Includes 2 slide variations

Free Budget Table PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Input your budget categories and line items

- 2Enter budgeted amounts for each period

- 3Update actual spend as data becomes available

- 4Review variance column for over/under spend

- 5Use work breakdown for project-based budgets

- 6Navigate quarters using the tab selector

When to Use This Template

- Monthly financial reviews

- Quarterly budget presentations

- Project cost tracking

- Department budget requests

- Marketing spend analysis

- Capital expenditure planning

Common Mistakes to Avoid

- Not explaining significant variances

- Mixing different time periods in one table

- Omitting the variance calculation method

- Using inconsistent currency or units

- Showing too many line items (aggregate for executive audiences)

Use This Template in PowerPoint

Get the Budget Table Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Budget Table Template FAQs

Common questions about the budget table template

Related Templates

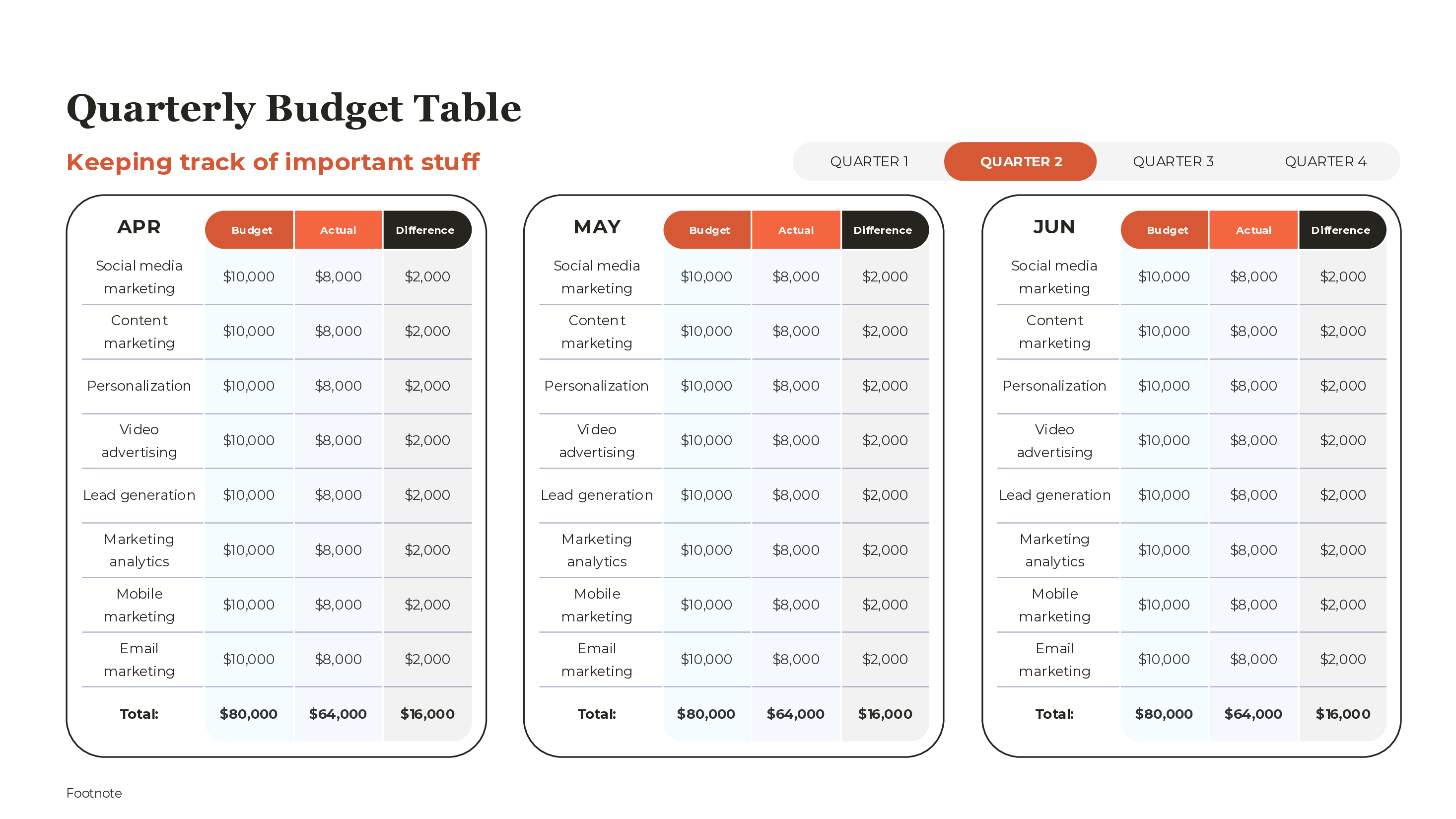

Making Budget Data Actionable

Budget tables turn financial planning into accountability. A well-structured budget presentation shows not just what you planned to spend, but what you actually spent and why the difference matters. The goal is not to display numbers—it is to drive decisions about resource allocation.

Our budget table template provides two complementary views: a monthly comparison table for tracking spend against plan, and a work breakdown structure for visualizing how budgets decompose across project phases. Together, they give stakeholders both the summary and the detail.

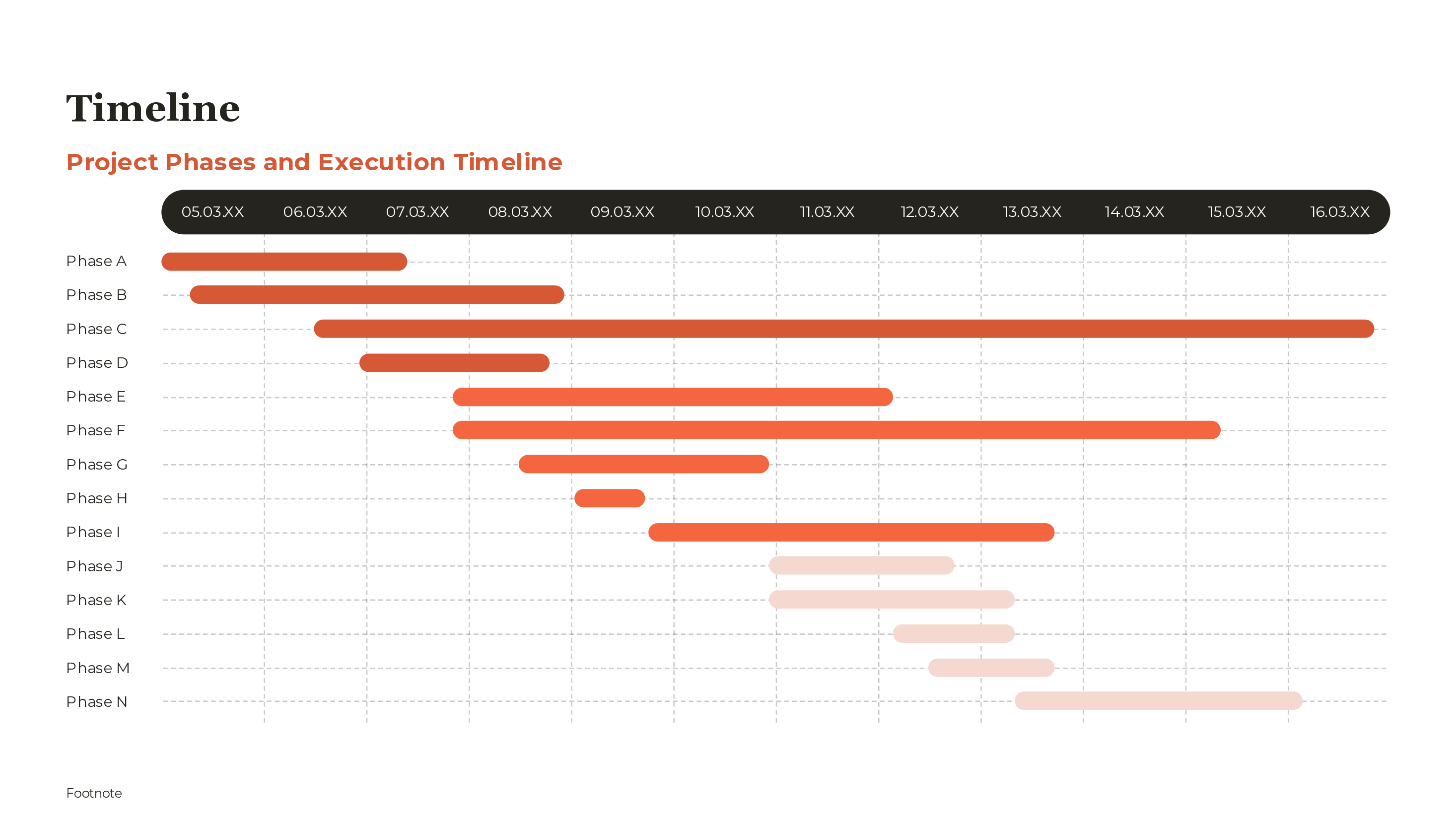

The Monthly Budget Table

The monthly budget table is the workhorse of financial reporting. It compares planned spending to actual spending for each budget category across a time period.

Structure:

- Row headers list budget categories (marketing channels, cost centers, or expense types)

- Column groups show Budget, Actual, and Difference for each month

- Quarter tabs allow navigation between reporting periods

- Total row sums all categories for each column

Key design elements:

- Consistent currency formatting (always show units)

- Right-aligned numbers for easy scanning

- Highlighted variance column draws attention to exceptions

- Subtotals and totals clearly differentiated from line items

This format works for any recurring budget: marketing spend, department operations, project phases, or capital expenditures.

Reading Budget Variance

The variance column is where action happens. A number without context is just data; variance creates information.

Favorable variance (under budget): Actual spend came in below plan. This might be good (efficiency) or bad (delayed spending, missed opportunities). Investigate before celebrating.

Unfavorable variance (over budget): Actual spend exceeded plan. This might be bad (cost overruns) or neutral (timing differences, approved scope changes). Context matters.

Materiality threshold: Not every variance deserves attention. Define a threshold (e.g., >10% or >$5K) and focus explanations on material variances. Minor fluctuations are noise.

For executive presentations, prepare explanations for every material variance. "We were over budget by $20K" is data. "We were over budget by $20K due to expedited shipping for the product launch—a deliberate tradeoff to hit the deadline" is insight.

The Work Breakdown Structure View

For project-based budgets, the work breakdown structure (WBS) shows how costs decompose hierarchically. This is essential for large initiatives where total budget spans multiple workstreams.

Structure:

- Top level shows total project budget and overall progress

- Second level breaks into major phases or workstreams

- Third level shows individual tasks or deliverables within each phase

- Each item shows its budget allocation and completion status

Progress indicators:

- Percentage complete shows how much work is done

- Budget consumed shows how much money is spent

- Comparing these reveals efficiency—are you spending in line with progress?

The WBS answers questions like: "Where is the money going?" and "Which phase is driving cost overruns?" It is particularly useful for steering committees that need to understand project economics without reviewing every invoice.

Choosing the Right Granularity

The right level of detail depends on your audience and purpose.

Executive summary (5-8 categories):

- Marketing: Digital, Events, Content

- Operations: People, Technology, Facilities

- Project: Phase 1, Phase 2, Phase 3

Working session (15-25 categories):

- Marketing: Social Media, SEM, SEO, Events, PR, Email, Video, Print

- Full breakdown of each area with sub-line items

Financial audit (50+ line items):

- Every vendor, every expense code, every transaction

- This level rarely belongs in PowerPoint—use Excel or your accounting system

Start with the summary view in your presentation. Keep detailed breakdowns in appendix slides or backup documents for those who want to drill down.

Building Budget Accountability

A budget table is not just reporting—it is a management tool. Structure your presentation to drive accountability.

Monthly rhythm:

- Review budget vs. actual for prior month

- Identify material variances and root causes

- Agree on corrective actions for overruns

- Reforecast remaining months if needed

Quarterly reviews:

- Assess year-to-date performance

- Compare to annual plan trajectory

- Make reallocation decisions across categories

- Update full-year forecast

Annual planning:

- Start from prior year actuals as baseline

- Adjust for known changes and initiatives

- Build in appropriate contingency

- Gain approval before fiscal year begins

The template supports all these rhythms with monthly detail and quarterly navigation.

Common Budget Presentation Pitfalls

Showing numbers without narrative: Every material variance needs an explanation. If you do not explain it, your audience will ask—or worse, assume incompetence.

Mixing forecast and actual: Clearly label which numbers are actual (historical) versus forecast (projected). Mixing them creates confusion about whether spend has occurred or is planned.

Ignoring timing: A monthly underspend might just mean timing—you will catch up next month. Distinguish between true savings and deferred spending.

Hiding bad news in the details: Burying a major overrun in a rolled-up category is worse than transparency. Executives will find it eventually, and trust is harder to rebuild than budget.

Presenting stale data: Budget reviews should use the most current data available. If numbers are two months old, decisions made on them are already outdated.

Integrating Budget With Project Management

Budget tracking is inseparable from project management. The work breakdown structure connects financial planning to project plans.

Earned Value Management (EVM) concepts apply:

- Planned Value: What you budgeted to spend by now

- Actual Cost: What you actually spent

- Earned Value: The value of work completed

Comparing these reveals whether you are on track (earned value matches actual cost) or have a problem (spending more than the value delivered).

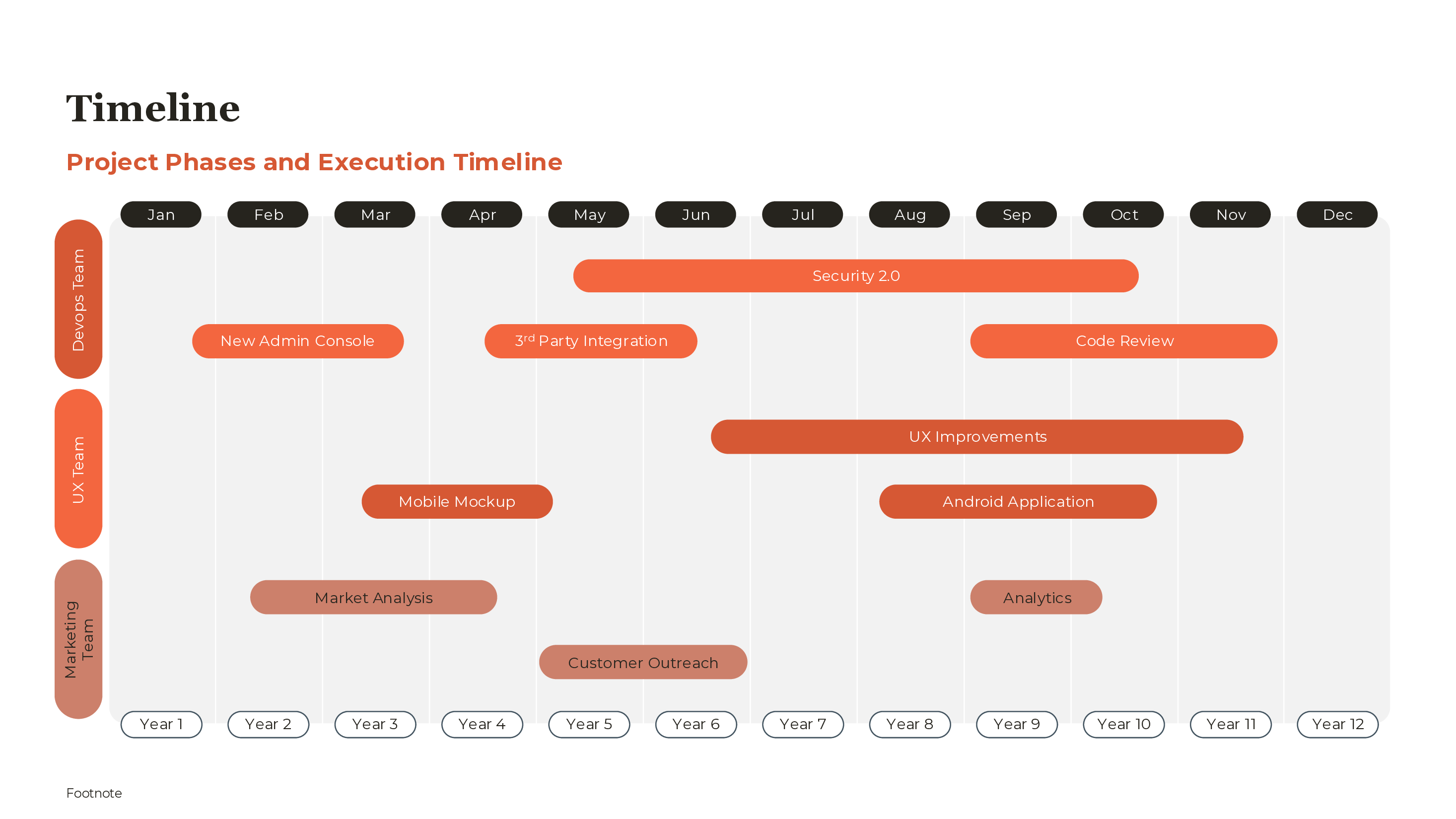

For project-based organizations, link budget tables to Gantt charts and project plans to show the full picture of schedule, scope, and cost.

For guidance on building a compelling business case around your budget data, see our Business Case Template Guide and Business Case Examples.

For related financial templates, see our KPI dashboard template and break-even analysis template. Deckary's AI Slide Builder can generate budget table layouts from your financial data.