Product Life Cycle Stages: Identifying Where Your Product Sits

Product life cycle stages explained with diagnostic criteria, strategic implications, and extension strategies. Actionable guidance for each of the four stages.

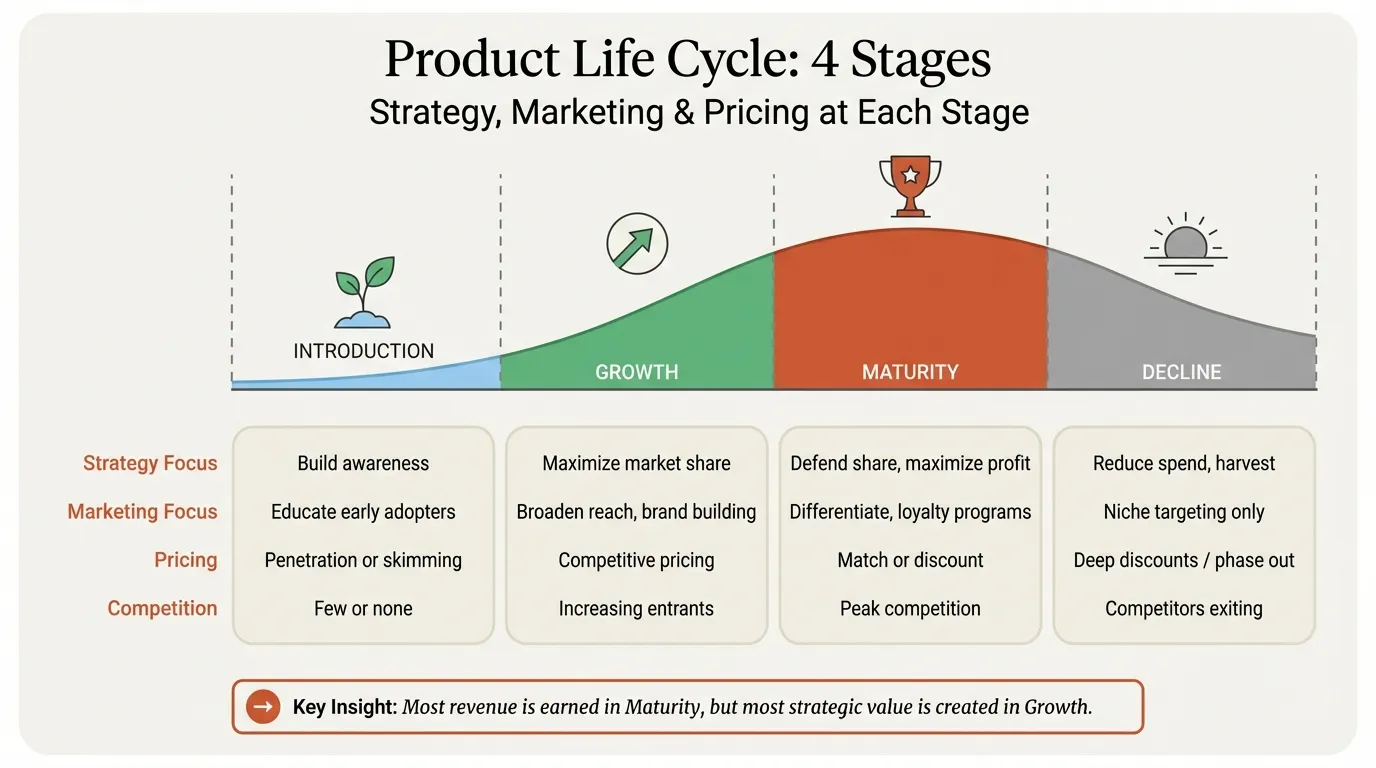

The product life cycle stages framework is one of the most cited models in business strategy, yet most teams use it descriptively rather than diagnostically. They can name the four stages but cannot determine which stage their product currently occupies or what that diagnosis implies for next quarter's budget.

After applying product life cycle stages analysis across 40+ growth strategy, portfolio review, and product rationalization engagements, we have found that the diagnostic question -- "which stage are we actually in?" -- drives more strategic value than the framework itself. Misdiagnosing a mature product as still in growth leads to over-investment. Treating an introduction-stage product like a mature one leads to premature cost-cutting that kills the opportunity before it scales.

This guide covers the four product life cycle stages in depth, with diagnostic criteria for each, a comprehensive comparison of strategic implications, lifecycle extension strategies that can restart the curve, and common misdiagnosis patterns. For broader context on strategic frameworks, see our Strategic Frameworks Guide. For the management process that spans all stages, see our companion guide on Product Lifecycle Management.

The Four Product Life Cycle Stages Explained#

Every product follows a trajectory from market entry to market exit, a pattern first articulated by Raymond Vernon in his international product life cycle theory and later expanded by Theodore Levitt in Harvard Business Review. The duration varies dramatically -- a mobile app feature might cycle in six months while a pharmaceutical compound spans two decades -- but the strategic pattern is consistent across industries.

Stage 1: Introduction#

The product enters the market with minimal awareness and no established customer base. Revenue is low or nonexistent, unit costs are high because of low production volumes, and marketing spend focuses on explaining why the category exists rather than why your product is better.

Most products fail during introduction. A major enterprise SaaS company we worked with launched three products in the same year; only one survived past 18 months because the other two never achieved enough early adoption to justify continued investment.

The critical strategic decision at introduction is pricing. Skimming pricing (high initial price to capture early adopter willingness to pay) works when the product has strong differentiation. Penetration pricing (low price to build share quickly) works when network effects or scale economics reward early volume. Choosing the wrong approach compounds through every subsequent stage.

Stage 2: Growth#

Demand accelerates. Revenue grows at 15% or more annually, margins improve as scale reduces unit costs, and the product transitions from early adopters to mainstream customers -- following the technology adoption lifecycle described by Everett Rogers. Competitors notice the market opportunity and enter.

Growth is where strategic value is created or lost. Under-investing during growth cedes market position that is nearly impossible to recover during maturity. A well-known streaming platform invested aggressively in content and international expansion during its growth stage, accepting thin margins for years. That investment built the subscriber base that now generates substantial operating margins.

The strategic imperative during growth is building competitive moats before the market matures. Once growth slows, the window for establishing defensible advantages closes. Every dollar spent on growth-stage market share typically returns multiples of what the same dollar would return during maturity.

Stage 3: Maturity#

Growth slows to single digits. The addressable market is largely penetrated, most potential customers have already adopted, and competition intensifies as growth-stage entrants fight for share in a market that is no longer expanding. Revenue peaks but growth-rate deceleration becomes the dominant trend.

Maturity is typically the longest stage and generates the most total revenue and profit. The strategic posture shifts fundamentally: from market capture to cash generation, from investment in growth to investment in efficiency.

Key characteristics of maturity:

- Revenue growth below 10%, often 0-5%

- Market penetration between 40-80% of addressable market

- Intense price competition as differentiation narrows

- Consolidation through M&A as weaker players exit

- Marketing focuses on retention and loyalty

- Cost optimization becomes a primary lever

The most sophisticated maturity-stage strategy is lifecycle extension, which we cover in detail below. Companies that simply accept maturity as a holding pattern leave significant value on the table.

Stage 4: Decline#

Demand contracts. A substitute technology reaches price or performance parity, customer preferences shift, or the market itself shrinks. Revenue falls, margins compress, and the strategic question becomes: harvest cash or exit?

Decline does not mean failure. A well-managed decline phase can generate substantial cash through the "last man standing" strategy -- deliberately outlasting competitors to consolidate the remaining market at low cost. A major photo film manufacturer demonstrated the opposite: mismanaged decline where continued investment in a contracting category drained resources that could have funded transformation.

Key characteristics of decline:

- Negative revenue growth

- Competitors exiting the market

- Customer base shrinking to loyal holdouts

- Overcapacity across the industry

- Minimal marketing investment

- Strategic focus on cash extraction or orderly exit

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Comprehensive Product Life Cycle Stages Comparison#

The following table summarizes the strategic implications across all four product life cycle stages.

| Dimension | Introduction | Growth | Maturity | Decline |

|---|---|---|---|---|

| Revenue trend | Low, often negative cash flow | Rapidly increasing | Peak, then plateauing | Decreasing |

| Profit margins | Negative to low | Improving rapidly | Peak, then compressing | Low, narrowing |

| Customers | Innovators, early adopters | Early majority | Late majority | Laggards, loyalists |

| Competitors | Few or none | Increasing rapidly | Stable, consolidating | Decreasing (exits) |

| Pricing strategy | Skim or penetrate | Gradual reduction to expand market | Competitive, price matching | Maintain or selectively raise |

| Marketing spend | High (education) | High (differentiation) | Moderate (retention) | Minimal (maintenance) |

| Marketing focus | Awareness, category creation | Brand preference, market share | Loyalty, defend position | Serve remaining base |

| Investment level | Heavy (product, distribution) | Heavy (scale, capacity) | Selective (efficiency) | Minimal (harvest) |

| Distribution | Selective, targeted | Expanding aggressively | Optimizing, pruning | Consolidating to core |

| Strategic priority | Prove product-market fit | Build competitive moats | Maximize cash generation | Extract value or exit |

How to Diagnose Which Stage Your Product Is In#

Misdiagnosis is the most common and most expensive product life cycle stages error. Teams frequently confuse a temporary growth slowdown with maturity, or mistake a mature product's line extension bump for a return to growth. Three metrics, tracked together over 6-12 months, provide reliable stage identification.

The Three Diagnostic Metrics#

1. Revenue growth rate. The most intuitive signal but also the most easily misread in isolation. A single quarter of slowing growth does not indicate maturity -- it could reflect seasonality, a pricing change, or a temporary competitive disruption.

| Stage | Revenue Growth Rate |

|---|---|

| Introduction | Volatile, often negative |

| Growth | 15%+ annually, sustained |

| Maturity | 0-10% annually |

| Decline | Negative, sustained |

2. Market penetration. What percentage of the total addressable market has adopted? This metric anchors the growth rate in context. A product growing at 20% with 60% market penetration is approaching maturity despite the headline growth number.

| Stage | Market Penetration |

|---|---|

| Introduction | Below 5% |

| Growth | 5-40%, rising |

| Maturity | 40-80%, stable |

| Decline | Falling from peak |

3. Competitive dynamics. The behavior of competitors reveals stage information that revenue data alone cannot. New entrants signal growth. Consolidation signals maturity. Exits signal decline.

| Stage | Competitive Pattern |

|---|---|

| Introduction | Few players, category still forming |

| Growth | New entrants each quarter |

| Maturity | Stable oligopoly, M&A activity |

| Decline | Players exiting, remaining share consolidating |

Stage Transition Warning Signs#

Catching transitions early creates a strategic advantage. Watch for these signals:

Introduction to Growth: First quarter of sustained positive revenue growth. Repeat purchases from customers outside the early adopter profile. The first meaningful competitor enters the market.

Growth to Maturity: Revenue growth rate declines for three or more consecutive quarters despite maintained or increased investment. Customer acquisition costs rise significantly. Market share positions stabilize.

Maturity to Decline: Total addressable market contracts (not just your share). A substitute technology achieves price parity. Three or more competitors exit within 12 months.

Lifecycle Extension Strategies#

The transition from maturity to decline is not inevitable. Lifecycle extension strategies can restart the growth curve, sometimes multiple times, adding years or decades of profitable operation. Three primary approaches work.

Line Extension#

Add new variants, features, or configurations that address unmet needs within the existing customer base. A consumer electronics company extending its product line from premium to mid-tier pricing opens a new adoption curve without developing an entirely new product.

Line extension works best when existing customers have identifiable unmet needs and the brand has sufficient equity to stretch into adjacent offerings. The risk is brand dilution -- extending too far weakens the core positioning.

Market Expansion#

Take the existing product to new customer segments or geographies. A B2B software tool designed for financial services firms expanding into healthcare and manufacturing creates new growth curves in markets where the product is effectively in its introduction stage.

Market expansion works best when the product solves a problem that transcends the original target segment. The risk is underestimating the adaptation required -- what works in one segment often needs meaningful modification for another.

Repositioning#

Change how the market perceives the product to open entirely new use cases. A well-known household product originally sold as a baking ingredient was repositioned successively as a cleaning agent, a deodorizer, and a dental care ingredient -- each repositioning initiated a new growth phase within what would otherwise have been terminal maturity.

Repositioning works best when the product has functional versatility that customers have not yet recognized. The risk is confusing the existing customer base while failing to capture the new one.

When to Invest in Extension vs. Accept Decline#

Not every mature product warrants extension. The decision depends on three factors:

- Remaining market potential. Is the addressable market large enough to justify the investment? Extension of a product in a $50M market has a fundamentally different ROI profile than extension of a product in a $5B market.

- Competitive position. Market leaders have the brand equity and distribution to execute extension strategies. Fourth-place players rarely have the leverage to reposition successfully.

- Capability requirements. Can the organization execute the extension with existing capabilities, or does it require building new ones? New capabilities add cost and execution risk.

Common Misdiagnosis Patterns#

Three patterns account for most lifecycle stage misdiagnosis:

Confusing a growth spike with a stage reset. A promotional campaign or seasonal surge can temporarily boost growth-stage metrics in a mature product. If the underlying penetration and competitive dynamics have not changed, the product is still in maturity. Look at 12-month trends, not quarterly spikes.

Treating all revenue decline as terminal. Cyclical downturns, one-time competitive events, or pricing adjustments can cause temporary revenue declines within the growth or maturity stages. True decline shows sustained contraction accompanied by competitor exits and addressable market shrinkage.

Applying a single product's diagnosis to an entire category. Your product may be in decline while the category is in growth -- because a competitor's substitute has captured your customers. Category-level and product-level lifecycles diverge frequently and require separate analysis.

Connecting Product Life Cycle Stages to Portfolio Strategy#

Product life cycle stages analysis becomes most powerful when applied at the portfolio level. Each product's stage diagnosis informs capital allocation through the BCG matrix: introduction-stage products are Question Marks requiring selective investment, growth-stage products are Stars deserving aggressive funding, mature products are Cash Cows that should fund the rest, and declining products are Dogs requiring harvest or divestiture decisions.

A balanced portfolio needs products distributed across stages. If every product is in maturity, the company faces a revenue cliff when they collectively enter decline with no growth pipeline behind them. If every product is in introduction, the company is burning cash with no near-term revenue engine.

For competitive context within each stage, a competitive analysis helps determine whether your product's position is strengthening or weakening relative to rivals at the same lifecycle stage. Products that are losing share during growth face a fundamentally different strategic situation than products that are gaining share during maturity.

Presenting Product Life Cycle Stages Analysis#

When communicating lifecycle analysis to leadership, two principles matter most. First, lead with the strategic implication, not the framework description. "Our core product has entered maturity 18 months ahead of forecast, requiring a $12M reallocation from growth investment to efficiency initiatives" is actionable. "Product lifecycle analysis shows Stage 3" is not.

Second, pair the stage diagnosis with a recommended action for each product. Executives do not need a lecture on the four stages -- they need to know what the diagnosis means for next quarter's resource allocation. Use the comprehensive comparison table in this guide as a starting template, then customize the strategic recommendations to your specific competitive context. Tools like Deckary can help build the portfolio visualization charts and comparison tables that typically accompany this analysis in strategy presentations.

Summary#

Product life cycle stages analysis is a diagnostic tool, not a descriptive label. Its value lies in matching strategic decisions to where a product actually sits on its market trajectory.

- Four stages, four postures -- introduction requires investment in market education, growth requires investment in competitive moats, maturity requires efficiency and cash generation, decline requires harvesting or exit

- Diagnose with three metrics -- revenue growth rate, market penetration, and competitive dynamics tracked together over 6-12 months; no single metric is reliable alone

- Stage transitions are where value is created or destroyed -- catching the growth-to-maturity transition early prevents over-investment; catching the maturity-to-decline transition early enables orderly exit or extension

- Lifecycle extension can restart the curve -- line extensions, market expansion, and repositioning are the three primary strategies; not every product warrants the investment

- Portfolio-level application drives the most value -- individual product diagnosis feeds into BCG matrix portfolio decisions and capital allocation across the full product portfolio

For related frameworks, explore BCG Matrix Examples for portfolio classification, Competitive Analysis Examples for understanding positioning within each stage, or browse the full Strategic Frameworks Guide for a comprehensive overview.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free