Free Decision Tree PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Start with the primary decision at the root node

- 2Add branches for each available option

- 3Include chance nodes where outcomes are uncertain

- 4Assign probabilities to uncertain outcomes (must sum to 100%)

- 5Add payoff values at terminal nodes

- 6Calculate expected values by working backward from endpoints

When to Use This Template

- Make-or-buy decisions

- Product launch go/no-go analysis

- Investment evaluation under uncertainty

- Market entry strategy selection

- Pricing strategy optimization

- Risk-adjusted project prioritization

Common Mistakes to Avoid

- Omitting key decision alternatives

- Probabilities at chance nodes not summing to 100%

- Mixing decisions and chance events in the same node

- Forgetting to include the status quo option

- Not validating probability estimates with data

Use This Template in PowerPoint

Get the Decision Tree Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Decision Tree Template FAQs

Common questions about the decision tree template

Related Templates

What Is a Decision Tree?

A decision tree is a structured diagram that maps choices to outcomes. Unlike an issue tree, which breaks a problem into components for analysis, a decision tree evaluates alternatives and their consequences. It's the visual tool consultants and strategists use when the question shifts from "what's happening?" to "what should we do?"

The power of decision trees comes from their ability to handle uncertainty systematically. When outcomes depend on factors outside your control — market response, competitor moves, regulatory decisions — a decision tree forces you to make probability estimates explicit and calculate expected values for each option.

Decision trees appear simple but encode sophisticated logic. A well-built tree clarifies which decision leads to the best expected outcome, which uncertainties matter most, and where additional information would be most valuable.

Structure of a Decision Tree

Every decision tree uses three types of nodes:

Decision nodes (typically drawn as squares) represent points where you choose between options. The decision-maker controls what happens here. Each branch from a decision node is an available alternative.

Chance nodes (typically drawn as circles) represent points where uncertainty determines the outcome. External factors control what happens here. Each branch represents a possible outcome, labeled with its probability. Probabilities at any chance node must sum to 100%.

Terminal nodes (typically drawn as triangles or simple endpoints) represent final outcomes. Each terminal node shows the payoff — revenue, profit, cost, or whatever metric you're optimizing.

The tree reads left to right: start with a decision, encounter uncertainties, reach outcomes. Work backward to calculate expected values: multiply outcomes by probabilities at chance nodes, then select the best option at decision nodes.

Building a Decision Tree

Step 1: Define the decision. State the choice clearly: "Should we launch Product X in Q2, delay to Q4, or cancel?" The decision must be actionable — something you control.

Step 2: Identify alternatives. List the options available at the decision point. Include "do nothing" or "status quo" if it's a real option. Most decisions have 2-4 meaningful alternatives; if you have more, you may need to structure the choice differently.

Step 3: Map uncertainties. For each alternative, identify what factors outside your control affect the outcome. Market size, competitive response, technology success, regulatory approval — these become chance nodes.

Step 4: Estimate probabilities. Assign probabilities to each uncertain outcome. Base these on data, expert judgment, or historical rates. Be honest about uncertainty — if you truly don't know, use a 50/50 split as a starting point and test sensitivity.

Step 5: Quantify payoffs. Assign a value to each terminal node. Use consistent units — typically net present value, profit contribution, or revenue. Include all relevant costs and benefits in the payoff.

Step 6: Calculate expected values. Work backward from terminal nodes. At chance nodes, calculate the probability-weighted average of outcomes. At decision nodes, identify the highest-value option. The result shows both the optimal decision and its expected value.

Quantitative vs. Qualitative Decision Trees

Quantitative decision trees include explicit probabilities and payoff values. They're appropriate when you can estimate these numbers with reasonable confidence — financial decisions, investment analysis, pricing strategy. The output is a recommended decision with an expected value.

Qualitative decision trees map the structure of a decision without assigning numbers. They're useful early in the process when you're clarifying what the decision actually involves, what outcomes matter, and what uncertainties you face. The output is shared understanding of the decision landscape.

Start qualitative to ensure you've captured the right structure. Move to quantitative when the decision warrants rigorous analysis and you have data (or reasonable estimates) for probabilities and payoffs.

Practical Applications in Business

Investment decisions: Should we build the factory? The tree maps capital costs, market scenarios (high/medium/low demand), and resulting cash flows. Sensitivity analysis reveals which assumptions drive the decision.

Product launches: Go, delay, or kill? Map development costs, launch scenarios, competitive responses, and market outcomes. The tree often reveals that "delay to gather more information" is the optimal strategy.

Make-or-buy decisions: Build capability in-house or outsource? Include upfront investment, operating costs under different volume scenarios, and strategic flexibility. Hidden costs often tip the analysis.

Pricing strategy: The tree maps price points, volume responses at each price, and competitor reactions. Expected revenue calculation shows where the optimal price point lies.

Market entry: Enter now, enter later, or don't enter? Map entry costs, competitive scenarios, and market size outcomes. The tree clarifies whether first-mover advantage justifies early entry risk.

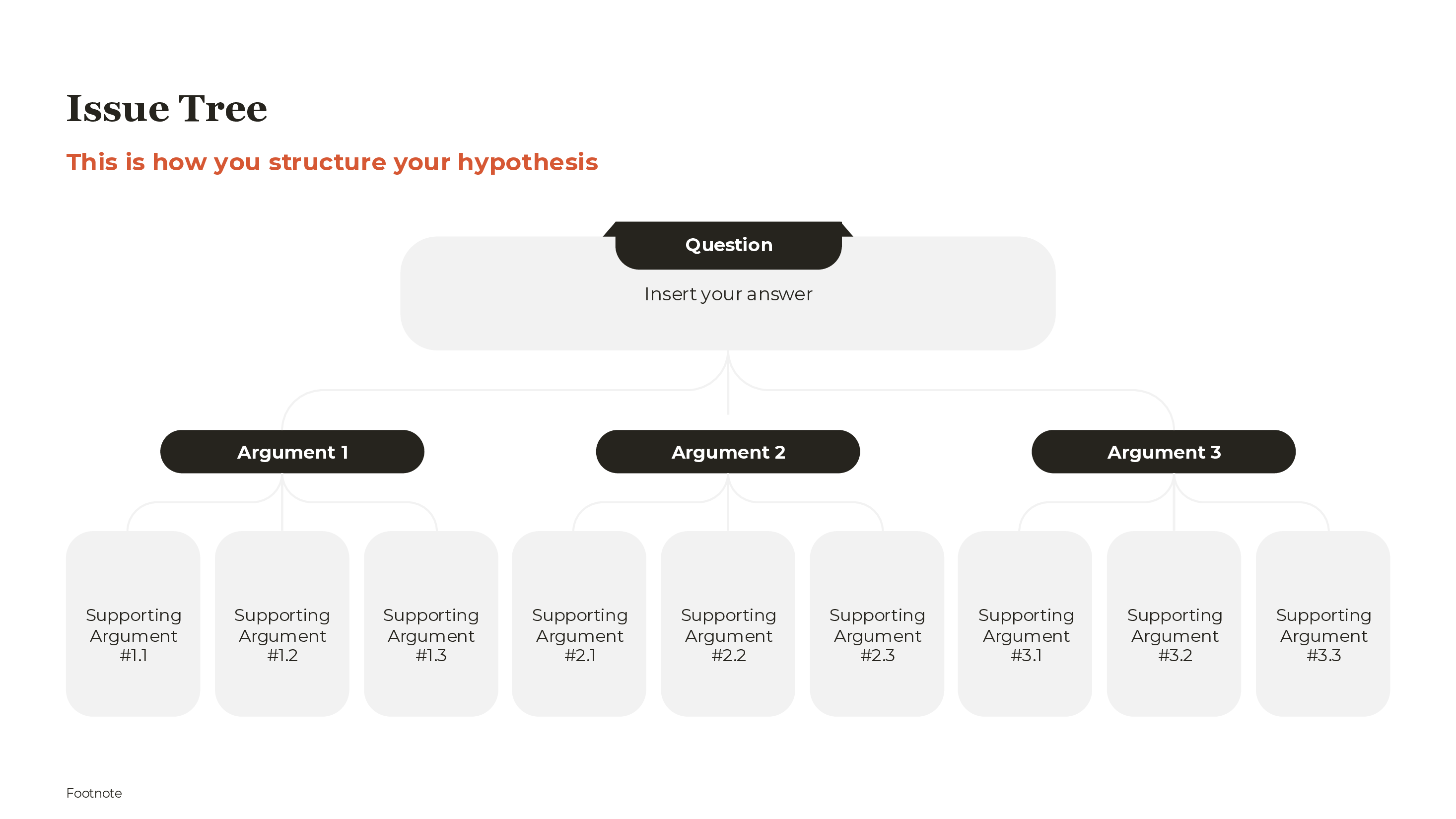

Decision Trees vs. Issue Trees

Consultants often confuse these tools because both look like branching diagrams. The distinction is fundamental:

Issue trees decompose problems. They break a complex situation into components for analysis. The output is understanding — what's causing the problem, what factors are relevant. Issue trees are diagnostic.

Decision trees evaluate choices. They compare alternatives and their outcomes. The output is a recommendation — which option to pursue. Decision trees are prescriptive.

In practice, you often need both. Start with an issue tree to diagnose the situation: "Why are sales declining?" Once you understand the causes, build a decision tree to evaluate solutions: "Should we cut prices, increase marketing, or exit the market?"

The structures are different too. Issue trees follow MECE logic — branches must be mutually exclusive and collectively exhaustive. Decision trees follow causal logic — branches represent choices or outcomes that occur in sequence.

Advanced Techniques

Sensitivity analysis: Test how the decision changes as you vary key assumptions. If the optimal choice flips when market size drops 10%, you know that estimate is critical.

Value of information: Calculate how much you'd pay to resolve an uncertainty before deciding. If knowing competitor response is worth $2M in improved decision-making, spending $100K on competitive intelligence is justified.

Sequential decisions: Real decisions often unfold over time. "Launch pilot, then decide on full rollout" is a sequential strategy. The tree structure captures optionality — the right to make future decisions based on what you learn.

Monte Carlo simulation: For complex trees with many uncertainties, simulate thousands of scenarios rather than calculating expected values analytically. This captures interactions between uncertainties that simple trees miss.

Building the Slide

Use squares for decision nodes, circles for chance nodes. Connect with angled lines, labeling branches with option names (at decisions) or outcome names with probabilities (at chance nodes).

Show payoffs at terminal nodes in consistent format. Display expected values in callout boxes at each node after "folding back" the calculations.

For presentation, build the tree in stages: first show the structure, then add probabilities, then reveal expected values and the optimal path. Color-code the recommended path to make the conclusion visually obvious.

Keep complexity manageable. If the tree has more than 15-20 nodes, split it across multiple slides or use a summary tree that references detailed sub-analyses.

For real-world examples and a step-by-step walkthrough, see our Decision Tree Examples, Decision Tree Analysis, and How to Make a Decision Tree.

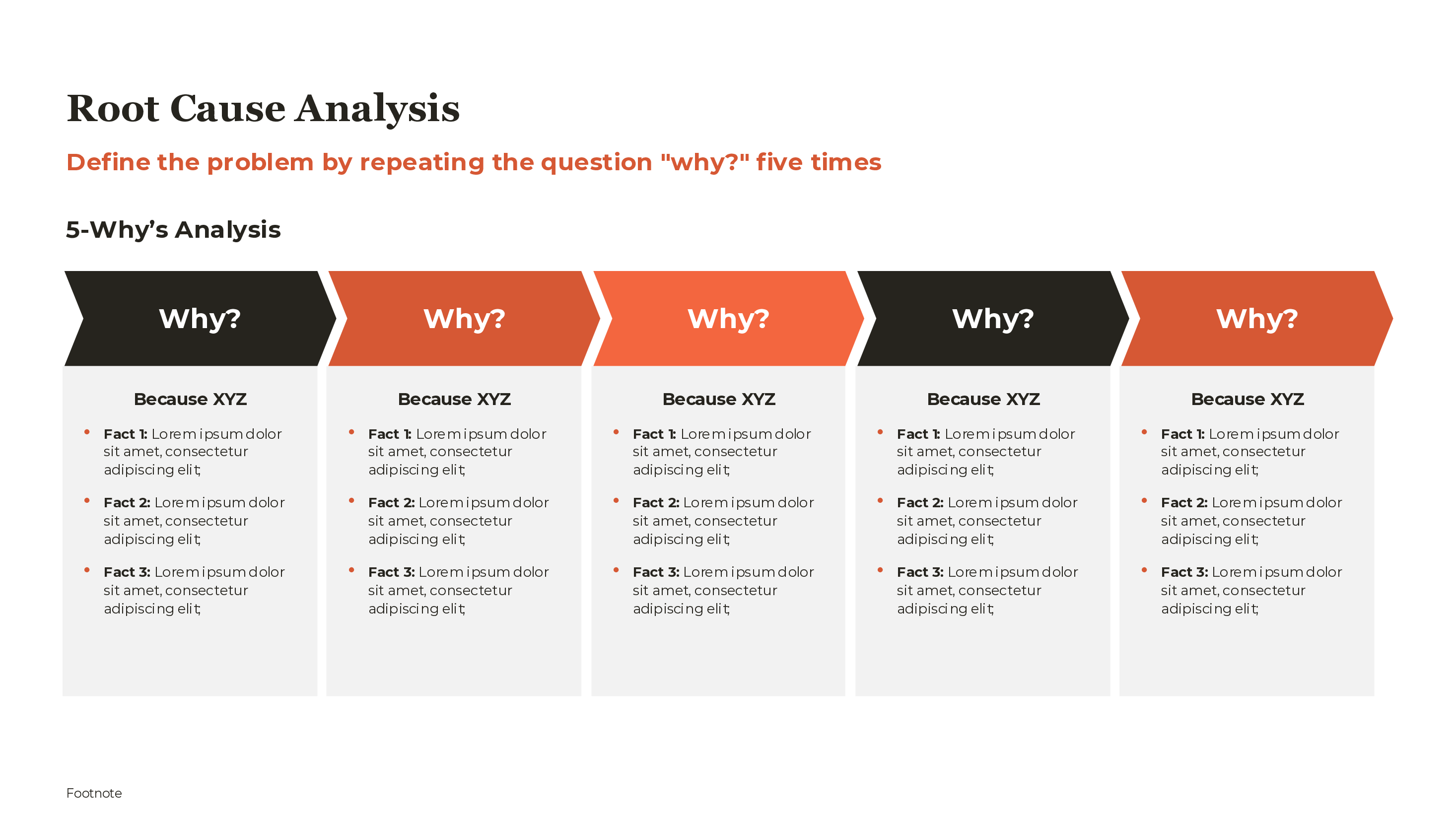

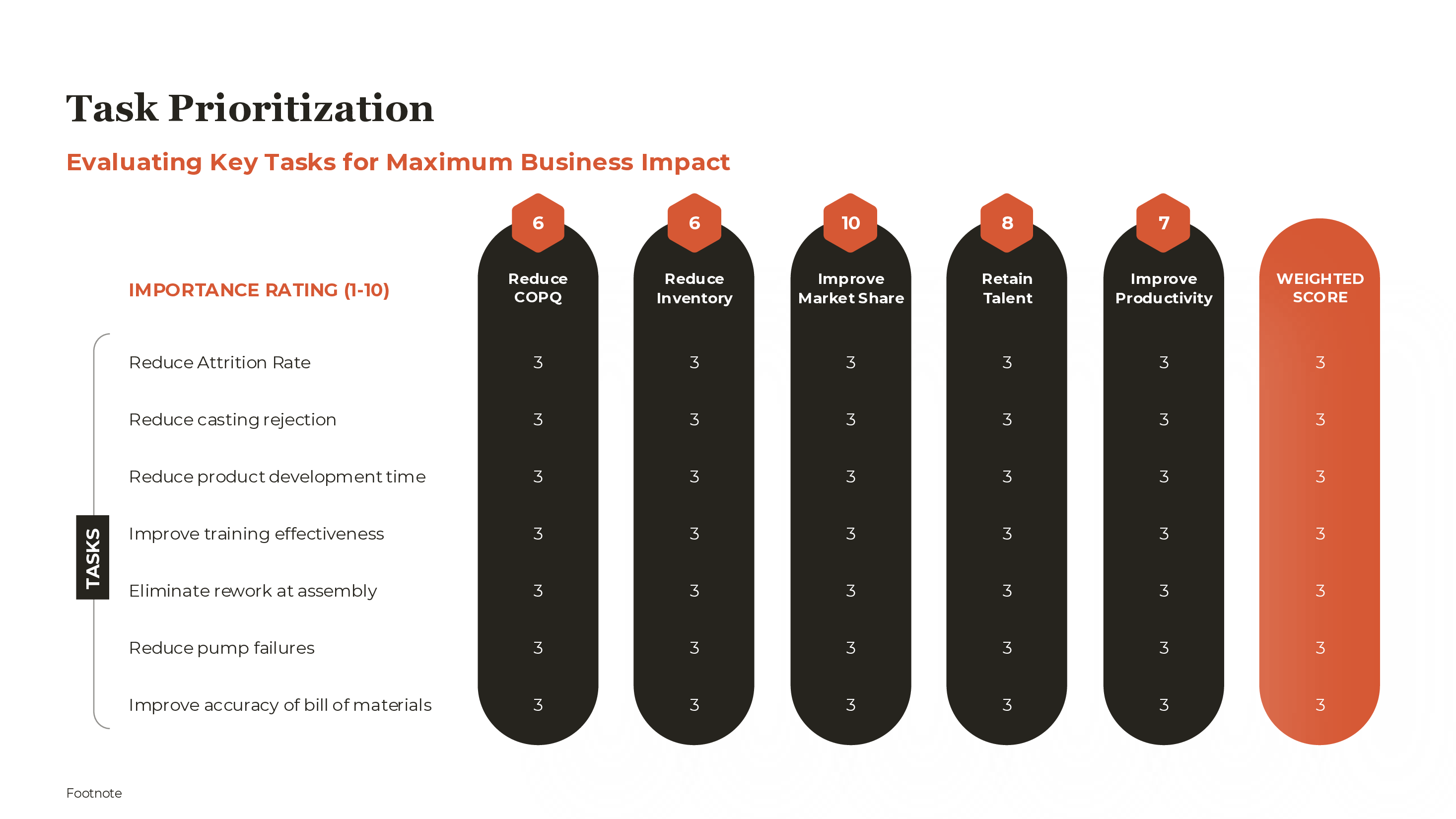

For related frameworks, see our issue tree template, root cause analysis template, and prioritization matrix template. For more on structured decision-making, explore our MECE framework guide.