Ansoff Matrix Template: Growth Strategy Framework for PowerPoint

Download our Ansoff Matrix template for PowerPoint. Learn how consultants use this framework to evaluate market penetration, development, product innovation, and diversification.

The Ansoff Matrix is a strategic planning framework that plots growth opportunities across two dimensions: products (existing vs. new) and markets (existing vs. new). This creates four distinct strategies—market penetration, market development, product development, and diversification—each with different risk profiles and resource requirements.

If you're developing a growth strategy, evaluating expansion options, or presenting strategic choices to executives, the Ansoff Matrix provides the structure to organize and compare different paths forward.

This guide covers how each quadrant works, when to use them, common mistakes to avoid, and how to build an Ansoff Matrix in PowerPoint that drives executive alignment.

After applying the Ansoff Matrix in 40+ growth strategy engagements, we've tracked which quadrant analyses lead to actionable strategies versus academic exercises. The difference lies in how you populate each quadrant and pressure-test the risk assumptions.

What Is the Ansoff Matrix?#

The Ansoff Matrix (also called the Product/Market Expansion Grid) is a strategic planning framework developed by Igor Ansoff in 1957. It helps companies systematically evaluate growth opportunities based on two dimensions:

- Products: Existing vs. New

- Markets: Existing vs. New

| Dimension | What It Represents | Strategic Question |

|---|---|---|

| Products | What you sell | Do we leverage existing products or develop new ones? |

| Markets | Who you sell to | Do we serve current customers or enter new segments? |

The intersection of these dimensions creates four distinct growth strategies, each with different risk profiles, resource requirements, and success factors.

PRODUCTS

Existing | New

______________|_______________

| | |

E | Market | Product |

x | Penetration | Development |

i |_____________|______________|

s | | |

t | Market | |

i | Development | Diversifi- |

n | | cation |

g |_____________|______________|

M

A

R

K

E

T

S

N

e

w

The Ansoff Matrix's power lies in its simplicity. It forces disciplined thinking about where growth will come from and makes explicit the trade-off between risk and familiarity. Companies that pursue growth without this framework often spread resources across too many initiatives without understanding which bets are core business optimization and which are genuine strategic pivots.

The Four Growth Strategies Explained#

Each quadrant of the Ansoff Matrix represents a fundamentally different approach to growth. Understanding the characteristics, risks, and success factors of each strategy is essential for building a balanced growth portfolio.

| Strategy | Products | Markets | Risk Level | Primary Focus |

|---|---|---|---|---|

| Market Penetration | Existing | Existing | Low | Increase market share |

| Market Development | Existing | New | Medium | Expand customer base |

| Product Development | New | Existing | Medium | Innovate offerings |

| Diversification | New | New | High | Enter new businesses |

Let's examine each strategy in depth.

Market Penetration (Existing Products, Existing Markets)#

Market penetration focuses on growing sales of current products to current customers. This is the lowest-risk growth strategy because you're operating in familiar territory—you know the product, you know the customer, and you understand the competitive dynamics.

Characteristics:

- Increase purchase frequency among existing customers

- Win customers from competitors

- Improve market share in current segments

- Optimize pricing and distribution

- Requires minimal new capabilities

Tactics for market penetration:

| Tactic | How It Works | Example |

|---|---|---|

| Increase usage rate | Encourage customers to use product more frequently | Shampoo bottles saying "lather, rinse, repeat" |

| Win competitor customers | Targeted campaigns to switch customers | Wireless carriers offering switching incentives |

| Price optimization | Adjust pricing to maximize volume × margin | Dynamic pricing in e-commerce |

| Improve distribution | Make product more accessible | Adding more retail locations or online channels |

| Loyalty programs | Increase share of wallet from existing customers | Airline frequent flyer programs |

Real-world examples:

- Coca-Cola's "Share a Coke" campaign — Personalized bottles drove increased consumption among existing customers

- Amazon Prime — Converting existing Amazon shoppers to Prime members increased purchase frequency dramatically

- Starbucks Rewards — Loyalty program increases visit frequency and average ticket size

When to prioritize market penetration:

- You have low market share in attractive markets

- Customer acquisition costs are high

- You have product-market fit and want to scale

- Competitors are vulnerable to displacement

- Market growth rate is still healthy

Common mistakes:

- Pursuing penetration in saturated markets with entrenched competitors

- Price wars that destroy industry profitability

- Ignoring customer churn while focusing on acquisition

- Underestimating competitor response

Market penetration should be the foundation of every growth strategy. Master your core business before expanding into new territory.

Market Development (Existing Products, New Markets)#

Market development means taking products you know well and selling them to customer segments or geographies you don't currently serve. The product is familiar, but you're learning new go-to-market approaches, channels, and customer needs.

Characteristics:

- Enter new geographic markets

- Target new customer segments or demographics

- Adapt existing products to new use cases

- Build new distribution channels

- Moderate risk—you know the product but not the customer

Approaches to market development:

| Approach | Description | Risk Factors |

|---|---|---|

| Geographic expansion | Enter new cities, regions, or countries | Cultural differences, regulatory complexity, logistics |

| New customer segments | Target different demographics or industries | Different buying behaviors, channel preferences |

| New use cases | Position product for different applications | Product-market fit uncertainty |

| New channels | Sell through different distribution methods | Channel conflict, margin pressure |

Real-world examples:

- Starbucks international expansion — Taking the coffeehouse concept proven in North America to Asia, Europe, and beyond

- Slack expanding from tech startups to enterprise — Same product, completely different customer segment with different needs and buying process

- Red Bull in India — Energy drink positioned for students/professionals in Western markets adapted for truck drivers and laborers in India

Success factors for market development:

- Deep customer research in new segments

- Willingness to adapt go-to-market approach

- Patient capital—new markets take time

- Local partnerships in unfamiliar geographies

- Product flexibility to meet segment-specific needs

When to pursue market development:

- Your core market is approaching saturation

- You have strong product differentiation

- New segments have similar needs to current customers

- You can leverage existing brand equity

- Regulatory or competitive barriers are manageable

Common mistakes:

- Assuming what works in Market A will work in Market B

- Underestimating cultural and regulatory differences

- Moving too quickly without validating product-market fit

- Spreading across too many new markets simultaneously

- Ignoring incumbent competitors in new markets

The key to market development is humility. Your product may be proven, but you're a newcomer in someone else's market.

Product Development (New Products, Existing Markets)#

Product development means creating new products or services for customers you already understand. You know the market, the buying process, and the customer needs—but you're building something new to meet those needs.

Characteristics:

- Launch new products to existing customer base

- Extend product lines with adjacent offerings

- Innovate to address unmet customer needs

- Leverage existing customer relationships and channels

- Moderate risk—you know the customer but not the product performance

Types of product development:

| Type | Description | Example |

|---|---|---|

| Line extension | Add variants to existing product lines | Apple adding iPhone Pro, Pro Max variants |

| Adjacent products | Launch complementary offerings | Amazon launching Echo after succeeding in e-commerce |

| Next-generation | Innovate on core product | Tesla Model 3 after Model S/X |

| Category creation | Pioneer entirely new product category | Apple Watch creating smartwatch category |

Real-world examples:

- Apple expanding from iPod to iPhone — Leveraging relationships with music consumers to launch a revolutionary new product

- Netflix moving from DVD rental to streaming — Same customers (entertainment seekers), completely new product delivery

- Nike+ — Athletic footwear company adding digital fitness tracking products

Success factors for product development:

- Customer insight into unmet needs

- Strong R&D and product management capabilities

- Willingness to test, learn, and iterate

- Cross-functional collaboration (product, engineering, marketing)

- Clear go-to-market advantage from existing customer access

When to pursue product development:

- Customer research reveals unmet needs

- Your core product is becoming commoditized

- Technology enables new solutions

- You have distribution advantage over new entrants

- Customer lifetime value justifies investment

Common mistakes:

- Building products customers don't want (lack of validation)

- Feature bloat—adding complexity without value

- Cannibalizing existing products unintentionally

- Underestimating development time and cost

- Launching without clear differentiation

Product development is where innovation meets market access. Your existing customer relationships are an unfair advantage—but only if you build something they actually want.

Diversification (New Products, New Markets)#

Diversification is the highest-risk growth strategy: you're developing new products for markets you don't currently serve. You're learning both product and market simultaneously, with minimal leverage from existing capabilities.

Characteristics:

- Enter entirely new business areas

- Requires new capabilities and expertise

- Highest risk, highest potential reward

- Often pursued through acquisition

- Can provide strategic hedging against core business risk

Types of diversification:

| Type | Relationship to Core | Example | Risk Level |

|---|---|---|---|

| Horizontal | Related products, different market | Disney acquiring ESPN (entertainment company buying sports media) | Medium-High |

| Vertical | Up/downstream in value chain | Amazon Web Services (retailer building cloud infrastructure) | Medium-High |

| Concentric | Related capabilities or technology | Google launching Android (search company entering mobile OS) | High |

| Conglomerate | Unrelated businesses | Berkshire Hathaway portfolio (insurance, railroads, utilities, retail) | Very High |

Real-world examples:

- Amazon Web Services — Online retailer building cloud infrastructure business (started as internal capability, became standalone business)

- Virgin Group — Music company diversifying into airlines, mobile, fitness, space travel

- Reliance Industries — Oil/petrochemical company diversifying into telecommunications (Jio)

When diversification makes sense:

- Core business is in structural decline

- Significant synergies exist across businesses

- Risk hedging through uncorrelated revenue streams

- Underutilized capabilities can serve new markets

- M&A opportunity too compelling to ignore

Success factors for diversification:

- Acquisition of expertise and talent

- Patient capital and long-term perspective

- Strong core business to fund exploration

- Clear strategic rationale beyond "growth"

- Realistic assessment of synergies

Common mistakes:

- "Diversification" as an excuse for lack of core business strategy

- Underestimating cultural and operational differences

- Overpaying for acquisitions based on illusory synergies

- Management bandwidth—spreading leadership too thin

- Conglomerate discount—market values focused companies higher

The diversification paradox:

Companies diversify to reduce risk, but diversification itself is the highest-risk growth strategy. This is why most successful diversification happens through acquisition (buying expertise) rather than organic development.

Warren Buffett's Berkshire Hathaway succeeds at conglomerate diversification through a unique model: acquire well-run businesses, keep existing management, provide capital, and stay out of the way. Most companies lack this discipline.

Continue reading: Bullet Charts in PowerPoint · Deloitte Presentation Template · Traction Slide

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Choosing the Right Growth Strategy#

The Ansoff Matrix doesn't prescribe a single answer. The right strategy depends on market conditions, competitive position, capabilities, and risk tolerance. Most companies should pursue a portfolio of strategies, weighted by risk and return.

Risk vs. Reward Framework#

| Strategy | Risk Level | Resource Requirements | Time to Revenue | Typical Success Rate |

|---|---|---|---|---|

| Market Penetration | Low | Low-Medium | Short (6-12 months) | High (60-70%) |

| Market Development | Medium | Medium | Medium (12-24 months) | Moderate (40-50%) |

| Product Development | Medium | High | Medium-Long (18-36 months) | Moderate (35-45%) |

| Diversification | High | Very High | Long (3+ years) | Low (20-30%) |

Strategic Fit Assessment#

Before committing to a growth strategy, evaluate your strategic position:

| Question | Market Penetration | Market Development | Product Development | Diversification |

|---|---|---|---|---|

| Do we have low market share? | ✓✓✓ | ✓ | ✓ | |

| Is our core market saturated? | ✓✓✓ | ✓✓ | ✓✓✓ | |

| Do customers have unmet needs? | ✓ | ✓ | ✓✓✓ | ✓ |

| Do we have distribution advantage? | ✓✓ | ✓ | ✓✓✓ | |

| Is our core business declining? | ✓ | ✓ | ✓✓✓ | |

| Do we have excess capital? | ✓ | ✓✓ | ✓✓ | ✓✓✓ |

| Can we acquire needed capabilities? | ✓✓ | ✓✓ | ✓✓✓ |

(✓✓✓ = strong fit, ✓✓ = moderate fit, ✓ = weak fit)

Building a Balanced Portfolio#

Best practice is to pursue multiple strategies simultaneously, weighted by risk:

Conservative portfolio (established companies in mature markets):

- 70% Market Penetration

- 20% Market Development or Product Development

- 10% Diversification (exploratory)

Growth portfolio (scaling companies in expanding markets):

- 40% Market Penetration

- 30% Market Development

- 20% Product Development

- 10% Diversification

Transformation portfolio (companies facing disruption):

- 20% Market Penetration (harvest core)

- 20% Market Development

- 30% Product Development

- 30% Diversification (bet on the future)

The right mix depends on your specific situation, but the principle holds: balance quick wins (penetration) with medium-term growth (development) and long-term bets (diversification).

How to Use the Ansoff Matrix (Step-by-Step)#

Here's the process we use in consulting engagements to apply the Ansoff Matrix to real strategic decisions.

Step 1: Define Your Current Position#

Map your existing business clearly:

- Products: What do we sell today? (Be specific—product lines, SKUs, services)

- Markets: Who do we serve today? (Geographic markets, customer segments, industries)

Create a simple table:

| Current Products | Current Markets |

|---|---|

| Product A, B, C | North America, Enterprise customers, Financial services |

This baseline is essential. You can't identify "new" products or markets without clarity on what's "existing."

Step 2: Brainstorm Growth Opportunities#

Generate a comprehensive list of potential growth initiatives. Include everything being discussed: sales team expansion, new product ideas, geographic expansion, M&A targets, and more.

Don't filter yet—capture all ideas.

Step 3: Plot Ideas on the Matrix#

For each growth opportunity, ask:

- Does this involve existing products or new products?

- Does this target existing markets or new markets?

Place each initiative in the appropriate quadrant.

Example mapping:

| Quadrant | Growth Initiatives |

|---|---|

| Market Penetration | Hire 20 more sales reps, Launch customer referral program, Optimize pricing strategy |

| Market Development | Expand to UK/Germany, Target healthcare vertical, Launch partner channel |

| Product Development | Launch premium tier, Build mobile app, Add AI features |

| Diversification | Acquire SaaS competitor in adjacent space, Build marketplace product |

Step 4: Assess Each Opportunity#

For each initiative, evaluate:

| Criterion | What to Assess | Questions to Ask |

|---|---|---|

| Risk | How much uncertainty? | How well do we understand this product/market? |

| Resource Requirements | What will it cost? | Capital, headcount, time to revenue? |

| Strategic Fit | Does it leverage our strengths? | Does this build on core capabilities? |

| Market Attractiveness | Is the opportunity large enough? | TAM, growth rate, competitive intensity? |

| Expected Return | What's the upside? | Revenue potential, margin profile? |

Step 5: Prioritize and Sequence#

Not all opportunities can be pursued simultaneously. Prioritize based on:

- Quick wins (high return, low risk) → Start immediately

- Strategic bets (high return, high risk) → Validate before scaling

- Opportunistic plays (medium return, low risk) → Pursue if capacity allows

- Pass (low return or prohibitive risk) → Deprioritize

Step 6: Build the Growth Portfolio#

Allocate resources across the matrix to balance risk and return:

- Heavy weight on market penetration (low-risk foundation)

- Selective bets on market or product development (medium-risk growth)

- Limited allocation to diversification (high-risk options)

Step 7: Present to Leadership#

Structure your presentation around the Ansoff Matrix:

- Current position — Where we are today

- Growth opportunities — Ideas mapped to quadrants

- Assessment — Risk/return evaluation of top initiatives

- Recommendation — Proposed portfolio with resource allocation

- Roadmap — Sequencing and milestones

The visual clarity of the 2×2 matrix facilitates executive discussion and drives alignment.

Ansoff Matrix Best Practices#

After using the Ansoff Matrix in dozens of strategy projects, these practices consistently improve analysis quality.

Be Specific About "New"#

"New market" and "new product" are relative terms. Define clearly:

- New market = Customer segment we don't currently serve with material revenue (less than 5% of total)

- New product = Offering that requires significant new development (not minor feature additions)

Without clear definitions, every initiative looks like "existing market, existing product" or the opposite.

Consider Adjacency#

Not all "new" is equally new. Distinguish between:

- Adjacent (close to core business—lower risk)

- Distant (far from core business—higher risk)

Example: For Starbucks, selling tea to coffeehouse customers is adjacent (new product, existing market). Selling coffee in China is adjacent (existing product, new market). Selling meal kits through retail would be distant diversification.

Quantify the Opportunity#

Attach numbers to each quadrant:

| Strategy | # of Initiatives | Expected Revenue (3yr) | Investment Required | Headcount |

|---|---|---|---|---|

| Market Penetration | 5 | $50M | $5M | 25 |

| Market Development | 3 | $30M | $8M | 15 |

| Product Development | 2 | $25M | $12M | 30 |

| Diversification | 1 | $15M | $20M | 20 |

This transforms the framework from conceptual to operational.

Update Regularly#

Markets evolve. Products mature. Yesterday's "new" market becomes today's core business. Revisit your Ansoff Matrix at least annually:

- Reclassify initiatives as products/markets mature

- Add new opportunities as they emerge

- Archive or sunset initiatives that haven't delivered

- Rebalance portfolio based on performance

Combine with Other Frameworks#

The Ansoff Matrix answers "where to grow" but not "how to compete." Combine with:

- Porter's Five Forces — Assess industry attractiveness in new markets

- BCG Matrix — Evaluate current portfolio to fund growth

- SWOT Analysis — Assess capabilities for new products/markets

- Market sizing (TAM/SAM/SOM) — Quantify opportunity size

Common Ansoff Matrix Mistakes#

These errors frequently undermine Ansoff Matrix analysis in corporate strategy settings.

Mistake 1: Treating All Quadrants Equally#

Problem: Allocating equal resources across all four strategies without considering risk

Fix: Weight heavily toward market penetration (low risk) with selective bets on development and diversification

Most companies don't fail because they invest too much in their core business. They fail because they spread resources too thin across too many risky new initiatives.

Mistake 2: Confusing Minor Variations with New Products#

Problem: Calling a feature enhancement or SKU variant a "new product"

Fix: Reserve "product development" for offerings requiring significant new capabilities, technology, or development effort

Adding a new color option isn't product development. Building a SaaS version of your on-premise software is.

Mistake 3: Underestimating Market Development Complexity#

Problem: "We'll just sell our product in Europe" without understanding regulatory, cultural, and competitive differences

Fix: Treat each new market as a new business. Research deeply, test small, scale what works.

Geography changes everything: customer preferences, purchasing behavior, distribution channels, competitive landscape, and regulatory requirements.

Mistake 4: Diversification Without Strategic Rationale#

Problem: Pursuing unrelated businesses because "we should diversify"

Fix: Only diversify if there's clear strategic logic: declining core business, compelling synergies, or unique acquisition opportunity

Diversification should be the exception, not the rule. Most companies lack the management capability to successfully run unrelated businesses.

Mistake 5: Static Analysis#

Problem: Creating the matrix once and never updating it

Fix: Revisit quarterly as a living strategic tool

Markets shift. Products mature. Competitors move. Your growth strategy should evolve accordingly.

Mistake 6: No Go/No-Go Criteria#

Problem: Every idea gets funded without clear decision criteria

Fix: Establish threshold requirements for each quadrant

Example criteria:

- Market Penetration: Must achieve payback within 12 months

- Market Development: Must address market ≥$100M TAM

- Product Development: Must solve validated customer problem

- Diversification: Must have clear acquisition target or founding team

Creating Ansoff Matrix in PowerPoint#

The Ansoff Matrix is one of the simplest strategic frameworks to visualize—a clean 2×2 grid with clear labels. Here's how to build one that looks professional and drives discussion.

Basic Structure#

A standard Ansoff Matrix slide includes:

- 2×2 grid with equal-sized quadrants

- Axis labels: Products (Existing/New), Markets (Existing/New)

- Quadrant labels: Market Penetration, Market Development, Product Development, Diversification

- Risk indicators: Arrow or color-coding showing increasing risk

- Initiative bullets: Specific growth opportunities in each quadrant

Design Approach 1: Simple Diagram#

For conceptual presentations:

- Create a large square

- Add two perpendicular lines to create four equal quadrants

- Add axis labels (Products: Existing → New, Markets: Existing → New)

- Label each quadrant

- Optional: Add diagonal arrow from bottom-left to top-right labeled "Increasing Risk"

Color coding:

- Green (Market Penetration) → Yellow (Development) → Red (Diversification)

Time required: 10-15 minutes

Design Approach 2: Data-Driven Template#

For strategic planning sessions with specific initiatives:

- Build the 2×2 grid

- Add initiative names in each quadrant

- Include sub-bullets: expected revenue, timeline, resource requirements

- Size text or boxes proportional to opportunity size

- Add status indicators (planned, in progress, launched)

Example layout:

MARKET PENETRATION PRODUCT DEVELOPMENT

• Expand sales team (25 reps) • Launch Pro tier

$15M revenue, 12mo $20M revenue, 18mo

• Referral program • Mobile app

$5M revenue, 6mo $10M revenue, 24mo

MARKET DEVELOPMENT DIVERSIFICATION

• UK/Germany expansion • Acquire competitor X

$25M revenue, 24mo $30M revenue, 36mo

• Healthcare vertical • Build marketplace

$12M revenue, 18mo $15M revenue, 48mo

Time required: 30-45 minutes

Design Approach 3: Portfolio View#

For executive presentations showing resource allocation:

- Create the 2×2 grid

- Use bubble charts with:

- X-axis: Existing → New Products

- Y-axis: Existing → New Markets

- Bubble size: Investment or expected revenue

- Color: Risk level or status

- Label each bubble with initiative name

This provides visual clarity on where resources are allocated.

PowerPoint Add-in Approach#

For consultants building strategy presentations regularly, tools like Deckary streamline framework creation:

- Pre-built strategy framework templates

- Consistent formatting with consulting slide standards

- Quick customization of labels and colors

- Professional alignment and spacing

| Method | Time | Flexibility | Professional Quality |

|---|---|---|---|

| Manual shapes | 15-20 min | High | Medium (formatting takes time) |

| Excel chart | 30-40 min | Medium | High |

| Deckary | 5-10 min | High | High (auto-formatted) |

For teams building multiple strategic frameworks, Deckary offers strategy templates alongside its charting capabilities at $49-119/year—a fraction of think-cell's $299/year pricing.

Real-World Ansoff Matrix Examples#

Understanding how major companies apply the Ansoff Matrix reveals the framework's strategic value.

Example 1: Starbucks Growth Strategy#

Starbucks demonstrates all four growth strategies in its expansion:

| Quadrant | Starbucks Initiatives | Outcome |

|---|---|---|

| Market Penetration | Open more stores in North America, Launch loyalty program, Drive-through locations | Core revenue growth, increased visit frequency |

| Market Development | International expansion (China, India, Europe), Target office customers vs. coffeehouse visitors | Now operates in 80+ countries, China is second-largest market |

| Product Development | Food offerings (sandwiches, salads), Packaged coffee in grocery stores, Cold brew innovation | Food now 20%+ of revenue, retail products major channel |

| Diversification | Teavana acquisition (tea retail stores), Evolution Fresh (juice), Roastery concept (premium experiences) | Mixed results—Teavana closed, Roasteries successful |

Key lessons:

- Market penetration (more stores, loyalty) funded expansion

- International market development required local adaptation

- Product development leveraged existing customer relationships

- Diversification was highest risk—Teavana acquisition failed

Example 2: Amazon's Growth Portfolio#

Amazon masterfully balances all four strategies:

| Quadrant | Amazon Initiatives | Strategic Rationale |

|---|---|---|

| Market Penetration | Prime membership, Same-day delivery, Price optimization | Increase purchase frequency and share of wallet |

| Market Development | International expansion, Amazon Business (B2B), Prime Video international | Leverage e-commerce model globally |

| Product Development | Echo/Alexa devices, Kindle, Amazon Basics private label | Deepen customer relationship, capture more value |

| Diversification | AWS (cloud infrastructure), Amazon Go (cashierless retail), Healthcare ventures | Hedge against retail commoditization, pursue new business models |

Portfolio balance:

- E-commerce penetration generates cash

- AWS (diversification) provides high-margin growth

- Devices (product development) create ecosystem lock-in

- International (market development) drives scale

Example 3: Tesla's Strategic Evolution#

Tesla's growth journey shows progression through the matrix:

| Phase | Strategy | Product | Market | Outcome |

|---|---|---|---|---|

| 2008-2012 | Market Penetration | Roadster → Model S | Luxury buyers, early adopters | Prove electric vehicles viable |

| 2012-2017 | Product Development | Model X, Model 3 | Same luxury/tech-forward buyers | Scale production |

| 2017-2020 | Market Development | Model 3 | Mass market consumers | Achieve volume production |

| 2020+ | Diversification | Energy storage, Solar, FSD software | Utilities, homeowners | Build sustainable energy ecosystem |

Strategic insight: Tesla started with the riskiest strategy (diversification—new product in nascent market) but had no choice as a startup. As they gained traction, they systematically moved through penetration, product development, and market development before re-diversifying.

Example 4: Hypothetical SaaS Company#

Here's how a mid-market SaaS company might map growth opportunities:

| Quadrant | Initiatives | Investment | 3-Year Revenue | Risk Assessment |

|---|---|---|---|---|

| Market Penetration | Hire 15 AEs, Build referral engine, Optimize conversion funnel | $3M | $25M | Low—proven playbook |

| Market Development | Enterprise expansion, Europe launch, Partner channel | $5M | $18M | Medium—same product, new buyers |

| Product Development | AI features, Mobile app, Premium tier | $8M | $15M | Medium—market validation needed |

| Diversification | Acquire adjacent tool, Build marketplace | $15M | $12M | High—new territory |

Recommended allocation: 50% penetration, 30% market development, 15% product development, 5% diversification (exploratory only).

Ansoff Matrix vs. Other Strategy Frameworks#

The Ansoff Matrix is one of several growth strategy frameworks. Understanding when to use each improves strategic analysis.

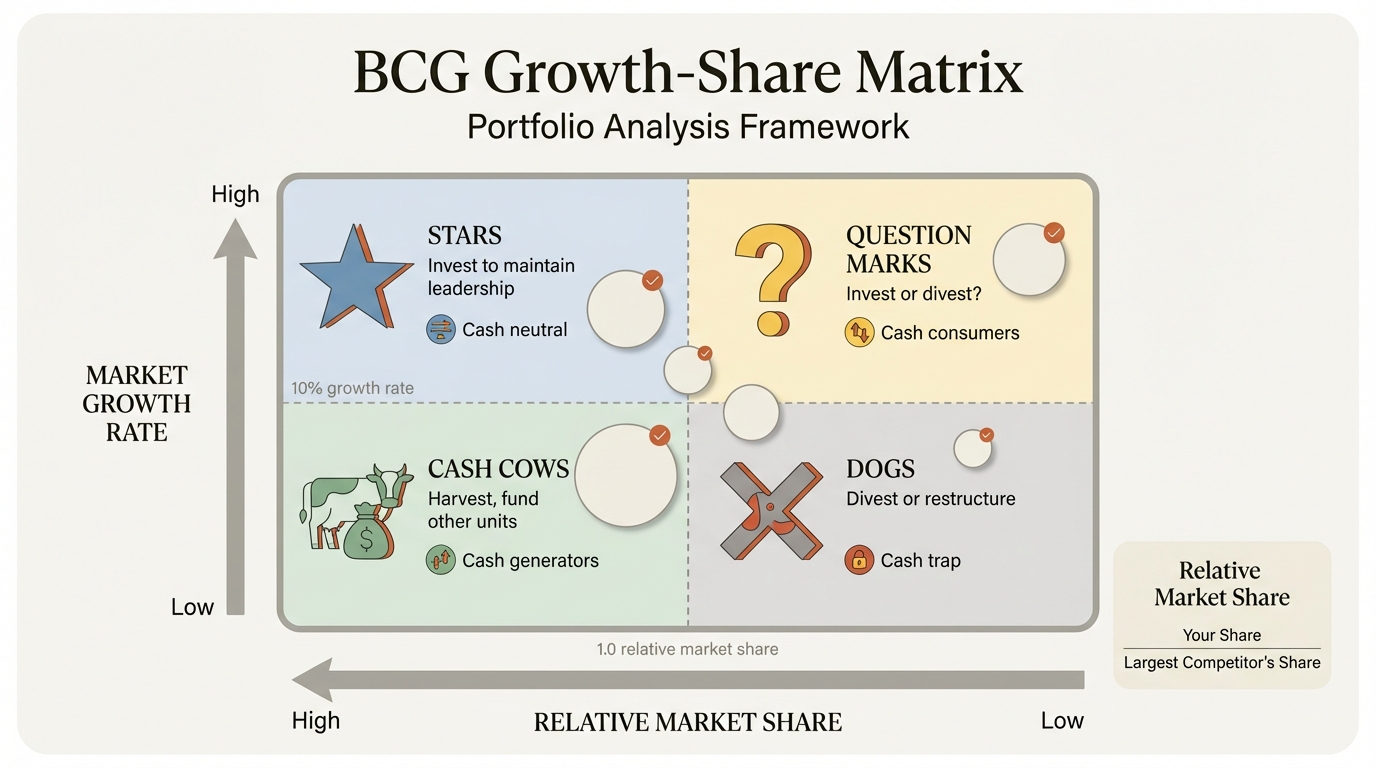

Ansoff Matrix vs. BCG Matrix#

| Dimension | Ansoff Matrix | BCG Matrix |

|---|---|---|

| Purpose | Identify growth opportunities | Evaluate existing portfolio |

| Focus | Future strategy | Current position |

| Axes | Products × Markets | Market growth × Market share |

| Output | Growth strategy options | Investment priorities |

| Best For | Strategic planning | Portfolio management |

When to use together: Use BCG Matrix to assess current portfolio health and identify which businesses can fund growth. Use Ansoff Matrix to determine where that growth investment should go.

Ansoff Matrix vs. Porter's Five Forces#

| Dimension | Ansoff Matrix | Porter's Five Forces |

|---|---|---|

| Purpose | Choose growth direction | Assess industry attractiveness |

| Focus | Your strategy choices | External competitive forces |

| Scope | Company-specific | Industry-level |

| Output | Growth strategy | Industry profitability outlook |

When to use together: Use Porter's Five Forces to evaluate industry attractiveness before committing to market development or diversification. Don't enter structurally unattractive industries regardless of growth potential.

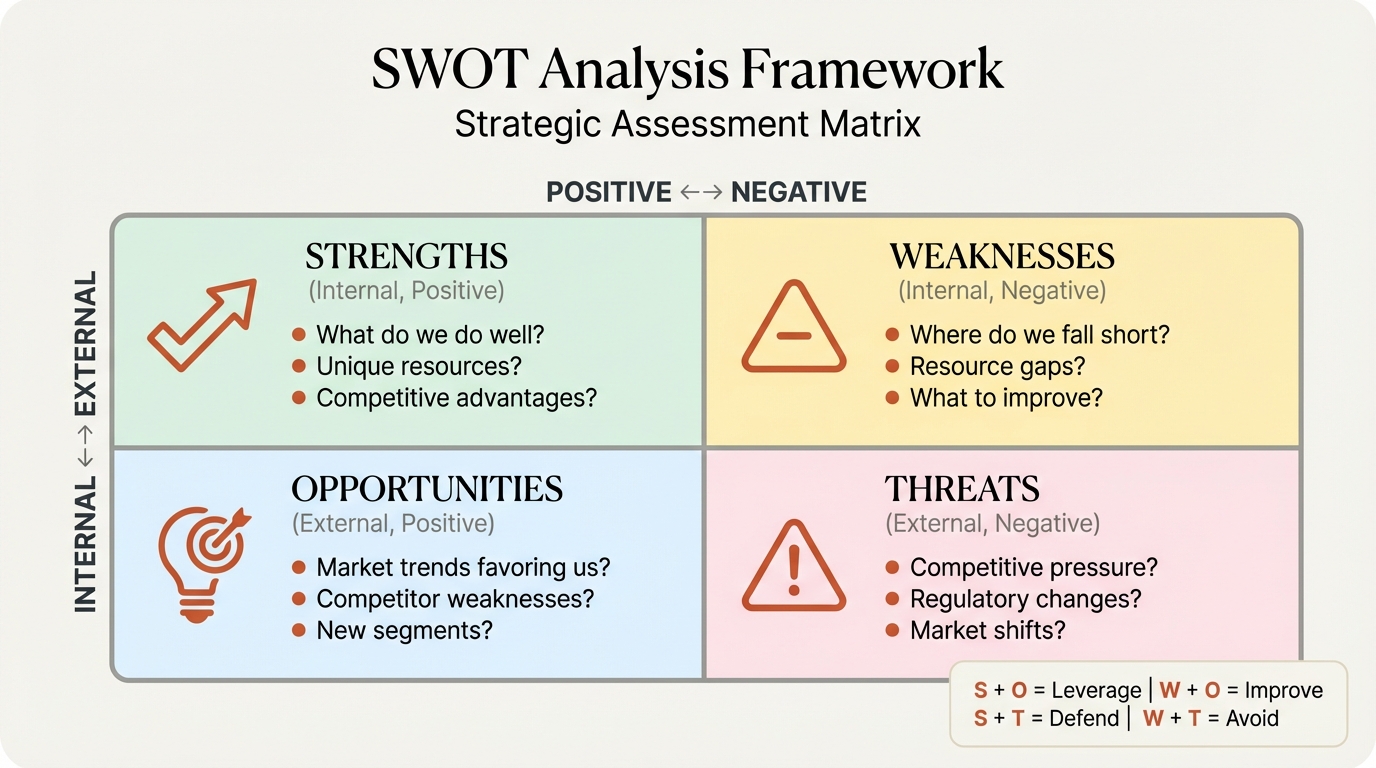

Ansoff Matrix vs. SWOT Analysis#

| Dimension | Ansoff Matrix | SWOT |

|---|---|---|

| Structure | 2×2 growth strategies | 4-quadrant capability assessment |

| Focus | Products and markets | Strengths, Weaknesses, Opportunities, Threats |

| Output | Growth path selection | Strategic positioning |

| Specificity | Growth-focused | General-purpose |

When to use together: Use SWOT to assess whether you have the capabilities to execute each Ansoff strategy. Strengths enable certain growth paths; weaknesses make others risky.

Combining Frameworks for Comprehensive Strategy#

Best practice is to use multiple frameworks in sequence:

- BCG Matrix — Evaluate current portfolio (Stars, Cash Cows, Question Marks, Dogs)

- Ansoff Matrix — Identify growth opportunities for each business unit

- Porter's Five Forces — Assess attractiveness of new markets before entering

- TAM/SAM/SOM — Size the opportunity for each growth initiative

- Financial modeling — Project returns and resource requirements

No single framework tells the complete story. The Ansoff Matrix is powerful for organizing growth thinking but should be complemented with deeper analysis of competitive dynamics, market sizing, and financial feasibility.

Summary#

The Ansoff Matrix remains one of the most practical frameworks for growth strategy. Developed by Igor Ansoff in 1957, it continues to help companies organize growth opportunities and make disciplined resource allocation decisions.

Key principles:

-

Four growth strategies exist: Market Penetration (low risk), Market Development (medium risk), Product Development (medium risk), and Diversification (high risk)

-

Risk increases with distance from core business: The further you move from existing products and markets, the higher the uncertainty

-

Most companies should weight toward penetration: Master your core business before expanding into new territory

-

Balance your growth portfolio: Combine quick wins (penetration) with medium-term growth (development) and long-term bets (diversification)

-

Be specific about "new": Define clearly what constitutes a new product or new market in your context

-

Combine with other frameworks: Use BCG Matrix, Porter's Five Forces, and financial analysis to validate growth choices

-

Update regularly: Markets evolve, products mature, and your strategy should adapt accordingly

For strategic planning:

- Map all growth initiatives onto the matrix

- Assess risk, resource requirements, and expected return for each quadrant

- Allocate resources to create a balanced portfolio

- Establish go/no-go criteria for each strategy type

- Present visually to facilitate executive alignment

The Ansoff Matrix's power lies in its simplicity. It forces disciplined thinking about where growth will come from and makes explicit the trade-offs between familiarity and opportunity, between risk and reward.

That's what separates companies that grow strategically from those that spread resources across every opportunity that emerges.

For consultants and strategists building growth strategy presentations, the right tools accelerate analysis. Deckary offers professional strategy framework templates alongside its charting capabilities at $49-119/year. Download a free trial—no credit card required—and build your next growth strategy presentation in minutes instead of hours.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free