Waterfall Charts in PowerPoint: The Complete Guide for Consultants

Create professional waterfall charts in PowerPoint. Covers revenue bridges, EBITDA walks, and cost bridges with step-by-step instructions and best practices.

Waterfall charts solve a specific communication problem: explaining complex financial breakdowns to executives who need to understand profit drivers without reading a spreadsheet. McKinsey popularized them in the 1990s, and three decades later every consulting firm uses them for the same reason. They work.

This guide covers when to use waterfalls, the three types consultants rely on, real-world use cases, and how to build them in PowerPoint. For a broader overview of all consulting chart types, see our PowerPoint Charts Guide.

What Is a Waterfall Chart?#

A waterfall chart visualizes how an initial value changes through a series of positive and negative contributions to reach a final value. The bars "float" between starting and ending points, creating a bridge-like visual.

| Other Names | Why It's Called That |

|---|---|

| Bridge chart | Bridges the gap between start and end values |

| Cascade chart | Values cascade from one to the next |

| Flying bricks chart | Floating bars resemble suspended bricks |

| McKinsey chart | Popularized by McKinsey & Company |

When to Use Waterfall Charts#

Waterfall charts excel in three scenarios:

- Explaining change over time — How did revenue change from last year to this year? A waterfall breaks down the contributing factors, making the story immediately clear. Use cases include year-over-year revenue variance, quarter-over-quarter profit changes, and budget vs. actual gaps.

- Breaking down components of a total — How does gross revenue become net income? A waterfall shows each deduction until you reach the final number. Use cases include income statement walks (Revenue to Net Income), cost structure breakdowns, and margin analysis.

- Highlighting gaps between targets and actuals — Where are we versus where we need to be? A gap waterfall shows the current state, shortfall, and target. Use cases include sales pipeline vs. quota, headcount actual vs. plan, and market share current vs. target.

| Don't Use When | Use Instead |

|---|---|

| Showing category composition | Pie or 100% stacked bar |

| Comparing multiple entities | Grouped bar chart |

| Displaying trends over many periods | Line chart |

| Changes happen simultaneously, not sequentially | Bar chart with annotations |

The Three Types of Waterfall Charts#

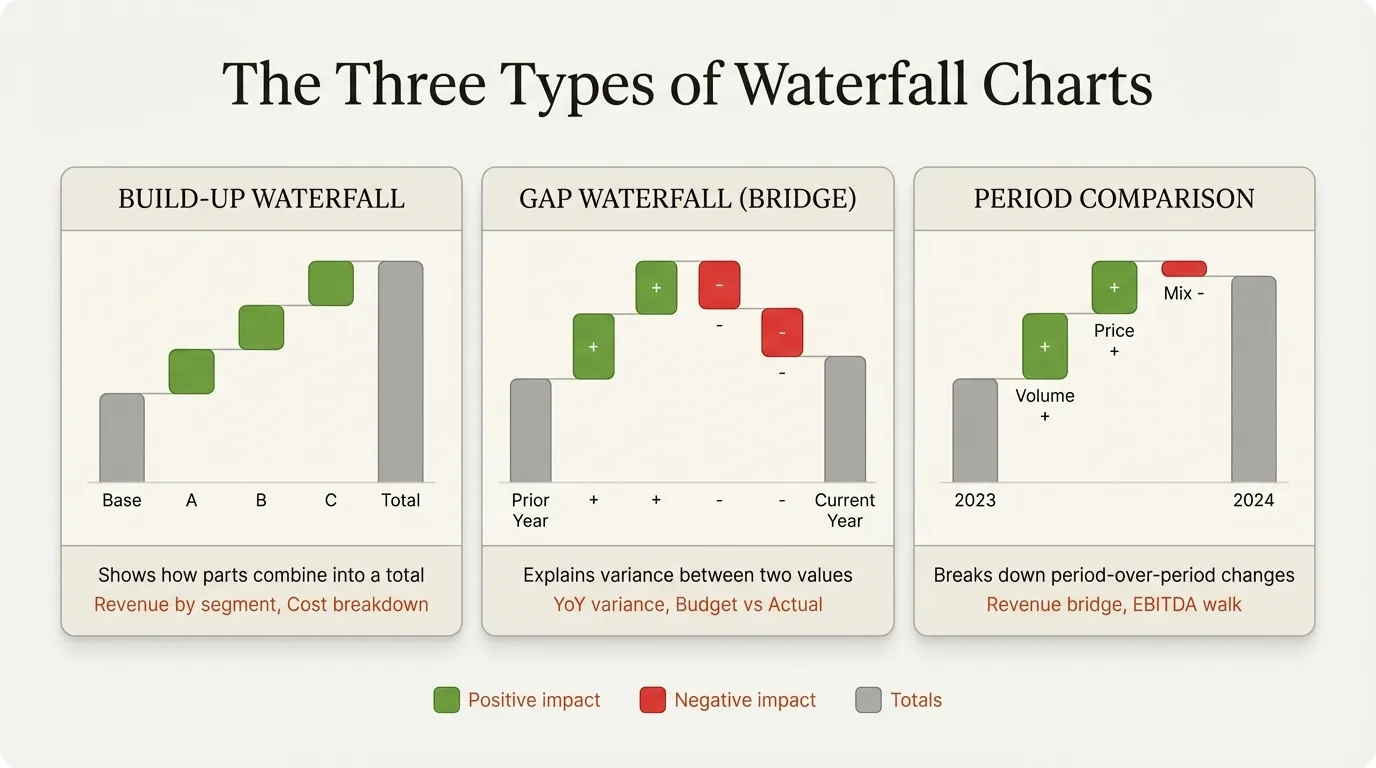

Consultants typically use three variations, each serving a different analytical purpose.

Type 1: Build-Up Waterfall#

Shows how individual components combine to create a total. Revenue by segment building to total revenue, cost categories building to total costs, headcount by department building to total FTEs.

Structure: Start → Component 1 → Component 2 → Component 3 → Total

Best practice: Group related components and show subtotals. Instead of 15 individual bars, show 5 groups with subtotals for each.

Type 2: Gap Waterfall (Bridge Chart)#

Shows the difference between two values — typically actual vs. target or current vs. prior period. Used for EBITDA bridges, revenue variance analysis, and profit walks.

Structure: Start Value → Positive Drivers → Negative Drivers → End Value

Best practice: Order bars by magnitude. Largest positive driver first, largest negative driver first in that section.

Type 3: Year-over-Year Comparison#

A specific application of the gap waterfall for time-based comparisons. Annual revenue changes broken into price/volume/mix, cost variance by category, or market share movement.

Structure: Prior Period → Volume Effect → Price Effect → Mix Effect → Current Period

Best practice: Use consistent categories across periods. If Q1 includes "New Customer Revenue," Q2 should too.

Waterfall Chart Best Practices#

Color should communicate direction instantly: green for positive changes, red for negative, and gray or blue for totals and starting values. Avoid using the same color throughout — the whole point of a waterfall is showing what helped and what hurt. Add plus/minus signs next to values to reinforce direction, percentage labels for relative impact, and callout boxes to highlight the key driver. Limit your chart to 7-10 bars maximum; group minor categories (anything under 5% of total change) and put the detailed breakdown in an appendix slide. Finally, ensure thin connector lines are present between bars — without them, the floating bars look disconnected and readers lose track of the running total.

Continue reading: 30-60-90 Day Plan Template · Agile vs Waterfall · Best Fonts for PowerPoint

Better charts for PowerPoint

Waterfall, Mekko, Gantt — build consulting-grade charts in seconds. Link to Excel for automatic updates.

Common Waterfall Chart Mistakes#

These errors undermine credibility and confuse audiences.

| Mistake | Problem | Fix |

|---|---|---|

| Inconsistent colors | Green for some positives, blue for others | Every positive green, every negative red, every total gray |

| Too many categories | 15+ bars because "the client needs detail" | Group minor items under 5% into "Other"; detail goes in appendix |

| Wrong ordering | Bars ordered alphabetically or randomly | Order by magnitude — largest impacts first |

| Missing labels | Assuming viewers calculate values from bar heights | Add numbers to each bar |

| Forced sequential logic | Waterfall used for simultaneous changes | Use a sorted bar chart instead |

| Inconsistent scales | $1M looks different across slides | Use consistent manual scaling across all waterfall charts in the deck |

Real-World Use Cases#

Revenue Bridge (YoY Analysis)#

The most common consulting waterfall. Breaks revenue change into volume impact (units sold at prior year price), price impact (price change applied to current units), mix impact (shift between products or segments), new products, and discontinued products. Executives need to know whether growth came from selling more, charging more, or shifting mix — each has different strategic implications and requires different follow-up actions.

A typical structure runs from Prior Year Revenue through each driver to Current Year Revenue. The key is ordering drivers by magnitude so the largest contributor to the change stands out visually.

EBITDA Walk#

The EBITDA bridge explains profit movement by isolating revenue change impact, gross margin change, SG&A change, and other operating expenses. This is the chart that appears in virtually every board presentation, investor deck, and due diligence data room. Stakeholders need to understand what drove profitability changes — not just what the final number is — and the EBITDA walk makes each driver's contribution explicit.

Cost Variance Analysis#

Shows where actual costs deviated from budget and why. The typical structure walks from budgeted costs through labor variance, materials variance, overhead variance, and one-time items to actual costs. Finance teams use this to explain budget misses to leadership without burying them in spreadsheets. When presented well, the chart immediately surfaces whether overruns came from controllable factors (headcount decisions) or external forces (material price inflation).

Cash Flow Bridge#

Traces cash from operating profit through depreciation add-backs, working capital changes, CapEx, debt service, and dividends to ending cash balance. This chart answers one of the most common executive questions: why a profitable company might be short on cash, or why a company with declining profits still has healthy cash reserves. The visual bridge makes abstract accounting adjustments tangible.

Creating Waterfall Charts in PowerPoint#

You have three options, each with different trade-offs.

Native PowerPoint (Office 2016+)#

Insert a waterfall via Insert, Chart, Waterfall. Enter data in the spreadsheet, then right-click bars to set them as "Total" where needed.

Limitations: No stacked waterfalls, no Excel linking, difficult connector formatting, and no build-down waterfalls. The real pain is updates — when you change one value, connector lines break and require manual repositioning.

Time to create: 10-15 minutes basic, 30+ minutes with proper formatting. Best for one-off charts you will not need to update.

PowerPoint Add-ins#

Add-ins like Deckary and Mekko Graphics are purpose-built for consulting charts. They provide waterfall charts in seconds with automatic connectors, live Excel links, stacked waterfalls, CAGR lines, and consistent scaling across charts.

Time to create: 30-60 seconds.

Trade-off: Cost. For consultants building multiple waterfall charts per week, the time savings pay for the subscription in one engagement. Deckary starts at $49/year.

Which Should You Use?#

| Your Situation | Recommended Approach |

|---|---|

| One waterfall chart, won't update | Native PowerPoint |

| Multiple charts, data changes | Add-in (Deckary) |

| Need Excel linking | Add-in only |

| Need stacked waterfalls | Add-in only |

| Budget is zero | Native PowerPoint + patience |

Building a Revenue Bridge: Example#

| Driver | Impact ($M) |

|---|---|

| 2023 Revenue | 100.0 |

| Volume | +8.5 |

| Price | +4.2 |

| Mix | –2.1 |

| New Products | +3.8 |

| Discontinued | –1.4 |

| 2024 Revenue | 113.0 |

With an add-in (30 seconds): Select your data in Excel, click Waterfall in the ribbon, drag onto your slide, set colors and connectors with one click.

In native PowerPoint (15+ minutes): Insert chart, enter data manually, right-click each total bar individually, format each bar's color one by one, manually draw connector lines, align by hand, repeat when data changes.

The output looks similar. The process does not.

Waterfall Chart Checklist#

Before presenting any waterfall chart, verify:

Data Accuracy

- All values sum correctly (start + changes = end)

- Direction of each bar matches the data (positive = up, negative = down)

- Totals are clearly marked

Visual Clarity

- Colors are consistent (green positive, red negative, gray totals)

- Bars are ordered by magnitude (largest impact first)

- Minor categories are grouped (no more than 10 bars)

- Connectors are present and aligned

Labels and Annotations

- Every bar has a value label

- Plus/minus signs clarify direction

- Key drivers have callouts explaining significance

- Chart has a clear title stating what it shows

Summary#

Waterfall charts are the standard for financial storytelling in consulting and corporate strategy. When built correctly, they explain complex variance analysis in seconds.

Key takeaways:

- Use waterfall charts for change analysis — explaining how you got from A to B

- Three types exist — Build-up, Gap/Bridge, and Year-over-Year

- Color coding is essential — green for positive, red for negative, gray for totals

- Limit to 7-10 bars — group minor categories to reduce noise

- Native PowerPoint has limitations — add-ins save significant time for recurring charts

For consultants building waterfall charts regularly, the right tools matter. A chart that should take 30 seconds shouldn't take 30 minutes. Explore Deckary's waterfall chart capabilities with Excel linking and automatic connectors.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free