CAGR Calculator

Calculate Compound Annual Growth Rate instantly. The standard metric used by consultants, analysts, and investors to measure growth.

CAGR Formula: (Ending Value / Beginning Value)1/n - 1

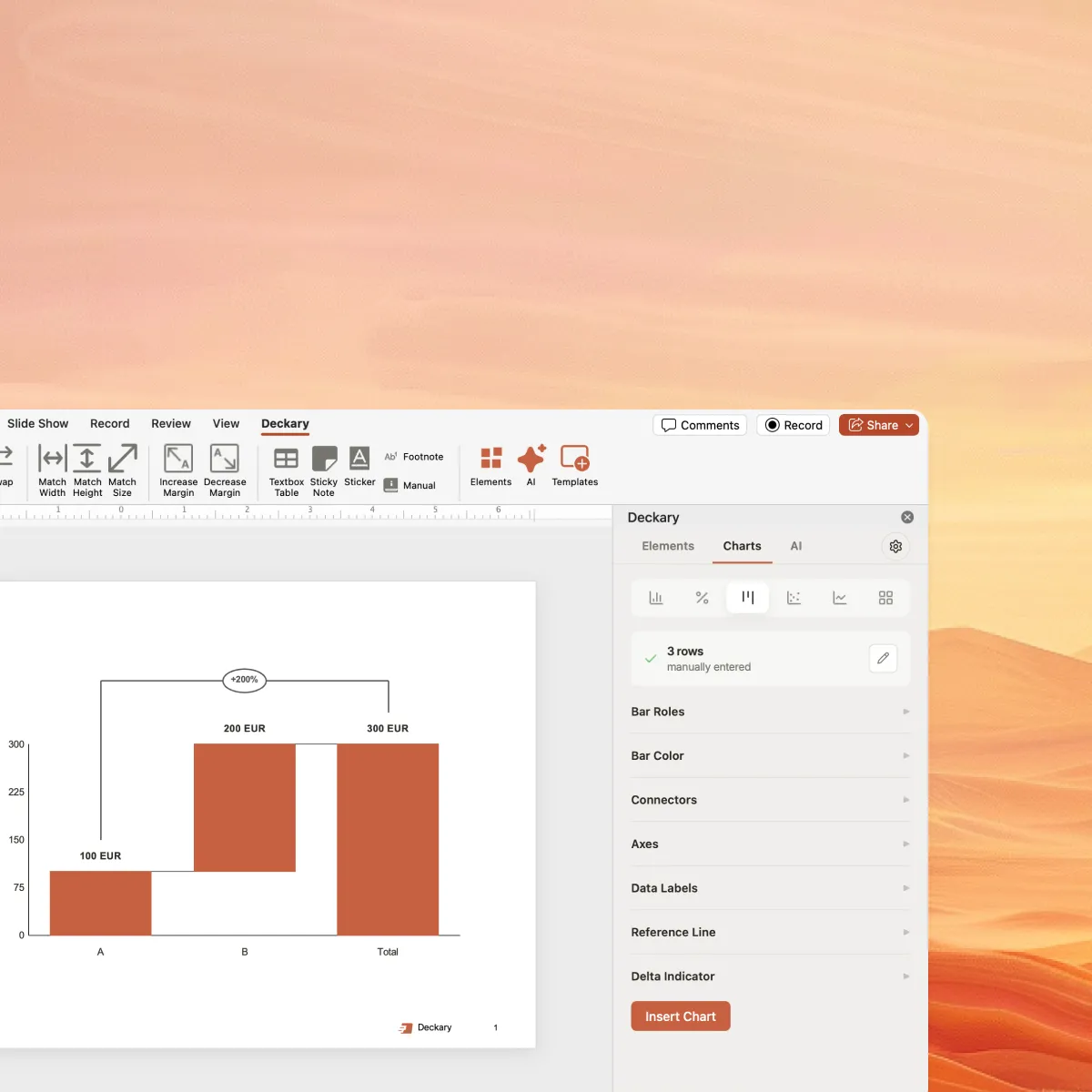

Now visualize it in PowerPoint

Add CAGR lines to your waterfall charts and bar charts with one click. Deckary automatically calculates and formats growth annotations.

What is CAGR?

CAGR (Compound Annual Growth Rate) is the rate of return that would be required for an investment to grow from its beginning value to its ending value, assuming profits are reinvested at the end of each period.

Unlike simple average returns, CAGR smooths out volatility and gives you a single percentage that represents consistent year-over-year growth. This makes it the go-to metric for:

- Comparing investment performance across different time periods

- Measuring company revenue or profit growth

- Setting growth targets and forecasting

- Benchmarking against industry standards

Example CAGR Calculation

A company's revenue grows from $10M to $25M over 5 years:

CAGR = (25,000,000 / 10,000,000)1/5 - 1

CAGR = (2.5)0.2 - 1

CAGR = 1.2011 - 1

CAGR = 20.11%

This means the revenue grew at an equivalent rate of 20.11% each year over the 5-year period.

When to Use CAGR

CAGR is the standard growth metric in consulting, finance, and business strategy

Revenue Growth Analysis

Show how revenue grew over multiple years on waterfall charts and bar charts. CAGR lines are standard in consulting presentations.

Investment Returns

Compare portfolio performance across different time periods. CAGR normalizes returns so you can compare a 3-year investment to a 10-year one.

Market Sizing & TAM

Project future market size using historical CAGR. Essential for TAM/SAM/SOM slides in pitch decks and strategy presentations.

Financial Forecasting

Build financial projections by applying CAGR to historical data. Used in financial projections slides and business plans.

CAGR Benchmarks by Industry

| Context | Typical CAGR | Notes |

|---|---|---|

| S&P 500 (Historical) | ~10% | Long-term average including dividends |

| High-Growth SaaS | 20-50% | ARR growth for venture-backed companies |

| Mature Tech | 10-20% | Large cap tech companies |

| Consumer Goods | 3-8% | Established CPG brands |

| Real Estate | 4-7% | Property value appreciation |

| Early-Stage Startups | 50-100%+ | VC expectations for portfolio companies |

How to Calculate CAGR in Excel

While this calculator provides instant results, you may need to calculate CAGR directly in Excel for financial models or presentations. Excel offers several methods:

Method 1: Manual CAGR Formula

The most transparent approach—shows exactly how CAGR is calculated:

=((B2/B1)^(1/A2))-1Where B2 = Ending Value, B1 = Beginning Value, A2 = Number of Years

Method 2: RRI Function (Excel 2013+)

The RRI function calculates equivalent interest rate for growth:

=RRI(nper, pv, fv)Example: =RRI(5, 1000, 2500) returns 20.11% for $1,000 growing to $2,500 over 5 years

Method 3: RATE Function

Originally for loan calculations, but works for CAGR with no periodic payments:

=RATE(nper, 0, -pv, fv)Note: The present value (pv) must be negative for proper calculation

Pro Tip: Excel vs. Presentation

Calculate CAGR in Excel for your analysis, but use a tool like Deckary to display CAGR lines on bar charts and waterfall charts in PowerPoint. Manual annotation in PowerPoint is time-consuming and error-prone when data changes.

Ready to build better charts?

Calculate CAGR here, then visualize it instantly in PowerPoint with Deckary's waterfall charts and bar charts.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about CAGR calculations

Related Calculators

ROI Calculator

Return on Investment for business cases and project justification.

Use calculatorNPV Calculator

Net Present Value for capital budgeting and investment analysis.

Use calculatorIRR Calculator

Internal Rate of Return to evaluate project attractiveness.

Use calculatorWACC Calculator

Weighted Average Cost of Capital for DCF valuations.

Use calculatorTAM SAM SOM Calculator

Total Addressable Market for strategy and due diligence.

Use calculator