Pitch Deck Template: The 12-Slide Framework That Gets Funded

Master the 12-slide pitch deck template used by Y Combinator startups. Includes real examples from Airbnb and Buffer, plus expert tips for each slide.

Every investor knows the 12-slide pitch deck framework. It has been validated by Y Combinator, Sequoia Capital, and hundreds of successful fundraising rounds from pre-seed through Series A. The structure itself is not the competitive advantage. Execution is.

The difference between a deck that gets filed away and one that lands a partner meeting comes down to three things: how well you frame the problem, how convincingly you prove traction, and how clearly you state the ask. Most founders spend 80% of their time perfecting slides that investors spend seconds on, while underinvesting in the three slides that actually drive decisions.

This guide gives you a condensed reference for all 12 slides, then goes deep on the three that matter most. We also break down what made the original Airbnb, Buffer, and Uber decks work when those companies were still pre-product or pre-revenue. For a comprehensive walkthrough of every slide with detailed templates and stage-specific guidance, see our Pitch Deck Guide.

Get the Template: Download our free Pitch Deck PowerPoint Template with all 12 slides, investor-tested layouts, and best practices for each section.

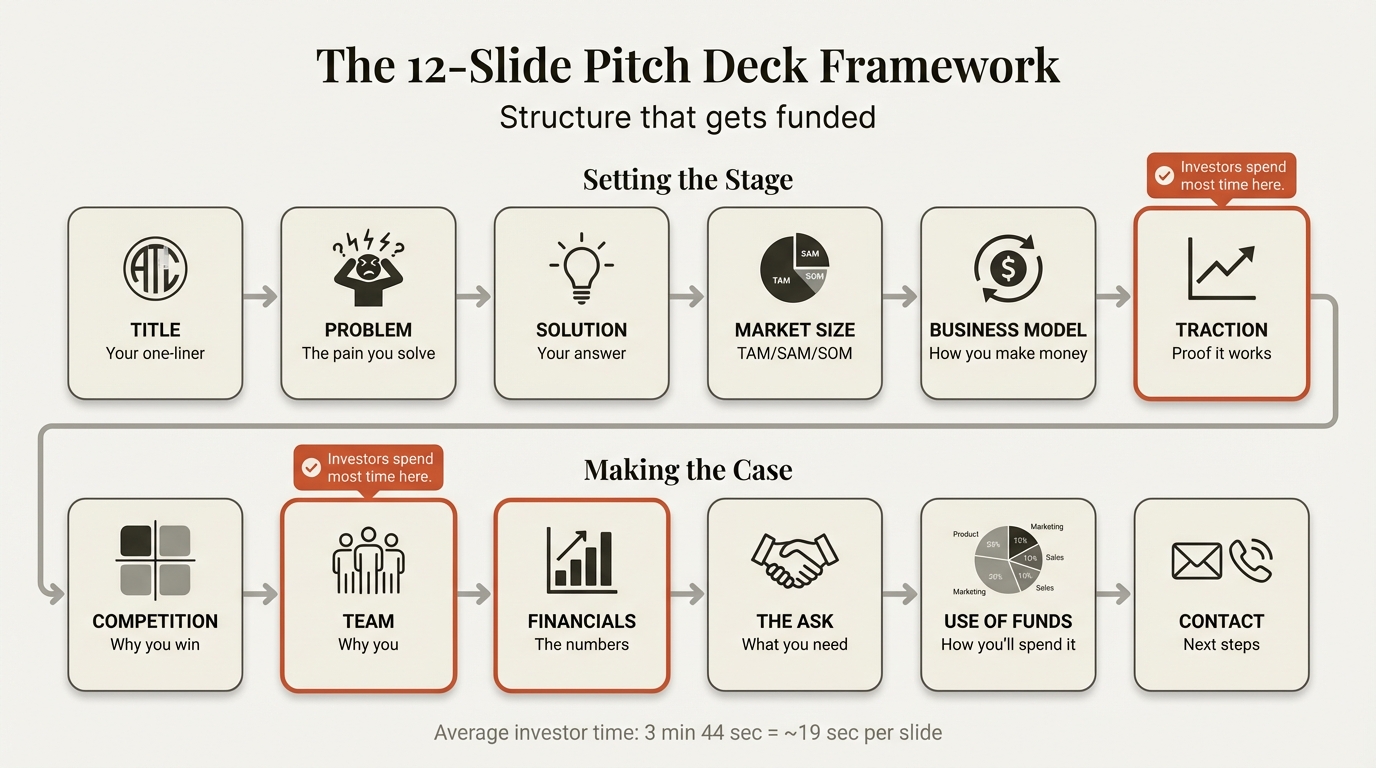

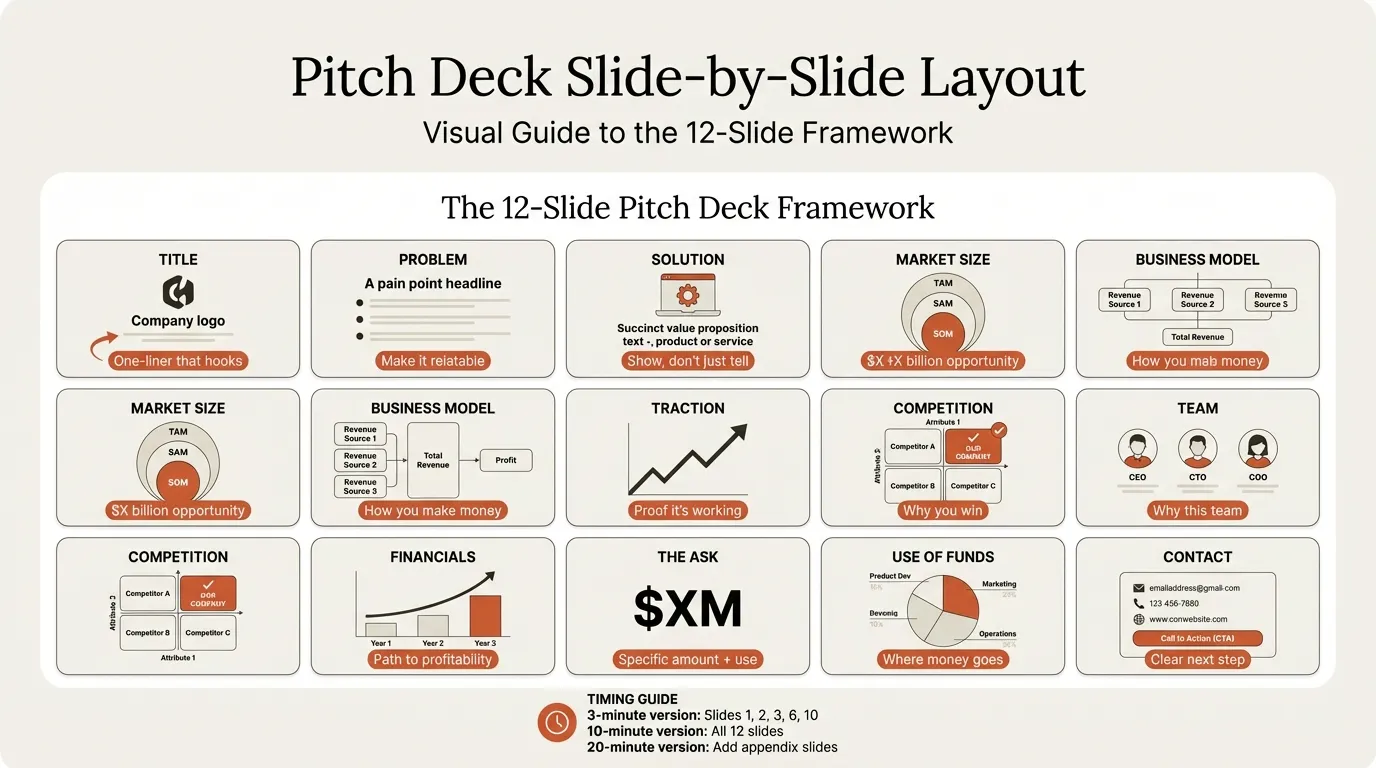

The 12-Slide Framework: Quick Reference#

The table below combines best practices from Y Combinator, Sequoia Capital, and analysis of hundreds of funded decks. Use it as a checklist when building or reviewing your pitch deck.

| Slide | Purpose | Must-Have Content | Time Investors Spend |

|---|---|---|---|

| 1. Title/Cover | First impression | Company name, one-liner, contact info | 5 seconds |

| 2. Problem | Why this matters | Specific pain point, who suffers, cost of inaction | 20 seconds |

| 3. Solution | What you do about it | Product description, key benefit, screenshot or demo | 20 seconds |

| 4. Market Size | How big the opportunity is | TAM/SAM/SOM with bottom-up calculation | 30 seconds |

| 5. Business Model | How you make money | Revenue model, pricing, unit economics | 25 seconds |

| 6. Traction | Proof it is working | Stage-appropriate metrics, growth trajectory | 30 seconds |

| 7. Competition | Why you will win | 2x2 matrix or comparison table, differentiation | 25 seconds |

| 8. Team | Why you are the right people | Founders, relevant experience, complementary skills | 30 seconds |

| 9. Financials | The numbers | Current state, 3-year projections, key assumptions | 35 seconds |

| 10. The Ask | What you need | Amount, round type, valuation or terms | 15 seconds |

| 11. Use of Funds | What you will do with it | Allocation percentages, milestones funded | 15 seconds |

| 12. Contact/Appendix | Next steps | Email, CTA, backup slides available | 10 seconds |

According to DocSend research, investors spend an average of 3 minutes and 44 seconds reviewing a pitch deck. That means every slide gets roughly 15-35 seconds. Your job is not to explain everything on each slide but to communicate one idea clearly enough that the investor wants to keep reading.

For detailed guidance on any individual slide, including templates, examples, and stage-specific advice, our Pitch Deck Guide covers each one in depth.

Three Critical Slides That Drive Funding Decisions#

While every slide plays a role, three consistently separate funded decks from rejected ones. These are the slides where founders most often underperform and where small improvements yield the largest returns.

The Problem Slide: Most Underestimated#

The problem slide is where most founders lose their audience. Not because they skip it, but because they describe the problem in abstract, corporate language that fails to create urgency.

What works: Specificity and quantification. According to Y Combinator's guidance, this slide should use real-world examples to make the problem relatable. The strongest problem slides name a specific person, describe a specific pain, and attach a specific cost.

Common mistake: Writing something vague like "Communication in enterprises is inefficient." This tells the investor nothing about severity, frequency, or willingness to pay. Compare that to: "Sales teams waste 4 hours per week searching for customer information across Slack, email, and CRM. That's $50,000 per rep per year in lost productivity." The second version is specific, quantified, and immediately understandable.

Real example: Airbnb's problem slide stated: "Price is an important concern for customers booking travel online. Hotels leave you disconnected from the city and its culture." Two sentences that framed the status quo as both expensive and inauthentic. This created a clear opening for their solution without needing a paragraph of explanation.

The best problem slides make investors nod because they recognize the pain, either from personal experience or from pattern-matching across their portfolio. If your problem requires a paragraph to explain, you have not found the right framing yet.

The Traction Slide: Most Scrutinized#

Investors spend more time on traction than almost any other slide. This is where they decide whether your startup is a real business or an interesting idea.

What works: Show a graph, not just numbers. A chart showing 20% month-over-month growth is more compelling than stating the same figure in text. For financial charts like revenue bridges or growth trajectories, waterfall charts can effectively break down what is driving your metrics. The key is demonstrating trajectory, not just a snapshot.

| Your Stage | What to Show |

|---|---|

| Pre-revenue | Users, waitlist signups, letters of intent, pilot results |

| Early revenue | MRR, paying customers, month-over-month growth rate |

| Scaling | ARR, net revenue retention, cohort analysis |

Common mistake: Hiding weak traction behind vanity metrics. Investors know the difference between "10,000 app downloads" and "500 weekly active users with 40% retention." If you are pre-revenue, own it and show strong demand signals instead. Fabricating momentum destroys credibility faster than admitting you are early.

Real example: Buffer's pitch deck led with "800 users, $150,000 annual revenue run rate." Not massive numbers, but specific and honest. Combined with visible month-over-month growth, this demonstrated product-market fit signals that investors could extrapolate from. Buffer raised $500K on these numbers because the trajectory was clear.

The Ask Slide: Most Often Botched#

Surprisingly, many founders forget this slide entirely or bury it somewhere in the middle of the deck. Others make the ask so vague that investors cannot evaluate it. This is the one slide where ambiguity directly costs you money.

What works: State the exact amount, round type, and terms. Then connect the raise to specific milestones. Be specific: "We're raising $1.5M on a $8M post-money SAFE to reach $1M ARR and Series A readiness by Q4 2025" tells the investor everything they need to make an initial decision.

Common mistake: Saying "We're raising a seed round" without specifying the amount, or presenting a range so wide ($1M-$5M) that it signals you have not done the work to model your capital needs. Every dollar you raise should map to a milestone.

Real example: The strongest ask slides in funded decks follow a simple formula: amount, instrument, and what the money achieves. Uber's seed deck made a clear $1.25M ask tied to launching in three initial cities. The specificity signaled that the founders understood their burn rate, their growth levers, and exactly what capital would unlock.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

Design and Delivery Principles#

Design matters more than most founders think. Professional presentation signals professional thinking.

| Principle | Application |

|---|---|

| One idea per slide | If you have two points, make two slides |

| Minimal text | Bullets, not paragraphs; aim for 30 words maximum per slide |

| Consistent formatting | Same fonts, colors, and alignment throughout |

| White space | Let content breathe; do not fill every inch |

| High contrast | Dark text on light background for readability |

Typography: Stick to one or two font families, minimum 24pt body text, and clear visual hierarchy between title, subtitle, and body text. Left-align text for readability.

Color: Limit your palette to 3-4 colors and use accent colors sparingly for emphasis. Consistency matters: the same color should mean the same thing throughout your deck.

Mobile optimization: Many investors review decks on their phones between meetings or while commuting. Test every slide on a mobile screen. If text is unreadable or charts are incomprehensible at phone size, simplify until they work. This single test eliminates most common design problems.

For market sizing visuals, consider using Mekko charts that show segment sizes and competitive positions simultaneously. These communicate more information per slide than standard bar charts while maintaining clarity.

What Made Three Famous Pitch Decks Work#

Studying successful decks reveals that the framework matters less than the clarity of execution within it.

Airbnb (2009) -- $600K Seed from Sequoia Capital#

Airbnb's original deck succeeded because every slide reinforced a single narrative: hotels are expensive and impersonal, and a massive population of travelers wants something better. The opening line -- "Book rooms with locals, rather than hotels" -- captured the entire value proposition in seven words. Their competitive positioning named Couchsurfing, Craigslist, and Hotels.com directly, then showed where Airbnb sat uniquely: affordable like hostels but private and authentic like local experiences. The deck went from $600K to an $86.5B valuation at IPO.

Buffer (2011) -- $500K Seed#

Buffer's deck became famous when founder Joel Gascoigne shared it publicly, and it remains one of the best examples of early-stage honesty. Buffer led with specific traction (800 users, $150K ARR) and was transparent about being early. The product screenshot spoke for itself. No jargon, no inflated projections. The deck worked because investors could see genuine product-market fit signals and a founder who understood exactly where the business stood.

Uber (2008) -- $1.25M Seed#

Uber's seed deck turned an everyday frustration into a billion-dollar opportunity by keeping the problem universally relatable: getting a cab in a city is unreliable and unpleasant. Their TAM slide showed massive opportunity through city-by-city analysis rather than top-down market sizing. The business model was instantly understandable: a take rate on every transaction. Most importantly, the deck showed an expandable opportunity where each new city was a repeatable growth unit.

The Pattern Across All Three#

| Pattern | Why It Works |

|---|---|

| Simple language | Investors scan quickly; jargon slows them down |

| Specific numbers | "$1.2M ARR" beats "significant traction" |

| Visual product | Screenshots make the abstract concrete |

| Honest about stage | Credibility comes from transparency |

| Clear ask | Investors need to know next steps |

Start Building Your Deck#

The 12-slide framework is proven. The difference between a forgettable deck and a funded one comes down to how well you execute three things: frame a problem worth solving, prove that customers agree, and make a specific ask tied to clear milestones.

Start with those three slides. Get them right. Then build the rest of the deck around them.

For a comprehensive walkthrough of every slide with detailed templates, stage-specific guidance, and deeper examples, see our complete Pitch Deck Guide. Browse ready-made pitch deck layouts in Deckary's slide library. For building professional financial slides and market sizing visuals, Deckary can help you create consulting-grade waterfall charts and Mekko charts, or use the AI Slide Builder to generate complete slides from descriptions.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free