Includes 6 slide variations

Free Pitch Deck PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Start with a compelling title and one-line description

- 2Clearly articulate the problem you're solving

- 3Show your solution and how it addresses the problem

- 4Present market size with credible sources

- 5Highlight traction metrics (users, revenue, growth)

- 6Introduce your team and relevant experience

- 7End with a clear ask and use of funds

When to Use This Template

- Seed round fundraising

- Series A/B investor meetings

- Angel investor pitches

- Startup competition presentations

- Accelerator applications

- Corporate partnership pitches

Common Mistakes to Avoid

- Too many slides (keep it to 10-15)

- Focusing on features instead of benefits

- Unrealistic market size claims without sources

- Missing clear traction metrics

- Forgetting to state your specific ask

- Slides too text-heavy to read

Use This Template in PowerPoint

Get the Pitch Deck Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Pitch Deck Template FAQs

Common questions about the pitch deck template

Related Templates

The Pitch Deck That Raises Money

A pitch deck can make or break your fundraising. Investors see hundreds of decks per month—most get 60 seconds of attention before a decision to engage or pass. Your pitch deck needs to communicate a compelling opportunity quickly and clearly.

Our pitch deck template follows the proven structure used by successful startups to raise millions: Problem → Solution → Market → Traction → Team → Ask. Each slide is designed to communicate one key idea—no cluttered layouts or confusing graphics.

The Standard Pitch Deck Structure

This sequence has been refined over thousands of startup fundraises. There's flexibility in ordering, but the elements are non-negotiable:

1. Title Slide: Company name, logo, and a one-sentence description of what you do. "We help [target customer] do [value proposition]." This is your first impression—make it clear.

2. Problem Slide: What pain are you solving? Make it visceral. Show the cost of the problem—time wasted, money lost, frustration experienced. If the problem isn't painful, the solution won't be valuable.

3. Solution Slide: How do you solve the problem? Focus on the benefit, not the feature. "Saves 10 hours per week" beats "AI-powered scheduling algorithm."

4. Market Size (TAM/SAM/SOM): How big is the opportunity? Use credible sources. Be realistic—investors discount inflated projections. Include bottom-up calculations, not just top-down "if we get 1% of a $100B market."

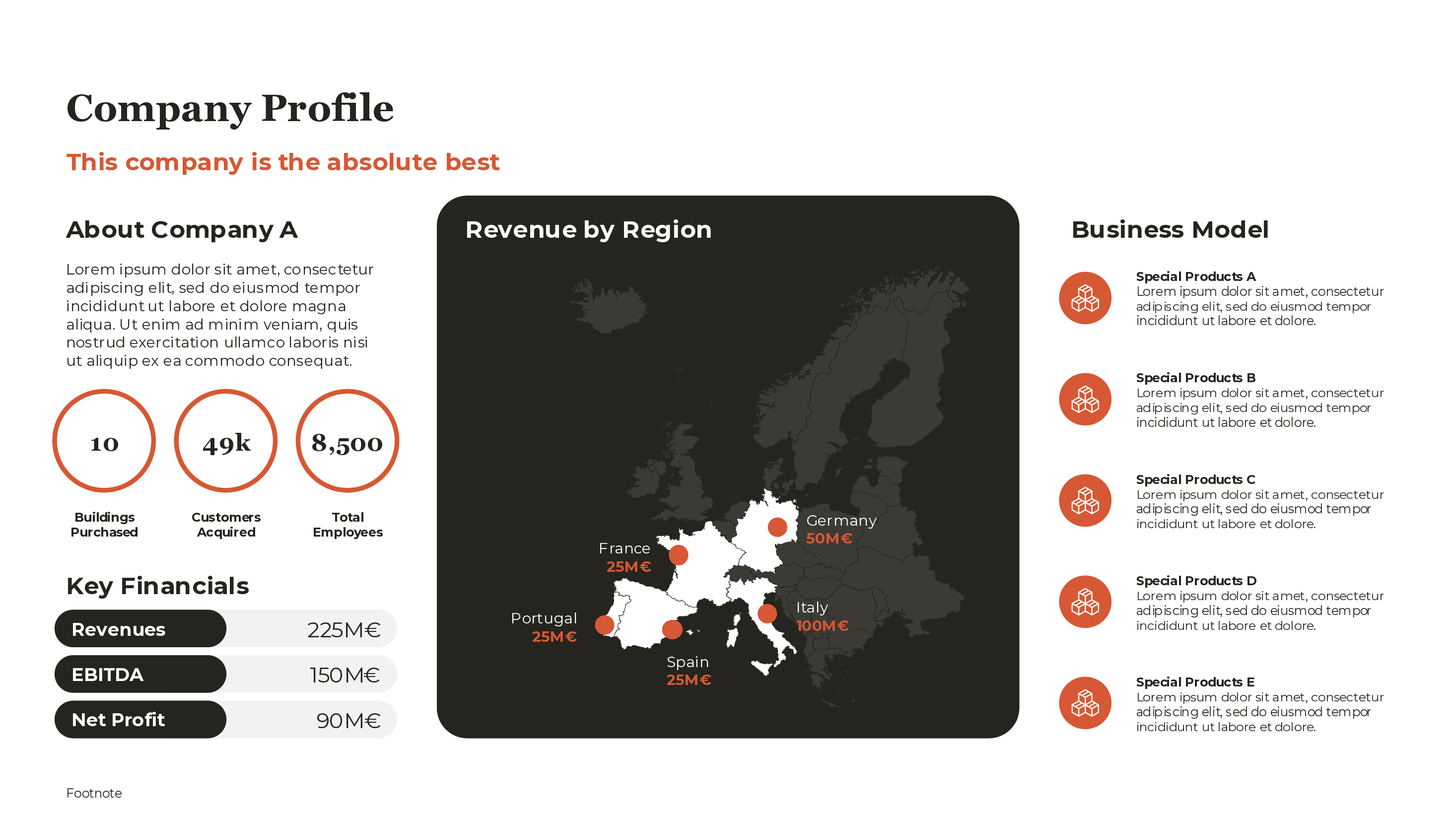

5. Business Model: How do you make money? Pricing, unit economics, gross margins. Show that you understand the path from revenue to profit.

6. Traction: What have you achieved? Users, revenue, growth rates, key customers. This is the slide that separates dreamers from operators. More traction = more leverage in negotiations.

7. Team: Why is this the team to win? Relevant experience, prior exits, domain expertise. Investors bet on teams as much as ideas.

8. Financials: High-level projections. Revenue growth, key milestones, path to profitability. 3-year projections are standard; detailed spreadsheets go in the data room.

9. The Ask: How much are you raising? What will you do with it? Be specific: "$2M to reach 10,000 paying users and achieve product-market fit."

The Problem Slide: Make It Hurt

The problem slide is where most pitch decks fall flat. Founders want to talk about their solution, so they rush past the problem. But investors need to believe in the pain before they'll care about the cure.

Show, don't tell: Instead of "Scheduling is hard," show the number of emails involved in scheduling one meeting, or the dollars lost to no-shows in the target industry.

Quantify the pain: "Marketing teams spend 8 hours per week manually formatting reports" is more compelling than "reporting takes too long."

Make it personal: If your target customer feels the pain, describe their experience. "You've just finished a board meeting when you realize the numbers were wrong..."

Avoid invented problems: Investors can smell a solution looking for a problem. If your problem slide doesn't resonate with the investor's understanding of the market, you've lost them.

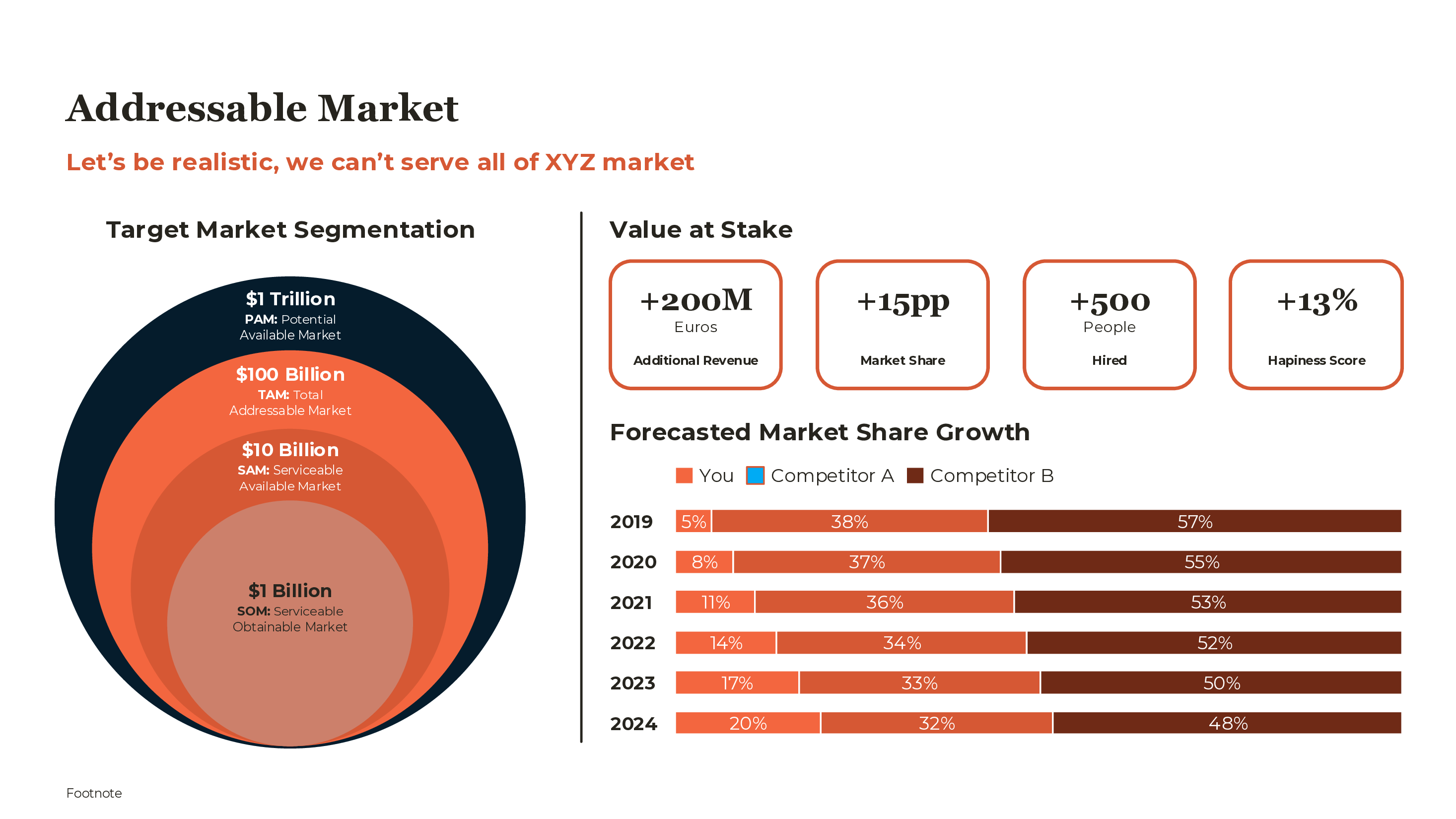

TAM/SAM/SOM: The Market Slide

Investors want big markets—but they're allergic to unrealistic projections. The TAM/SAM/SOM framework provides credible market sizing:

TAM (Total Addressable Market): The total revenue opportunity if you captured 100% of the market. Use external sources (Gartner, CB Insights, industry reports) for credibility.

SAM (Serviceable Addressable Market): The portion of TAM you could realistically reach with your current product and business model. This is where geography, segment focus, and pricing come in.

SOM (Serviceable Obtainable Market): What you can realistically capture in the near term. This should connect to your traction and financial projections.

Bottom-up validation: In addition to top-down market sizing, show a bottom-up calculation. "1,000 target companies × $50K average contract = $50M SOM" is more credible than market research estimates alone.

For a deep dive on market sizing, see our TAM SAM SOM template.

The Traction Slide: Your Credibility Moment

Traction is proof that your solution works and customers want it. This slide separates fundraises—companies with strong traction command higher valuations and better terms.

What counts as traction:

- Revenue (best)

- Paying customers

- Users/active users

- Growth rate (month-over-month or year-over-year)

- Key partnerships or pilot customers

- Waitlist signups (weaker but still valid)

How to present traction:

- Lead with your best metric

- Show growth trajectory, not just a snapshot

- Use graphs for visual impact

- Include specific numbers, not just percentages

Pre-traction startups: If you're pre-revenue, show what you do have—user signups, pilot commitments, letters of intent. Frame it as validation of demand, not as an apology for lack of revenue.

The Team Slide: Why You'll Win

At seed stage, investors bet on teams more than products. At later stages, traction speaks louder. But the team slide matters regardless.

Include:

- Founder photos and titles

- Relevant background (prior startups, domain expertise, key skills)

- Notable achievements (exits, leadership roles at relevant companies)

- Board members or advisors with recognizable names

Avoid:

- Full bios (this isn't a resume)

- Every team member (stick to founders and key leaders)

- Irrelevant credentials (unless your MBA is from Stanford, leave it off)

The unfair advantage: If your team has unique access, knowledge, or relationships that competitors don't, highlight it. "Former head of data at Uber" signals that you know how to build data products at scale.

The Ask Slide: Close the Deal

Your final slide should be crystal clear about what you need and what you'll do with it.

State the amount: "Raising $2M seed round" — no ambiguity.

Use of funds: Show where the money goes, typically in percentages. "60% product, 25% go-to-market, 15% operations" is standard.

Milestones enabled: What will you achieve with this capital? "Reach $2M ARR and launch in European market." This gives investors a framework for your next round.

Valuation (optional): Some founders include target valuation; others prefer to negotiate. If you have leverage (competing term sheets, strong traction), you can be explicit. If not, leaving it off invites a conversation.

Design Principles for Pitch Decks

Your pitch deck should look as professional as your company intends to be:

- One idea per slide: If a slide has two messages, split it

- Minimal text: Slides support your narrative, they don't replace it

- Consistent visual language: Same fonts, colors, and layout conventions throughout

- High-quality images: Avoid stock photos that look like stock photos

- Data visualization: Charts beat tables; well-labeled charts beat unlabeled ones

Investors have seen thousands of decks. Visual quality signals competence and attention to detail. A sloppy deck raises questions about the product.

For more on fundraising presentations, see our Pitch Deck Guide, TAM SAM SOM template, and traction slide best practices. Deckary's AI Slide Builder can generate pitch deck slides from a description.