Includes 2 slide variations

Free TAM SAM SOM PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Calculate TAM from credible industry reports

- 2Filter TAM to SAM by product fit and geography

- 3Estimate SOM using comparable benchmarks

- 4Use concentric circles for investor pitches

- 5Add assumptions panel showing calculation logic

- 6Include bottom-up sanity check for SOM

When to Use This Template

- Investor pitch decks

- Series A/B fundraising

- Board presentations

- Market entry analysis

- Strategic planning

- M&A due diligence

Common Mistakes to Avoid

- Citing TAM without source year

- Skipping SAM and jumping to SOM

- Using inconsistent units (billions vs millions)

- Showing only top-down without bottom-up validation

- SOM exceeding 5% of TAM at early stage

Use This Template in PowerPoint

Get the TAM SAM SOM Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

TAM SAM SOM Template FAQs

Common questions about the tam sam som template

Related Templates

Market Sizing That Builds Investor Confidence

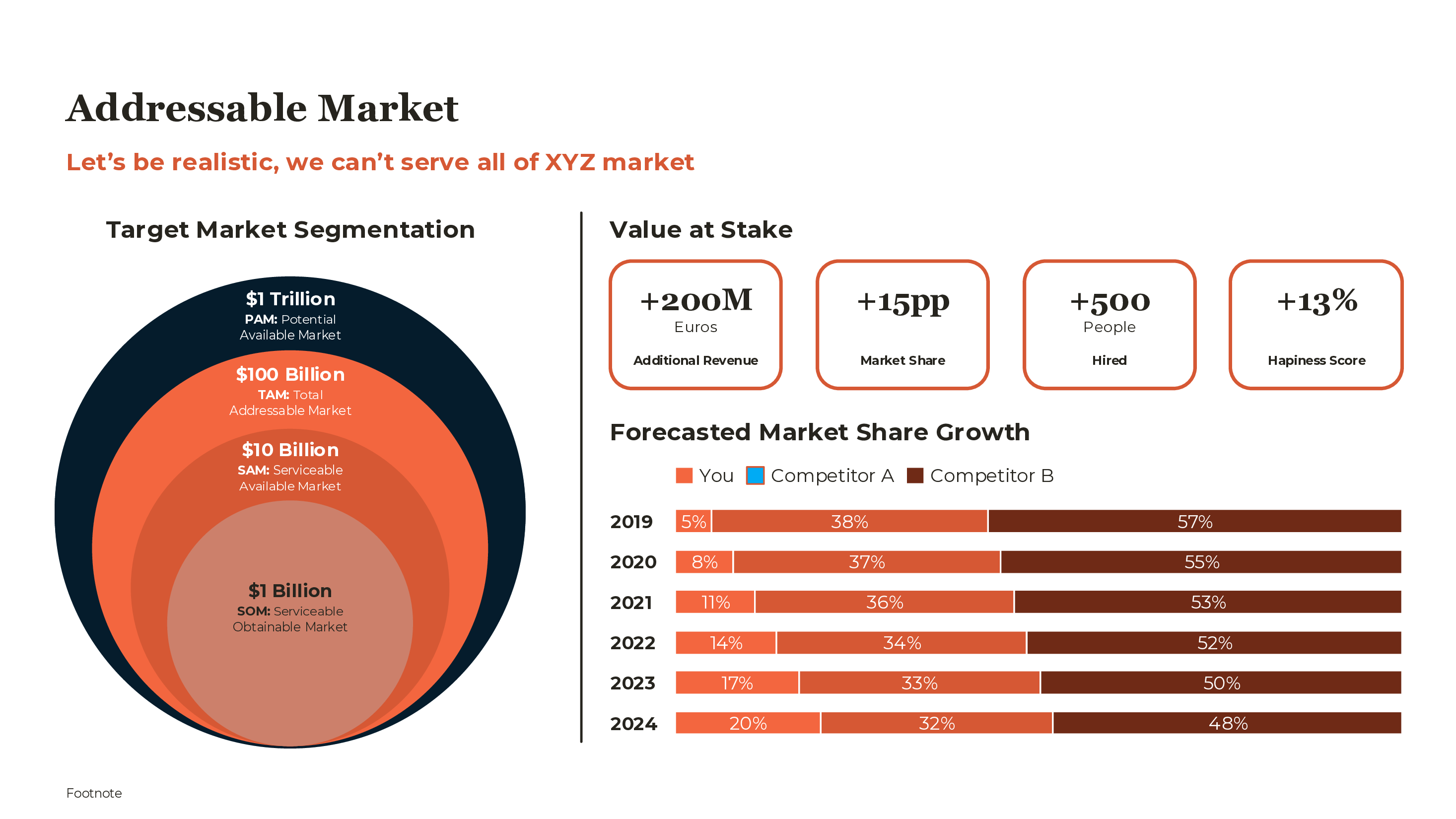

The TAM SAM SOM slide is one of the most scrutinized slides in any pitch deck. Investors have seen thousands of market sizing presentations—they can spot inflated numbers, missing logic, and unsupported assumptions immediately.

The framework itself is simple: Total Addressable Market (everything), Serviceable Addressable Market (your realistic target), and Serviceable Obtainable Market (what you can actually capture). But execution matters enormously. This template provides the visual structure; the guidance below helps you fill it with credible content.

Understanding the Three Layers

TAM (Total Addressable Market): The entire market demand if you had 100% share. This is typically sourced from industry analyst reports (Gartner, IDC, Statista) and represents the total revenue opportunity globally or in your target geography.

SAM (Serviceable Addressable Market): The segment of TAM you can realistically target given your product focus, geographic reach, and go-to-market model. SAM answers: "Of the total market, which portion could we theoretically serve?"

SOM (Serviceable Obtainable Market): The portion of SAM you can realistically capture in 3-5 years given your resources, competition, and execution capacity. SOM answers: "What can we actually win?"

The relationship is always TAM > SAM > SOM. Each layer narrows by adding constraints.

Layout Choice: Circles vs. Funnel

Concentric circles emphasize that your current opportunity (SOM) sits within a much larger potential market (TAM). This is the right choice for investor pitches—it shows upside.

Funnel layout emphasizes the filtering logic from total market down to realistic capture. This is better for internal strategy work where the analytical journey matters more than the aspiration.

Our template includes both options. Use circles for external audiences, funnels for internal analysis.

Building Credible TAM Estimates

TAM should come from recognized third-party sources:

- Gartner, IDC, Forrester (technology)

- CB Insights, PitchBook (startups)

- Grand View Research, Statista (cross-industry)

- Industry-specific analysts

Always include:

- The source name

- The year of the estimate

- The geographic scope

- Growth rate (CAGR) if available

"Global EdTech market: $62B (HolonIQ 2026, CAGR 12.3%)" is credible. "$62B EdTech market" without source or year is not.

SAM: The Analytical Bridge

SAM is where your analytical rigor shows. It's not enough to say "we can address 40% of TAM." Show the filtering logic:

Good SAM calculation: "TAM $62B × 42% (K-12 + higher ed tutoring segments) × 32% (English-speaking markets) = $8.4B SAM"

Weak SAM claim: "We estimate we can address about half the market"

SAM should reflect real constraints: product capability (which segments can you actually serve?), geographic reach (where can you sell?), and pricing alignment (does your price point match the market?).

SOM: The Credibility Test

SOM is where most market sizing slides lose credibility. Investors scrutinize the SOM/TAM ratio:

- 1-5% of TAM: Reasonable for early-stage startups

- 5-10% of TAM: Needs strong justification

- >10% of TAM: Will face skepticism

The best SOM estimates use comparable benchmarks: "Duolingo captured 4.7% of language learning market within 5 years of Series A. We're targeting 5% of our SAM using a similar go-to-market."

Bottom-up validation: Even a one-line calculation adds credibility. "150K users × $2,800 ARPU = $420M SOM" shows you've connected the market size to your business model.

Number Formatting Standards

Professional market sizing slides follow consistent formatting:

- Use $B and $M notation: Never spell out "billion" or use $4,200,000,000

- One decimal place maximum: $8.4B, not $8.42B or $8,400M

- Include year and geography: Markets change; specify the basis

- Add CAGR next to TAM: Shows growth trajectory

- Consistent units: If TAM is in $B, SAM should be in $B or $M, not mixed

The Assumptions Panel

Reserve the right third of your slide for an assumptions panel. This is what separates a credible market sizing from a number pulled from Google:

Example assumptions:

- TAM: Global EdTech market (HolonIQ 2026)

- SAM: English-speaking markets, K-12 and higher ed segments

- SOM: 5% penetration based on comparable SaaS adoption curves

- CAGR: 12.3% (2024-2029)

Transparency builds trust. Investors can challenge individual assumptions—that's better than them questioning the entire analysis.

Common Investor Challenges

"Where did TAM come from?": Be ready with source, year, and methodology.

"Why this SAM filter?": Explain the constraints that narrow TAM to SAM.

"Is SOM realistic?": Have a comparable benchmark and bottom-up validation.

"What's the path to SAM?": Show that SAM isn't just theoretical—you have a strategy to expand beyond initial SOM.

Anticipating these questions and having answers ready (in your appendix if not on the slide) demonstrates analytical rigor.

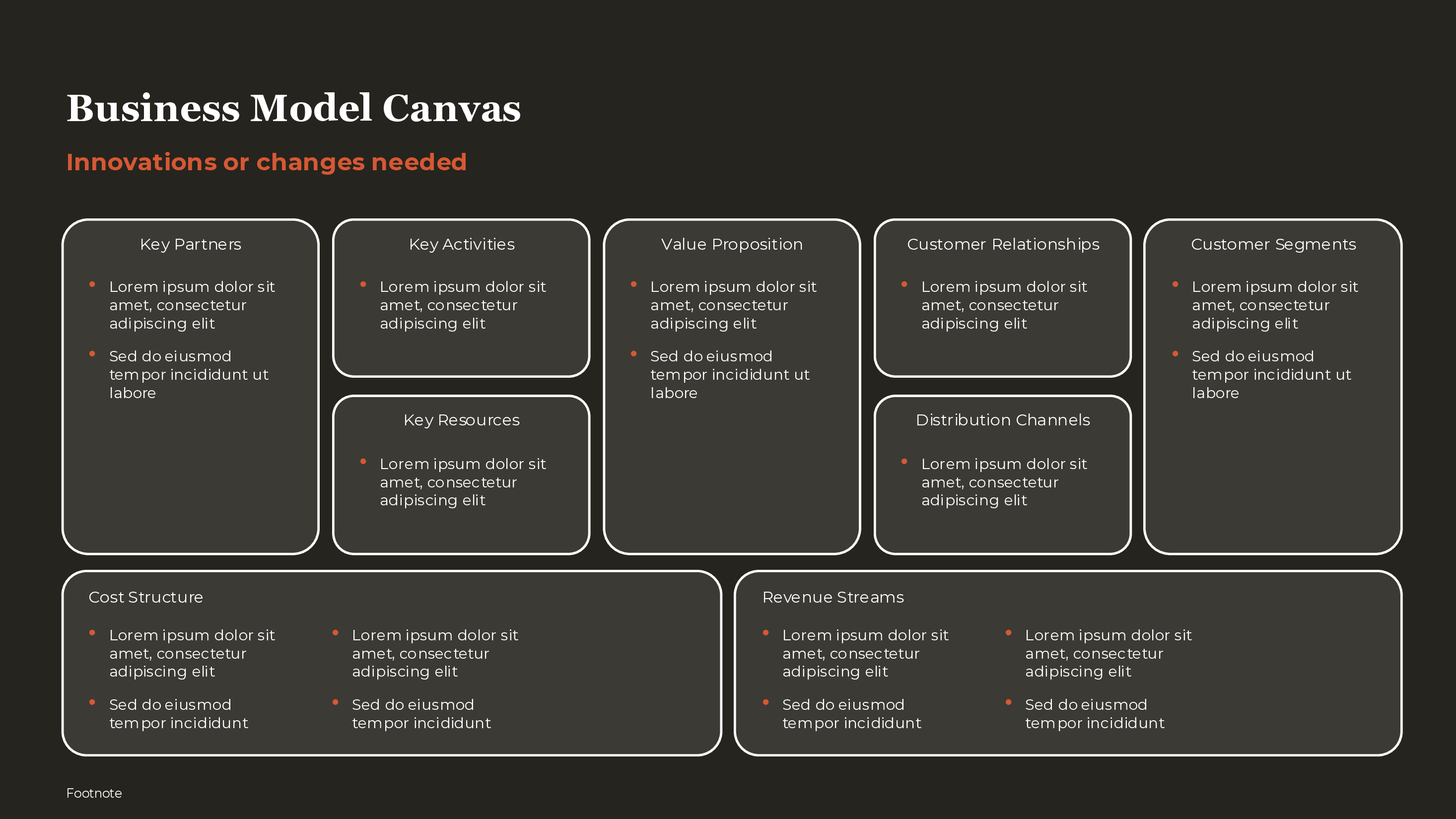

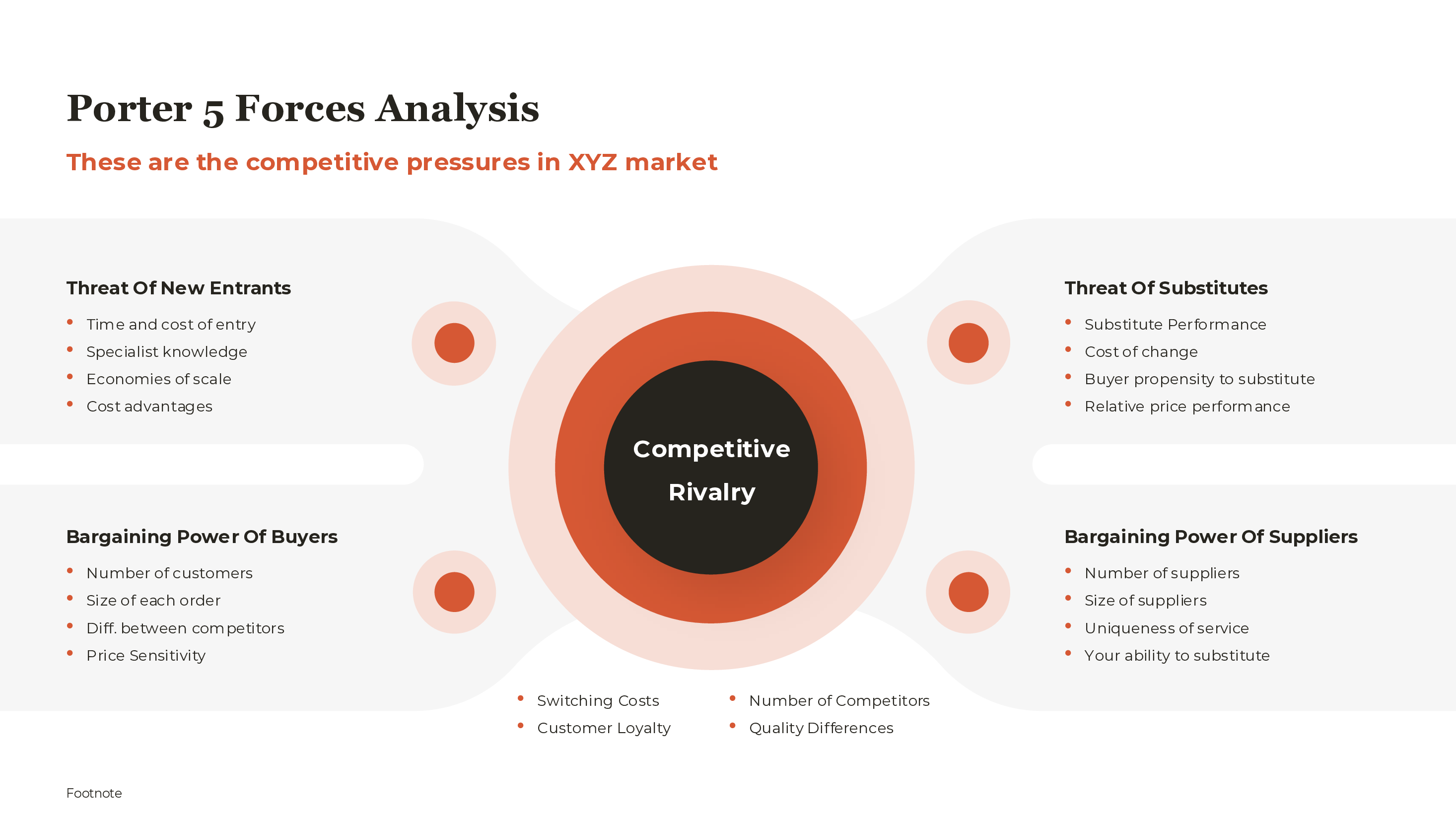

For related pitch deck templates, see our pitch deck template, competitive analysis template, and business model canvas. For more on investor presentations, explore our Pitch Deck Guide.