Series A Pitch Deck: What Investors Want to See in 2026

Master the Series A pitch deck with proven slide frameworks. Learn the metrics VCs expect, how Series A differs from seed, and common mistakes to avoid.

After tracking investor feedback across 40 Series A pitches--including sit-ins on partner meetings and post-mortem conversations with VCs--a clear threshold emerged: the decks that advanced past the first meeting led with three numbers within the first 60 seconds. ARR, growth rate, and net revenue retention. Everything else was context.

Series A investors aren't evaluating potential anymore; they're underwriting a growth machine. The storytelling approach that raised your seed round will get you passed on at this stage. This guide focuses on what makes Series A fundamentally different: the slides that change, the metrics that matter, and the mistakes that kill deals. For a complete pitch deck framework covering all essential slides from seed to growth stage, see our Pitch Deck Guide. If you're pre-product-market-fit, see our pitch deck template for seed-stage guidance.

How Series A Differs from Seed#

Before diving into deck specifics, let's establish why Series A is a different animal entirely.

| Dimension | Seed Round | Series A |

|---|---|---|

| Primary question | Can this team execute on a vision? | Is there product-market fit that scales? |

| Proof required | Early signals, pilot customers | Repeatable revenue, proven unit economics |

| Revenue expectation | Pre-revenue to $500K ARR | $1-3M+ ARR |

| Growth rate | Showing trajectory | 100%+ YoY growth |

| Unit economics | Hypothetical | Proven CAC, LTV, payback |

| Team focus | Founders | Founders + key hires |

| Use of funds | Find product-market fit | Scale what's working |

| Deck emphasis | Vision and story | Metrics and execution |

| Typical raise | $1-4M | $8-20M |

| Due diligence | Light | Extensive |

The Fundamental Shift: From Story to Proof#

Seed investors are buying a lottery ticket. They know most investments will fail, so they optimize for upside potential. A compelling founder with a big vision in a large market can raise seed funding with minimal traction.

Series A investors are buying a growth company. They expect you've already found product-market fit and now need capital to pour fuel on a fire that's already burning. The conversation shifts from "What could this become?" to "Show me the data that proves this is working."

Seed deck: "Here's the massive problem, here's our innovative solution, here's why we're the team to build it."

Series A deck: "Here's our $2M ARR growing 15% month-over-month with 130% net revenue retention, here's how we'll get to $15M ARR with this funding, here's the data proving our unit economics work."

Numbers replace narrative. Charts replace stories. Execution replaces vision.

The Slides That Change at Series A#

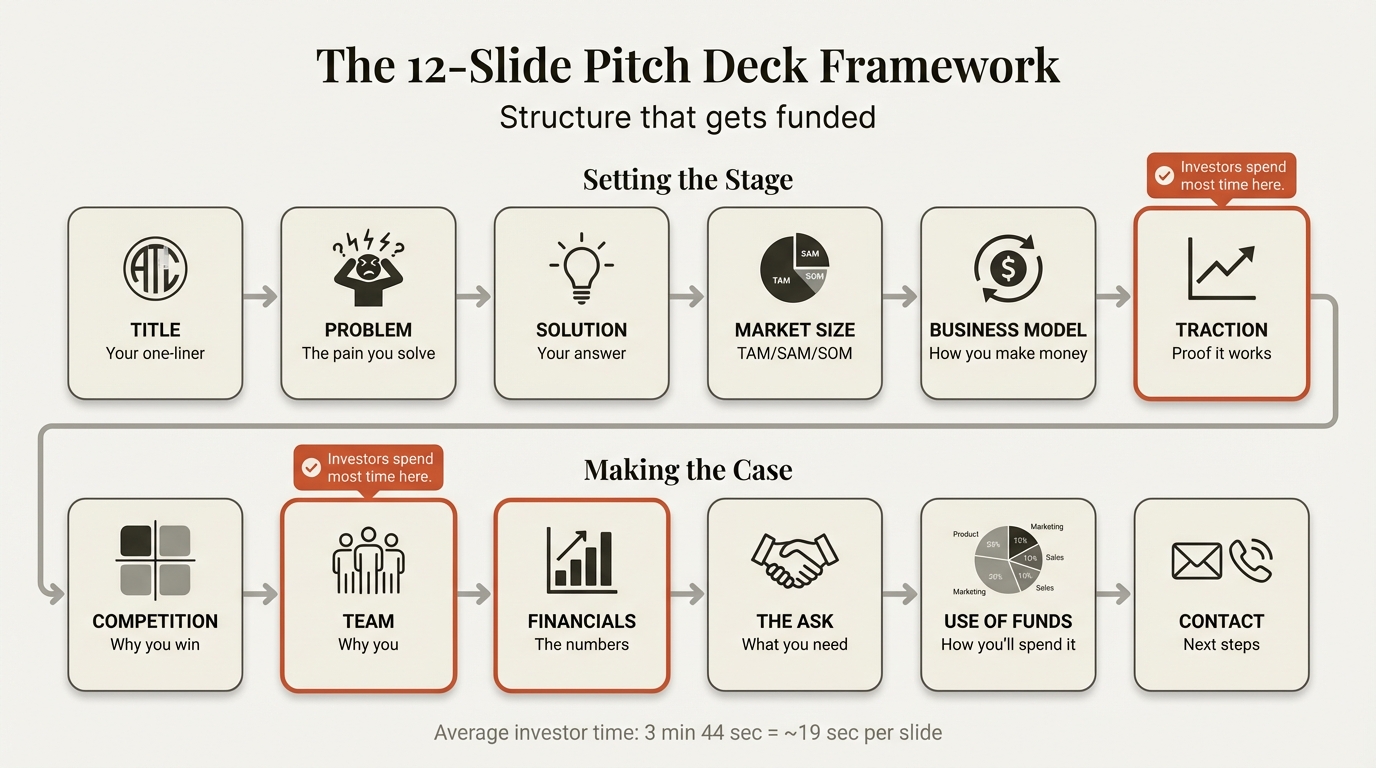

Series A decks run 12-15 slides. Many foundational slides--Problem, Market Size, Competition, Team, Business Model, Go-to-Market--follow the same principles as seed decks but with more data depth. For guidance on those slides, see our Pitch Deck Guide.

Here's the full slide framework for reference:

| Slide | Purpose | Key Metric/Element |

|---|---|---|

| 1. Title | Company identity | One-liner + stage |

| 2. Traction Overview | Hook with results | ARR + growth rate |

| 3. Problem | Market context | Quantified pain point |

| 4. Solution | What you built | Product screenshot |

| 5. How It Works | Product depth | Key differentiators |

| 6. Market Size | Opportunity scale | TAM/SAM/SOM |

| 7. Business Model | Revenue mechanics | Pricing + expansion |

| 8. Unit Economics | Profitability proof | CAC, LTV, payback |

| 9. Traction Deep Dive | Growth evidence | Cohorts, retention |

| 10. Go-to-Market | Scale strategy | Sales efficiency |

| 11. Competition | Market position | Differentiation matrix |

| 12. Team | Execution capability | Key hires made |

| 13. Financials | Projections | 3-year model |

| 14. The Ask | Funding request | Amount + milestones |

| 15. Appendix | Due diligence | Detailed metrics |

The five slides below are where Series A decks diverge most from seed. These are the ones that make or break your raise.

Slide 2: Traction Overview -- Lead with Proof#

Unlike seed decks that build to traction, Series A decks open with it. This is the single biggest structural change: your strongest metrics go on slide 2, not slide 8.

Include:

- Current ARR or revenue

- Growth rate (MoM and YoY)

- Number of customers

- Net revenue retention

- One or two other standout metrics

Example layout:

$2.4M ARR | 18% MoM Growth | 132% NRR

340+ paying customers | 98% gross margin

This slide should take 10 seconds to scan and immediately establish credibility. For visualizing growth metrics, a clean line chart or bar chart works well here. Tools like Deckary can help create consulting-quality growth charts that communicate trajectory at a glance.

Slides 4-5: Product Depth and How It Works#

At seed, you showed a concept. At Series A, you show a real product with defensible differentiation.

Slide 4 (Solution) should include:

- Product screenshot (actual UI, not mockup)

- Key value proposition in one sentence

- Logos of recognizable customers willing to be named

Slide 5 (How It Works) is new at Series A. This slide didn't exist in your seed deck. Investors need to understand why your product is defensible and why customers stick with you.

Include:

- Product demo or workflow

- Key features that drive value

- Technical differentiation

- Integration ecosystem

These two slides together answer the question seed investors never asked: "Why can't a well-funded competitor replicate this in six months?"

Slide 9: Traction Deep Dive -- Cohort Analysis and NRR#

While slide 2 hooked investors with headline metrics, this slide provides the analytical depth they need to move forward.

Include:

- Revenue growth chart (monthly or quarterly)

- Cohort analysis showing retention over time

- Net revenue retention by cohort

- Usage metrics that predict retention

Cohort analysis is the most important visual in your entire deck. Show that customers acquired 12+ months ago are still active and expanding. This proves product-market fit more than any growth chart.

Example cohort data:

Month 0: 100% revenue (baseline)

Month 6: 95% revenue (5% churn)

Month 12: 115% revenue (expansion > churn)

Month 18: 125% revenue (continued expansion)

If your cohorts expand over time, you have strong product-market fit. If they don't, you're not ready for Series A--no amount of deck polish will overcome flat or declining cohorts.

A waterfall chart can effectively show how you bridge from revenue to gross profit to contribution margin, demonstrating where value is created and captured.

Slide 14: The Ask -- Specificity That Builds Confidence#

At seed, "we're raising $2M to find product-market fit" is acceptable. At Series A, investors expect a precise capital deployment plan tied to measurable milestones.

Include:

- Amount raising

- Use of funds breakdown with headcount specifics

- 18-month milestones this funding achieves

- Path to Series B readiness

Example:

Raising: $12M Series A

Use of Funds:

- 50% Sales & Marketing (scale from 3 to 15 AEs)

- 30% Product & Engineering (platform expansion, 8 new engineers)

- 20% Operations (infrastructure, CS team)

18-Month Milestones:

- $10M ARR (from $2.4M)

- 150+ customers (from 85)

- 3 new market segments

- Series B ready

Every dollar should trace to a specific hire or initiative, and every initiative should trace to a revenue outcome. Vague allocations like "growth" and "operations" signal that you haven't thought through the plan.

Slide 15: Appendix -- The Due Diligence Safety Net#

Series A due diligence is extensive compared to seed. Your appendix slides won't be in the live presentation, but they signal preparation and transparency when investors inevitably ask for more.

Prepare slides for:

- Detailed cohort analysis (monthly, by segment)

- Full financial model with assumptions

- Customer case studies (2-3 detailed wins)

- Product roadmap (next 12-18 months)

- Competitive deep dive with win/loss data

- Reference customer contacts (3-5 willing to take calls)

Having these ready and polished shortens due diligence timelines, which keeps deal momentum alive.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

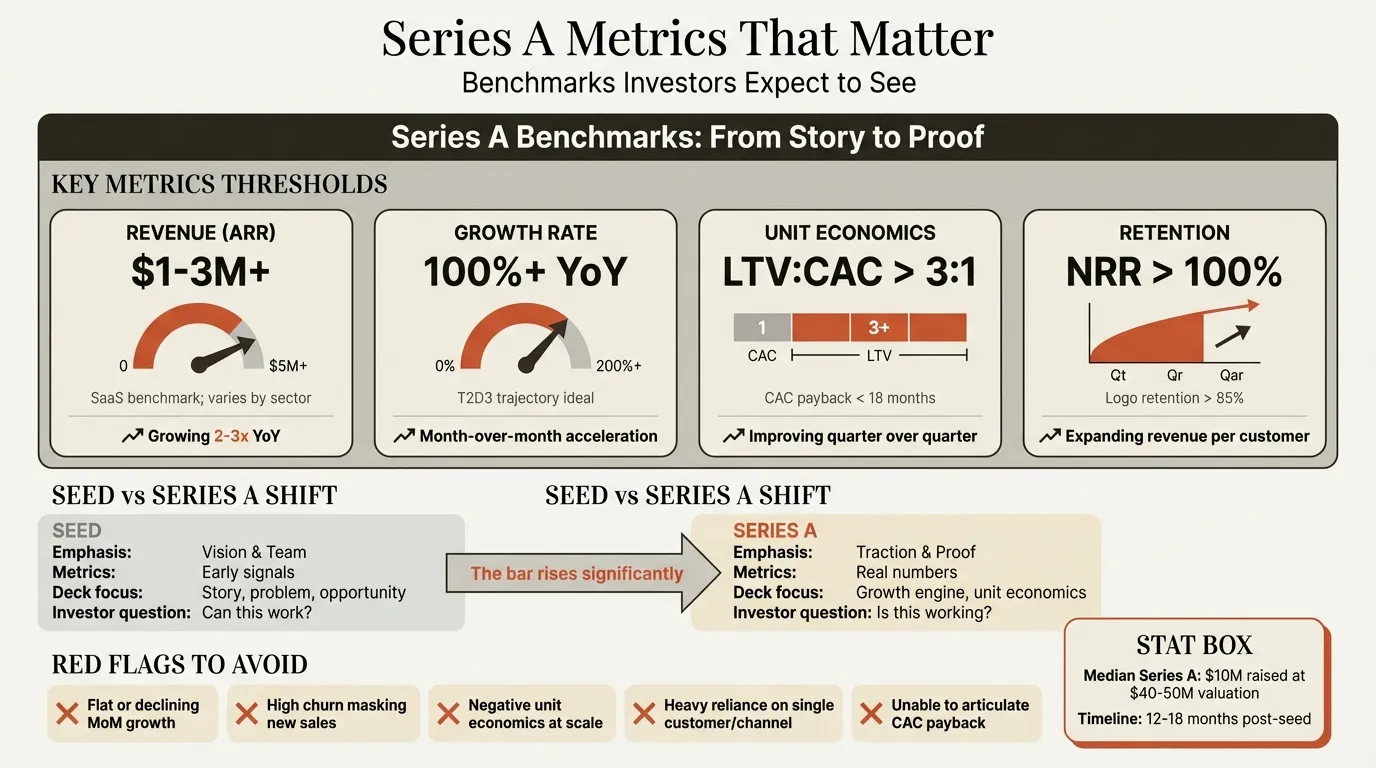

The Metrics That Matter for Series A#

Series A investors evaluate four categories of metrics. Knowing the benchmarks helps you position your numbers effectively--and signals whether you're truly ready to raise.

Revenue Metrics#

| Metric | Series A Benchmark | Why It Matters |

|---|---|---|

| ARR | $1-3M+ | Proof of repeatable revenue |

| MoM Growth | 10-20%+ | Demonstrates momentum |

| YoY Growth | 100%+ (2x) | Proves scaling ability |

| Runway to $100M | Visible path | Shows venture-scale potential |

Retention Metrics#

| Metric | Series A Benchmark | Why It Matters |

|---|---|---|

| Logo Retention | >90% annually | Customers stay |

| Net Revenue Retention | >100% (ideally 120%+) | Expansion exceeds churn |

| Gross Revenue Retention | >85% | Core product stickiness |

Net revenue retention above 100% means you grow even without new customers. This is the strongest signal of product-market fit. If your NRR is below 100%, focus on fixing retention before raising.

Efficiency Metrics#

| Metric | Series A Benchmark | Why It Matters |

|---|---|---|

| LTV:CAC | >3:1 | Profitable unit economics |

| CAC Payback | Under 18 months | Capital efficiency |

| Gross Margin | >65% (SaaS) | Room for operating leverage |

| Magic Number | >0.75 | Sales efficiency |

The Magic Number = (Current Quarter ARR - Prior Quarter ARR) x 4 / Prior Quarter Sales & Marketing spend. Above 0.75 indicates efficient growth; above 1.0 means you should be investing more aggressively.

Engagement Metrics#

| Metric | Why It Matters |

|---|---|

| DAU/MAU | User stickiness and habit formation |

| Feature adoption | Product breadth usage |

| Time in product | Engagement depth |

| NPS | Customer satisfaction and referral potential |

Strong engagement metrics predict future retention. If users log in daily and use multiple features, they won't churn. These metrics are especially important for companies where revenue metrics alone don't tell the full story.

Common Series A Mistakes#

Based on working with founders and feedback from VCs, these are the mistakes most directly tied to failed Series A raises.

Mistake #1: Leading with Story Instead of Metrics#

The problem: Opening with problem/solution narrative like a seed deck, burying traction on slide 8.

The fix: Lead with traction on slide 2. ARR, growth rate, and NRR tell investors whether to keep reading. If they don't find strong metrics quickly, they move on.

Mistake #2: Weak or Missing Unit Economics#

The problem: Hand-waving CAC and LTV, or showing "placeholder" unit economics.

The fix: Know your numbers cold. CAC by channel, LTV by segment, payback period, and how they're trending. If you don't know your unit economics, you're not ready for Series A.

Mistake #3: Hockey Stick Projections Without Foundation#

The problem: Showing growth from $2M to $50M ARR in 18 months without explaining how.

The fix: Build projections bottoms-up. Show the math: "X salespeople x Y quota attainment x Z ACV = revenue." Every projection should trace back to current metrics and specific drivers.

Mistake #4: No Cohort Analysis#

The problem: Showing only topline growth without cohort retention data.

The fix: Show monthly cohort analysis. Topline growth can mask bad retention--VCs know this and will dig for cohort data. If your cohorts retain and expand, this becomes your strongest slide.

Series A Preparation Checklist#

Raising a Series A typically takes 3-6 months. Here's the timeline.

3-6 months before raise:

- Track and document all key metrics (ARR, NRR, CAC, LTV)

- Build your data room with financial model and cohort data

- Refine unit economics calculations by channel and segment

- Identify 30-50 target investors and research their portfolio

- Get warm introductions lined up through existing investors

1-2 months before raise:

- Build your Series A deck using this framework

- Prepare appendix materials and due diligence documents

- Brief 3-5 reference customers willing to take investor calls

- Create detailed financial model with bottoms-up projections

- Practice your pitch with friendly VCs for feedback

During the raise:

- Run a tight process (meet many investors in compressed timeline)

- Update deck weekly with latest metrics

- Track investor feedback and iterate on weak slides

- Prepare for due diligence requests immediately after partner meetings

Summary#

Series A pitch decks require a fundamental shift from seed-stage storytelling to proof-based selling. Lead with metrics on slide 2. Prove unit economics with real data. Show cohort analysis that demonstrates product-market fit. Ground every projection in current performance, and be specific about how you'll deploy capital.

The founders who raise successful Series A rounds understand that investors aren't buying potential anymore--they're buying proof of scalable growth. Your deck should make that proof impossible to miss.

For professional charts that communicate your metrics clearly, Deckary offers consulting-quality waterfall charts, growth visualizations, and Mekko charts that help Series A decks stand out. Browse ready-made layouts in the slide library, or use the AI Slide Builder to accelerate your deck creation by generating professional slides from descriptions.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free