Bullet Charts in PowerPoint: A Consultant's Guide to Compact Data Visualization

Create bullet charts in PowerPoint for KPI dashboards. Step-by-step guide, gauge vs bullet comparison, and consulting use cases.

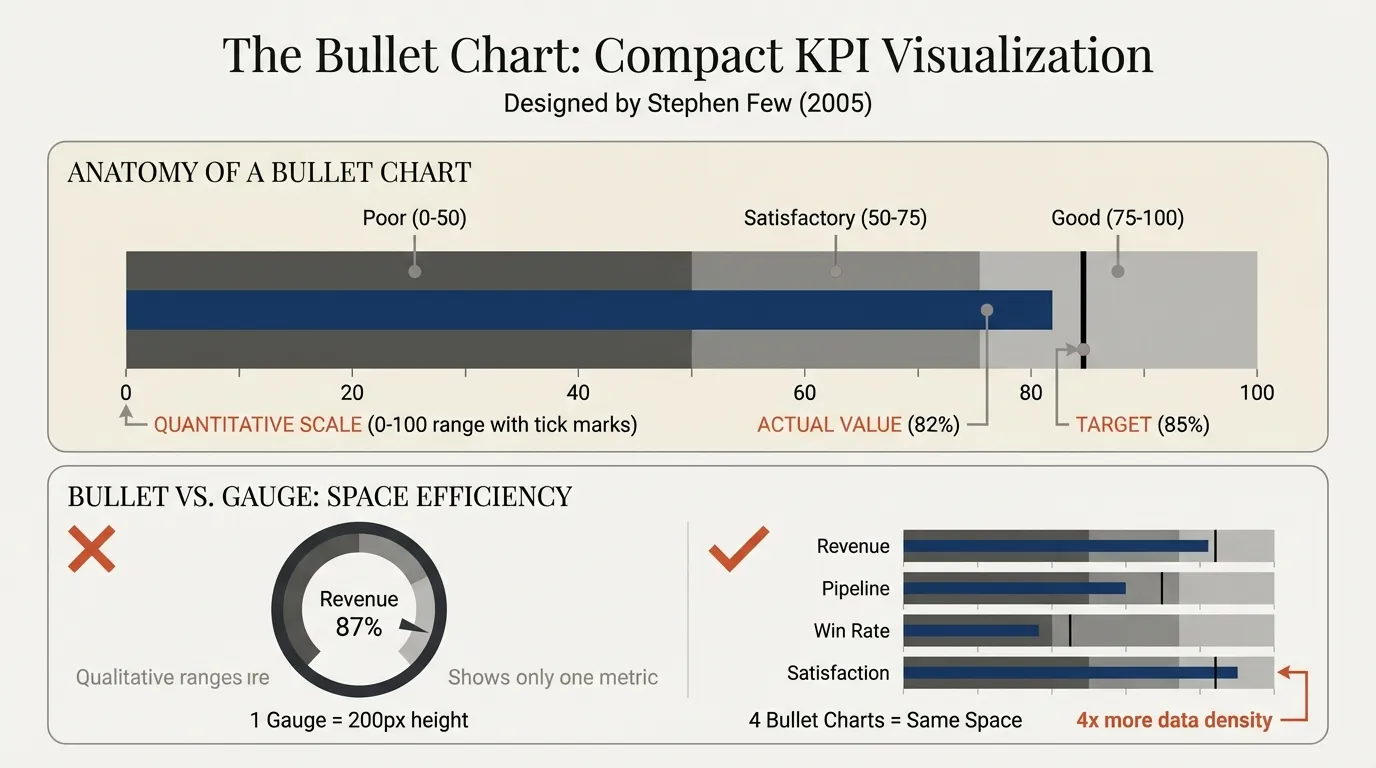

Dashboard gauges look impressive in software demos but fail in practice. A circular speedometer showing 73% completion wastes the space that could display three other KPIs. Stephen Few designed the bullet chart in 2005 specifically to solve this problem: show actual performance, target, and qualitative ranges in a compact horizontal bar that stacks efficiently.

This guide covers the bullet chart anatomy Few specified, how it compares to gauge charts and standard bar charts, and how to build them in PowerPoint. Bullet charts are one of many chart types consultants rely on — for a complete overview, see our PowerPoint Charts Guide.

What Is a Bullet Chart?#

A bullet chart (also called a bullet graph) is a linear visualization designed to display performance data in a compact format. It was created by data visualization expert Stephen Few to replace the circular gauges and meters that dominated early dashboard designs.

Every bullet chart contains five essential components:

- Quantitative Scale — the horizontal axis showing the numeric range of possible values

- Primary Measure (Feature Bar) — a solid horizontal bar representing the actual current value

- Comparative Measure (Target Marker) — a thin vertical line showing the target or benchmark

- Qualitative Ranges — shaded background bands indicating performance zones (typically poor, satisfactory, and good)

- Text Labels — the metric name, units, and any necessary context

In a single horizontal bar, you can read actual performance, whether it hits the target, which qualitative zone it falls in, and the gap between actual and target. A gauge chart shows only the first of these.

When Bullet Charts Beat the Alternatives#

Bullet charts occupy a specific niche. Understanding when they outperform other chart types prevents you from using them where a simpler alternative would communicate better.

Bullet Charts vs. Gauge Charts#

This is the original comparison Few designed for, and bullet charts win decisively in most business contexts. A gauge chart occupies the vertical space of 3-4 stacked bullet charts while communicating less information. Gauges show a single value on a circular arc. Bullet charts show actual value, target, qualitative context, and the gap between actual and target — all in a fraction of the space.

FusionCharts research confirms that a chart with three bullet categories occupies the same space as a gauge for one category. Linear scales are also inherently easier for humans to interpret accurately than circular arcs, per Tableau's visual analytics research.

The only scenario where a gauge wins is a single prominent metric displayed for a general audience — a lobby dashboard showing one number, for instance. For partner reviews, QBRs, and operating committees where you need 5-10 KPIs on a single slide, bullet charts are the clear choice.

Bullet Charts vs. Standard Bar Charts#

Bar charts are more familiar to general audiences, but they lack the built-in target comparison and qualitative context. A bar chart showing revenue at $92M requires a separate annotation to show that the target was $85M. A bullet chart encodes both in the same visual element.

For partner reviews and board presentations where the core question is "are we hitting our targets," bullet charts answer that question more directly than any bar chart variation. The qualitative ranges add context that would otherwise require footnotes or verbal explanation — the partner can see at a glance not just whether you hit the target, but whether the result falls in the "good," "satisfactory," or "concerning" zone.

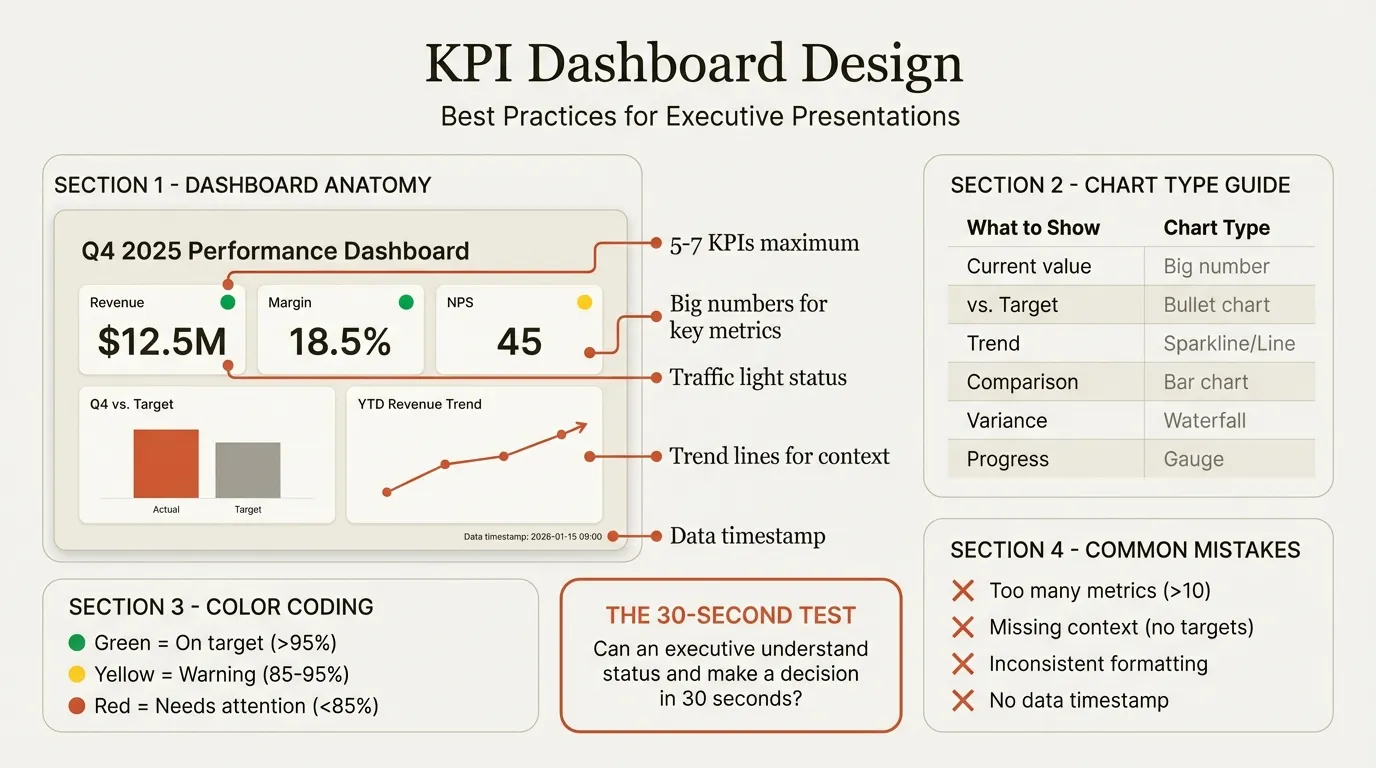

For KPI dashboard design in general, see our KPI Dashboard PowerPoint guide.

When NOT to Use Bullet Charts#

| Don't Use When | Use Instead |

|---|---|

| Showing trends over time | Line chart or sparkline |

| Breaking down components of a total | Waterfall chart or stacked bar |

| Comparing many categories against each other | Bar chart |

| Audience is unfamiliar with the format | Simpler bar chart with target line |

| You have only one metric | Large number with context |

The biggest risk with bullet charts is audience confusion. If your viewers need to be trained to read the chart, consider whether the space savings justify the learning curve. For executive audiences accustomed to BI dashboards, bullet charts are immediately readable. For broader audiences, a labeled bar chart with a target line communicates nearly as well.

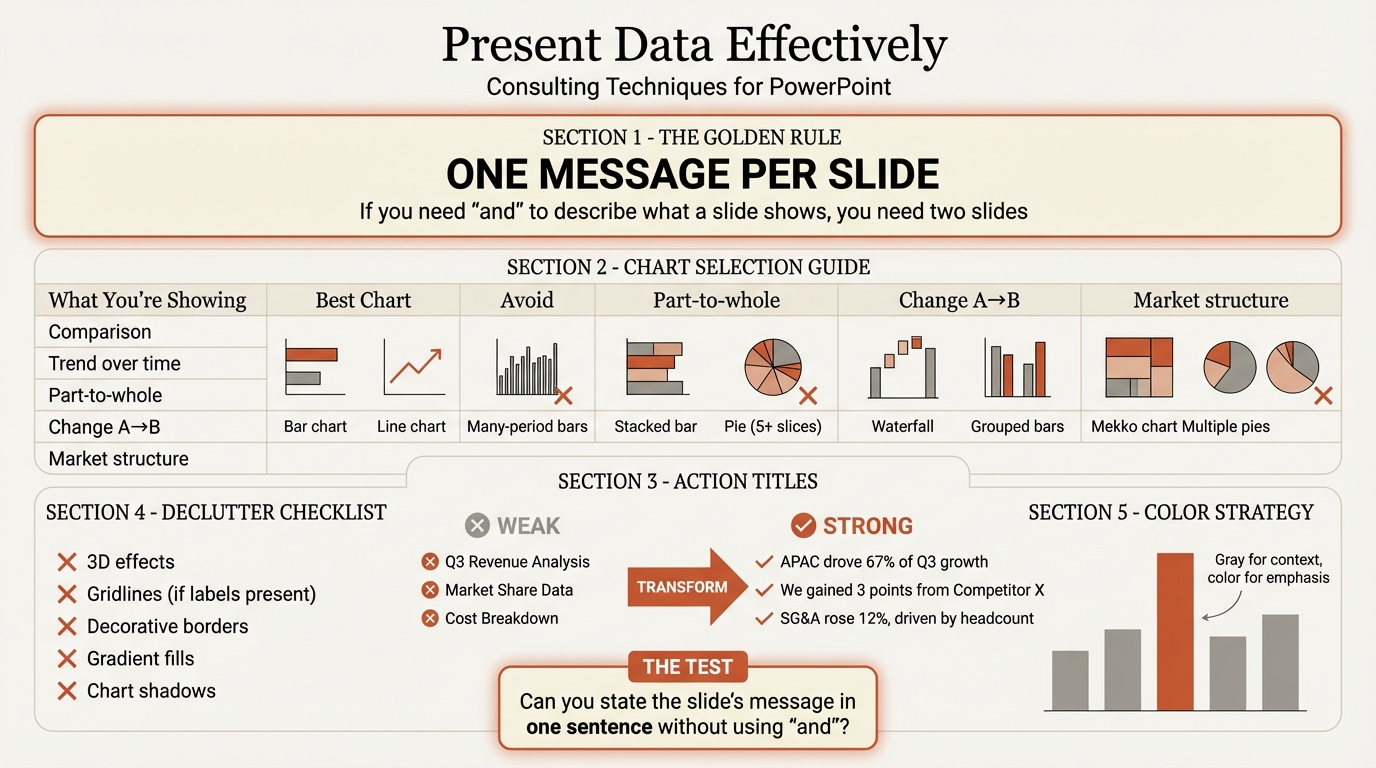

Continue reading: 30-60-90 Day Plan Template · Agile vs Waterfall · Best Fonts for PowerPoint

Better charts for PowerPoint

Waterfall, Mekko, Gantt — build consulting-grade charts in seconds. Link to Excel for automatic updates.

Bullet Chart Best Practices#

Color coding the qualitative ranges. Use graduated intensities of a single hue, not different colors. Few's specification recommends dark gray (poor), medium gray (satisfactory), and light gray (good). The qualitative ranges are background context — using muted grays keeps attention on the feature bar.

Formatting the feature bar. Make it narrower than the qualitative ranges (roughly one-third the height), high contrast against the background (dark blue, black, or a brand color), and visually prominent. This is what the viewer should see first.

Positioning the target marker. Use a thin vertical line, not a thick bar. Ensure it is visible against all backgrounds and positioned at the exact target value.

Handling reversed metrics. For metrics where lower is better (costs, churn, defects), either reverse the bar direction or reframe the metric positively — "retention rate 96%" instead of "churn rate 4%."

Stacking multiple bullet charts. Use consistent scales where metrics are comparable, align all charts vertically for easy scanning, and group related metrics together with category headers.

Labels. Place metric names on the left, show actual values at the end of the feature bar, indicate units clearly, and consider adding variance text ("+5% vs. target").

Creating Bullet Charts in PowerPoint#

PowerPoint does not include a native bullet chart type. You have two practical options.

Method 1: Clustered Bar Chart Workaround#

This method uses a clustered bar chart with overlapping series to simulate a bullet chart. Insert a clustered bar chart with three data series — the qualitative range as a wide background bar, the target as a thin marker, and the actual value as the feature bar. Overlap the series fully so they stack on top of each other, then format the range in light gray, the target as a thin outline, and the actual value in a bold color.

This approach takes 20-30 minutes to set up and is brittle — manual adjustments break when data changes, and achieving the right bar-width ratios requires patience. For a one-off chart, it works. For recurring dashboards, the maintenance cost adds up quickly.

Method 2: PowerPoint Add-ins#

Add-ins like Deckary and specialized visualization tools create bullet charts automatically. Deckary handles chart construction and Excel linking so you can focus on the analysis.

| Capability | Native PowerPoint | Add-in (Deckary) |

|---|---|---|

| Creation time | 20-30 min | 30-60 sec |

| Excel data linking | Manual paste-link | Automatic |

| Qualitative ranges | Multiple series workaround | Built-in |

| Target marker | Manual formatting | Automatic |

| Update when data changes | Manual rebuild | Click to refresh |

For consultants and analysts building KPI dashboards regularly, add-ins pay for themselves quickly. A chart that takes 30 seconds instead of 25 minutes means the $49-119/year Deckary subscription is recovered in the first week.

Common Bullet Chart Mistakes#

| Mistake | Why It Fails | Fix |

|---|---|---|

| Too many qualitative ranges (5-6) | Visual noise requires a legend to decode | Limit to three ranges using graduated grays |

| Feature bar blends into background | Actual performance gets lost visually | Use high-contrast color (dark blue, black) |

| Missing target marker | Chart loses its primary purpose | Always include a visible target line |

| Inconsistent scales across metrics | Viewers assume equal scales; misinterpret data | Use consistent scales or label clearly |

| No labels or context | Ambiguous — is that 75% or $75M? | Label every metric with values and units |

| Wrong metric direction | Long "Cost" bar falsely signals good performance | Reverse the scale or reframe positively |

Summary#

Bullet charts are the space-efficient alternative to dashboard gauges, designed by Stephen Few to maximize information density in performance visualizations. They communicate actual performance, target comparison, and qualitative assessment in a single compact display.

Key takeaways:

- Bullet charts replace gauges — same information in one-third the space

- They beat bar charts for target comparison — actual, target, and qualitative context in a single element

- Use for KPI dashboards and partner reviews — ideal when showing multiple metrics against targets

- Three qualitative ranges — poor, satisfactory, good in graduated grays

- PowerPoint lacks native support — use the clustered bar workaround for one-offs or add-ins for recurring work

For consultants building KPI dashboards and performance reviews regularly, the right tools matter. Deckary creates bullet charts in seconds with automatic formatting and Excel linking—with a 14-day free trial and no credit card required.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free