Business Model Canvas Examples: 4 Worked Models With All 9 Blocks

Business model canvas examples for SaaS, marketplace, freemium, and consulting firms. All 9 building blocks filled in with real metrics and interconnections.

Alexander Osterwalder introduced the Business Model Canvas in 2010 through Strategyzer's Business Model Generation to solve a specific problem: strategy teams were writing 40-page business plans that no one read, when what they needed was a single-page view of how a business creates, delivers, and captures value.

The canvas works because it forces nine building blocks onto one page, making the connections between them visible. A value proposition that does not map to a defined customer segment is exposed immediately. A revenue stream with no supporting channel is impossible to miss.

After applying the Business Model Canvas across 80+ strategy engagements, corporate planning sessions, and new venture launches, we have identified what separates useful canvases from generic ones: specificity in each block and explicit connections between them. This guide walks through four complete business model canvas examples with all 9 blocks filled in, covers how to run a BMC workshop, and compares the canvas against Lean Canvas and Value Proposition Canvas. For the broader strategy toolkit, see our Strategic Frameworks Guide.

The 9 Building Blocks of the Business Model Canvas#

Before working through examples, a quick reference on what each block captures and how they connect:

| Block | What It Answers | Connects To |

|---|---|---|

| Customer Segments | Who are we serving? | Value Propositions, Channels, Relationships |

| Value Propositions | What problem do we solve for them? | Customer Segments, Channels |

| Channels | How do we reach and deliver to them? | Customer Segments, Value Propositions |

| Customer Relationships | How do we acquire, retain, and grow them? | Customer Segments, Revenue Streams |

| Revenue Streams | How do we make money from each segment? | Value Propositions, Customer Segments |

| Key Resources | What assets do we need? | Value Propositions, Key Activities |

| Key Activities | What must we do well? | Value Propositions, Key Resources |

| Key Partnerships | Who helps us do what we cannot do alone? | Key Activities, Key Resources |

| Cost Structure | What are the major cost drivers? | Key Resources, Key Activities, Key Partnerships |

The right side of the canvas (segments, propositions, channels, relationships, revenue) focuses on value creation and delivery. The left side (resources, activities, partnerships, cost) covers the infrastructure required to make it work. Revenue and cost sit at the bottom as the financial outcome.

Business Model Canvas Examples by Business Type#

The four examples below use realistic scenarios with specific metrics. Each shows how blocks interconnect -- not just what fills them. For a blank version you can customize, see our Business Model Canvas Template.

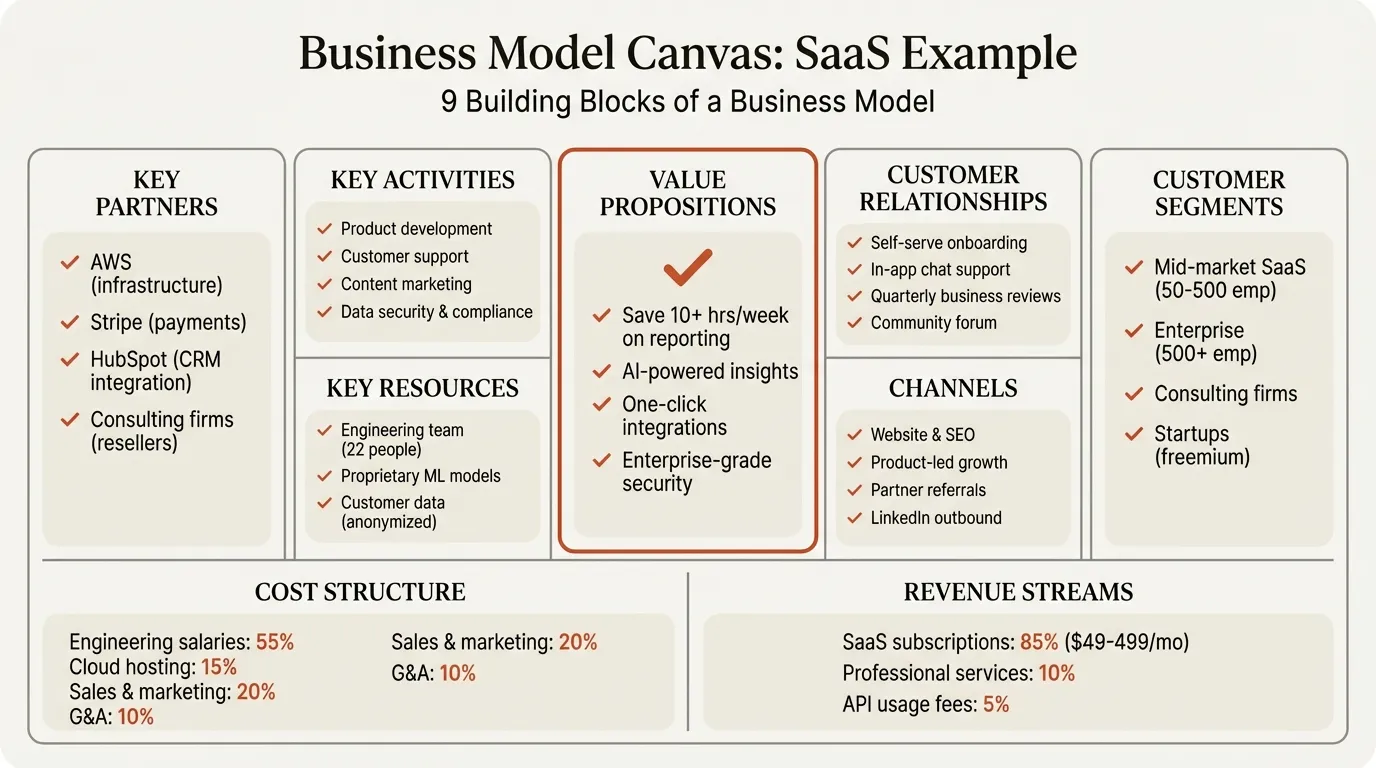

Example 1: B2B SaaS (Project Management Platform)#

Context: A Series B project management tool with $32M ARR serving mid-market companies (200-2,000 employees).

Customer Segments: Mid-market operations teams and PMOs. Secondary segment: professional services firms needing client-facing project visibility. 78% of revenue from companies with 200-2,000 employees.

Value Propositions: Reduces project delivery time by 23% through automated resource allocation and real-time dashboards. Replaces 3-4 point solutions (task tracking, time logging, resource planning, reporting) with a single platform.

Channels: Product-led growth via free trial (42% of new revenue). Inside sales for deals above $15K ACV. Partner channel through SI firms contributing 18% of pipeline.

Customer Relationships: Self-serve onboarding with in-app guides for free-trial users. Dedicated CSM for accounts above $25K ACV. Quarterly business reviews for enterprise accounts.

Revenue Streams: Annual SaaS subscriptions at $18K average ACV. Professional services (implementation, training) at 12% of total revenue. Usage-based add-on for advanced analytics at $3/user/month.

Key Resources: Engineering team (58% of headcount). Proprietary resource allocation algorithm (3 patents). Customer success team managing 340 accounts.

Key Activities: Product development (bi-weekly release cycles). Customer onboarding (average 14-day time-to-value). Data infrastructure maintenance (99.95% uptime SLA).

Key Partnerships: AWS for cloud infrastructure ($1.2M annually). Three SI partners for enterprise implementation. Integrations with Salesforce, Jira, and Slack.

Cost Structure: Engineering (52% of spend). Cloud infrastructure (14%). Sales and marketing (24%). G&A (10%). Gross margin: 78%.

Key interconnection: The product-led growth channel (free trial) feeds the inside sales motion. Users who convert from free trial have a 34% higher retention rate than outbound-sourced accounts because they have already validated the value proposition before purchasing. This connection between Channels and Customer Relationships directly impacts Revenue Streams through lower churn.

Example 2: Two-Sided Marketplace (Freelance Design Platform)#

Context: A marketplace connecting businesses with vetted freelance designers. $14M in gross merchandise volume, 8% take rate, with 4,200 active freelancers and 1,800 active clients.

Customer Segments: Two distinct sides. Supply: Mid-career freelance designers (5-15 years experience) who want steady project flow without agency overhead. Demand: Marketing teams at companies with 50-500 employees who need design talent faster than hiring allows.

Value Propositions: For freelancers: consistent project pipeline ($6,200 average monthly earnings for top-quartile), payment protection (escrowed funds), and no business development effort. For clients: pre-vetted talent (only 12% of applicants accepted), 48-hour average match time, and no recruitment fees.

Channels: Freelancer acquisition through portfolio review and referral bonuses ($500 per accepted referral). Client acquisition through content marketing (SEO drives 38% of client signups), LinkedIn outreach (27%), and word-of-mouth (35%).

Customer Relationships: Algorithmic matching with manual curation for projects above $10K. Account managers for clients spending over $50K annually. Community forums and skill-building webinars for freelancer retention.

Revenue Streams: 8% platform fee on completed projects (charged to client). Featured listing fees for freelancers ($99/month, 14% adoption). Rush matching premium ($250 flat fee for 24-hour turnaround).

Key Resources: Vetting team (12 people reviewing 800+ applications monthly). Matching algorithm trained on 28,000 completed projects. Trust and safety infrastructure (escrow, dispute resolution).

Key Activities: Supply quality control (ongoing portfolio reviews, client satisfaction tracking). Demand generation (content marketing producing 45 articles/month). Platform development (matching algorithm optimization).

Key Partnerships: Payment processor (Stripe) for escrow and international payouts. Design tool partnerships (Figma, Adobe) for freelancer benefits. Staffing agencies for overflow demand.

Cost Structure: Engineering and product (34%). Sales and marketing (28%). Vetting and trust operations (18%). Payment processing (5%). G&A (15%). Net take-rate margin after costs: 3.2%.

Key interconnection: The 12% acceptance rate is the engine that makes everything work. It constrains supply growth but drives the value proposition on both sides: clients trust the talent quality, and accepted freelancers earn more because they are not competing with thousands of low-cost alternatives. Loosening the acceptance rate would increase volume but destroy the pricing power that sustains the 8% take rate.

Example 3: Freemium Consumer App (Personal Finance Tracker)#

Context: A mobile-first personal finance app with 2.8M registered users, 340,000 monthly active users, and 42,000 premium subscribers ($7.99/month).

Customer Segments: Primary: millennials and Gen Z (ages 22-38) earning $45K-$120K who want visibility into spending without the complexity of traditional budgeting tools. Secondary (premium): users with investment accounts and multiple financial goals who need portfolio tracking and forecasting.

Value Propositions: Free tier: automatic transaction categorization, spending insights, and bill reminders -- replacing manual spreadsheet tracking. Premium tier: investment tracking, goal-based forecasting, tax-loss harvesting alerts, and multi-account net worth dashboard.

Channels: App Store and Google Play organic search (31% of installs). Social media (TikTok and Instagram financial content creators, 28%). Referral program (22% -- users get 1 free month of premium per referral). Paid acquisition via Google and Meta (19%).

Customer Relationships: Fully automated for free tier (push notifications, in-app tips). Email nurture sequences for premium conversion (12-touch sequence over 60 days). In-app chat support for premium users (average response time: 4 minutes).

Revenue Streams: Premium subscriptions: $7.99/month or $59.99/year (73% choose annual). Affiliate commissions from financial product recommendations: $2.40 average per qualified referral. Anonymized, aggregated spending data licensing to market research firms: $800K annually.

Key Resources: Bank data aggregation partnerships (covers 11,400 financial institutions). Machine learning models for transaction categorization (94.3% accuracy). Mobile engineering team (22 people).

Key Activities: Data pipeline reliability (bank connections break frequently; maintaining 97%+ uptime is a core challenge). ML model retraining (monthly, using corrected categorizations). User acquisition optimization (target CAC under $2.80 for free users).

Key Partnerships: Plaid for bank data aggregation ($0.12 per connected account per month). Financial product partners (credit cards, savings accounts) for affiliate revenue. Cloud infrastructure (GCP).

Cost Structure: Engineering and data (44%). Data aggregation fees (16%). User acquisition (22%). Support (8%). G&A (10%). Free-to-premium conversion rate: 1.5%. LTV of premium subscriber: $187. CAC for premium conversion: $38.

Key interconnection: The free tier is not charity -- it is the acquisition engine. The 2.8M free users generate the aggregated spending data that produces $800K in licensing revenue and create the funnel for premium conversion. The economics only work because free-tier marginal cost ($0.12/user/month in Plaid fees) stays below the combined value of data licensing revenue per user and the 1.5% conversion probability multiplied by $187 LTV.

Example 4: Consulting and Professional Services Firm#

Context: A 45-person management consulting firm specializing in digital transformation for financial services companies. $16M annual revenue, headquartered in New York.

Customer Segments: Tier 1: C-suite at mid-size banks and insurance companies ($1B-$20B in assets) undertaking core system modernization. Tier 2: Chief Digital Officers at large financial institutions needing transformation strategy and vendor selection. 80% of revenue from Tier 1.

Value Propositions: Reduces core banking transformation timeline by 30-40% through proprietary implementation methodology tested across 22 completed migrations. Unlike MBB firms, all project work is partner-led (not delegated to junior staff after the pitch). Unlike IT consultancies, the firm combines strategic advisory with hands-on implementation oversight.

Channels: Partner referral networks and conferences (42% of new business). Thought leadership -- published research on financial services modernization (28%). Alumni referrals from former clients now at new institutions (30%).

Customer Relationships: Long-term advisory (average client engagement: 18 months). Executive workshops and quarterly steering committees. Post-project support retainers (38% of clients retain advisory access after project completion).

Revenue Streams: Project-based fees (75% of revenue, average engagement: $620K). Monthly advisory retainers (18% of revenue, $25K-$45K/month). Training and capability building workshops (7% of revenue).

Key Resources: Senior consultants with financial services operating experience (average 14 years in industry). Proprietary transformation methodology and benchmarking database (180+ data points across 22 migrations). Partner relationships and personal reputations.

Key Activities: Client delivery (target 65% consultant utilization). Methodology refinement based on project learnings. Business development through thought leadership and relationship management.

Key Partnerships: Technology vendors (Temenos, FIS, Thought Machine) for implementation expertise and co-selling. Niche subcontractors for data migration and testing. Industry associations (ABA, ACORD) for conference access and credibility.

Cost Structure: Compensation (68% of revenue -- highest cost by far). Travel and expenses (8%). Technology and tools (4%). Business development (6%). Office and G&A (14%). Operating margin: 18%.

Key interconnection: The partner-led delivery model is both the value proposition and the growth constraint. It drives the 18-month average engagement length and 38% retainer conversion rate (clients stay because they trust the specific people). But it caps growth -- the firm cannot scale beyond what its senior partners can personally oversee without diluting the exact thing clients pay for. Every growth decision filters through this tension. For more on how consulting firms navigate competitive positioning, see our Competitive Analysis Examples.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

How to Run a Business Model Canvas Workshop#

A canvas filled out alone at a desk is a hypothesis. A canvas built with cross-functional stakeholders is a shared understanding. Here is how to run a workshop that produces the second kind.

Preparation (before the session):

- Invite 6-10 participants from different functions (product, sales, finance, operations, customer success)

- Share a blank canvas and the 9 block definitions 48 hours in advance

- Ask each participant to bring 3-5 sticky notes for the block most relevant to their function

Session structure (90-120 minutes):

-

Customer Segments (15 min) -- Start here because every other block depends on knowing who you serve. Define segments by behavior and needs, not demographics. Ask: "If we had to pick one segment to serve and ignore the rest, which one?"

-

Value Propositions (20 min) -- For each segment, define what job you do for them. Be specific. "We help mid-market PMOs reduce project delivery time by 23%" is useful. "We provide a great project management solution" is not. Reference SWOT Analysis Examples for identifying where your value proposition aligns with organizational strengths.

-

Channels and Customer Relationships (15 min) -- How do customers discover, evaluate, purchase, and receive the value proposition? These are two separate blocks because how someone finds you (channel) is different from how you maintain the relationship over time.

-

Revenue Streams (10 min) -- How does each segment pay? Subscription, transaction, licensing, advertising? What is the pricing model and average deal size?

-

Key Resources, Activities, and Partnerships (20 min) -- What do you need to deliver the value proposition? What must you do well versus outsource? These three blocks are tightly coupled and work best discussed together.

-

Cost Structure (10 min) -- What are the biggest cost drivers? Is the model cost-driven (minimize spend) or value-driven (premium positioning)?

-

Connections review (15 min) -- The most important step. Walk through the canvas and draw arrows between blocks that depend on each other. If you cannot trace a clear path from Customer Segments through Value Propositions to Revenue Streams, something is missing.

After the workshop: Photograph the physical canvas, digitize it into a clean slide, and circulate within 24 hours. Schedule a 30-minute follow-up one week later to validate assumptions that surfaced during the session. Build your presentation using our Business Model Canvas Template.

BMC vs Lean Canvas vs Value Proposition Canvas#

Three popular canvas frameworks serve different purposes. Choosing the wrong one wastes the session.

| Dimension | Business Model Canvas | Lean Canvas | Value Proposition Canvas |

|---|---|---|---|

| Creator | Alexander Osterwalder (2010) | Ash Maurya (2012) | Osterwalder & Pigneur (2014) |

| Best for | Established businesses, corporate strategy | Early-stage startups, pre-revenue ventures | Deep-diving into product-market fit |

| Scope | Full business model (9 blocks) | Problem-solution fit (9 blocks, different focus) | Single customer segment and value proposition |

| Unique blocks | Key Partnerships, Customer Relationships | Problem, Solution, Unfair Advantage, Key Metrics | Customer Jobs, Pains, Gains, Pain Relievers, Gain Creators |

| Replaced blocks | -- | Replaces Partnerships, Relationships, Resources, Activities | N/A (zooms into 2 blocks of BMC) |

| Time to complete | 90-120 min (workshop) | 30-45 min (rapid iteration) | 45-60 min (per segment) |

| When to avoid | Pre-product-market fit (too much infrastructure focus) | Post-Series A (too problem-focused, ignores operations) | When business model, not product, is the question |

Use BMC when you need a complete picture of how a business operates -- strategy offsites, annual planning, M&A due diligence.

Use Lean Canvas when you are testing whether a problem worth solving exists and whether anyone will pay for your solution.

Use Value Proposition Canvas when you have a defined customer segment but need to sharpen exactly what value you deliver and how. It zooms into the Customer Segments and Value Propositions blocks of the BMC.

In practice, many teams start with Lean Canvas during validation, expand to BMC once the business model stabilizes, and use Value Proposition Canvas whenever they enter a new segment. Understanding product lifecycle stages helps determine which canvas fits your current phase.

Common Mistakes With the Business Model Canvas#

After facilitating 80+ canvas workshops, the same errors surface repeatedly:

Treating blocks as independent lists. The canvas is a system, not nine separate brainstorms. If your Value Propositions do not directly address a specific Customer Segment's needs, and your Channels do not match how that segment actually buys, you have nine lists -- not a business model. The connections between blocks matter more than the content within them.

Being too generic in the Value Proposition. "We provide high-quality solutions" fills the block but communicates nothing. A useful value proposition is specific enough to be falsifiable: "We reduce core banking migration timelines by 30-40% versus the industry average of 18-24 months." If a competitor could copy your Value Proposition text word-for-word, it is not specific enough.

Confusing Channels with Customer Relationships. Channels are how you reach and deliver value (website, sales team, app store, partner network). Customer Relationships describe how you interact over time (self-service, dedicated account management, community, co-creation). A website is a channel. An automated email nurture sequence is a customer relationship. Many teams collapse these into one block and lose the distinction between acquisition and retention.

Filling in blocks in isolation. Teams that start with Key Resources or Cost Structure before defining Customer Segments build infrastructure for a customer they have not identified. Always start with the right side of the canvas (who you serve and what value you deliver) before designing the left side (how you deliver it).

Confusing the canvas with a strategy. As Harvard Business Review's work on business model innovation emphasizes, the BMC describes how a business model works today. It does not prescribe what to change. Pair it with frameworks like SWOT analysis to identify which blocks need strengthening and which external forces threaten the current model.

Summary#

Effective business model canvas examples demonstrate three things that generic ones miss:

- Specificity in every block -- metrics, customer behaviors, and operational details replace vague descriptions

- Explicit connections between blocks -- the value proposition maps to a segment, the channel matches how that segment buys, and the cost structure reflects the resources needed to deliver

- Honest assessment of constraints -- every business model has a tension (the consulting firm that cannot scale without diluting quality, the marketplace that cannot loosen vetting without destroying pricing power)

- Right-to-left construction -- start with who you serve and what value you deliver before designing infrastructure

The four examples above show how different business types produce fundamentally different canvases. A SaaS model centers on product-led growth and recurring revenue. A marketplace must balance two-sided value propositions. A freemium model depends on free-tier economics justifying the conversion funnel. A consulting firm's model revolves around the people who deliver it.

For a blank canvas you can fill in with your own data, start with our Business Model Canvas Template. For the broader strategic framework toolkit, see our Strategic Frameworks Guide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free