack data, but because they do not convert data into predictions about competitor behavior. Here is the full operating model.

Data Sources (Three Tiers)#

Tier 1 — Automated, daily (low effort): Google Alerts for competitor mentions and executive moves. Job posting monitoring — a cluster of ML engineer postings signals an AI investment 6-12 months before launch. G2/Capterra review tracking for emerging sentiment themes.

Tier 2 — Structured, monthly (moderate effort): Competitor pricing page and changelog screenshots. Patent filings and trademark applications as 12-18 month product direction indicators. Monthly thematic review analysis coded by category (pricing, support, features, reliability).

Tier 3 — Primary research, quarterly (high effort, highest signal): Win/loss interviews covering 20-30 deals. Customer advisory board feedback on competitive encounters. Channel partner intelligence from those who sell alongside or against you.

Analysis Cadence#

| Output | Frequency | Owner |

|---|---|---|

| Competitor news digest (5-7 bullets with "so what") | Weekly | Product marketing |

| Competitive battlecard refresh | Monthly | Product marketing + sales enablement |

| Win/loss pattern report with recommended actions | Quarterly | Sales ops + product marketing |

| Competitive landscape brief (positioning shifts, pricing changes) | Quarterly | Strategy |

| Full reassessment (Five Forces + positioning + benchmarking + win/loss) | Annually | Strategy |

Decision Triggers#

HBR's research finds that storytelling — not spreadsheets — drives executive action. Define in advance which signals trigger which responses:

- Competitor drops price by more than 15% — emergency pricing review within 5 business days

- Competitor acquires a company in an adjacent space — 2-page impact assessment within 10 business days

- Win rate against any competitor drops below 40% for two consecutive months — focused win/loss deep dive

- Competitor launches a feature targeting your top differentiator — battlecard update within 48 hours

- New entrant raises over $20M — add to tracked set with a one-page threat assessment

Without predefined triggers, competitive intelligence becomes a passive archive. With them, it becomes an early warning system.

Common Mistakes#

Analyzing too many competitors. Focus on 3-5. If you cannot articulate why a competitor is included, remove them.

Relying exclusively on public data. Marketing websites tell you what competitors want you to know. The highest-value intelligence comes from win/loss interviews, customer feedback, and channel partners. A PESTLE analysis covers macro factors, but competitive insights require primary research.

Confusing current position with trajectory. A competitor with 5% share but 80% year-over-year growth is a bigger threat than a stagnant 25% incumbent. Track hiring, patents, and capital allocation to project 12-18 months ahead.

Skipping the "so what." If your slide title says "Competitive Landscape" instead of "Price competition intensifying — shift to service differentiation," the analysis is not finished. Follow the Pyramid Principle: lead with the conclusion.

Combining Frameworks#

For market entry: Porter's Five Forces for industry attractiveness, strategic group map for clusters and white space, profiling matrix for the 3-5 competitors in your target segment. Use our Competitive Analysis Template to structure the output.

For annual planning: Profiling matrix quarterly, positioning map semi-annually, Five Forces annually. Win/loss every quarter, benchmarking semi-annually. Present a combined brief — not separate frameworks.

For deal-level support: Profiling matrix plus win/loss data from similar deals. Skip industry-level frameworks.

The competitive analysis framework you choose matters less than three things: the quality of your data, the specificity of your conclusions, and whether anyone acts on the output. For worked examples of positioning maps, feature matrices, and Five Forces across industries, see our Competitive Analysis Examples. For the broader strategy toolkit including SWOT and PESTLE, see the Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free