Investor Presentation Template: Free PowerPoint for Fundraising Success

Free investor presentation template with the 10 slides VCs expect. What to include in each, real examples from funded startups, and design tips.

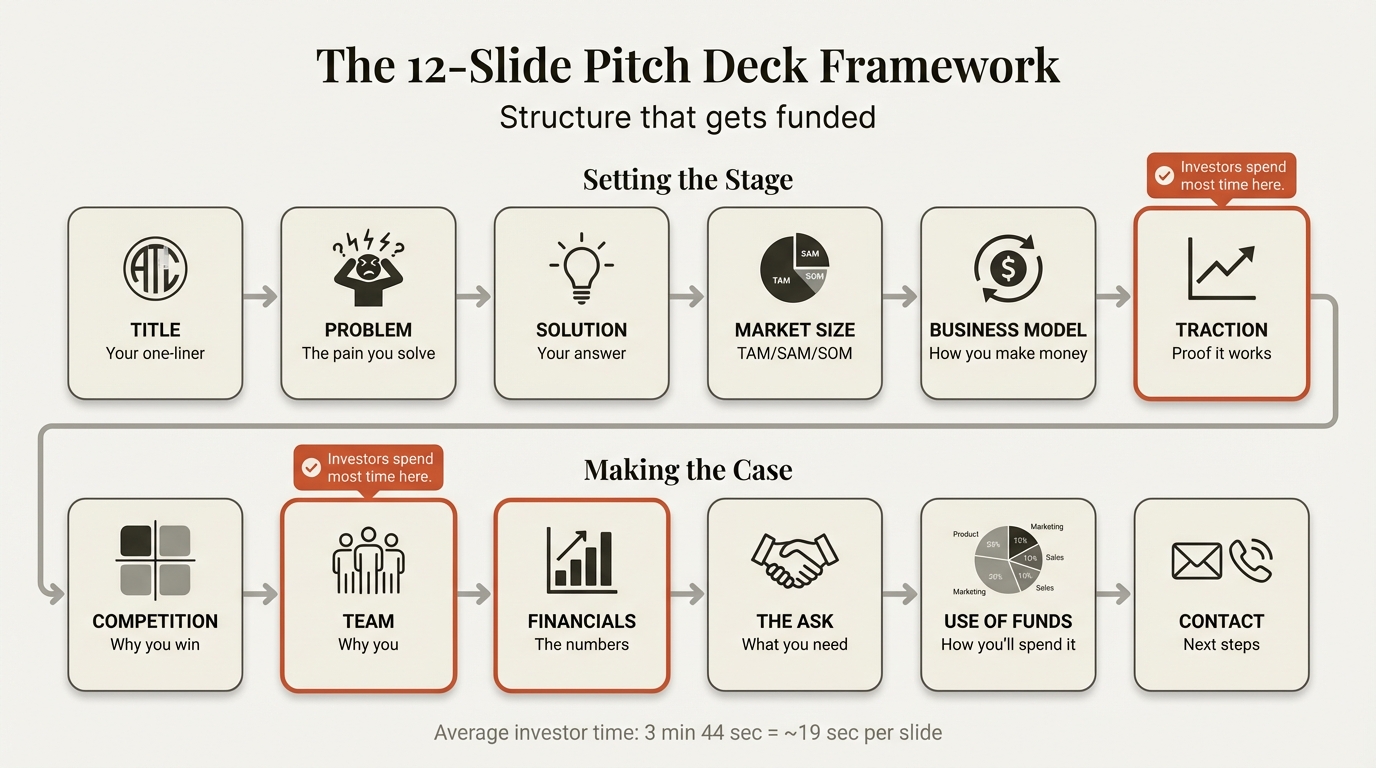

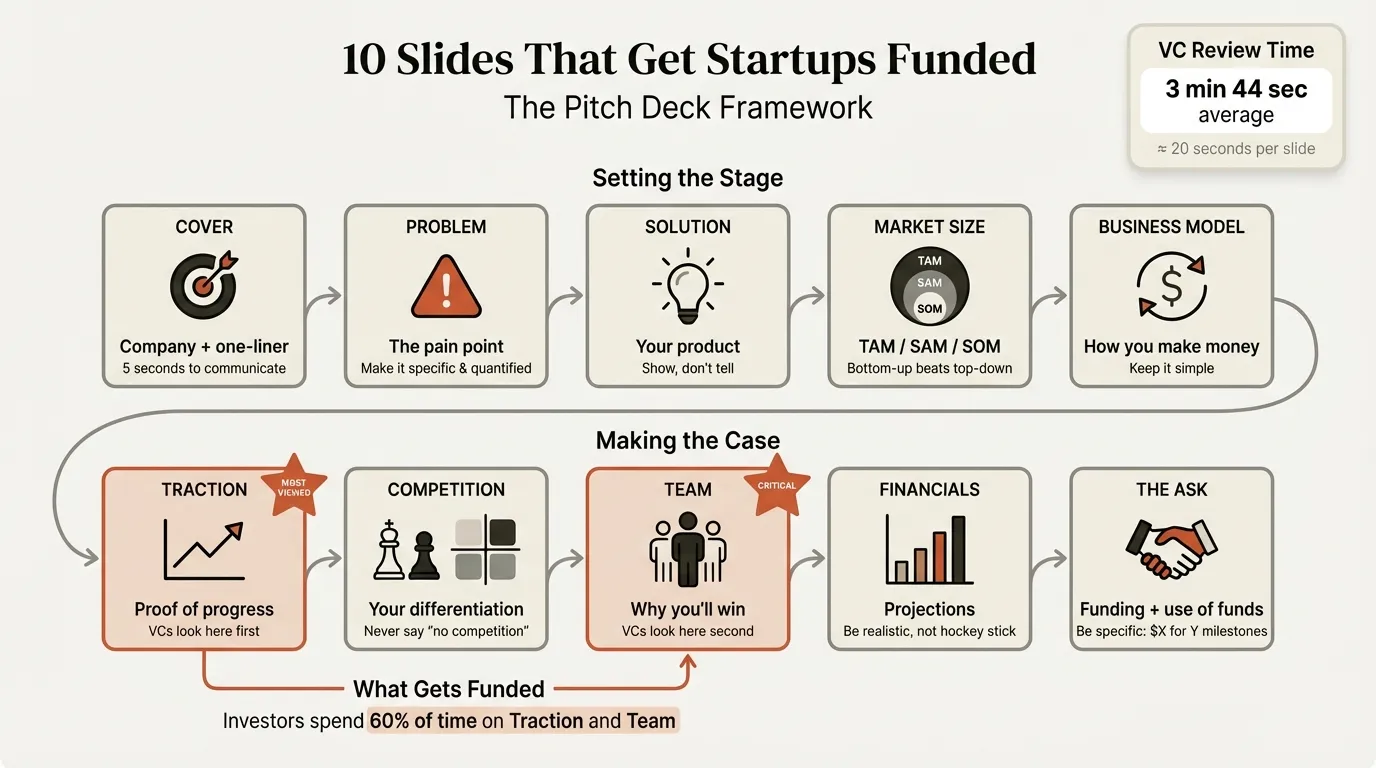

Series A and growth-stage fundraising runs on proof, not potential. According to DocSend research, investors spend an average of 3 minutes and 44 seconds reviewing a deck, focusing heavily on unit economics, retention, and financial projections at later stages.

This guide covers the 10 essential slides, the metrics investors expect, and design principles that signal professional execution. For a comprehensive overview of pitch deck fundamentals, see our Pitch Deck Guide. If you're raising a seed round, see our pitch deck template guide for an earlier-stage approach.

An investor presentation communicates your business opportunity in 10-15 slides designed to earn the next meeting. The structure stays consistent across stages, but emphasis shifts from vision and team (pre-seed/seed) to metrics and scalability (Series A and beyond).

The 10 Essential Slides in Every Investor Presentation#

Slide 1: Title/Cover#

Your opening slide has five seconds to communicate who you are and what you do. Include your company name, a one-sentence description, funding stage, key metric (if applicable), and contact information.

The one-liner is everything. Compare: "AI-powered platform for enterprise digital transformation" versus "Stripe: Payments infrastructure for the internet." The strong version immediately tells you the customer, the product, and the value. For later-stage companies, add a traction metric: "Series A | $2.4M ARR."

Slide 2: Problem#

The problem slide explains why your company needs to exist. Make it specific and quantified.

Weak: "Enterprise communication is inefficient." Strong: "Sales teams waste 4 hours per week searching for customer information across Slack, email, and CRM systems. That's $50,000 per sales rep per year in lost productivity."

According to Y Combinator's pitch deck guidance, use real-world examples to make the problem relatable. Airbnb's original problem slide framed hotels as both expensive and inauthentic, positioning their solution against both dimensions.

Slide 3: Solution#

Show, don't tell. A product screenshot or demo visual communicates more than paragraphs of description. Focus on outcomes, not features. Investors don't care about "AI-powered natural language processing." They care that "customers get answers in 2 seconds instead of 2 hours."

The solution should directly map to the problem. Save architecture diagrams and feature lists for follow-up conversations.

Slide 4: Market Size (TAM/SAM/SOM)#

| Term | Definition | Example |

|---|---|---|

| TAM (Total Addressable Market) | Everyone who could theoretically buy | All businesses needing CRM software ($100B) |

| SAM (Serviceable Addressable Market) | The portion you can realistically reach | Small businesses in North America ($15B) |

| SOM (Serviceable Obtainable Market) | What you can capture in 3-5 years | 2% of North American SMB market ($300M) |

Bottom-up beats top-down. Calculate from actual customers: "500,000 target customers spending $2,000/year = $1B SAM" is more credible than claiming a percentage of a massive TAM. For segment visualization, Mekko charts show market segments and competitive positioning simultaneously. For detailed formulas and examples, see our TAM SAM SOM template guide.

Slide 5: Business Model#

Explain how you make money with a clear revenue model, pricing structure, and high-level unit economics. Keep it simple. If you have multiple revenue streams, focus on the primary one.

Show the math works: for SaaS, investors want LTV exceeding 3x CAC. Compare to known models ("similar to Shopify's merchant model") to help investors pattern-match quickly.

Slide 6: Traction#

The traction slide is often the most scrutinized. Show a graph, not just numbers. A chart showing 20% month-over-month growth is dramatically more compelling than stating the number.

| Stage | Key Metrics to Show |

|---|---|

| Pre-revenue | Waitlist signups, letters of intent, pilot users, engagement |

| Early revenue | MRR/ARR, paying customers, month-over-month growth |

| Scaling | ARR, net revenue retention, growth rate, customer logos |

Highlight trajectory over absolute numbers. 100 customers with 25% month-over-month growth for six consecutive months shows stronger signal than a large but flat number. For financial charts, waterfall charts effectively break down what's driving your metrics.

Slide 7: Competition#

Use a 2x2 matrix or comparison table. Pick the two dimensions where you're strongest, then plot yourself and competitors.

| Feature | You | Competitor A | Competitor B | Alternative |

|---|---|---|---|---|

| Key differentiator 1 | ✓ Strong | ✗ | ✓ | ✗ |

| Key differentiator 2 | ✓ Strong | ✓ | ✗ | ✗ |

| Price point | $$ | $$$$ | $$ | Free |

| Target customer | SMB | Enterprise | SMB | DIY |

Acknowledge competitor strengths honestly. Never claim you have no competition. Every solution has alternatives, even if it's "doing nothing."

Slide 8: Team#

Focus on "why us for this problem." Specific relevance matters more than generic credentials. Highlight founders who built similar products, worked in the target industry, or experienced the problem firsthand.

Keep it to 3-4 people maximum. Show complementary skills covering product, technical, and go-to-market capabilities. Include advisors only if they're genuinely involved.

Slide 9: Financials#

Show current state (revenue, burn rate, runway) and 3-year projections using charts, not spreadsheets. Break down the building blocks: "X customers at $Y ACV with Z% retention and W% new customer growth."

Be realistic. VCs mentally cut projections in half. A waterfall chart can show how you bridge from current state to projected state, breaking down growth drivers.

Slide 10: The Ask#

Be specific: "$1.5M on an $8M post-money SAFE" is better than "seeking investment." Match your ask to milestones: "This funding gets us to $1M ARR and Series A readiness."

Show strategic capital deployment: product development (50%), sales and marketing (35%), and operations (15%), with specific outcomes for each allocation.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

Investor Presentation Design Best Practices#

Visual Principles#

| Principle | Application |

|---|---|

| One idea per slide | If you have two ideas, make two slides |

| Minimal text | 30 words maximum per slide, use bullets |

| Consistent formatting | Same fonts, colors, alignment throughout |

| White space | Let content breathe; don't fill every inch |

| High contrast | Dark text on light background for readability |

Charts and Data Visualization#

Professional charts dramatically improve traction and financial slides.

For growth metrics: Line charts for trends, bar charts for period comparisons, waterfall charts for revenue bridges.

For market sizing: Nested circles for TAM/SAM/SOM, Mekko charts for segment analysis.

Tools like Deckary offer consulting-quality chart templates that create professional visualizations quickly. The difference between amateur Excel charts and professional presentations is immediately apparent to investors who review hundreds of decks.

The mobile test: Many investors review decks on their phones. If your text is unreadable or charts are incomprehensible on a 6-inch screen, your deck fails before it's even considered.

What Investors Look For#

The Five Questions Every Investor Asks#

| Question | Where They Look | What They Want to See |

|---|---|---|

| Is the market big enough? | Market size slide | TAM over $1B, growing market |

| Is there product-market fit? | Traction slide | Growth, retention, engagement metrics |

| Can this team execute? | Team slide | Domain expertise, complementary skills |

| How do they make money? | Business model | Clear path to profitability, strong unit economics |

| Why will they win? | Competition slide | Defensible differentiation |

Time Spent by Slide (DocSend Data)#

| Slide Type | Average Time | What This Means |

|---|---|---|

| Financials | 35-40 seconds | Most scrutinized; must be clear |

| Team | 30-35 seconds | Credibility check; experience matters |

| Traction | 25-30 seconds | Proof of execution |

| Market Size | 20-25 seconds | Quick opportunity assessment |

| Solution | 15-20 seconds | Understanding what you do |

| Other slides | 10-15 seconds | Supporting context |

Invest the most effort in your Financials, Team, and Traction slides. These are where deals progress or die.

Investor Presentation Variations by Stage#

| Dimension | Seed | Series A | Series B+ |

|---|---|---|---|

| Primary question | Can this team build something customers want? | Is there proven PMF that can scale? | Can this scale to a very large business? |

| Emphasis | Team, problem validation, early signals | Revenue metrics, unit economics, cohort retention | Path to $100M+ ARR, margins, competitive moats |

| Key metrics | 1,000+ waitlist or 50+ pilot users | $1-2M+ ARR, 100%+ YoY growth, NRR >100% | $5M+ ARR, 70%+ gross margins, efficient CAC |

| Typical deck | 10-12 slides | 12-15 slides, data-heavy | 15-20 slides, extensive financials |

For seed-stage guidance, see our startup pitch deck guide. For Series A specifics, see our Series A pitch deck guide.

Common Investor Presentation Mistakes#

Mistake 1: Too Much Information#

Dense slides create cognitive overload and signal inability to prioritize. Each slide gets one message. If you can't explain it in 20 seconds, split it or move it to the appendix.

Mistake 2: Burying the Traction#

Investors jump to traction first. If they can't find strong metrics quickly, they assume you don't have them. For later-stage companies, consider putting a traction overview on slide 2.

Mistake 3: Missing or Vague Funding Ask#

Ending without stating how much you're raising signals indecision. Be specific: "$1.5M seed round on SAFE, funding 18 months to $1M ARR."

Mistake 4: Claiming No Competition#

Every solution has alternatives. Claiming otherwise signals you don't understand your market. Sophisticated competitive analysis builds credibility.

Mistake 5: Unrealistic Financial Projections#

VCs see inflated projections constantly. Ground projections in current traction. Show the math: customers x price x growth rate = revenue.

Mistake 6: Amateur Design#

Design quality signals execution capability. Consistent formatting and clean charts matter. Tools like Deckary provide professional templates and chart tools that elevate presentation quality.

Mistake 7: Forgetting the Appendix#

Build backup slides for detailed questions: financial model, customer case studies, competitive deep dive, product roadmap, team bios, and reference customers.

Building Your Investor Presentation: Step-by-Step#

Step 1: Start with the story. Before opening PowerPoint, write your narrative covering problem, solution, opportunity size, proof, team, and funding needs. If you can't tell this story in 5 minutes verbally, the deck won't work.

Step 2: Gather your data. Collect revenue metrics, customer testimonials, market research, competitive analysis, financial projections, and team backgrounds before building slides.

Step 3: Build the essential 10 slides. Create each core slide with one focused message. Use professional templates from the start. Deckary provides presentation templates with consistent formatting and professional chart tools built in.

Step 4: Create professional visuals. Use waterfall charts for revenue composition, TAM SAM SOM visualizations for market sizing, and Mekko charts for segment breakdowns. Deckary's chart library creates consulting-quality visualizations.

Step 5: Build the appendix. Prepare backup slides for unit economics, acquisition funnels, full financial model, product roadmap, hiring plan, and reference customers.

Step 6: Test and iterate. Run the mobile test (readable on a phone?), squint test (visual hierarchy works?), and 30-second test (main point clear at a glance?). Have other founders who've raised successfully review your deck.

Summary#

The best investor presentations share five characteristics: ruthless focus (one message per slide), evidence-based claims (metrics that prove traction), professional execution (consistent formatting, quality charts), a clear ask (specific amount, use of funds, milestones), and honest positioning (acknowledging competition while articulating why you'll win).

Your deck doesn't close the deal. It gets you the meeting. Optimize for a 4-minute review where every slide communicates immediately, traction leads the narrative, and specificity replaces vague language.

For professional presentation tools, Deckary offers an AI Slide Builder that generates complete slides, a slide library with 140+ consulting-quality layouts, chart templates for waterfall charts and market sizing, 2,000+ professional icons, and Excel-linked charts that update automatically.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free