Competitive Analysis Template: PowerPoint Slides for Strategy

Download our competitive analysis template and learn how consultants map competitors. Step-by-step frameworks with matrices, scoring systems, and real examples.

A competitive analysis answers three questions that generic market research ignores: Where are we vulnerable? Where can we win? What should we do differently? Unlike broad industry overviews, competitive analysis focuses on the specific companies fighting for your customers—their strategies, capabilities, and likely moves.

After building competitive analyses for 50+ market entry, M&A, and strategic planning engagements, we've tracked which comparison frameworks executives actually reference in decision-making and which get filed away unread. The difference comes down to focus: analyses that answer specific strategic questions drive action; comprehensive competitor encyclopedias become shelf decoration.

This guide covers the frameworks that work, templates that communicate clearly to executives, and the mistakes that derail even thorough competitive research.

What Is a Competitive Analysis?#

A competitive analysis is a structured framework with five components, each serving a distinct purpose in building strategic recommendations.

| Component | Purpose | Key Questions |

|---|---|---|

| Competitor Identification | Define who you're competing against | Who serves our customers? Who could enter? |

| Capability Assessment | Understand what competitors can do | What are their strengths and weaknesses? |

| Strategy Analysis | Determine competitor intentions | What are they trying to achieve? How? |

| Positioning Evaluation | Map competitive landscape | How do competitors differentiate? Where are gaps? |

| Implications | Derive strategic actions | What should we do? What should we stop doing? |

The analysis only creates value when it answers specific questions: not just "what are our competitors doing?" but "why are we losing deals to Competitor X?" and "how should we respond to their new product launch?" General awareness of competitor activity is market intelligence; competitive analysis translates that intelligence into decisions.

Competitive Analysis vs. Market Research#

These terms are sometimes confused, but they serve different purposes:

| Dimension | Competitive Analysis | Market Research |

|---|---|---|

| Focus | Competitors specifically | Customers, market trends, opportunities |

| Primary Question | How do we beat competitors? | What do customers want? |

| Output | Strategic positioning decisions | Product/marketing decisions |

| Frequency | Ongoing, event-driven | Project-based, periodic |

In practice, competitive analysis uses market research inputs (customer preferences, market size) but focuses on competitive dynamics rather than customer insights.

When to Use Competitive Analysis#

Competitive analysis is essential in specific strategic contexts. Understanding when to deploy it—and what type—improves outcomes.

Strategic Planning#

Annual strategy reviews need competitive context. How has the competitive landscape shifted? Which competitors gained or lost position? What moves should we anticipate?

Market Entry Decisions#

Before entering a new market, competitive analysis reveals:

- Who are the incumbents and how entrenched are they?

- What barriers have they erected?

- What gaps exist that we could exploit?

- How will they likely respond to our entry?

Product Launch Planning#

Understanding competitive products helps position new offerings:

- Where are competitor weaknesses we can exploit?

- What features are table stakes vs. differentiators?

- How should we price relative to alternatives?

- What messaging will resonate given competitive context?

M&A Due Diligence#

Evaluating acquisition targets requires understanding their competitive position:

- How defensible is their market share?

- What competitive threats do they face?

- Would the acquisition change competitive dynamics?

Investor Presentations#

Investors want to understand competitive moats. A clear competitive analysis demonstrates:

- Market awareness and strategic thinking

- Defensible positioning

- Growth opportunities

- Realistic assessment of competitive threats

The pitch deck template and investor presentation template both include competitive landscape sections for this reason.

Response Planning#

When a competitor makes a significant move—new product, price change, acquisition—structured analysis helps determine whether and how to respond.

Types of Competitive Analysis Frameworks#

Different strategic questions call for different frameworks. Here's when to use each.

Framework Selection Guide#

| Framework | Best For | Key Output | Complexity |

|---|---|---|---|

| Porter's Five Forces | Industry-level competition | Industry attractiveness assessment | Medium |

| SWOT Competitor Analysis | Individual competitor assessment | Competitor strengths/vulnerabilities | Low-Medium |

| Competitive Feature Matrix | Product/service comparison | Feature gaps and advantages | Low |

| Perceptual Positioning Map | Market positioning | Strategic positioning options | Medium |

| Competitor VRIO Analysis | Sustainable advantage assessment | Sources of competitive advantage | High |

| Competitive Response Analysis | Anticipating competitor moves | Response planning | Medium-High |

Let's examine each framework in detail.

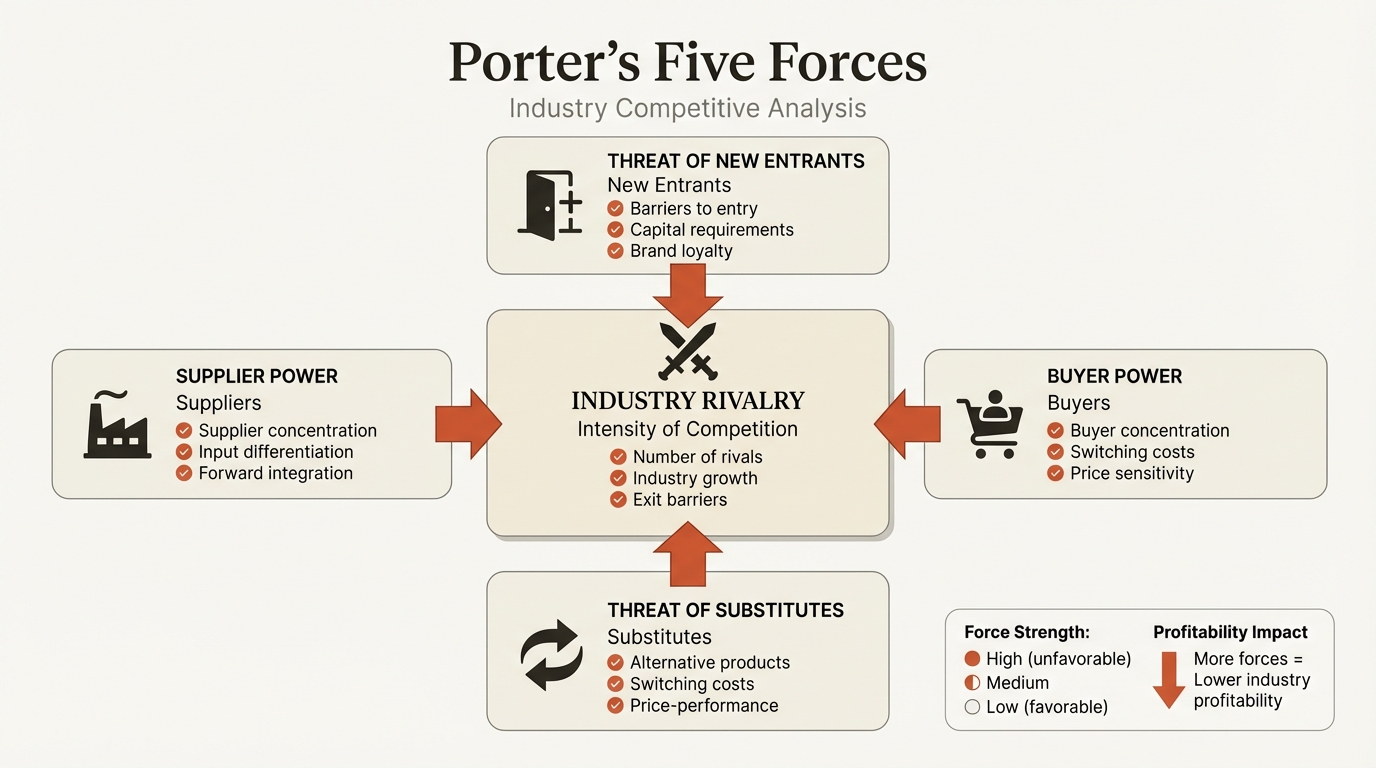

Porter's Five Forces#

Porter's Five Forces analyzes industry-level competitive dynamics rather than individual competitors. It examines:

- Threat of New Entrants — How easily can new competitors enter?

- Bargaining Power of Suppliers — How much leverage do suppliers have?

- Bargaining Power of Buyers — How much leverage do customers have?

- Threat of Substitutes — Can customers switch to alternatives?

- Industry Rivalry — How intense is competition among existing players?

When to use: Market entry decisions, industry attractiveness assessments, strategic planning context.

Output: Assessment of whether the industry structure allows for profitability and where competitive pressure is most intense.

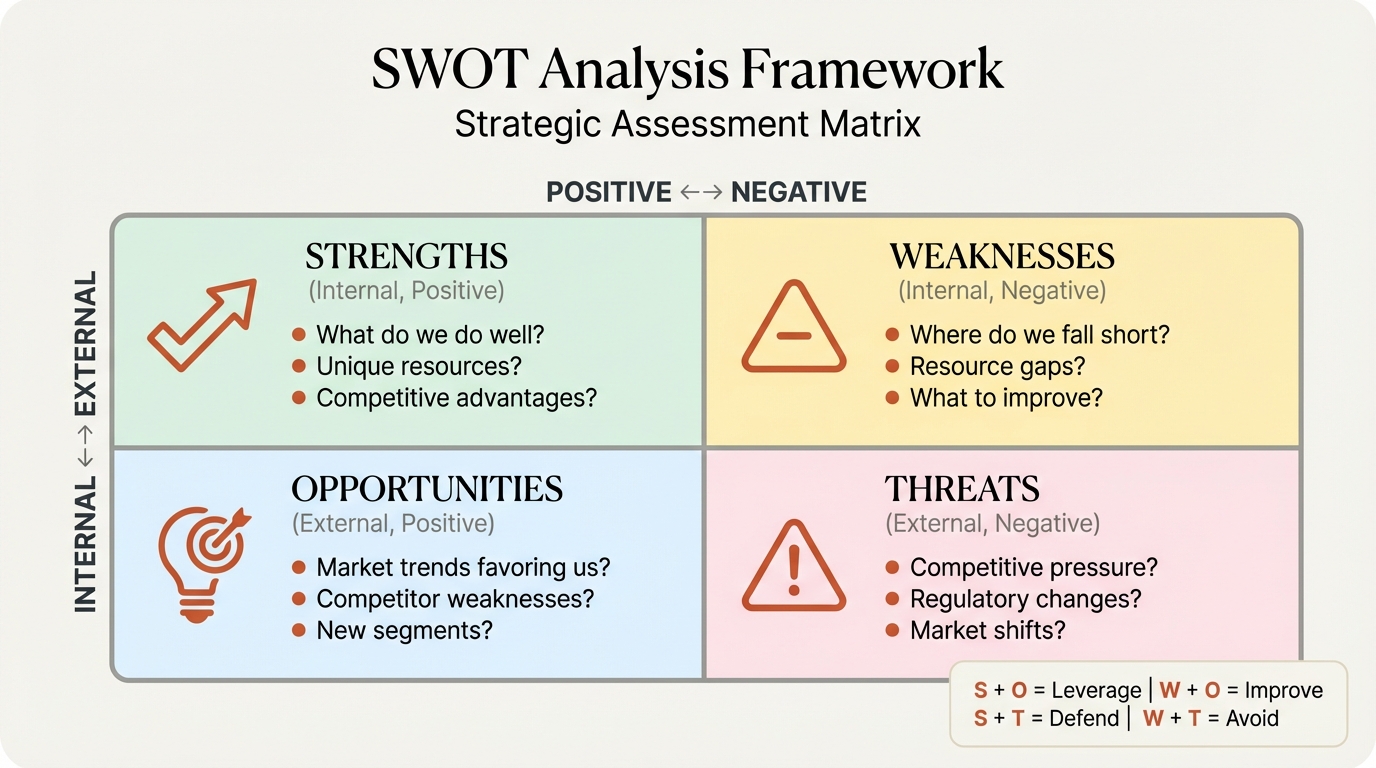

SWOT Analysis for Competitors#

Applying SWOT analysis to individual competitors reveals their strategic position:

| Quadrant | What to Assess |

|---|---|

| Strengths | Capabilities, resources, advantages they hold |

| Weaknesses | Gaps, limitations, vulnerabilities to exploit |

| Opportunities | Market changes that could benefit them |

| Threats | Risks to their business model or position |

When to use: Deep-dive on key competitors, M&A target assessment, response planning.

Output: Understanding of competitor vulnerabilities and likely strategic moves.

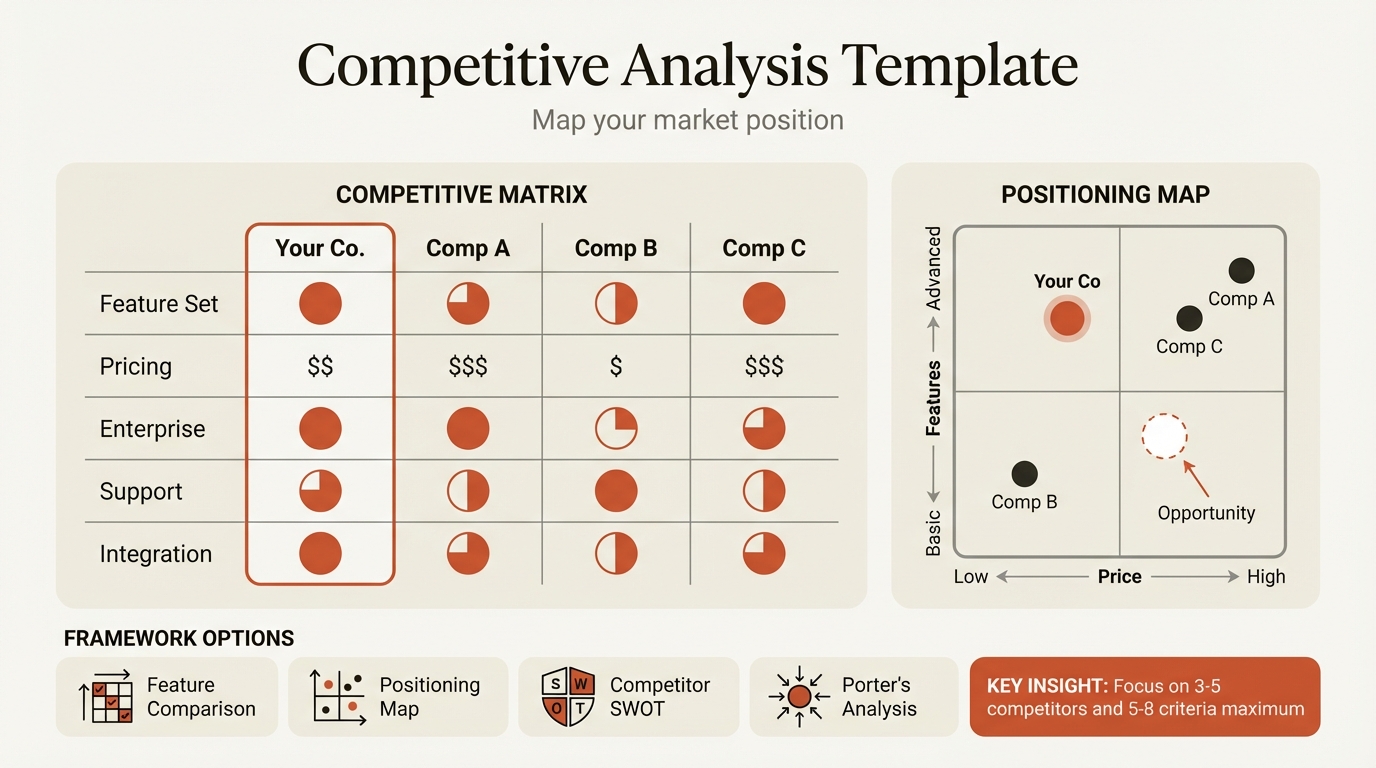

Competitive Feature Matrix#

The most common competitive analysis format: a matrix comparing features, capabilities, or attributes across competitors.

| Feature/Attribute | Your Company | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Feature 1 | Yes | Yes | No | Partial |

| Feature 2 | Yes | No | Yes | Yes |

| Pricing | $$$ | $$$$ | $$ | $$$ |

| Customer Rating | 4.5 | 4.2 | 3.8 | 4.0 |

| Market Share | 25% | 35% | 15% | 20% |

When to use: Product comparisons, sales enablement, feature prioritization, investor presentations.

Output: Clear visualization of competitive advantages and gaps.

Visualization options:

- Checkmarks and X marks (simple presence/absence)

- Harvey balls (partial completion or ratings)

- Color-coded ratings (green/yellow/red)

- Numerical scores (1-5 scale)

Perceptual Positioning Map#

A 2x2 or XY chart plotting competitors along two strategic dimensions.

| Axis Options | Example Dimensions |

|---|---|

| Price vs. Quality | Premium/Budget on one axis, High/Low quality on another |

| Features vs. Ease of Use | Feature-rich/Simple on one axis, Easy/Complex on another |

| Enterprise vs. SMB | Large customer focus vs. small customer focus |

| Innovation vs. Reliability | Cutting edge vs. proven and stable |

When to use: Strategic positioning decisions, identifying market gaps, communicating differentiation.

Output: Visual map showing where competitors cluster and where white space exists.

Tools like Deckary help create professional positioning maps with proper axis formatting and competitor plotting.

Competitor VRIO Analysis#

VRIO examines whether competitive advantages are sustainable:

| Criterion | Question | If No... |

|---|---|---|

| Valuable | Does this capability enable value creation? | Not a source of advantage |

| Rare | Do few competitors possess it? | Competitive parity only |

| Imitable | Is it costly to imitate? | Temporary advantage |

| Organized | Is the firm organized to exploit it? | Unrealized potential |

Only capabilities that satisfy all four criteria create sustained competitive advantage.

When to use: Assessing defensibility of competitor positions, identifying truly sustainable advantages.

Output: Understanding of which competitor advantages are durable vs. temporary.

Competitive Response Analysis#

A framework for anticipating and planning responses to competitor moves:

| Question | Analysis Required |

|---|---|

| What will competitors do? | Scenario planning based on competitor objectives |

| What triggers a response? | Market share loss, price changes, product launches |

| How fast can they respond? | Resource availability, decision-making speed |

| What options do we have? | Response alternatives with pros/cons |

| What should we do? | Recommended response with rationale |

When to use: After major competitive moves, before actions likely to trigger response.

Output: Response plan with contingencies.

How to Create a Competitive Analysis Slide#

Creating effective competitive analysis slides requires both analytical rigor and visual clarity. Here's our step-by-step process.

Step 1: Define the Strategic Question#

Before opening PowerPoint, clarify what you're trying to answer:

- "Who should we target as our primary competitor?"

- "Where are we losing deals and why?"

- "What features should we prioritize for our roadmap?"

- "How should we position our pricing?"

The question determines which framework to use and what data to gather.

Step 2: Select Your Competitors#

Not all competitors deserve equal attention. Categorize them:

| Category | Definition | Analysis Depth |

|---|---|---|

| Primary Competitors | Direct competitors for same customers | Deep analysis |

| Secondary Competitors | Partial overlap in offerings or customers | Moderate analysis |

| Potential Entrants | Could enter your market | Monitor and scenario plan |

| Substitutes | Alternative solutions to same problem | Understand positioning |

For most analyses, focus on 3-5 primary competitors. More than that dilutes focus and clutters slides.

Step 3: Define Comparison Dimensions#

Choose criteria relevant to your strategic question:

For product comparison:

- Core features and capabilities

- Integration options

- Ease of use / UX quality

- Performance / reliability

- Support and service

For business model comparison:

- Pricing structure

- Customer segments served

- Go-to-market approach

- Revenue model

- Geographic coverage

For strategic comparison:

- Market positioning

- Growth strategy

- Investment focus

- Partnerships and ecosystem

Limit to 5-8 dimensions per analysis. More becomes unwieldy.

Step 4: Gather Data#

Sources for competitive intelligence:

| Source | What It Provides | Reliability |

|---|---|---|

| Public filings (10-K, 10-Q) | Financial data, strategy statements | High |

| Product websites | Features, pricing, positioning | High |

| G2/Capterra reviews | Customer perception, strengths/weaknesses | Medium |

| Customer interviews | Why they chose/rejected competitors | High |

| Win/loss analysis | Deal-specific competitive dynamics | High |

| Industry reports | Market share, segment analysis | Medium |

| Patent filings | R&D direction | Medium |

| Job postings | Strategic priorities | Low-Medium |

| Social media/press | Announcements, positioning | Medium |

Pro tip: Triangulate sources. If customers, reviews, and your sales team all point to the same competitor weakness, it's real.

Step 5: Build the Visual#

Choose the right visual format for your content:

Feature Matrix:

| Feature | Us | Competitor A | Competitor B |

|---------|-----|--------------|--------------|

| Core feature 1 | Full | Full | Partial |

| Core feature 2 | Full | None | Full |

Positioning Map:

- 2x2 grid with labeled axes

- Competitor logos or bubbles plotted by position

- Size indicating market share or relevance

Competitive Profile:

- One slide per major competitor

- Key stats, strategy summary, strengths/weaknesses

- Implications for your strategy

Comparison Table:

- Side-by-side competitor snapshots

- Standardized categories across competitors

- Clear visual hierarchy

Step 6: Add Strategic Implications#

Every competitive analysis slide should answer "so what?"

Include:

- What does this mean for our strategy?

- Where should we focus investment?

- What should we stop doing?

- How should we respond to competitor moves?

Without implications, competitive analysis is just interesting information.

Continue reading: Bullet Charts in PowerPoint · Deloitte Presentation Template · Traction Slide

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Competitive Analysis Template Elements#

A complete competitive analysis presentation includes these components:

1. Competitive Landscape Overview#

A single slide showing the overall competitive environment:

- Market structure (fragmented vs. consolidated)

- Key players and approximate market shares

- Strategic groups or segments

- Your position in the landscape

2. Competitor Profiles#

One slide per major competitor covering:

- Company overview (size, history, focus)

- Product/service offering

- Target customers

- Competitive strategy

- Key strengths and weaknesses

- Recent moves and likely future direction

3. Feature Comparison Matrix#

The classic comparison table:

- Competitors as columns

- Features/capabilities as rows

- Consistent scoring method (checkmarks, Harvey balls, ratings)

- Color coding for quick scanning

- Summary insights in action title

4. Positioning Map#

Visual representation of competitive positioning:

- Two dimensions most relevant to your strategy

- All major competitors plotted

- Identify clusters and white space

- Your current and potential positions marked

5. Competitive Dynamics#

Analysis of how competition actually works:

- Who competes with whom (direct vs. indirect)

- Basis of competition (price, features, service)

- Competitive intensity and trends

- Recent competitive moves and market reactions

6. Strategic Implications#

The "so what?" slide:

- Key insights from the analysis

- Competitive threats to address

- Opportunities to exploit

- Recommended strategic actions

7. Response Scenarios (Optional)#

For active competitive situations:

- Likely competitor moves

- Potential responses for each scenario

- Recommended response strategy

- Triggers for action

Competitor Comparison Table Formats#

Different formats suit different situations. Here's when to use each.

Checkmark Matrix#

Format: Simple yes/no for feature presence

| Feature | Us | Comp A | Comp B |

|---|---|---|---|

| Feature 1 | X | X | - |

| Feature 2 | X | - | X |

Best for: Binary comparisons, sales battlecards, quick overviews

Limitation: No nuance for partial capabilities

Harvey Ball Matrix#

Format: Circles filled to indicate capability level

| Capability | Us | Comp A | Comp B |

|---|---|---|---|

| Capability 1 | Full | 3/4 | Half |

| Capability 2 | Full | 1/4 | Full |

Best for: Nuanced comparisons, capability assessments, executive presentations

Tools like Deckary include Harvey ball templates for consistent formatting.

Numerical Rating Matrix#

Format: Scores (1-5 or 1-10) for each dimension

| Dimension | Us | Comp A | Comp B |

|---|---|---|---|

| Innovation | 4 | 5 | 3 |

| Price | 3 | 2 | 5 |

| Support | 5 | 4 | 3 |

| Total | 12 | 11 | 11 |

Best for: Weighted comparisons, quantitative decision-making, RFP responses

Color-Coded Matrix#

Format: Colors indicating relative performance

| Attribute | Us | Comp A | Comp B |

|---|---|---|---|

| Speed | Green | Yellow | Red |

| Cost | Yellow | Red | Green |

| Quality | Green | Green | Yellow |

Legend: Green = strong, Yellow = adequate, Red = weak

Best for: Executive summaries, quick visual scanning, presentation decks

Combination Matrix#

Most effective: combine multiple formats

| Feature | Us | Comp A | Comp B | Notes |

|---|---|---|---|---|

| Core Platform | Full (green) | 3/4 (yellow) | Half (red) | Our key differentiator |

| Integration | 3/4 (yellow) | Full (green) | Half (yellow) | Gap to address |

| Price ($K/yr) | $50 | $120 | $35 | We're mid-market |

Common Competitive Analysis Mistakes#

These errors appear repeatedly. Avoid them, and your analysis will be more useful than most.

Mistake 1: Analyzing Too Many Competitors#

A 20-competitor analysis isn't thorough—it's unfocused. Executives can't act on matrices with 15 columns.

Fix: Focus on 3-5 primary competitors. Mention others briefly if relevant, but deep analysis should focus where it matters most.

Mistake 2: Describing Without Analyzing#

Listing competitor features isn't analysis. "Competitor A has feature X" is a fact. "Competitor A's strength in X threatens our enterprise deals because..." is analysis.

Fix: Every observation should connect to implications. Why does this matter? What should we do about it?

Mistake 3: Static Snapshots#

Competitors don't stand still. A competitive analysis from 6 months ago may be obsolete.

Fix:

- Date your analysis prominently

- Include trend indicators (arrows showing direction)

- Establish update cadence (quarterly for dynamic markets)

- Flag major changes that require immediate reassessment

Mistake 4: Confirmation Bias#

It's tempting to emphasize competitor weaknesses and downplay their strengths. This produces a feel-good analysis, not a useful one.

Fix: Actively seek disconfirming evidence. Ask "where are they actually better than us?" Customers will tell you the truth—listen.

Mistake 5: Feature Obsession#

Not all competitive differentiation is about features. Business model, pricing, brand, distribution, and service often matter more.

Fix: Analyze the full competitive picture, not just feature comparison. Why do customers actually choose competitors?

Mistake 6: Missing the "So What"#

The most common mistake: presenting data without implications. Executives want to know what to do, not just what exists.

Fix: Every competitive analysis must end with strategic implications and recommended actions.

Mistake 7: Ignoring Indirect Competition#

Customers often choose alternatives you don't consider competitors. A CRM tool might lose deals to spreadsheets, not other CRMs.

Fix: Include substitute solutions and the "do nothing" option in your analysis. Understand the full competitive set from the customer's perspective.

Mistake 8: Single Source Dependence#

Relying only on public information misses competitive dynamics visible to customers and sales teams.

Fix: Combine external research with internal intelligence. Win/loss interviews and customer feedback reveal what competitors actually do in deals, not just what they claim.

Best Practices for Competitive Analysis#

1. Start with Customer Perception#

The customer's view matters most. How do customers see you vs. competitors? What drives their choices?

Methods:

- Win/loss interviews

- Customer surveys including NPS drivers

- Sales team debriefs

- Review site analysis

2. Weight by Strategic Importance#

Not all comparison dimensions matter equally. Weight criteria by importance to your strategic decisions.

| Dimension | Weight | Rationale |

|---|---|---|

| Enterprise security | 30% | Must-have for target segment |

| Integration depth | 25% | Key differentiator |

| Ease of use | 20% | Important for adoption |

| Price | 15% | Less important for enterprise |

| Brand | 10% | Secondary factor |

3. Use Consistent Methodology#

Comparisons require consistent evaluation criteria. Ad hoc assessments produce unreliable results.

Establish:

- Clear definitions for each dimension

- Consistent rating scales

- Documented evidence requirements

- Regular update process

4. Separate Facts from Assumptions#

Mark the difference between verified information and educated guesses.

| Data Quality | Symbol | Example |

|---|---|---|

| Confirmed | (no marker) | "Competitor A charges $100/user/month (per their website)" |

| Estimated | (e) | "Competitor A has ~500 employees (e) based on LinkedIn" |

| Assumed | (a) | "Competitor A likely investing in AI (a) based on job postings" |

5. Think Like Competitors#

Understanding competitor motivation helps predict their moves:

- What are their stated objectives?

- What does their leadership incentivize?

- What are their constraints?

- How have they responded to competitive moves before?

This is particularly valuable for competitive response analysis.

6. Make It Actionable#

The best competitive analysis drives decisions:

- Specific recommendations, not vague suggestions

- Clear owners for each action

- Timeline for implementation

- Success metrics to track

7. Update Regularly#

Competitive landscapes change. Establish update cadence:

| Trigger | Action |

|---|---|

| Quarterly | Review and refresh key competitor profiles |

| Major competitor move | Immediate reassessment of affected areas |

| Annual planning | Comprehensive competitive analysis |

| Pre-launch | Deep dive on directly competitive products |

Creating Competitive Analysis in PowerPoint#

Practical guidance for building competitive analysis slides.

Visual Hierarchy#

Structure slides for scanning:

- Action title — The insight, not just the topic

- Primary visual — Matrix, map, or comparison

- Supporting detail — Evidence bullets or annotations

- Implications — What this means strategically

Formatting Standards#

Follow consulting slide standards:

- Consistent fonts and sizes

- Aligned elements (use PowerPoint alignment tools or Deckary for precision)

- Appropriate white space

- Professional color palette

Color Coding Conventions#

Standard colors for competitive analysis:

| Color | Meaning |

|---|---|

| Green | Strong/good/advantage |

| Yellow/Orange | Moderate/adequate/parity |

| Red | Weak/poor/disadvantage |

| Blue | Your company (highlight) |

| Gray | Neutral information |

Be consistent throughout the deck.

Icon Usage#

Icons can clarify competitive matrices:

- Checkmarks for presence

- X marks for absence

- Up/down arrows for trends

- Lightning bolts for innovation

- Shield for security

The Deckary icon library includes business strategy icons suitable for competitive analysis.

Template Approaches#

Option 1: Native PowerPoint

- Create tables and shapes manually

- Full control but time-consuming

- Risk of inconsistent formatting

Option 2: SmartArt

- Quick matrix creation

- Limited customization

- Can look generic

Option 3: Add-ins

- Deckary, think-cell, and similar tools

- Professional templates

- Consistent formatting

- Faster iteration

For frequent competitive analysis, add-ins like Deckary save significant time while maintaining quality.

Real-World Competitive Analysis Examples#

Example 1: SaaS Product Comparison#

Context: B2B software company evaluating competitive positioning for sales enablement.

| Dimension | Our Product | Competitor A | Competitor B | Competitor C |

|---|---|---|---|---|

| Core Features | Full | Full | 3/4 | Full |

| Enterprise Security | Full | Full | 1/4 | Half |

| Integration Ecosystem | Full | 3/4 | Half | Full |

| Ease of Use | 3/4 | Half | Full | Half |

| Mobile Experience | Half | Full | 3/4 | Half |

| Price (per user/mo) | $50 | $80 | $30 | $75 |

| NPS Score | 62 | 48 | 55 | 42 |

Implications:

- Security and integrations are our key differentiators for enterprise

- Mobile gap is a vulnerability—Competitor A winning deals on this

- Competitor B is price leader but lacks enterprise readiness

- Our value proposition: "Enterprise-grade with mid-market accessibility"

Example 2: Market Entry Competitive Landscape#

Context: Consumer goods company evaluating entry into new geographic market.

Positioning Map:

Plot on two axes:

- X-axis: Price point (Low to Premium)

- Y-axis: Distribution breadth (Narrow/Specialty to Broad/Mass)

| Competitor | Position | Market Share |

|---|---|---|

| Incumbent A | Premium, Broad | 35% |

| Incumbent B | Mid-price, Broad | 25% |

| Local Player C | Low, Narrow | 15% |

| Private Label | Low, Broad | 20% |

| (White space) | Premium, Narrow | 5% |

Implications:

- White space exists in premium specialty segment

- Entry via broad distribution requires competing with entrenched incumbents

- Acquisition of Local Player C could provide distribution foothold

- Private label pricing pressure makes mid-market challenging

Example 3: Feature Roadmap Prioritization#

Context: Product team using competitive analysis to prioritize features.

| Feature Gap | Competitive Urgency | Customer Demand | Dev Effort | Priority |

|---|---|---|---|---|

| Mobile app | High (2 of 3 competitors have it) | High | Medium | 1 |

| API v2 | Medium (1 competitor) | High | High | 2 |

| AI assistant | Low (no competitors) | Medium | High | 3 |

| Offline mode | Medium (1 competitor) | Low | Medium | 4 |

Implications:

- Mobile app is table stakes—competitive and customer demand align

- API v2 addresses enterprise needs despite lower competitive pressure

- AI assistant could differentiate but wait for v1 mobile and API

- Offline mode is not a priority given low customer demand

Competitive Analysis and Other Frameworks#

Competitive analysis works with other strategic frameworks:

With Porter's Five Forces#

Porter's Five Forces provides industry-level context. Competitive analysis goes deeper into specific competitor dynamics. Use Five Forces to understand industry attractiveness, then competitive analysis to understand how to win within that industry.

With SWOT Analysis#

Apply SWOT analysis to individual competitors:

- What are their strengths we must respect?

- What weaknesses can we exploit?

- What opportunities might they pursue?

- What threats do they face that we don't?

Competitor SWOTs reveal vulnerabilities and predict behavior.

With PESTLE Analysis#

PESTLE analysis identifies macro factors affecting all competitors. Some competitors are better positioned for certain trends. Understanding how political, economic, social, technological, legal, and environmental factors differentially impact competitors improves strategic planning.

With BCG Matrix#

The BCG matrix analyzes portfolio positioning. Overlay competitive analysis to understand how competitors' portfolio positions affect their likely behavior. Cash cows fund competitive moves; question marks drive desperation or opportunism.

With Business Model Canvas#

The Business Model Canvas maps how competitors create, deliver, and capture value. Comparing business model canvases across competitors reveals strategic positioning differences beyond product features.

Summary#

Competitive analysis is essential for strategic decision-making. Done well, it reveals where you're vulnerable, where you can win, and what you should do differently.

Key principles:

- Focus on strategic questions — Start with what you need to decide, not what data you can gather

- Choose the right framework — Different questions require different analytical approaches

- Limit scope — 3-5 competitors, 5-8 dimensions, one clear message per slide

- Balance multiple sources — Triangulate customer feedback, public data, and internal intelligence

- Include implications — Every analysis must answer "so what?" with actionable recommendations

- Update regularly — Static analyses become obsolete; establish update triggers and cadence

For PowerPoint execution:

- Use consistent visual formatting and color coding

- Apply consulting slide standards for professional presentation

- Choose appropriate comparison formats (checkmarks, Harvey balls, ratings)

- Include action titles that communicate insights, not just topics

- Tools like Deckary accelerate professional competitive analysis slides

The goal isn't to know everything about competitors. It's to know what matters for your strategic decisions and act on that knowledge. As that McKinsey partner taught us: description isn't analysis, and analysis isn't strategy.

Build the analysis. Derive the implications. Make the decisions.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free