Product Lifecycle Management: A Strategic Guide for Every Stage

Product lifecycle management explained with strategic decisions for introduction, growth, maturity, and decline. Real examples and portfolio-level frameworks.

Product lifecycle management is not a software category. Before PLM became synonymous with engineering tools like Siemens Teamcenter and PTC Windchill, it was a strategic discipline -- the practice of managing pricing, investment, marketing, and distribution decisions differently at each stage of a product's market life. That strategic discipline is what separates companies that extract decades of value from a product from those that watch margins erode within a few years.

After applying product lifecycle management frameworks across 35+ portfolio strategy and growth engagements, we have found that the most common mistake is treating all products the same way regardless of where they sit on the curve. A mature cash cow does not need growth-stage investment levels. An introduction-stage product cannot be held to mature-product margin targets. Getting the stage diagnosis right determines whether capital allocation decisions create value or destroy it.

This guide covers the four lifecycle stages and the strategic decisions each demands, how to diagnose which stage your product occupies, portfolio management across stages, and the critical distinction between product lifecycle management and the product development lifecycle. For the broader framework context, see our Strategic Frameworks Guide.

What Product Lifecycle Management Actually Means#

Product lifecycle management is the strategic practice of adjusting a product's go-to-market approach as it moves from market entry to market exit. The concept originated with Theodore Levitt's 1965 Harvard Business Review article "Exploit the Product Life Cycle," which argued that companies needed to plan for each stage proactively, not react after margins had already eroded.

The framework rests on a simple observation: products do not generate the same returns forever. Markets evolve, competitors enter, and technologies mature. Product lifecycle management differs from product management in scope -- product management focuses on building and iterating features, while PLM focuses on the higher-order strategic questions: when to increase investment, when to harvest cash, when to extend the lifecycle through repositioning, and when to exit.

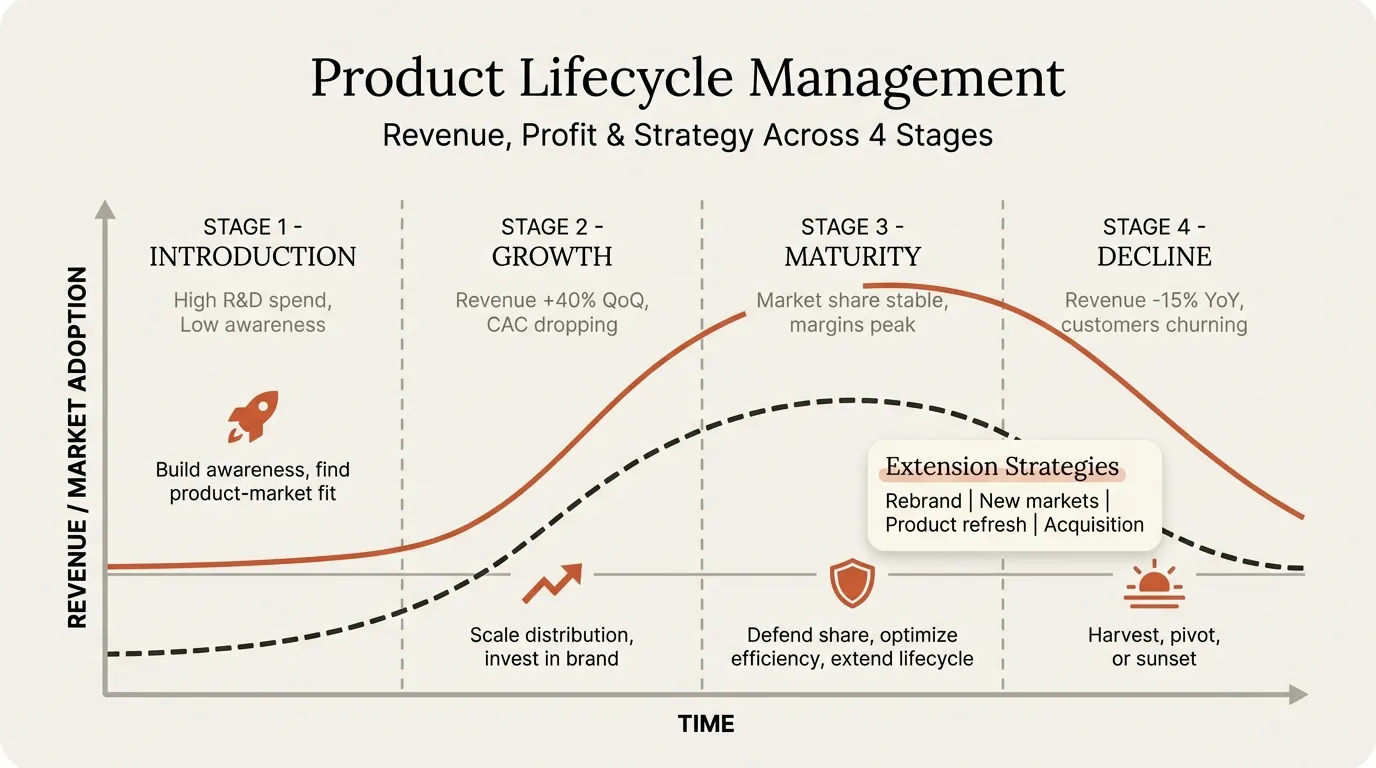

The Four Stages of Product Lifecycle Management#

Every product follows a recognizable trajectory through four stages. The duration varies -- a consumer electronics product might cycle in 18 months while a pharmaceutical compound spans 20 years -- but the strategic pattern is consistent.

Stage 1: Introduction#

The product enters the market. Revenue is low, costs are high, and the customer base is limited to early adopters and innovators. Most products lose money during this stage.

Strategic priorities at introduction:

| Decision Area | Introduction-Stage Approach |

|---|---|

| Pricing | Skimming (high price for early adopters) or penetration (low price for rapid adoption) |

| Investment | Heavy -- product development, market education, distribution buildout |

| Marketing | Awareness and education; explain why the category exists |

| Distribution | Selective -- target channels where early adopters shop |

| Competition | Few direct competitors; category creation is the primary challenge |

The key decision at introduction is pricing strategy. Skimming works when the product has strong differentiation and a segment willing to pay a premium (think original iPhone). Penetration works when network effects or scale economics favor early market share capture (think early Uber). The wrong choice compounds throughout the entire lifecycle.

Stage 2: Growth#

The product gains traction. Revenue accelerates, margins improve as scale kicks in, and new competitors enter the market attracted by demonstrated demand. This is where most strategic value is created or lost.

Strategic priorities at growth:

| Decision Area | Growth-Stage Approach |

|---|---|

| Pricing | Gradually reduce to expand addressable market; defend against new entrants |

| Investment | Scale operations, expand capacity, build brand |

| Marketing | Shift from education to differentiation; explain why your product, not just the category |

| Distribution | Expand aggressively -- new channels, geographies, segments |

| Competition | New entrants arriving; establish competitive moats before the market matures |

Growth is the stage where companies must invest ahead of demand, a principle reinforced by BCG's experience curve research. Under-investing during growth cedes market position that is nearly impossible to recover during maturity. Amazon operated at minimal margins for over a decade during its growth stage -- a deliberate lifecycle management decision that built the scale advantages now generating massive cash flows.

Stage 3: Maturity#

Growth slows. The market is saturated, most potential customers have adopted, and competition is intense. Revenue peaks but growth rates fall to single digits or flatten entirely. This is typically the longest stage and where the most total revenue is generated.

Strategic priorities at maturity:

| Decision Area | Maturity-Stage Approach |

|---|---|

| Pricing | Competitive; price wars are common; defend margin through efficiency, not premium |

| Investment | Selective -- operational efficiency, cost reduction, line extensions |

| Marketing | Defend market share; loyalty programs, brand reinforcement |

| Distribution | Optimize existing channels; reduce unprofitable ones |

| Competition | Consolidation; weaker players exit or get acquired |

Maturity demands a fundamentally different posture than growth. The goal shifts from market capture to cash generation and efficiency. Companies that keep spending at growth-stage levels during maturity destroy value.

The most sophisticated maturity-stage strategy is lifecycle extension: restarting the growth curve through product modifications, new segments, or repositioning. Arm & Hammer extended baking soda's lifecycle for decades by repositioning it from a baking ingredient to a cleaning product, deodorizer, and toothpaste ingredient -- each repositioning opened a new growth curve within the same product.

Stage 4: Decline#

Demand falls. The technology is superseded, customer preferences shift, or the market simply contracts. Revenue and margins both decrease, and the strategic question becomes: harvest or exit?

Strategic priorities at decline:

| Decision Area | Decline-Stage Approach |

|---|---|

| Pricing | Maintain or selectively increase for remaining loyal customers |

| Investment | Minimal -- only what is needed to maintain current operations |

| Marketing | Reduce to near zero; serve existing customers, do not acquire new ones |

| Distribution | Consolidate to highest-volume channels only |

| Competition | Competitors exiting; opportunity to capture remaining share at low cost |

Decline does not mean failure. A well-managed decline extracts significant cash through the "last man standing" strategy -- deliberately outlasting competitors to capture their customers at minimal cost. Kodak's film business is the textbook example of mismanaged decline: rather than harvesting cash from still-profitable film operations to fund digital transformation, Kodak continued investing in film growth while the market contracted, draining both the legacy and the new business.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

How to Identify Which Lifecycle Stage Your Product Occupies#

Misdiagnosing the stage is the most expensive product lifecycle management error. Three metrics, tracked together, provide a reliable diagnosis:

| Metric | Introduction | Growth | Maturity | Decline |

|---|---|---|---|---|

| Revenue growth rate | Volatile, often negative | 15%+ annually | 0-10% annually | Negative |

| Market penetration | Below 5% of addressable market | 5-40%, rising rapidly | 40-80%, stable | Falling from peak |

| Competitive dynamics | Few players, category undefined | New entrants each quarter | Stable oligopoly, consolidation | Players exiting |

Warning signs of stage transitions:

- Introduction to Growth: First quarter of sustained positive revenue growth; repeat purchases from non-early-adopter segments; first competitor enters.

- Growth to Maturity: Revenue growth rate declines for three consecutive quarters despite maintained investment; market share stabilizes; acquisition costs rise.

- Maturity to Decline: Total addressable market shrinks (not just your share); a substitute technology reaches price parity; three or more competitors exit within 12 months.

No single metric is sufficient. Use all three indicators together and track the trend over 6-12 months before changing your strategic posture.

Product Lifecycle Management at the Portfolio Level#

Portfolio-level lifecycle management is where the real strategic value lies. A company with all products in the same stage faces a predictable crisis: all-growth portfolios burn cash with no near-term returns; all-maturity portfolios have no growth pipeline; all-decline portfolios are heading for irrelevance.

The BCG Matrix maps directly to lifecycle stages:

| BCG Quadrant | Lifecycle Stage | Role in Portfolio |

|---|---|---|

| Question Marks | Introduction | Future growth options; invest selectively |

| Stars | Growth | Build into tomorrow's cash generators |

| Cash Cows | Maturity | Fund investment in Stars and Question Marks |

| Dogs | Decline | Harvest or divest; free up resources |

A balanced portfolio needs products across at least three stages. Cash from mature products funds growth and introduction-stage investments. When growth products mature, they become the next generation of cash generators.

This is where product lifecycle management connects to the Ansoff Matrix. When a product enters maturity, the Ansoff framework helps identify extension strategies: sell the existing product to new markets (market development), modify it for existing customers (product development), or pursue entirely new products for new markets (diversification).

Portfolio Rebalancing Signals#

Watch for these portfolio-level imbalances:

Too many introduction-stage products. Cash burn exceeds what mature products can fund. Fix: kill the weakest bets and concentrate resources on two or three with the strongest early signals.

No introduction-stage products. The company is living off its current portfolio with no growth pipeline. Fix: allocate 10-15% of annual revenue to new product exploration, regardless of current profitability.

All products maturing simultaneously. Revenue peaks across the portfolio at the same time, followed by synchronized decline. Fix: stagger product launches and lifecycle extension efforts so maturity curves overlap rather than coincide.

Product Lifecycle Management vs. Product Development Lifecycle#

These two concepts are frequently confused, and the confusion leads to organizational misalignment.

| Dimension | Product Development Lifecycle | Product Lifecycle Management |

|---|---|---|

| Scope | Concept to launch | Launch to retirement |

| Timeframe | Months (typically 3-18) | Years (typically 2-20+) |

| Primary owner | Product management / engineering | Strategy / general management |

| Key decisions | Features, architecture, release timing | Pricing, investment level, market positioning |

| End point | Product ships | Product exits the market |

| Frameworks | Agile, stage-gate, design thinking | BCG matrix, lifecycle curve, portfolio analysis |

The product development lifecycle is a subprocess within the introduction stage of product lifecycle management. It answers "how do we build and launch this?" Product lifecycle management answers "how do we manage this product's strategic trajectory over its entire market life?" Organizations that conflate the two often hand lifecycle management to the product development team, but product managers are optimized for building and shipping, not the harvest-or-invest decisions that define maturity and decline management.

Real Examples of Lifecycle Management Decisions#

Apple's iPhone: Apple manages the iPhone lifecycle through annual refreshes that restart the growth curve within the maturity stage. Pricing follows lifecycle logic: the newest model commands a premium (introduction pricing), previous generations drop in price (maturity pricing), and models three generations old are discontinued (managed decline).

Netflix's DVD business: Netflix harvested the DVD business for over a decade rather than abandoning it abruptly, using its cash flows to fund the streaming transition. By 2023, the DVD business still served 1-2 million subscribers at high margins because most competitors had exited -- textbook "last man standing" decline management.

Microsoft Office: Microsoft extended Office's lifecycle from a maturity-stage packaged product to a growth-stage subscription service (Microsoft 365). The business model transition restarted the revenue growth curve -- lifecycle extension through business model innovation rather than product modification.

Presenting Product Lifecycle Management Analysis#

Two presentation formats work well for lifecycle analysis. The lifecycle curve slide plots products along an S-curve with stage boundaries marked, showing portfolio balance at a glance. The portfolio grid maps products onto a BCG matrix with lifecycle annotations, connecting position directly to investment decisions.

For either format, the action title should state the strategic implication: "Three of five products entering maturity simultaneously creates a revenue cliff by 2028" is actionable, while "Product Lifecycle Analysis" is not. For more on structuring strategy slides, see our consulting slide standards guide. Tools like Deckary streamline the chart creation process for the waterfall and comparison charts that typically accompany lifecycle analysis with financial data.

Summary#

Product lifecycle management matches investment, pricing, marketing, and distribution decisions to where a product sits on its market trajectory.

- Four stages, four postures -- introduction demands investment and market education; growth demands scaling and competitive moat building; maturity demands efficiency and selective investment; decline demands harvesting or exit

- Diagnose with three metrics -- revenue growth rate, market penetration, and competitive dynamics together; no single metric is reliable alone

- Portfolio balance matters more than individual product management -- cash from mature products funds growth products; a gap in any lifecycle stage creates a predictable future problem

- Lifecycle extension is the highest-value strategy -- repositioning, new segments, or business model changes can restart the growth curve within maturity

- PLM is not product development -- development ends at launch; lifecycle management begins at launch and continues until market exit

For related strategic frameworks, explore the BCG Matrix for portfolio classification, the Ansoff Matrix for growth strategy at each lifecycle stage, or browse the full Strategic Frameworks Guide for a comprehensive overview. For a deeper look at what happens within each stage, see our guide on product life cycle stages.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free