Financial Projections Slide: How to Present Your Startup's Numbers to Investors

Financial projections slide best practices for pitch decks. Learn what metrics investors expect, how to build credible forecasts, and common mistakes to avoid.

The financial projections slide presents your startup's revenue forecast, key metrics, and path to profitability in a format investors can evaluate quickly. According to DocSend research, investors spend more time on the financials slide than on almost any other--an average of 23 seconds in a deck that gets 3-4 minutes total.

This slide separates credible founders from wishful thinkers. The difference lies not in projecting larger numbers, but in grounding every number in defensible assumptions--bottom-up models built from customer acquisition costs, sales productivity, and cohort expansion rather than top-down market-size-times-market-share calculations.

This guide covers what to include, the metrics investors expect by stage, best practices for presenting numbers, and the mistakes that kill credibility. For the full 12-slide structure investors expect, see our Pitch Deck Guide.

What to Include in a Financial Projections Slide#

Your financial projections slide needs to answer three questions: Where is the business today? Where will it be in 3-5 years? What drives that growth?

Essential Components#

| Component | Purpose | Example |

|---|---|---|

| Current state | Baseline for projections | "$2.1M ARR, 15% MoM growth" |

| Revenue projections | Growth trajectory | "Year 1: $6M, Year 2: $15M, Year 3: $35M" |

| Key assumptions | Credibility drivers | "20 sales reps at $500K quota each" |

| Unit economics | Profitability proof | "LTV:CAC of 4:1, 18-month payback" |

| Path to profitability | Capital efficiency | "Cash flow positive at $20M ARR" |

Metrics by Stage and Business Model#

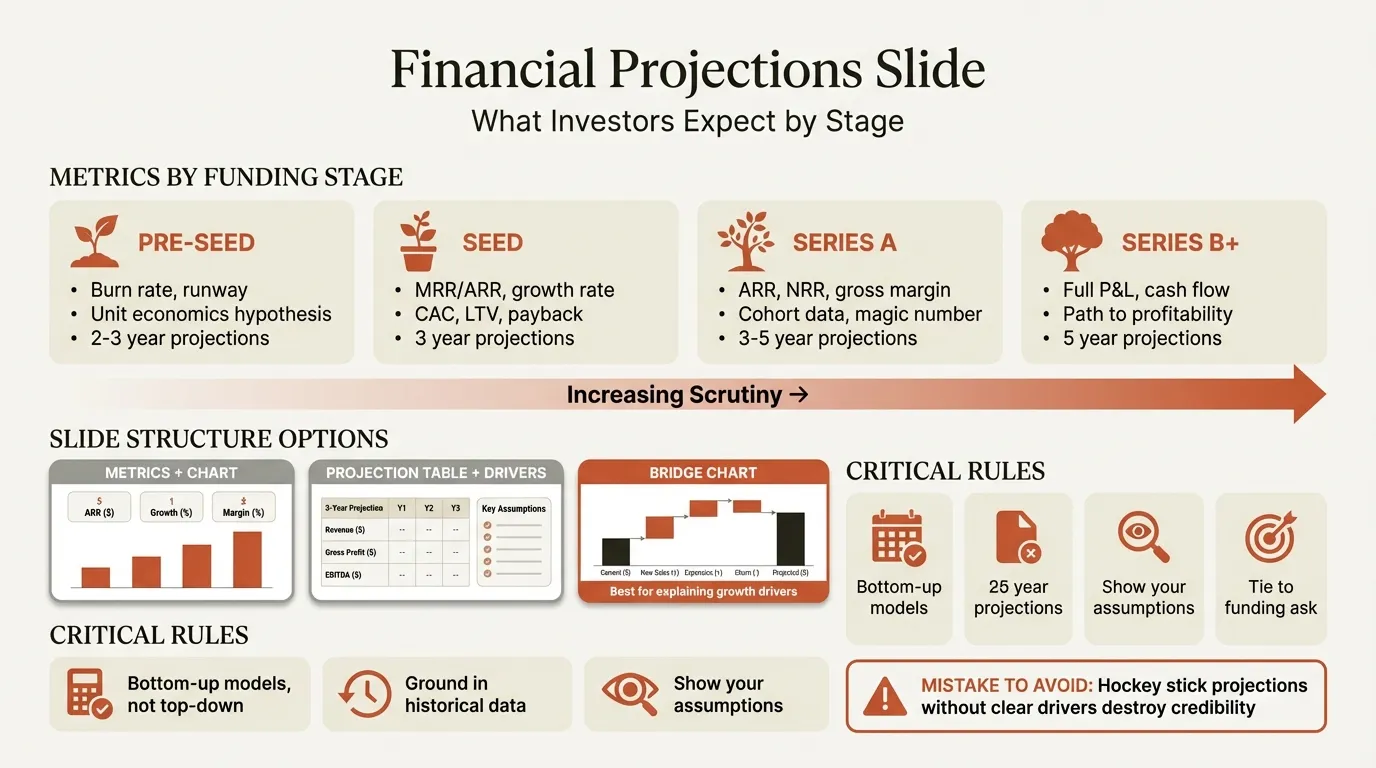

The depth investors expect increases with company maturity. According to Sharpsheets research, early-stage startups need a 3-year plan while Series A and beyond require 5-year projections based on verified assumptions.

| Stage | Primary Metrics | Timeline |

|---|---|---|

| Pre-seed | Burn rate, runway, unit economics hypothesis | 2-3 years |

| Seed | Revenue, growth rate, CAC, LTV | 3 years |

| Series A | ARR, NRR, gross margin, cohort data, path to profitability | 3-5 years |

| Series B+ | Full P&L, cash flow, segment-level projections, scenario analysis | 5 years |

Master Metrics Reference#

| Metric | Definition | Benchmark |

|---|---|---|

| ARR / MRR | Annual (or Monthly) Recurring Revenue | Growth trajectory |

| Gross Margin | (Revenue - COGS) / Revenue | 65-80% for SaaS |

| Burn Rate | Monthly cash spend | Determines runway |

| Runway | Months of operation at current burn | 18-24 months post-funding |

| CAC | Sales + marketing spend / new customers | Varies by model |

| LTV | Total expected revenue per customer | Must exceed 3x CAC |

| NRR | Existing customer revenue after expansion and churn | >100%, ideally 120%+ |

| CAC Payback | Months to recoup acquisition cost | Under 18 months |

| Magic Number | Net new ARR / prior quarter sales spend | >0.75 |

For more on how these metrics fit your fundraising narrative, see our guide to Series A pitch decks.

Metrics by Business Model#

SaaS is the most standardized model. Focus on ARR/MRR, MoM growth, NRR, gross margin, CAC payback, and LTV:CAC. Each projection year should trace to specific drivers: sales headcount, average deal size, conversion rates, and expansion revenue.

Marketplace models center on GMV (Gross Merchandise Value), take rate, buyer/seller liquidity, CAC by side, and repeat rate. Show GMV and revenue separately, and prove both sides of the market are growing.

E-Commerce projections emphasize AOV (Average Order Value), gross margin (30-60% typical), repeat purchase rate (>30% for healthy brands), and ROAS (>3x).

Consumer/Social apps prioritize engagement before revenue: DAU/MAU, retention curves, viral coefficient, and cohort retention. Post-monetization, add ARPU and conversion to paid.

Best Practices for Presenting Numbers#

How you present financial projections matters as much as the numbers themselves.

1. Use Bottom-Up Revenue Models#

Top-down projections ("The market is $50B, we'll capture 1%") signal lazy thinking. Bottom-up models start from granular inputs and build to revenue.

Top-down (weak):

Total market: $50B

Our segment: 10% = $5B

Market share: 2% = $100M

Bottom-up (strong):

Sales reps: 20

Quota per rep: $500K

Attainment rate: 80%

New ARR: $8M

Expansion revenue: $2M

Total Year 1 ARR: $10M

Bottom-up models are defensible because investors can evaluate each assumption independently and adjust any single input to see the impact.

2. Show Your Assumptions Explicitly#

According to OpenVC's analysis of financial slides, investors want to see the key assumptions that drive your model. Making assumptions explicit shows analytical rigor and enables productive follow-up conversations.

Key Assumptions:

- Average deal size: $50K (based on current pipeline)

- Sales cycle: 90 days (current average)

- Close rate: 25% (trailing 6-month average)

- Sales rep ramp: 6 months to full productivity

3. Ground Projections in Historical Data#

Graphite Financial's research emphasizes that investors want 2-3 years of historical financials when available. Use traction as the foundation: "Current MoM growth is 15%. Maintaining 12% MoM with a scaled sales team yields $35M ARR in year 3" beats "We project $50M in year 3."

4. Use Clear Visualizations#

Financial projections should be immediately scannable. Use charts, not spreadsheets.

| Chart Type | Best For |

|---|---|

| Bar chart | Revenue by year |

| Line chart | Growth trajectory over time |

| Waterfall chart | Bridge from current to projected |

For visualizing revenue bridges, waterfall charts are particularly effective. They break down growth into component drivers (new sales, expansion, churn) in a format executives understand immediately.

5. Create Multiple Scenarios and Tie to Funding#

Sophisticated founders present multiple scenarios to show they've stress-tested their model. Show the base case on the main slide; keep bull and bear cases for due diligence.

Your projections should also connect to your ask. Investors want to see how the capital you're raising drives you to specific milestones:

Raising: $8M Series A

Use of funds: Scale sales team from 5 to 20 reps

Milestone: $15M ARR in 18 months

Next raise: Series B at $15M+ ARR

For more on structuring your funding ask, see our pitch deck template.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

Common Mistakes to Avoid#

These errors destroy credibility faster than any other aspect of a pitch deck.

Hockey stick projections without foundation. As SlideModel notes, investors see these constantly and will mentally cut your numbers in half. Fix: make the hockey stick an output of defensible bottom-up inputs--sales team productivity, conversion rates, and market expansion--not a starting assumption.

Missing unit economics. Growth that burns cash indefinitely is not valuable. Include CAC, LTV, payback period, and gross margin to prove you can acquire customers profitably at scale.

False precision. "$12,847,293 in year 3" signals you believe you can predict the unpredictable. Round appropriately--"$12-15M in year 3" is more credible.

Ignoring competition. Projections that assume you'll grow in a vacuum look naive. Build realistic market share assumptions and explain why competitors won't prevent your growth.

Inconsistent numbers across slides. Internal contradictions destroy trust in your entire presentation. Audit your deck so the financials slide matches market sizing, use of funds, and traction slides.

No path to profitability. Post-2022, investors care about capital efficiency. Show when you expect to reach cash flow breakeven, even if it's 5+ years out.

Leaving out key expenses. As Storydoc research indicates, omitting CAC or COGS is a common mistake. Show gross margin, not just revenue, and include major expense categories at a high level.

Worked Example: Building a Three-Year SaaS Projection#

Step 1: Document Current State#

| Metric | Current Value | Source |

|---|---|---|

| ARR | $1.8M | Trailing 12 months |

| MoM growth | 12% | Last 6 months average |

| Gross margin | 75% | Current P&L |

| CAC | $15,000 | Last quarter |

| LTV | $65,000 | Cohort analysis |

| Sales reps | 4 | Current headcount |

| Quota per rep | $400K | Annual target |

Step 2: Define Key Assumptions#

| Assumption | Year 1 | Year 2 | Year 3 | Rationale |

|---|---|---|---|---|

| Sales rep growth | 4 → 8 | 8 → 15 | 15 → 25 | Post-funding hiring |

| Quota attainment | 75% | 80% | 85% | Rep maturation |

| Expansion rate | 20% | 25% | 30% | Product expansion |

| Churn rate | 15% | 12% | 10% | Product improvement |

Step 3: Build the Model#

Year 1:

New ARR from sales: 8 reps x $400K x 75% = $2.4M

Expansion revenue: $1.8M x 20% = $360K

Churn: $1.8M x 15% = -$270K

End of Year 1 ARR: $1.8M + $2.4M + $360K - $270K = $4.3M

Year 2:

New ARR from sales: 15 reps x $400K x 80% = $4.8M

Expansion revenue: $4.3M x 25% = $1.1M

Churn: $4.3M x 12% = -$516K

End of Year 2 ARR: $4.3M + $4.8M + $1.1M - $516K = $9.7M

Year 3:

New ARR from sales: 25 reps x $400K x 85% = $8.5M

Expansion revenue: $9.7M x 30% = $2.9M

Churn: $9.7M x 10% = -$970K

End of Year 3 ARR: $9.7M + $8.5M + $2.9M - $970K = $20.1M

Step 4: Sanity Check#

- Growth rate: $1.8M to $20M is ~11x in 3 years--aggressive but achievable with funding.

- Sales productivity: $400K quota at 75-85% attainment is reasonable for mid-market SaaS.

- Team growth: 4 to 25 reps requires strong recruiting but is feasible with capital.

- Churn improvement: 15% to 10% assumes product investment and needs clear justification.

Step 5: Visualize#

Present the summary on one slide: a bar chart showing Year 0-3 ARR, key metric boxes (Current $1.8M, Y3 $20M, 3-Year CAGR 123%), and a callout for key drivers. A waterfall chart could break down each year's growth into new sales, expansion, and churn components.

Example: What Works#

Airbnb's original pitch deck showed financial projections grounded in real traction--displaying historical revenue growth before projecting future growth and letting the trend speak for itself. The takeaway: if you have traction, lead with it. Historical data makes projections credible.

Summary#

The financial projections slide is where founders demonstrate analytical rigor or reveal wishful thinking. Four principles matter most:

- Build bottom-up. Start with granular assumptions (sales rep productivity, conversion rates, deal sizes) and calculate revenue as an output. Top-down projections lack credibility.

- Ground projections in traction. Use historical data as the foundation. Extend current trends with clear drivers rather than presenting standalone forecasts.

- Include unit economics. Show CAC, LTV, payback period, and gross margin. Revenue growth without profitable economics is a red flag.

- Make assumptions explicit. Call out key drivers so investors can evaluate each independently. This shows analytical sophistication and enables productive conversations.

For professional financial visualizations, tools like Deckary offer consulting-quality waterfall charts and financial charts that help your projections slide stand out.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free