Traction Slide: How to Show Growth Metrics That Win Investor Confidence

Master your traction slide with the right metrics by funding stage. Includes examples, templates, and tips for presenting growth that gets you funded.

Analyzing traction slides from 75 funded startups revealed a counterintuitive pattern: the absolute numbers mattered less than the shape of the growth curve. A company at $50K MRR growing 25% month-over-month consistently outperformed companies at $200K MRR with flat or erratic growth. Investors were buying trajectory, not snapshots.

According to First Round Capital's research on early-stage evaluation, traction metrics account for roughly 60% of Series A decisions--up from about 30% at seed stage. The traction slide isn't just one slide among many; at growth stages, it's often the slide that determines whether you get a term sheet.

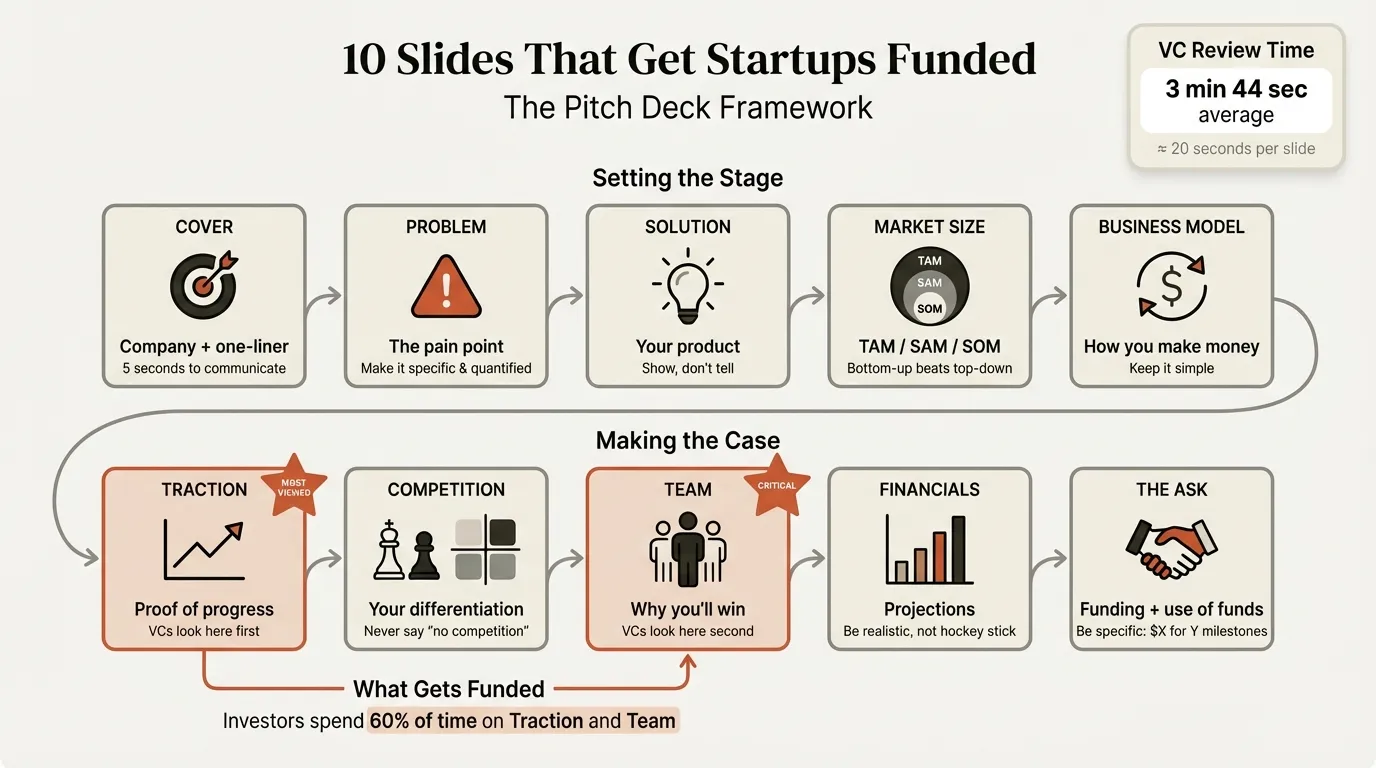

This guide covers exactly which metrics to include at each funding stage (with benchmarks), how to visualize growth effectively, common presentation mistakes, and how to position limited traction when you're still early. For a complete pitch deck framework showing how the traction slide fits into the full 12-slide structure, see our Pitch Deck Guide.

What Is a Traction Slide?#

A traction slide is the section of your pitch deck that proves your business has momentum. It answers the investor's core question: Is this actually working, or is it still just an idea?

| What Traction Shows | What Traction Doesn't Show |

|---|---|

| Customer demand for your solution | Potential future demand |

| Revenue or engagement growth | Market size opportunity |

| Product-market fit evidence | Product features or roadmap |

| Execution capability | Team credentials |

| Scalability indicators | Competitive positioning |

The purpose of traction isn't to impress with big numbers. It's to demonstrate that you've found something that works and can scale it with additional capital.

Y Combinator's guidance on traction emphasizes trajectory over absolute numbers: "The most important thing is growth rate. A company that's making $100/week but growing 20% week over week is doing better than a company making $10,000/week growing 1% week over week."

Why Traction Matters to Investors#

Investors evaluate traction differently depending on stage, but the underlying logic is consistent: traction de-risks the investment.

| Risk Type | What Traction Proves |

|---|---|

| Market risk | Customers actually want this |

| Product risk | The solution works |

| Execution risk | This team can build and sell |

| Timing risk | The market is ready now |

| Business model risk | People will pay for this |

Strong traction metrics provide evidence across all these dimensions. A startup with 20% month-over-month revenue growth and 130% net revenue retention has demonstrated that customers want the product, the solution works, and the business model is viable.

According to research from First Round Capital, early-stage investors spend about 60% of their evaluation on market and product, and 40% on team. By Series A, that ratio flips--60% is about traction and execution evidence.

What Metrics to Include by Funding Stage#

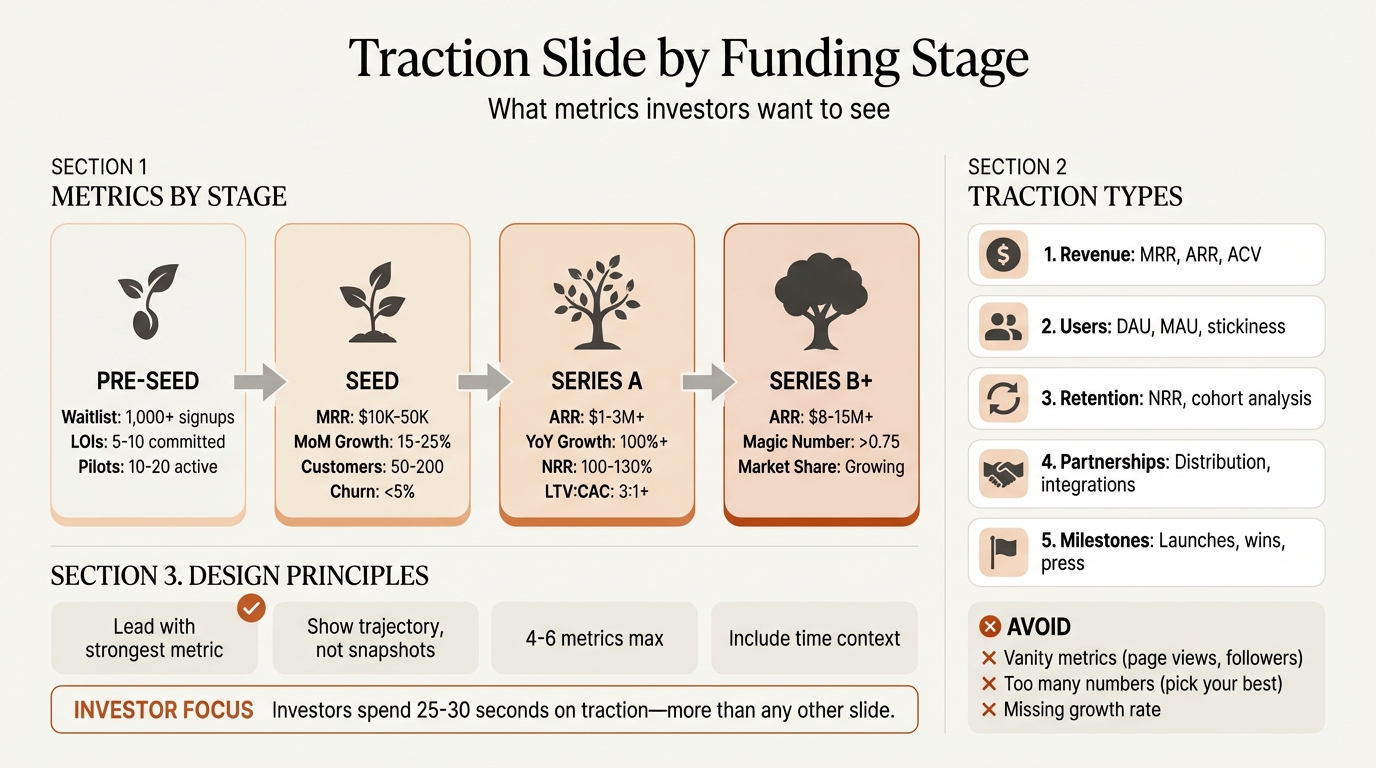

The metrics that matter change significantly as you progress through funding stages. Using the wrong metrics for your stage signals that you don't understand investor expectations. The table below consolidates the key metrics, benchmarks, and strategic focus for each stage.

| Stage | Key Metrics | Good Benchmarks | Strategic Focus |

|---|---|---|---|

| Pre-Seed | Waitlist signups, LOIs, pilot customers, DAU/MAU ratio | 1,000+ waitlist, 5-10 LOIs, 50%+ DAU/MAU | Validate the problem exists and early customers engage with your solution |

| Seed | MRR, MoM growth, paying customers, churn rate, NPS | $10-50K MRR, 15-25% MoM growth, under 5% monthly churn | Demonstrate customers will pay and growth is accelerating |

| Series A | ARR, YoY growth, NRR, LTV:CAC, CAC payback, gross margin | $1-3M+ ARR, 100%+ YoY, 100-130%+ NRR, 3:1+ LTV:CAC | Prove product-market fit and efficient scalability |

| Series B+ | ARR, magic number, NRR, market share, revenue per employee | $8-15M+ ARR, 80-100%+ YoY, 0.75+ magic number | Demonstrate category leadership and operating leverage |

For detailed guidance on later-stage metrics, see our Series A pitch deck guide which covers the full spectrum of growth-stage metrics.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

How to Design a Traction Slide#

The design of your traction slide matters almost as much as the metrics themselves. A well-designed slide communicates professionalism and analytical rigor. Investors spend 25-30 seconds on this slide, so every element must communicate immediately.

Lead with Your Strongest Metric#

Your most impressive number should be the first thing investors see. If you have $2M ARR with 18% month-over-month growth, that headline number goes at the top.

Structure template:

[Headline Metric]

$2.4M ARR | 18% MoM Growth | 127% NRR

[Supporting Metrics]

- 340 paying customers

- 78% gross margin

- 11-month CAC payback

[Growth Visualization]

[Chart showing trajectory]

Visualize the Trajectory#

A chart showing growth over time is more compelling than numbers alone. The visual shape of your growth curve communicates momentum instantly.

Best chart types for traction:

- Line or area charts for revenue or user growth over time (start from zero, use consistent intervals, annotate inflection points)

- Bar charts for period-over-period comparisons

- Waterfall charts for revenue bridges showing new customer revenue, expansion, and churn

A waterfall breakdown shows the health of your revenue growth beyond just the headline number. Tools like Deckary offer consulting-quality chart templates that make growth trajectories immediately clear.

Show Context and Benchmarks#

Metrics without time context are meaningless. Always show when you started, where you are now, and how long it took.

Example:

Revenue Growth (Jan 2025 - Jan 2026)

Month 1: $8K MRR

Month 6: $25K MRR

Month 12: $85K MRR

Growth: 22% average MoM

If your metrics exceed industry benchmarks, highlight the comparison:

| Your Metric | Industry Benchmark | Your Performance |

|---|---|---|

| DAU/MAU | 20% average | 58% (2.9x better) |

| Net Revenue Retention | 100% | 127% |

| Month-over-month growth | 10-15% typical | 22% |

Keep It Scannable#

Design principles:

- One clear message per visual element

- Limit to 4-6 key metrics maximum

- Use consistent formatting and time frames

- Bold or highlight the most impressive numbers

A dashboard layout with 4-6 key metrics works well for overview slides:

[Layout example]

+-------------------+-------------------+

| $2.4M ARR | 18% MoM |

| (headline) | Growth Rate |

+-------------------+-------------------+

| 127% NRR | 4.2:1 LTV:CAC |

+-------------------+-------------------+

| 285 Customers | 9mo Payback |

+-------------------+-------------------+

Traction Slide Examples by Stage#

Let's look at how traction slides should differ by funding stage.

Pre-Seed Example#

For a pre-revenue B2B SaaS startup:

Traction: Validated Demand

Waitlist: 3,200 signups

- 40% from target enterprise segment

- 100% organic (no paid acquisition)

Pilot Program: 18 companies

- 12 Fortune 500 enterprises

- 82% weekly active usage

- 6 committed to paid contracts at launch

Validation:

- 65 customer discovery interviews conducted

- Problem confirmed by 89% of target buyers

- Average stated willingness to pay: $2,400/month

Seed Example#

For an early-revenue consumer subscription product:

Traction: Product-Market Fit Emerging

$52K MRR (as of January 2026)

- 24% average month-over-month growth

- From $0 in January 2025

[Line chart showing MRR growth over 12 months]

Key Metrics:

- 2,100 paying subscribers

- 4.1% monthly churn (improving from 7.2%)

- $25 average revenue per user

- 72 NPS score

Customer Acquisition:

- 65% organic/referral

- 35% paid (Instagram, TikTok)

- CAC: $28 (declining)

Series A Example#

For a B2B SaaS company ready for growth capital:

Traction: Proven Product-Market Fit

$2.8M ARR | 142% YoY Growth | 124% NRR

[Bar chart showing quarterly ARR progression]

Unit Economics:

- LTV:CAC: 4.2:1

- CAC Payback: 9 months

- Gross Margin: 81%

Customer Base:

- 285 customers (including Stripe, Shopify, Notion)

- $9,800 average ACV

- 97% logo retention

Growth Trajectory:

[Cohort analysis showing expansion over time]

For detailed Series A guidance, see our Series A pitch deck guide.

Common Mistakes That Kill Traction Slides#

Based on reviewing hundreds of pitch decks, these mistakes consistently undermine investor confidence.

Mistake 1: Too Many Metrics#

The problem: Showing 10-15 different numbers hoping something will impress.

Why it fails: Investors assume you're hiding weak performance behind complexity. If you had strong metrics, you'd lead with them.

The fix: Choose 3-5 metrics maximum. Lead with the strongest. Cut everything else.

Mistake 2: Vanity Metrics#

The problem: Showing total signups, page views, or social followers instead of metrics that matter.

Why it fails: Experienced investors know these metrics don't predict revenue or retention.

The fix: Focus on metrics that directly relate to revenue or strongly predict it. Paying customers > free users > signups > page views.

Mistake 3: Hiding Weaknesses#

The problem: Omitting churn, showing only good months, or using selective time periods.

Why it fails: Investors will find weaknesses in due diligence. Hiding them upfront destroys trust.

The fix: Be transparent about challenges while showing how you're addressing them. "Churn was 8% in Q1, improved to 4% in Q3 after [specific changes]."

Mistake 4: Wrong Metrics for Stage#

The problem: Showing revenue metrics when pre-revenue, or showing waitlist numbers at Series A.

Why it fails: Signals you don't understand investor expectations for your stage.

The fix: Use stage-appropriate metrics from the consolidated table above. When in doubt, ask investors what they want to see.

Connecting Traction to Your Funding Ask#

Your traction slide should naturally lead to your funding ask. The logic should be clear:

Here's our trajectory (traction slide) + here's how we'll accelerate it (use of funds) = here's where we'll be (milestones).

Make the Connection Explicit#

After showing traction, explain what additional capital will do:

"With $2.4M ARR growing 18% monthly, we've proven product-market fit. A $12M Series A will fund expansion to 25 sales reps, accelerating growth to reach $15M ARR in 18 months."

Match Ask to Trajectory#

Your funding amount should match your demonstrated growth rate and planned milestones.

| Current ARR | Growth Rate | Typical Series A | 18-Month Target |

|---|---|---|---|

| $1M | 15% MoM | $8-10M | $4-5M ARR |

| $2M | 18% MoM | $12-15M | $8-10M ARR |

| $3M | 12% MoM | $15-20M | $10-12M ARR |

For more on structuring your funding ask, see our investor presentation template.

Summary#

The traction slide is where investors decide whether your startup is an idea or a business with momentum. Getting it right requires:

Selecting the right metrics for your stage:

- Pre-seed: Validation signals (waitlist, LOIs, pilots)

- Seed: Early revenue or engagement ($10-50K MRR, 15-25% MoM growth)

- Series A: Proven scale ($1-3M ARR, 100%+ YoY, strong retention)

- Series B+: Market leadership indicators

Presenting with clarity:

- Lead with your strongest metric

- Show trajectory, not just snapshots

- Include time context for all numbers

- Use charts to communicate growth visually

- Limit to 4-6 key metrics maximum

Connecting to your ask:

- Traction proves you've found something that works

- Funding accelerates what's already working

- Milestones show what you'll achieve with capital

The best traction slides tell a simple story: "Here's proof we're onto something real, here's how fast we're growing, and here's why more capital will accelerate our trajectory."

For professional chart templates that make your traction metrics stand out, Deckary offers consulting-quality waterfall charts, growth visualizations, and data presentation tools. Combined with the 2,000+ icon library and alignment shortcuts, you can build investor-ready traction slides that communicate momentum clearly.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free