Includes 3 slide variations

Free Break-Even Analysis PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Enter your fixed costs as the constant baseline

- 2Calculate variable costs per unit and add to table

- 3Input your revenue per unit to calculate total revenue

- 4Find the intersection point where Revenue equals Total Costs

- 5Use the chart to visualize the break-even point

- 6Position the gauge needle to show current profitability status

When to Use This Template

- New product launch business cases

- Startup funding presentations

- Investment committee proposals

- Pricing strategy analysis

- Manufacturing capacity planning

- Expansion feasibility studies

Common Mistakes to Avoid

- Forgetting to separate fixed and variable costs

- Using unrealistic price or volume assumptions

- Not showing sensitivity to key assumptions

- Ignoring step-function cost changes at scale

- Presenting break-even without path to profitability timeline

Use This Template in PowerPoint

Get the Break-Even Analysis Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Break-Even Analysis Template FAQs

Common questions about the break-even analysis template

Related Templates

The Foundation of Every Business Case

Break-even analysis answers the most fundamental business question: When do we start making money? Every new product, market expansion, or capital investment faces this test. If you cannot articulate the path to profitability, you should not expect funding approval.

Our break-even analysis template provides three complementary views: a data table for detailed calculations, a line chart for visual explanation, and a profitability gauge for executive summaries. Together, they build the financial foundation of your business case.

Understanding Break-Even Economics

Break-even analysis rests on a simple equation: Total Revenue must equal Total Costs.

Total Costs = Fixed Costs + Variable Costs Total Revenue = Price per Unit x Units Sold

At the break-even point: Fixed Costs + (Variable Cost per Unit x Units) = Price per Unit x Units

Solving for units: Break-Even Units = Fixed Costs / (Price - Variable Cost)

The denominator—Price minus Variable Cost—is the contribution margin. Each unit sold contributes this amount toward covering fixed costs. Once fixed costs are fully covered, contribution margin becomes profit.

Example:

- Fixed Costs: $100,000 (rent, salaries, equipment)

- Variable Cost per Unit: $20 (materials, direct labor)

- Price per Unit: $50

- Contribution Margin: $50 - $20 = $30

- Break-Even: $100,000 / $30 = 3,333 units

Sell 3,333 units and you break even. The 3,334th unit generates $30 profit.

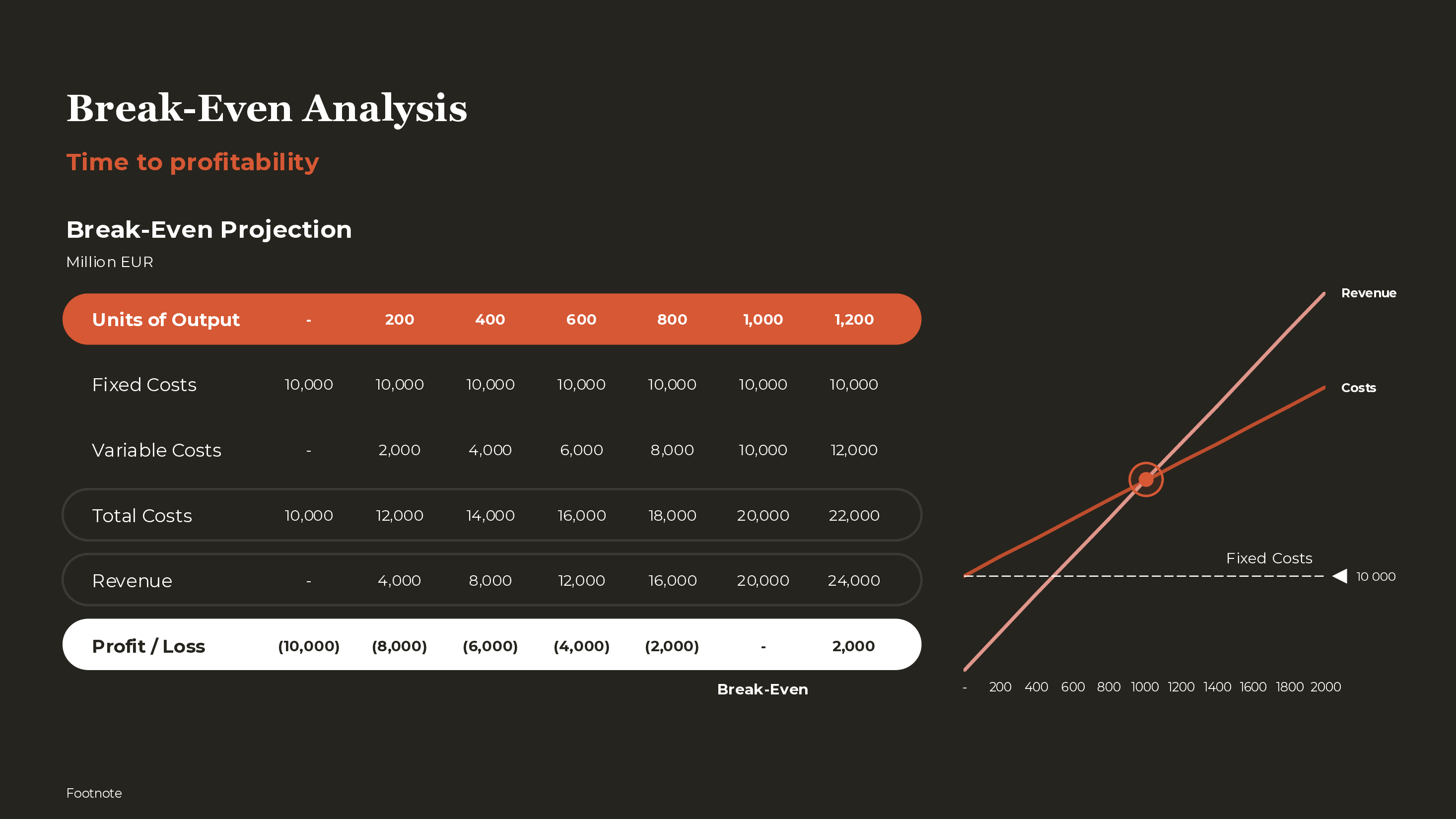

The Break-Even Data Table

The data table shows break-even calculations across different volume scenarios. This builds intuition about the relationship between volume, costs, revenue, and profit.

Column structure:

- Units of Output: 0, 200, 400, 600, 800, 1000, 1200

- Fixed Costs: Constant across all volume levels

- Variable Costs: Increases linearly with volume

- Total Costs: Fixed + Variable

- Revenue: Price x Units

- Profit/Loss: Revenue - Total Costs

Key observations:

- Fixed costs remain flat regardless of volume

- Variable costs increase proportionally with production

- Revenue increases proportionally with sales

- The break-even point is where Revenue equals Total Costs

- Losses decrease as you approach break-even; profits grow after

The table format is particularly useful for finance teams who want to verify calculations and test sensitivities.

The Break-Even Line Chart

The line chart visualizes break-even dynamics in a way that executives immediately understand.

Chart elements:

- X-axis: Units of output (or sales volume)

- Y-axis: Currency (costs and revenue)

- Revenue line: Starts at origin, slopes upward based on price

- Total Cost line: Starts at fixed cost level, slopes upward based on variable cost

- Fixed Cost line: Horizontal reference showing fixed cost baseline

- Intersection point: Where Revenue and Total Cost lines cross—the break-even point

- Profitability zone: Shaded area above break-even where Revenue exceeds Costs

Visual insights:

- The steeper the revenue line, the faster you reach profitability

- Higher fixed costs push the break-even point right

- Higher variable costs flatten the total cost line, also pushing break-even right

- The gap between revenue and cost lines after break-even is your profit margin

A well-designed break-even chart lets executives see the path to profitability without reading a spreadsheet.

The Profitability Gauge

The semi-circular gauge provides an executive summary view of profitability status. It answers a simple question: Where are we on the profitability spectrum?

Gauge stages:

- Big Loss: Significantly below break-even

- Loss: Below break-even, trending toward it

- Break-Even: Revenue equals costs

- Profit: Above break-even with positive margins

- High Profit: Well above break-even with strong margins

Use cases:

- Monthly status updates to leadership

- Project health dashboards

- Product portfolio reviews

- Investment committee summaries

The gauge is not for detailed analysis—it is for quick status checks. Position the needle based on current performance relative to break-even, and use the surrounding text to explain the trajectory.

Sensitivity Analysis

Break-even analysis is only as good as its assumptions. Sophisticated audiences will challenge your inputs. Build credibility by showing sensitivity to key variables.

Test these scenarios:

- What if price is 10% lower? (Competitor pressure, market conditions)

- What if variable costs are 15% higher? (Supplier issues, quality problems)

- What if fixed costs increase? (Expansion, hiring)

- What if volume ramps slower than expected? (Sales cycle, market adoption)

Present a sensitivity table or tornado chart showing how break-even changes with different assumptions. This demonstrates rigor and prepares you for tough questions.

Beyond Simple Break-Even

Basic break-even analysis has limitations. More sophisticated versions address these.

Contribution margin analysis: Instead of units, express break-even in revenue dollars. Break-Even Revenue = Fixed Costs / Contribution Margin Ratio (where CM Ratio = Contribution Margin / Price).

Multi-product break-even: Weight contribution margins by expected sales mix to get a blended break-even calculation.

Step-function costs: Real businesses have costs that jump at certain volumes (new equipment, additional shifts, warehouse space). Model these as stepped fixed costs.

Time-to-break-even: Add a time dimension showing not just what volume is needed, but when you expect to reach it based on sales projections.

Operating leverage: Higher fixed costs mean higher risk but also higher profit potential once break-even is passed. Consider the risk-reward tradeoff in your analysis.

Presenting Break-Even to Executives

When presenting break-even analysis to decision-makers, structure your message for impact.

Lead with the bottom line: "We break even at 3,333 units, which we project to reach in Month 8."

Show the path: Use the line chart to visualize the trajectory from launch to profitability.

Address assumptions: Proactively share key assumptions and their sensitivities.

Connect to the ask: If you need funding, tie break-even to the investment timeline. "The $500K investment funds operations until break-even in Month 8, with profitability generating $50K/month thereafter."

Provide comfort: Show what happens after break-even—the profit potential that makes the investment worthwhile.

Break-even analysis is not just math; it is a narrative about how your business creates value. Present it as a story with a beginning (investment), middle (path to break-even), and end (sustainable profitability).

For worked examples of break-even analysis in business case presentations, see our Business Case Examples and Business Case Template Guide.

For related financial analysis templates, see our budget table template and pitch deck template. Deckary's AI Slide Builder can generate break-even visualizations from your cost and revenue assumptions.