Market Sizing Template: Top-Down and Bottom-Up on One Slide

Free market sizing template for PowerPoint. Top-down and bottom-up estimates with reconciliation, two worked examples, and common assumption errors.

Most market sizing slides show a single number — a top-down TAM pulled from a Gartner report. Partners and investors see through this immediately. One number from one source with no methodology visible tells them nothing about your analytical rigor. It tells them you Googled "cybersecurity market size" and put the first result on a slide.

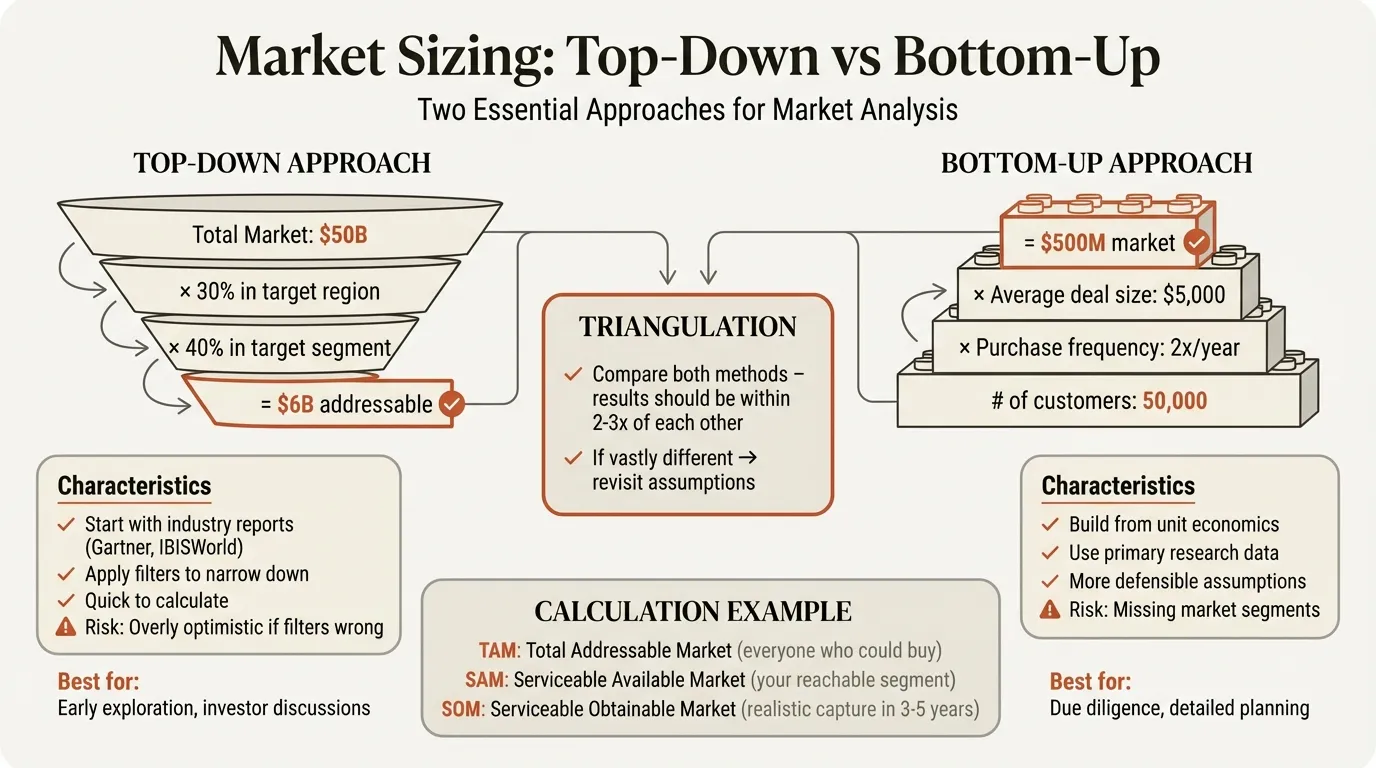

What earns credibility is showing two independent approaches — top-down and bottom-up — that converge on a similar figure. The convergence is the proof. If your top-down estimate says $14B and your bottom-up calculation yields $12B, that 15% gap actually builds confidence because it shows you triangulated rather than cherry-picked. After building market sizing slides for 60+ strategy engagements and due diligence projects at BCG, we've refined this dual-methodology layout into a template that consistently passes partner review. For broader consulting slide principles, see our Consulting Presentations Guide.

Market Sizing: Two Approaches, One Slide#

| Approach | Starts With | Ends With | Strengths | Weaknesses |

|---|---|---|---|---|

| Top-down | Total industry revenue | Narrow by segment, geography, share | Fast, uses published data, defensible sources | Can overestimate if filters are loose |

| Bottom-up | Unit economics (customers x price) | Build up to total market | Grounded in real economics, testable assumptions | Can underestimate if you miss segments |

Neither approach alone is sufficient. Top-down risks being disconnected from reality. Bottom-up risks being too narrow. The consulting standard is to show both and reconcile.

Structuring the Dual-Methodology Slide#

The slide has three zones: a title bar at the top stating the market size and methodology, two columns in the middle (top-down on the left, bottom-up on the right), and a reconciliation bar at the bottom showing the gap analysis and range statement.

Use an action title, not a label. "Enterprise cybersecurity market is $12-14B, validated by two independent sizing approaches" tells the audience the answer. The slide body shows the work. This follows the Pyramid Principle.

Each column shows 3-4 calculation steps as a vertical waterfall or build-up. The top-down column narrows from a large starting number through successive filters. The bottom-up column starts with unit economics and builds upward. Always cite sources — uncited market sizing numbers lose credibility immediately.

Deckary's AI Slide Builder generates market sizing slides from a text description in seconds — no manual shape formatting needed. For alignment shortcuts when building manually, see our PowerPoint alignment shortcuts guide.

Worked Example 1: Enterprise Cybersecurity Market#

A strategy team is sizing the enterprise cybersecurity market for a PE firm evaluating an acquisition target. The slide needs to show the addressable market for endpoint and network security solutions sold to large enterprises.

Slide title: "Enterprise endpoint + network security market is $12-14B, supported by top-down and bottom-up convergence"

Top-Down (Left Column)#

| Step | Filter | Value |

|---|---|---|

| 1. Global IT security spending (2026) | Starting point | $186B |

| 2. Enterprise segment (>500 employees) | x 48% | $89.3B |

| 3. Endpoint + network security | x 16% of enterprise security spend | $14.3B |

Sources: Gartner IT Security Spending Forecast, IDC Security Products Tracker

Bottom-Up (Right Column)#

| Step | Building Block | Value |

|---|---|---|

| 1. Enterprise companies globally (>500 emp.) | 142,000 establishments | -- |

| 2. Average cybersecurity budget | $95K per company (endpoint + network) | -- |

| 3. Total spend | 142,000 x $95K | $13.5B |

| 4. Adjusted for outsourced/managed | x 90% direct spend | $12.1B |

Sources: Bureau of Labor Statistics (establishment counts), CyberEdge Group CDR Report (budget benchmarks)

Reconciliation#

Top-down: $14.3B | Bottom-up: $12.1B | Delta: 15%

The top-down estimate includes managed security services revenue that flows through endpoint/network vendors. The bottom-up estimate captures only direct enterprise spending. Adjusting the top-down by removing the estimated managed services pass-through (~$2B) brings it to $12.3B — within 2% of the bottom-up figure.

Stated range: $12-14B

This level of math transparency is what separates a consulting-grade market sizing from a pitch deck number. The partner reviewing this slide can challenge any individual assumption — the 48% enterprise share, the $95K average budget, the 142K establishment count — and the analyst can defend each one with a cited source.

Continue reading: 30-60-90 Day Plan Template · Bar Charts in PowerPoint · Investment Banking Pitch Book

Free consulting framework templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Worked Example 2: Plant-Based Protein in the US Foodservice Channel#

A different sector to show how the same dual-methodology structure applies. A CPG company is evaluating an acquisition in the plant-based protein space and needs the US foodservice TAM.

Slide title: "US foodservice plant-based protein market is $2.8-3.4B, with top-down and bottom-up estimates converging within 18%"

Top-Down (Left Column)#

| Step | Filter | Value |

|---|---|---|

| 1. US foodservice market (2026) | Starting point | $1.1T |

| 2. Protein as % of food spend | x 22% | $242B |

| 3. Plant-based share of protein | x 1.4% (SPINS/IRI data) | $3.4B |

Sources: Technomic US Foodservice Forecast, SPINS Plant-Based Category Data

Bottom-Up (Right Column)#

| Step | Building Block | Value |

|---|---|---|

| 1. US foodservice establishments | 1,010,000 locations | -- |

| 2. % offering plant-based items | x 38% (menu penetration) | 384,000 |

| 3. Avg. annual plant-based purchasing | $7,300 per location | -- |

| 4. Total plant-based foodservice spend | 384K x $7.3K | $2.8B |

Sources: NRA Restaurant Industry Forecast (location counts), Datassential MenuTrends (penetration), distributor invoice analysis (avg. spend)

Reconciliation#

Top-down: $3.4B | Bottom-up: $2.8B | Delta: 18%

The gap is driven by the top-down including institutional foodservice (hospitals, schools, corporate cafeterias) where plant-based menu penetration is lower but total volumes are significant. The bottom-up's 38% penetration rate is weighted toward commercial restaurants, which skews the average purchasing figure downward. Adjusting the bottom-up to include institutional at an estimated 22% penetration adds ~$0.4B, narrowing the gap to 6%.

Stated range: $2.8-3.4B

Notice how the reconciliation itself generates analytical value. The gap is not a problem to explain away — it reveals that institutional foodservice is an underpenetrated segment that the acquisition target could expand into.

Mistakes That Undermine Market Sizing Slides#

1. Mixing Top-Down and Bottom-Up Without Reconciling#

The most common failure. Analysts present a top-down number on one slide and a bottom-up number on another, with no attempt to explain the gap. Or worse, they average the two and present the midpoint as "the answer." The reconciliation is the analysis. It forces you to understand why the approaches diverge and what that divergence means strategically.

2. Using Stale TAM Numbers Without Adjustment#

Citing a 2022 Gartner report for a 2026 market sizing. Industry reports age fast, especially in high-growth categories. If your source is older than 18 months, apply a growth rate to bring it forward. Better yet, find a more recent source. When you must use older data, state the original year and your adjustment methodology explicitly.

3. Conflating Addressable and Obtainable Market#

TAM (Total Addressable Market) is the full revenue opportunity if you had 100% market share. SAM (Serviceable Addressable Market) is the portion you can actually reach with your product and go-to-market. SOM (Serviceable Obtainable Market) is what you can realistically capture in a defined timeframe. Most market sizing mistakes happen when analysts present the TAM as if it were the SAM — or when they filter the top-down to a segment but call the result "addressable" without testing whether the company can actually serve that segment. For the investor-facing version of this breakdown, see our TAM SAM SOM template.

4. Mismatching Scope Between Approaches#

Your top-down and bottom-up must size the same market. If the top-down includes managed services but the bottom-up excludes them, the reconciliation gap becomes meaningless. Define scope upfront — geography, product category, customer segment — and apply it consistently to both columns. When scope differs, call it out explicitly in the reconciliation.

Showing Only One Methodology#

If you only show top-down, the audience wonders whether the number is grounded in reality. If you only show bottom-up, they wonder whether you've captured the full market. The reconciliation between them is your strongest credibility signal.

False Precision#

Writing "$14.327B" implies a level of accuracy that market sizing doesn't support. Round to the nearest billion for TAM-scale numbers. Better yet, state a range. "$12-14B" is more honest and more credible than "$13.2B."

Burying the Assumptions#

If your bottom-up depends on "142,000 enterprises spending $95K each," those two numbers need to be visible on the slide — not buried in an appendix. The assumptions are the analysis. Hide them, and you've just put a number on a slide with no supporting logic.

Summary#

A credible market sizing slide shows the work, not just the answer:

- Dual-column layout — top-down on the left, bottom-up on the right

- 3-4 steps per approach — more than four over-segments and clutters the slide

- Reconciliation bar at the bottom — show the gap, explain it, state a range

- Cite every source — uncited numbers lose credibility instantly

- State ranges, not point estimates — $12-14B beats $13.2B every time

- Make assumptions visible — the numbers behind the numbers are the analysis

For building structured slides with precise alignment, Deckary offers formatting shortcuts that handle the layout work so you can focus on the analysis. Find market sizing templates in our slide library. See also our TAM SAM SOM template for the investor-facing version of market sizing, our Strategic Frameworks Guide, and our guide to consulting slide standards for the formatting rules that apply to every MECE strategy slide.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free