NPV Calculator

Calculate Net Present Value instantly. The gold standard for capital budgeting, investment analysis, and corporate finance decisions.

NPV Formula: Σ(CFt / (1 + r)^t) - Initial Investment

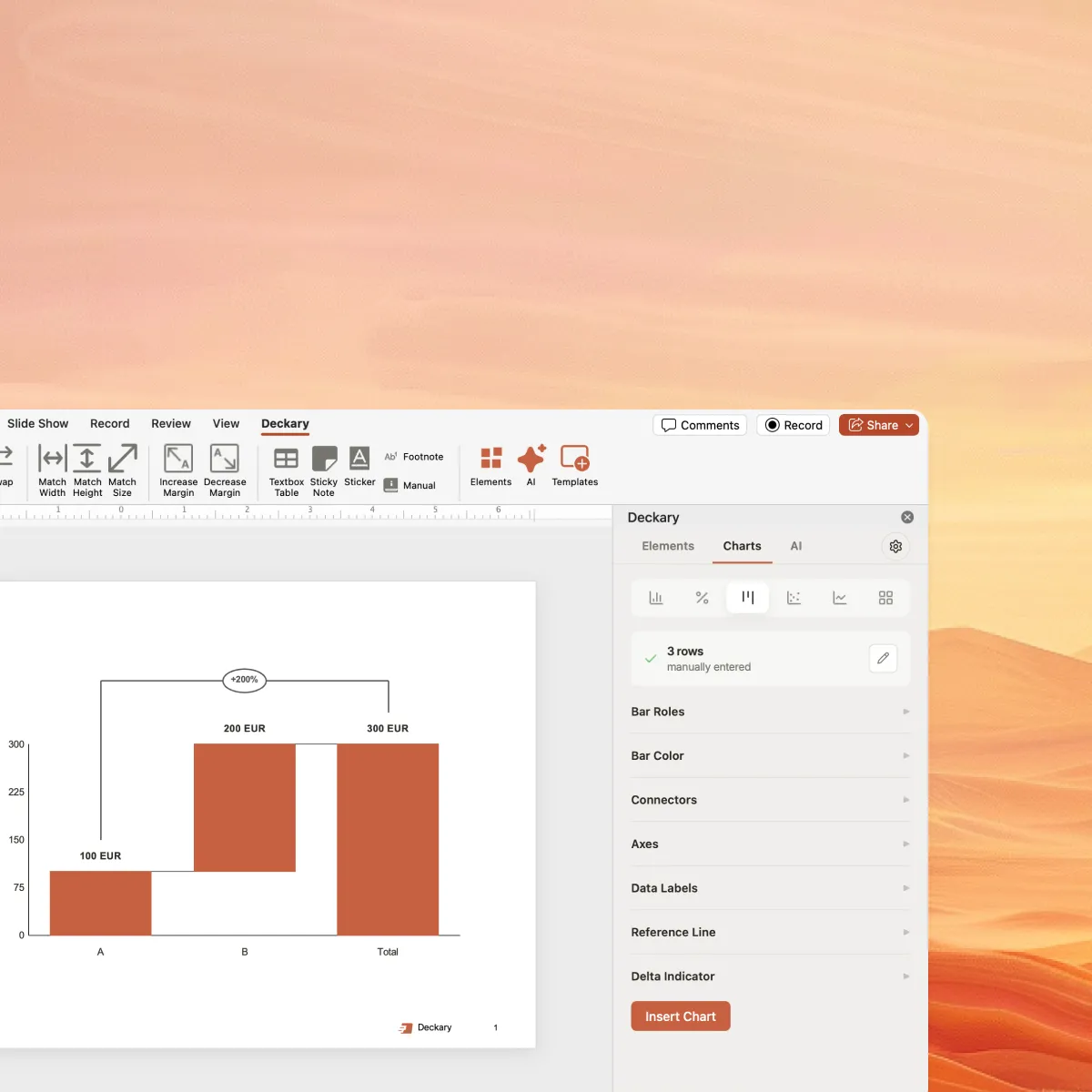

Present NPV in your business case

Create professional waterfall charts and bar charts to visualize NPV, cash flows, and investment returns in your presentations.

What is NPV?

NPV (Net Present Value) is a financial metric that calculates the present value of all future cash flows from an investment, minus the initial investment cost. It accounts for the time value of money—the principle that a dollar today is worth more than a dollar tomorrow.

NPV is considered the gold standard in corporate finance for evaluating investments because it directly measures value creation. If NPV is positive, the investment is expected to generate returns above the required rate of return (discount rate).

- Accounts for time value of money with discounting

- Shows absolute dollar value created (or destroyed)

- Enables apples-to-apples comparison of different projects

- Forms the basis for all DCF (Discounted Cash Flow) analysis

Example NPV Calculation

A company invests $100,000 and expects cash flows of $30,000 per year for 5 years at a 10% discount rate:

Year 1: $30,000 / 1.10 = $27,273

Year 2: $30,000 / 1.21 = $24,793

Year 3: $30,000 / 1.33 = $22,539

Year 4: $30,000 / 1.46 = $20,490

Year 5: $30,000 / 1.61 = $18,628

PV of Cash Flows = $113,723

NPV = $113,723 - $100,000 = $13,723

A positive NPV of $13,723 indicates the project creates value above the 10% required return.

When to Use NPV

NPV is the preferred metric for major capital decisions in corporate finance and consulting

Capital Budgeting

Evaluate major equipment purchases, facility expansions, or technology investments. NPV directly shows dollar value created at your cost of capital.

M&A Valuation

Value acquisition targets using DCF analysis. Calculate NPV of expected synergies and future cash flows to determine fair acquisition price.

Project Prioritization

Compare competing projects for limited capital. Use NPV alongside Profitability Index to rank investments when you can't fund everything.

Real Estate Investment

Analyze property investments with projected rental income, appreciation, and expenses. NPV accounts for the long-term nature of real estate.

Choosing the Right Discount Rate

| Discount Rate | Typical Range | When to Use |

|---|---|---|

| Risk-Free Rate | 3-5% | Government bond baseline, theoretical minimum |

| Corporate WACC | 8-12% | Standard corporate investments, most business cases |

| Higher Risk Projects | 15-20% | New market entry, R&D, unproven technology |

| Venture/Startup | 25-50% | Early-stage investments, high uncertainty |

| Private Equity | 20-30% | Leveraged buyouts, operational turnarounds |

How to Present NPV in Business Cases

In consulting and corporate settings, NPV is presented alongside complementary metrics to give a complete picture of investment value and risk.

Sensitivity Analysis

Show NPV at different discount rates (e.g., 8%, 10%, 12%) to demonstrate how robust the investment is to rate changes.

Scenario Planning

Present NPV under conservative, base, and optimistic scenarios to show the range of possible outcomes.

The Investment Committee Format

When presenting to leadership or investment committees, include these elements:

- Executive Summary: NPV, IRR, and payback at a glance

- Investment Required: Total capital with deployment timeline

- Cash Flow Projections: Year-by-year breakdown with assumptions

- Sensitivity Analysis: NPV tornado chart showing key drivers

- Scenario Analysis: Conservative/Base/Optimistic cases

- Risk Assessment: Key risks and mitigation strategies

NPV vs. ROI vs. IRR vs. Payback Period

Understanding when to use each metric for capital allocation and investment decisions

| Metric | What It Measures | Best For | Limitation |

|---|---|---|---|

| NPV | Present value of cash flows minus investment | Large capital decisions, absolute value | Requires discount rate assumption |

| ROI | Total return as % of investment | Quick comparison, executive communication | Ignores time value of money |

| IRR | Discount rate that makes NPV = 0 | Comparing projects of different sizes | Can give multiple results; assumes reinvestment at IRR |

| Payback | Time to recover initial investment | Liquidity assessment, risk screening | Ignores cash flows after payback |

When to Use NPV

- • Major capital expenditures ($1M+)

- • Long-term projects (5+ years)

- • When comparing projects with different cash flow patterns

- • M&A and valuation analysis

NPV Decision Rule

- • NPV > 0: Accept the project

- • NPV < 0: Reject the project

- • NPV = 0: Indifferent (returns equal cost of capital)

- • When comparing: Choose higher NPV

Consulting Best Practice

McKinsey, BCG, and Bain typically present all four metrics for major capital decisions: NPV for absolute value creation, IRR for percentage return, ROI for intuitive communication, and payback period for risk assessment. The investment committee gets a complete picture.

Ready to build your business case?

Calculate NPV here, then create professional charts to visualize your investment analysis in PowerPoint with Deckary.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about NPV calculations

Related Calculators

ROI Calculator

Return on Investment for business cases and project justification.

Use calculatorCAGR Calculator

Compound Annual Growth Rate for measuring growth over time.

Use calculatorIRR Calculator

Internal Rate of Return to evaluate project attractiveness.

Use calculatorWACC Calculator

Weighted Average Cost of Capital for DCF valuations.

Use calculatorTAM SAM SOM Calculator

Total Addressable Market for strategy and due diligence.

Use calculator