TAM SAM SOM Template: Market Sizing Slides for Investor Presentations

Learn how to calculate TAM, SAM, and SOM for your pitch deck. Includes formulas, real-world examples, visualization best practices, and mistakes to avoid.

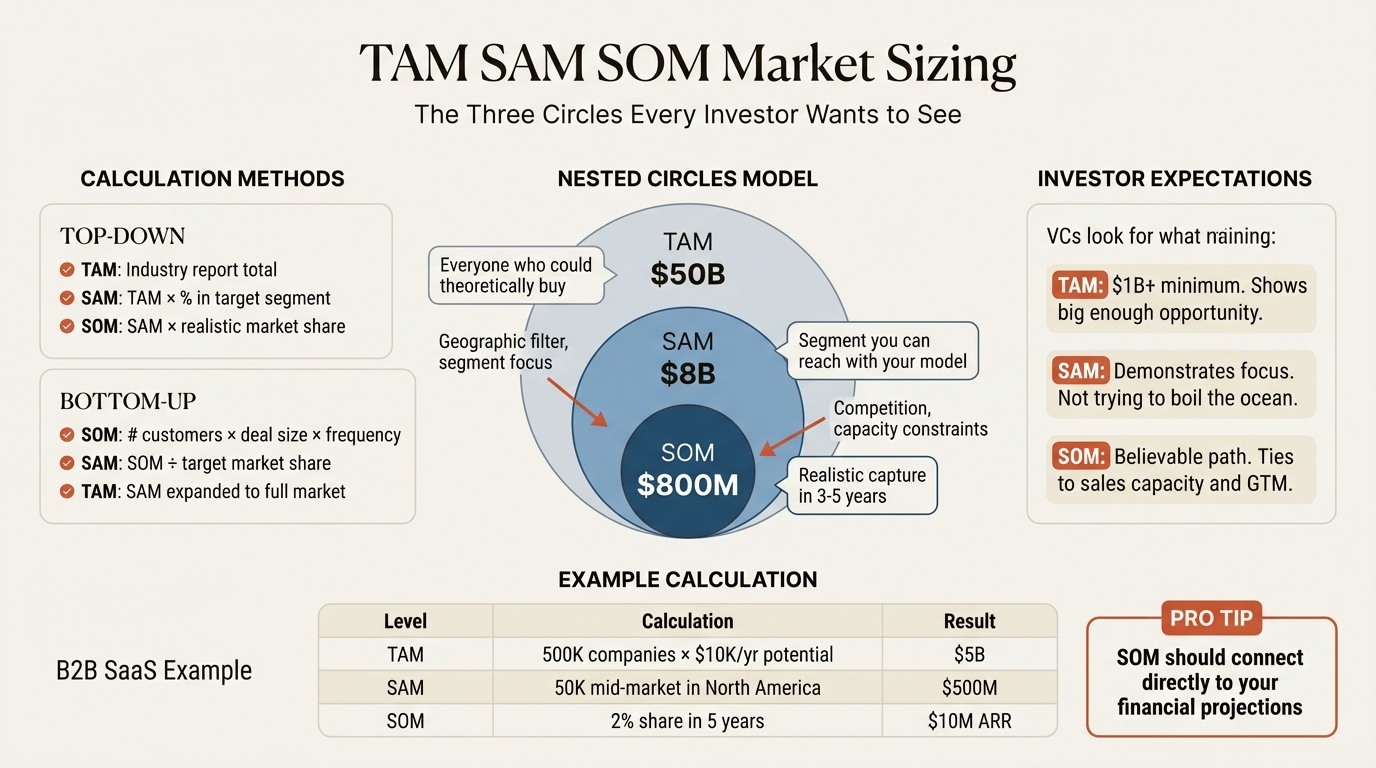

TAM, SAM, and SOM are the three metrics investors use to evaluate market opportunity in your pitch deck. TAM (Total Addressable Market) is the total revenue opportunity if you had 100% market share. SAM (Serviceable Addressable Market) is the portion you can actually reach with your business model. SOM (Serviceable Obtainable Market) is the realistic share you can capture in 3-5 years.

These metrics matter because investors use market sizing to evaluate both the opportunity and your judgment as a founder. A bottom-up TAM built from customer counts and pricing shows you understand your market. A top-down number pulled from an analyst report often signals the opposite.

This guide covers what TAM, SAM, and SOM actually mean, how to calculate each metric correctly, common mistakes that kill credibility, and how to visualize market sizing for maximum impact.

What Is TAM SAM SOM?#

TAM, SAM, and SOM are three metrics that describe market opportunity at different levels of realism. Developed as a framework for evaluating market potential, these metrics help founders and investors assess whether a business opportunity is worth pursuing.

| Metric | Full Name | Definition | Key Question |

|---|---|---|---|

| TAM | Total Addressable Market | Total market demand for your product/service | How big is the entire opportunity? |

| SAM | Serviceable Addressable Market | Portion of TAM you can reach with your business model | What can you actually serve? |

| SOM | Serviceable Obtainable Market | Realistic market share you can capture | What will you realistically win? |

Think of these as three concentric circles, with TAM as the outer ring and SOM as the bullseye.

Why These Three Metrics Matter#

Each metric serves a different analytical purpose:

TAM answers: "Is this market big enough to build a large company?" Venture capitalists typically want TAM of $1 billion or more to justify the risk of early-stage investment. A small TAM means limited upside even if everything goes perfectly.

SAM answers: "Given our specific approach, how much of that market can we actually serve?" A ride-sharing company's TAM might be all transportation spending, but their SAM is limited to urban areas with smartphone penetration and regulatory approval.

SOM answers: "What share can we realistically capture in 3-5 years?" This is where competitive dynamics, execution ability, and market penetration rates come into play.

The Investor Perspective#

From an investor's standpoint, TAM SAM SOM analysis reveals several things:

- Market attractiveness: Is this opportunity big enough?

- Founder judgment: Do they understand their market realistically?

- Go-to-market clarity: Is there a logical path from today to their SOM?

- Competitive awareness: Do they understand what limits their serviceable market?

A founder who claims 50% market share in year three signals naivety. A founder who shows thoughtful analysis of why they can capture 2-3% of a defined segment demonstrates business acumen.

How to Calculate TAM (Total Addressable Market)#

TAM represents the total revenue opportunity if you achieved 100% market share. There are two primary methods to calculate it.

Method 1: Top-Down Analysis#

Top-down starts with published market research and applies filters to reach your specific opportunity.

Formula:

TAM = Total Industry Market Size x Relevant Segment Percentage

Example calculation for a B2B SaaS product:

| Step | Calculation | Result |

|---|---|---|

| Global SaaS market (source: Gartner) | Given | $300B |

| Enterprise segment (vs SMB) | x 60% | $180B |

| Project management vertical | x 8% | $14.4B |

| TAM | — | $14.4B |

Pros: Fast, uses credible third-party sources, easy to cite Cons: May not reflect your actual opportunity, can inflate numbers, less credible to sophisticated investors

Method 2: Bottom-Up Analysis#

Bottom-up starts with your specific target customers and builds up to total market potential.

Formula:

TAM = Number of Potential Customers x Average Annual Contract Value

Example calculation for the same B2B SaaS product:

| Step | Calculation | Result |

|---|---|---|

| Companies with 500+ employees globally | Count | 85,000 |

| Companies needing project management tools | x 90% | 76,500 |

| Average contract value (enterprise tier) | x $15,000 | — |

| TAM | 76,500 x $15,000 | $1.15B |

Pros: Highly credible, shows you understand your customer, harder to inflate Cons: Requires more research, may miss market segments

Which Method Should You Use?#

For investor presentations, use both methods and triangulate.

Show the bottom-up calculation as your primary number (it's more credible), then reference top-down research as a sanity check. If your bottom-up TAM is $1.15B and industry reports suggest $14B for the broader category, you can explain that your focused approach targets a specific segment of that larger market.

| Situation | Recommended Approach |

|---|---|

| Seed/Series A pitch | Bottom-up (demonstrates customer understanding) |

| Board presentations | Both methods, reconciled |

| Internal planning | Bottom-up (more actionable) |

| Market expansion analysis | Top-down (for new segments) |

Common TAM Mistakes#

Mistake 1: Using the wrong market definition

If you're building accounting software for restaurants, your TAM isn't "the $500B restaurant industry." It's the total spending on accounting software by restaurants. Market definition should match what customers actually spend on your category.

Mistake 2: Counting the same customer multiple times

If your product serves both the finance team and the operations team at the same company, don't count that company twice unless they would genuinely purchase separate licenses.

Mistake 3: Including markets you won't enter

A US-focused startup shouldn't include the Chinese market in their TAM unless there's a realistic path to serving it.

How to Calculate SAM (Serviceable Addressable Market)#

SAM narrows TAM to the portion you can actually reach with your current business model, go-to-market strategy, and geographic focus.

The SAM Formula#

SAM = TAM x Serviceable Percentage

The serviceable percentage is determined by your specific constraints:

| Constraint Type | Example Filter |

|---|---|

| Geographic | "We only operate in North America" |

| Customer segment | "We only serve enterprises (500+ employees)" |

| Use case | "We only serve companies using Salesforce" |

| Distribution | "We only sell direct, not through partners" |

| Technology | "Our solution only works on cloud infrastructure" |

SAM Calculation Example#

Continuing the B2B SaaS example:

| Step | Calculation | Result |

|---|---|---|

| TAM (from bottom-up) | Given | $1.15B |

| North America only | x 45% | $517M |

| Companies using Salesforce (integration requirement) | x 55% | $284M |

| Companies with budget authority | x 80% | $228M |

| SAM | — | $228M |

What Filters Define Your SAM?#

Your SAM filters should reflect genuine limitations of your business model, not arbitrary reductions. Ask yourself:

- Geographic reach: Where can you actually sell and support customers?

- Customer profile: Who is your ideal customer, and who can't you serve?

- Technical requirements: What infrastructure must customers have?

- Regulatory limits: Are there markets you legally cannot enter?

- Distribution capability: Can you reach all potential customers?

SAM Best Practices#

Be honest about limitations. If you're a two-person startup that can only support English-speaking customers with direct sales, your SAM should reflect that--even if it seems small.

Show the path to SAM expansion. While your current SAM might be $228M, you can note that expanding to Europe would increase SAM to $340M, and adding partner distribution would increase it further.

Keep the ratio reasonable. SAM is typically 20-50% of TAM for focused startups. If your SAM is 90% of TAM, you're probably not being rigorous about your filters.

How to Calculate SOM (Serviceable Obtainable Market)#

SOM is the portion of SAM you can realistically capture in a defined timeframe--typically 3-5 years. This is where competitive dynamics and execution reality come into play.

The SOM Formula#

SOM = SAM x Realistic Market Share Percentage

What Determines Realistic Market Share?#

| Factor | Impact on SOM |

|---|---|

| Competitive intensity | More competitors = lower achievable share |

| Switching costs | High switching costs = harder to win share |

| Your differentiation | Stronger differentiation = higher potential share |

| Sales capacity | Limited sales team = limited coverage |

| Brand awareness | Unknown brand = slower adoption |

SOM Calculation Example#

| Step | Calculation | Result |

|---|---|---|

| SAM | Given | $228M |

| Realistic market share (3 years) | x 3% | — |

| SOM | $228M x 3% | $6.8M |

A 3% market share in 3 years might seem small, but consider what it actually means: winning against established competitors, building brand awareness, and successfully selling to hundreds of enterprise accounts.

How to Defend Your SOM to Investors#

Investors will scrutinize your SOM calculation. Be prepared to defend it with:

Comparable analysis: "Similar companies in adjacent markets achieved 2-4% share in years 2-4. Our 3% projection is in line with these benchmarks."

Bottom-up customer math: "3% of SAM equals 285 enterprise customers. At our current close rate and pipeline growth, we project reaching 285 customers by year 3."

Competitive positioning: "The market has two dominant players with 30% share each. The remaining 40% is fragmented. We're targeting the underserved mid-market segment where neither leader focuses."

SOM Reality Check#

| SOM as % of SAM | Investor Reaction |

|---|---|

| Less than 1% | Reasonable for highly competitive markets |

| 1-5% | Credible for most startups |

| 5-10% | Ambitious but possible with strong differentiation |

| Greater than 10% | Skeptical--needs strong justification |

| Greater than 20% | Red flag--likely unrealistic |

Continue reading: Bullet Charts in PowerPoint · Market Sizing Template · Traction Slide

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Top-Down vs Bottom-Up Market Sizing#

The debate between top-down and bottom-up market sizing is central to credible TAM SAM SOM analysis.

Comparison Table#

| Dimension | Top-Down | Bottom-Up |

|---|---|---|

| Starting point | Industry reports, analyst estimates | Target customer count, pricing |

| Data sources | Gartner, IDC, Statista, IBISWorld | Customer interviews, pricing analysis |

| Credibility | Moderate (depends on source) | High (shows customer understanding) |

| Risk of inflation | High | Low |

| Time required | 1-2 hours | 1-2 days |

| Best for | Sanity checks, new markets | Investor presentations, planning |

| Formula | Market size x Segment % | Customers x Price |

When to Use Each Approach#

Use top-down when:

- Entering a new market with limited customer data

- Validating bottom-up calculations

- Discussing market trends and growth rates

- Benchmarking against industry reports

Use bottom-up when:

- Presenting to investors

- Building financial projections

- Setting sales targets

- Evaluating market entry decisions

The Triangulation Method#

The most robust approach uses both methods and reconciles the differences.

Step 1: Calculate TAM using bottom-up (customers x price) Step 2: Calculate TAM using top-down (industry data) Step 3: Explain the gap between the two numbers Step 4: Use the bottom-up number as your primary TAM

If bottom-up produces $1.15B and top-down produces $14B, explain that your bottom-up number represents the specific enterprise project management segment, while the $14B includes adjacent categories (collaboration, resource management, time tracking) that you don't directly address.

Common TAM SAM SOM Mistakes#

After reviewing hundreds of pitch decks, these mistakes consistently undermine market sizing credibility.

Mistake 1: The "1% of China" Fallacy#

The problem: "The Chinese market is $500 billion. If we capture just 1%, we'll have a $5 billion business."

Why it fails: Investors hear this constantly. It shows no understanding of competitive dynamics, market entry barriers, or realistic penetration rates. Getting 1% of a massive market is extraordinarily difficult.

The fix: Start with bottom-up analysis of how many customers you can realistically acquire, then work up to market share.

Mistake 2: Expanding TAM to Impress#

The problem: A CRM company claiming their TAM is "all enterprise software spending" because customers use budget from the same pool.

Why it fails: It makes you look either naive or deceptive. Investors know you're not competing with ERP and cybersecurity for the same budget.

The fix: Define TAM as the specific category where customers make purchase decisions. Your CRM competes with other CRMs, not with all software.

Mistake 3: SAM Without Clear Filters#

The problem: SAM that's 95% of TAM with no explanation of why certain customers are excluded.

Why it fails: It suggests you haven't thought critically about your go-to-market constraints.

The fix: Be explicit about what limits your serviceable market: geography, customer segment, technical requirements, distribution capability.

Mistake 4: SOM That's Too Aggressive#

The problem: Claiming 15% market share in year 3 when the market has established competitors.

Why it fails: Experienced investors know that 15% market share takes years to build, even with great execution. Unrealistic SOM undermines credibility for the entire analysis.

The fix: Benchmark against comparable companies. What share did similar startups achieve in similar timeframes?

Mistake 5: Static Market Analysis#

The problem: Presenting TAM as a fixed number without acknowledging market growth or evolution.

Why it fails: Markets change. A $1B market growing at 25% annually is very different from a $1B market growing at 2%.

The fix: Include market growth rate in your analysis. Show where the market will be in 3-5 years, not just where it is today.

Mistake 6: Inconsistent Definitions#

The problem: Using different market definitions for TAM, SAM, and SOM, making the ratios meaningless.

Why it fails: If TAM is "all transportation" but SAM is "ride-sharing," the percentages don't provide useful information.

The fix: Use consistent market definitions throughout. The filters between TAM, SAM, and SOM should be logical and cumulative.

How to Visualize TAM SAM SOM#

Effective visualization makes complex market sizing data immediately understandable. Here are the most effective approaches.

The Nested Circles (Most Common)#

Three concentric circles showing TAM as the outer ring, SAM as the middle ring, and SOM as the center.

Best for: Simple presentations, quick visual communication Include: Dollar amounts and labels for each tier

Design tips:

- Use distinct but related colors (e.g., light blue, medium blue, dark blue)

- Label each circle clearly with the acronym and dollar amount

- Keep the proportions roughly accurate (SOM shouldn't look like 50% of TAM)

The Funnel Visualization#

A funnel showing market narrowing from TAM at the top through SAM to SOM at the bottom.

Best for: Showing the filtering logic between each tier Include: The filters/constraints at each stage

Design tips:

- Show what criteria reduce each tier

- Include percentages at each step

- Make the visual flow match your verbal explanation

The Stacked Bar or Waterfall#

A horizontal bar or waterfall chart showing the reduction from TAM to SAM to SOM.

Best for: Detailed presentations where you need to explain each filter Include: Each constraint as a separate element

This approach works especially well when you have multiple filters reducing TAM to SAM. Each filter becomes a segment showing how much market is excluded and why.

The Market Map (Advanced)#

A Mekko chart or bubble chart showing different market segments with your position highlighted.

Best for: Complex markets with multiple segments, competitive positioning Include: Segment sizes, growth rates, your target area

Tools like Deckary make creating professional market sizing visualizations straightforward. Rather than struggling with PowerPoint's basic shapes, you can build data-driven charts that update automatically when your numbers change.

Visualization Best Practices#

| Do | Don't |

|---|---|

| Use consistent colors across slides | Use 3D effects or complex graphics |

| Include dollar amounts on the visual | Make viewers guess at the numbers |

| Cite sources for market data | Present numbers without attribution |

| Show your calculation method | Hide the methodology |

| Use professional chart tools | Rely on hand-drawn shapes |

Real-World TAM SAM SOM Examples#

Understanding how successful companies approach market sizing provides practical templates for your own analysis.

Example 1: B2B SaaS (Project Management)#

Company context: Enterprise project management software targeting companies with 500+ employees in North America.

| Tier | Calculation | Amount |

|---|---|---|

| TAM | 85,000 enterprises globally x 90% need PM tools x $15K ACV | $1.15B |

| SAM | TAM x 45% (North America) x 55% (Salesforce users) | $284M |

| SOM | SAM x 3% (3-year target share) | $8.5M |

Why this works: Each tier has clear logic. The bottom-up TAM shows customer understanding. The SAM filters reflect genuine business constraints (geography, integration requirements). The SOM is realistic for a venture-backed startup.

Example 2: Consumer Marketplace (Food Delivery)#

Company context: Food delivery platform targeting urban areas in the United States.

| Tier | Calculation | Amount |

|---|---|---|

| TAM | US food service spending (restaurants, delivery) | $900B |

| SAM | Urban areas x delivery-compatible restaurants x smartphone users | $45B |

| SOM | SAM x 0.5% (3-year target) | $225M |

Note: For marketplaces, TAM is typically GMV (gross merchandise value). You might also show take-rate revenue: $225M GMV x 15% take rate = $34M revenue.

Example 3: Healthcare Technology#

Company context: AI diagnostic tool for radiology departments.

| Tier | Calculation | Amount |

|---|---|---|

| TAM | Global radiology imaging market (software + services) | $12B |

| SAM | US + EU x hospitals with 100+ beds x AI-ready infrastructure | $2.1B |

| SOM | SAM x 2% (3-year target, regulatory pending) | $42M |

Why healthcare is different: Regulatory requirements, long sales cycles, and clinical validation needs mean SOM percentages are typically lower than other industries.

Example 4: Fintech Platform#

Company context: B2B payments infrastructure for e-commerce platforms.

| Tier | Calculation | Amount |

|---|---|---|

| TAM | Global e-commerce GMV x payment processing fees | $85B |

| SAM | SMB e-commerce platforms x API-first architecture | $12B |

| SOM | SAM x 1.5% (3-year target) | $180M |

Key insight: In payments, small market share percentages translate to large absolute numbers due to the massive TAM.

Presenting TAM SAM SOM to Investors#

The market sizing slide is one of the most scrutinized in any pitch deck. Here's how to present it effectively.

What to Include on the Slide#

- All three metrics with dollar amounts

- Visual representation (nested circles, funnel, or chart)

- Calculation methodology (bottom-up vs top-down)

- Source citations for any third-party data

- Growth rate of the market (if relevant)

The Verbal Explanation#

When presenting the slide, walk through:

- TAM: "The total market for [category] is [$X], calculated by [method]."

- SAM: "Our serviceable market is [$Y] because we focus on [specific segment/geography/etc.]"

- SOM: "In 3 years, we believe we can capture [$Z], representing [X%] of our serviceable market."

- Why it's credible: "This is based on [comparable analysis / customer pipeline / competitive positioning]."

Anticipating Investor Questions#

Be prepared for these follow-ups:

| Question | How to Answer |

|---|---|

| "How did you calculate TAM?" | Walk through bottom-up methodology step by step |

| "Why that SAM filter?" | Explain the business constraint driving each filter |

| "3% SOM seems high/low" | Reference comparable companies or pipeline math |

| "What about [adjacent market]?" | Acknowledge expansion potential without inflating current numbers |

| "Is this market growing?" | Cite growth rates and drivers |

Design Tips for the Slide#

- One slide for TAM SAM SOM. Don't spread across multiple slides.

- Large, readable numbers. The dollar amounts should be visible from across the room.

- Clean visualization. Use tools like Deckary for professional bubble or Mekko charts rather than basic PowerPoint shapes.

- Source citations. Small footnotes are fine, but investors should be able to verify your data.

For pitch decks specifically, check our startup pitch deck guide and pitch deck template for how market sizing fits into the overall presentation flow.

TAM SAM SOM for Different Industries#

Market sizing approaches vary by industry. Here's how to adapt the framework.

SaaS / Software#

TAM approach: Customer count x ACV (Annual Contract Value) SAM filters: Geography, company size, tech stack requirements SOM considerations: Net revenue retention, competitive displacement rate

Key metric: Often expressed as ARR (Annual Recurring Revenue) potential

Marketplaces#

TAM approach: GMV (Gross Merchandise Value) of the category SAM filters: Geographic reach, supply availability, category focus SOM considerations: Take rate, liquidity, network effects

Key metric: Show both GMV and revenue (GMV x take rate)

Hardware / Devices#

TAM approach: Units sold x ASP (Average Selling Price) SAM filters: Distribution channels, geographic availability SOM considerations: Manufacturing capacity, retail relationships

Key metric: Consider replacement cycles and installed base

Healthcare#

TAM approach: Procedure volume x reimbursement or Total category spending SAM filters: Regulatory approval status, clinical validation, payer coverage SOM considerations: Adoption curves are typically slower (3-5 years to meaningful share)

Key metric: Often includes reimbursement pathway timeline

Fintech#

TAM approach: Transaction volume x fee or Total assets under management SAM filters: Regulatory license coverage, bank partnership availability SOM considerations: Compliance requirements may limit growth speed

Key metric: Show both transaction volume and revenue

Summary#

TAM SAM SOM analysis is a foundational tool for evaluating market opportunity and demonstrating business acumen to investors. Done well, it shows you understand your market, your customers, and your realistic potential.

Key takeaways:

-

TAM is theoretical maximum--the total market if you had 100% share. Calculate bottom-up (customers x price) for credibility.

-

SAM is reachable market--what you can actually serve given your business model constraints. Be honest about filters.

-

SOM is realistic target--what you can capture in 3-5 years. Benchmark against comparable companies.

-

Bottom-up beats top-down for investor presentations. It shows customer understanding and is harder to inflate.

-

Avoid common mistakes: inflated TAM, undefined SAM filters, unrealistic SOM, and the "1% of China" fallacy.

-

Visualize effectively. Nested circles, funnels, or professional charts communicate faster than tables of numbers.

-

Be prepared to defend every number. Investors will ask how you calculated each tier.

For creating professional market sizing visualizations, tools like Deckary offer Mekko charts, bubble charts, and other chart types that communicate market analysis clearly. Combined with Excel linking for easy updates, you can build investor-ready slides without hours of manual formatting.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free