Startup Pitch Deck: Examples from Funded Companies That Raised Millions

Analyze real startup pitch decks from Airbnb, Buffer, Uber, and LinkedIn. Learn the 10-slide framework, what VCs look for, and design tips that get funded.

Airbnb raised $600K with a 10-slide deck. Buffer's pitch deck became a template after raising $500K. Uber's original presentation helped secure $1.25M for what became a $72B company. What made these decks work when thousands of others failed?

After studying the original pitch decks from 15 companies that collectively raised over $1 billion in early funding, the patterns are consistent: extreme simplicity, a problem investors can immediately feel, and just enough traction to prove this isn't just an idea.

This guide breaks down those actual decks, covers the essential slides every startup needs, and highlights the mistakes that get decks immediately rejected. For a complete pitch deck framework with detailed guidance on each slide, see our Pitch Deck Guide.

What Makes Startup Pitch Decks Different#

A startup pitch deck is not a business plan in slide format. It's a story designed to generate enough interest that an investor wants to learn more.

| Startup Pitch Deck | Corporate Presentation |

|---|---|

| Sells future potential | Reports past performance |

| Story-driven narrative | Data-driven reporting |

| 10-12 slides maximum | Often 50+ slides |

| One message per slide | Multiple points per slide |

| Designed for quick scanning | Designed for detailed review |

| Goal: Get the meeting | Goal: Inform the audience |

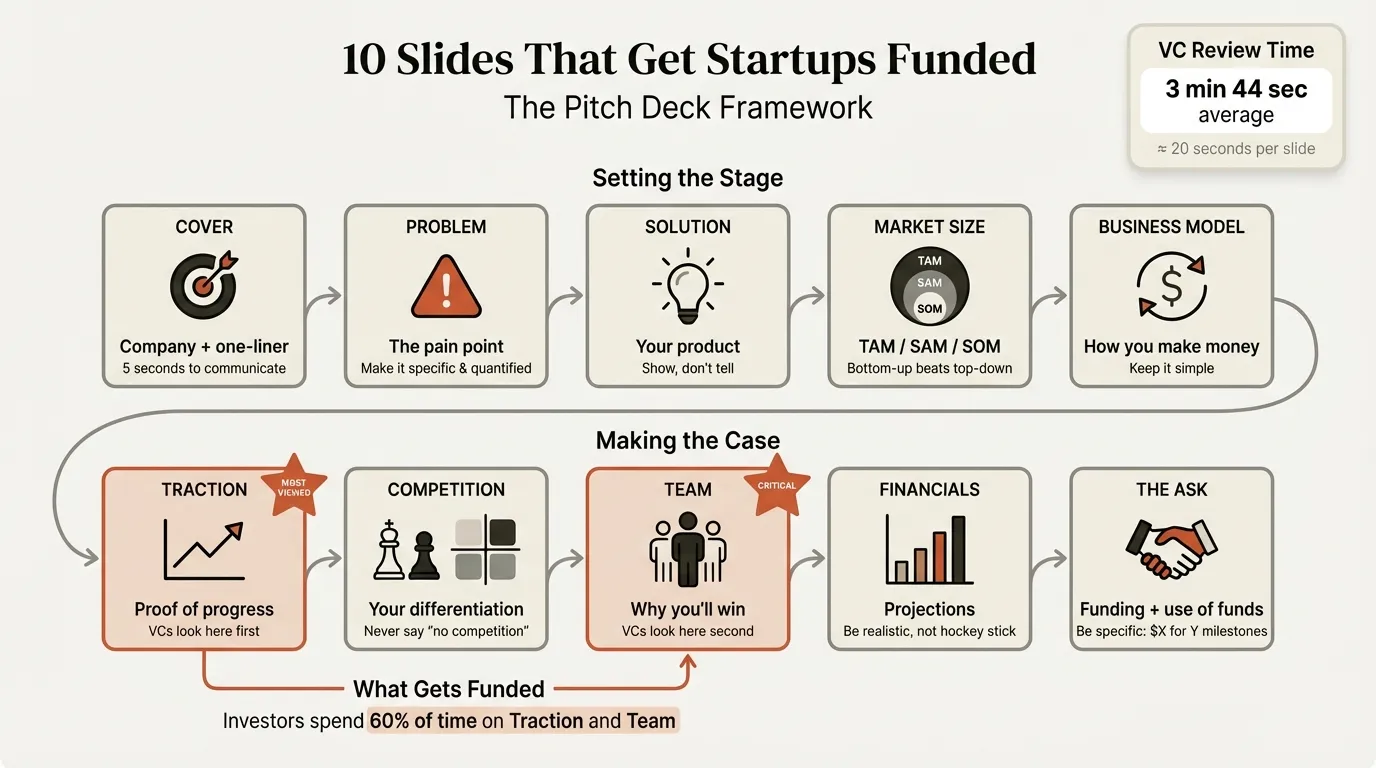

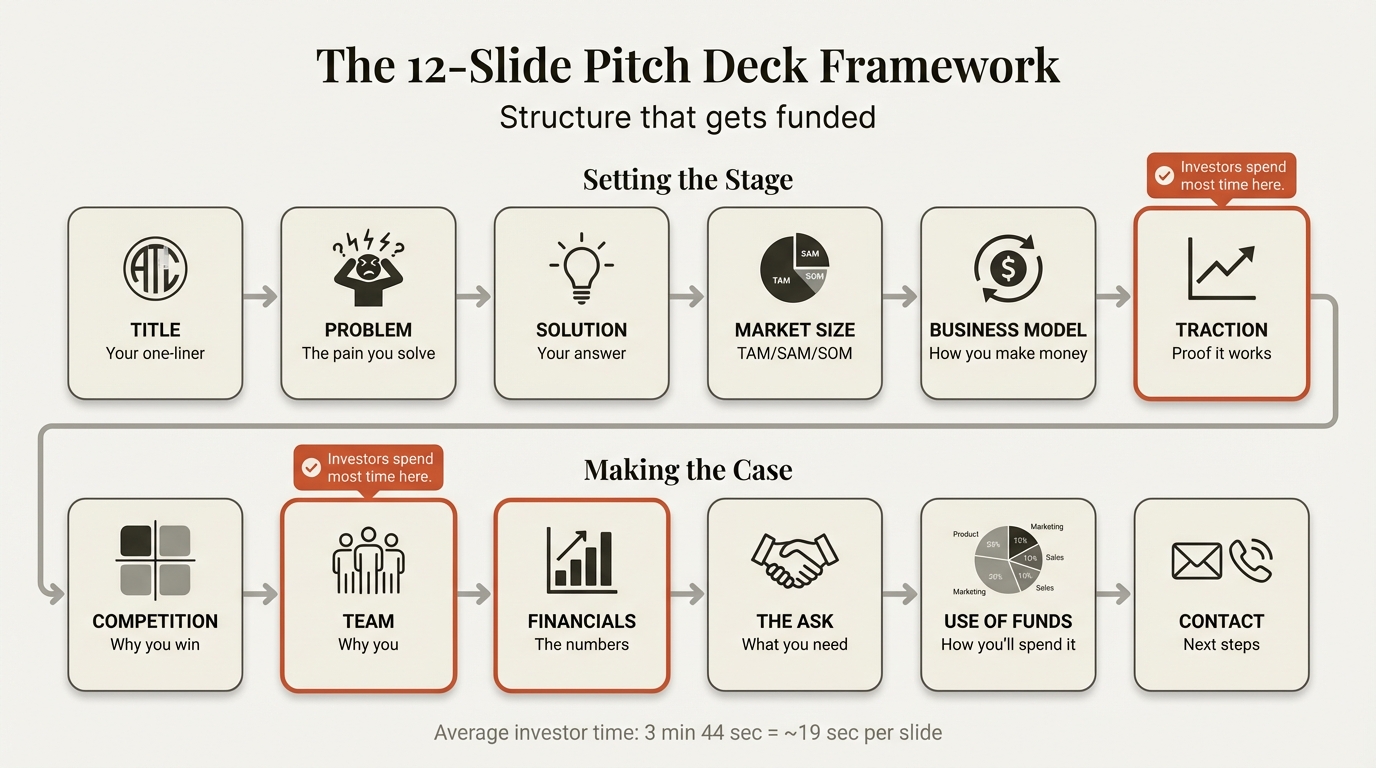

According to DocSend research, VCs spend an average of 3 minutes and 44 seconds reviewing a pitch deck. Your deck isn't competing for deep attention--it's competing against hundreds of other decks for those 4 minutes.

Analyzing Real Pitch Decks That Raised Millions#

Airbnb: The Deck That Launched a $100B Company#

Airbnb's original pitch deck raised $600,000 from Sequoia Capital in 2009, leading to an $86.5 billion IPO valuation.

What made it work: The one-liner--"Book rooms with locals, rather than hotels"--captured the entire value proposition in seven words. The problem slide focused on emotional pain points (expensive hotels, disconnected from local culture) rather than abstract statistics. Market sizing was bottom-up, built from specific numbers: budget travelers per year, average trip cost, share that could use home-sharing. Clean design with minimal text and plenty of white space showed the founders understood that clarity beats polish.

Key lesson: Airbnb's deck told a simple story investors could immediately understand and repeat to their partners.

Buffer: Radical Transparency as Strategy#

Buffer's pitch deck became legendary when founder Joel Gascoigne published it publicly, pioneering the "transparent startup" movement.

What made it work: The deck led with specific traction--800 users, $150,000 annual revenue run rate--building immediate credibility through remarkable transparency. Rather than describing what Buffer did, a clean product screenshot communicated the product instantly. The freemium revenue model was dead simple, with no convoluted pricing to explain.

Key lesson: In a world of exaggerated claims, honest metrics and realistic projections stand out. Buffer's transparency built trust.

Uber: Massive TAM, Focused Entry#

Uber's 2008 pitch deck raised $1.25 million in seed funding for what became a $72 billion company.

What made it work: Every investor had experienced the frustration of hailing a taxi--the problem was immediately relatable. Uber grounded their enormous TAM with city-by-city transportation spending analysis using INSEAD research data. The take-rate business model (a percentage of every transaction) was proven in other marketplaces. The deck hinted at expansion potential without getting distracted from the core pitch.

Key lesson: Uber showed how to present a massive opportunity while staying focused on a specific, achievable starting point.

LinkedIn: Building Network Effects#

Reid Hoffman's original LinkedIn pitch deck from 2004 raised $10 million in Series B funding.

What made it work: The deck clearly articulated why professional networking gets more valuable as more people join, helping investors understand the moat. LinkedIn acknowledged existing players (Friendster, Tribe) while explaining why professional networking differed from social networking. Revenue through job postings and premium subscriptions would grow with the network. Reid Hoffman's background (PayPal, Socialnet) gave investors confidence in the team.

Key lesson: LinkedIn demonstrated how to explain complex business models--network effects, multi-sided marketplace--in simple visual terms.

Continue reading: Agile vs Waterfall · Bar Charts in PowerPoint · 30-60-90 Day Plan Template

Build your pitch deck in minutes

Describe your startup. AI generates an investor-ready pitch deck — structured, polished, and ready to present.

The Essential Slides: What Every Startup Pitch Deck Needs#

Based on analyzing hundreds of successful pitch decks, here are the essential slides.

Slide 1: Title/Cover#

Include your company name, logo, one-sentence description, and contact information. The one-liner is everything--"Stripe: Payments for developers" immediately communicates customer and offering. Test it: can someone with no context understand your business in five seconds?

Slide 2: Problem#

State the core pain point, who experiences it, the cost (financial, time, emotional), and why existing solutions fail. Make it specific and quantified: "Sales teams waste 4 hours per week searching for customer information" beats "Enterprise communication is inefficient." Abstract problems don't create urgency.

Slide 3: Solution#

Show what your product does and how it solves the problem. A product screenshot communicates faster than description. Focus on benefits to the customer, not technical capabilities. Save architecture diagrams for follow-up conversations.

Slide 4: Market Size (TAM/SAM/SOM)#

| Term | Definition | Example |

|---|---|---|

| TAM (Total Addressable Market) | Everyone who could theoretically use your product | All businesses needing CRM software ($100B) |

| SAM (Serviceable Addressable Market) | The segment you can realistically reach | SMBs in North America ($20B) |

| SOM (Serviceable Obtainable Market) | What you can capture in 3-5 years | 2% of North American SMBs ($400M) |

Bottom-up beats top-down. "500,000 target customers x $2,000/year = $1B SAM" is more credible than "We'll capture 0.5% of a $200B market." For sophisticated market sizing visualizations, Mekko charts can show market segments and positioning simultaneously.

Slide 5: Business Model#

Explain your revenue model, pricing structure, and unit economics (CAC, LTV, margins). Keep it simple--focus on the primary revenue stream. Show the math works: LTV should exceed 3x CAC for SaaS businesses. Comparing to known models ("Similar to Shopify's merchant model") helps investors pattern-match quickly.

Slide 6: Traction#

The most scrutinized slide. Show a chart, not just numbers--a growth curve showing 20% MoM growth is more compelling than stating it.

| Stage | Key Metrics |

|---|---|

| Pre-revenue | Users, waitlist signups, LOIs, pilot results |

| Early revenue | MRR, paying customers, MoM growth rate |

| Scaling | ARR, net revenue retention, growth rate |

For financial metrics, waterfall charts can effectively break down what's driving your numbers. Tools like Deckary help create consulting-quality charts that communicate growth clearly.

Slide 7: Competition#

Use a 2x2 matrix or comparison table, picking two dimensions where you're strongest. Acknowledge competitor strengths--"Salesforce is powerful but complex" is more credible than "Salesforce is terrible." Never claim you have no competition.

Slide 8: Team#

Focus on "why us" for this specific problem. Domain experience matters more than pedigree. Keep it to 3-4 people maximum and show complementary skills--product, technical, and go-to-market should be covered.

Slide 9: Financials#

Show current state (revenue, burn, runway) and 3-year projections using charts, not spreadsheets. Ground projections in building blocks: "X customers x $Y price x Z% retention." Be realistic--VCs mentally cut projections in half. A waterfall chart can show how you bridge from current state to projected revenue.

Slide 10: The Ask and Use of Funds#

Be specific: "$1.5M on $8M post-money SAFE" beats "raising a seed round." Match your ask to milestones--investors want to know what the capital gets you to. Show allocation strategically ("40% product, 35% sales, 25% operations") and tie it to outcomes: "This funding gets us to $1M ARR and Series A readiness."

What VCs Actually Look For#

Design isn't decoration--it's communication. Based on investor feedback, VCs evaluate three signals in your deck:

Clarity of thinking. A cluttered slide with 8 bullet points signals unclear thinking. One message per slide signals a founder who can prioritize.

| Design Element | What It Signals |

|---|---|

| One idea per slide | Clear prioritization |

| Clean data visualization | Analytical capability |

| Consistent formatting | Attention to detail |

| Professional charts | Execution ability |

Ability to communicate. VCs ask: "If this founder can't explain their startup clearly in a deck, how will they explain it to customers, recruits, or the board?"

Understanding of audience. Many VCs review decks on their phones between meetings. If your text is unreadable on a 6-inch screen, your deck fails before it's considered. Test every slide on mobile.

For detailed design guidance covering typography, color, visual hierarchy, and chart best practices, see our Pitch Deck Guide. Tools like Deckary offer consulting-quality chart templates, and Deckary's 2,000+ business icons add visual interest without clutter.

Common Pitch Deck Mistakes That Kill Fundraising#

Information overload. Founders cram slides with text, charts, and bullet points. Investors scan--they don't read. Each slide gets one message. If you can't explain it in 15 seconds, simplify.

Burying the traction. Traction on slide 9, after extensive market analysis, signals there isn't much to show. Many successful decks put traction on slide 2 or 3.

Unrealistic projections. Hockey-stick charts showing $0 to $100M in 18 months destroy credibility. Ground projections in current traction: customers x price x growth rate = revenue.

The "no competition" claim. Every solution has alternatives, even "doing nothing." Acknowledge competitors and explain your differentiation.

Missing or vague ask. End with specific amount, terms, timeline, and what you'll accomplish with the capital.

Amateur design. Default templates, inconsistent fonts, misaligned elements, and 3D chart effects from 2005 make investors question your execution ability.

How to Build Your Startup Pitch Deck#

Start with story, not slides. Write your pitch in narrative form first: problem, solution, opportunity size, proof it's working, why your team wins, what you need. If you can't tell this story compellingly in 5 minutes without slides, your deck won't work.

Build focused slides. Each slide communicates one message. Use professional templates or tools like Deckary to ensure consistent formatting and chart quality from the start.

Test relentlessly. Before sending to investors: Can you read every slide on a phone? Does the visual hierarchy work when you squint? Can someone understand your business in 30 seconds of scanning? Have founders who've raised give feedback.

Summary: What Makes Startup Pitch Decks Work#

The best startup pitch decks share five characteristics: ruthless simplicity (one message per slide), story-driven structure (problem to solution to opportunity to ask), evidence of traction presented visually, professional design with consistent formatting, and a clear, specific ask.

The companies that raised millions--Airbnb, Buffer, Uber, LinkedIn--didn't succeed because of elaborate decks. They succeeded because their decks told simple, compelling stories backed by evidence. Your pitch deck should do the same.

For professional charts that make your traction and financial slides stand out, tools like Deckary offer consulting-quality templates for waterfall charts, growth visualizations, and market sizing. Browse pitch deck layouts in the slide library, or use the AI Slide Builder to create polished slides from descriptions quickly.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free