TAM SAM SOM Calculator

Calculate Total Addressable Market, Serviceable Addressable Market, and Serviceable Obtainable Market for strategy, due diligence, and investment analysis.

Enter your total market size in dollars

What portion of TAM can you serve? (typical: 10-30%)

What can you realistically capture? (typical: 1-5% early stage)

Enter your TAM and click calculate

to see your market breakdown

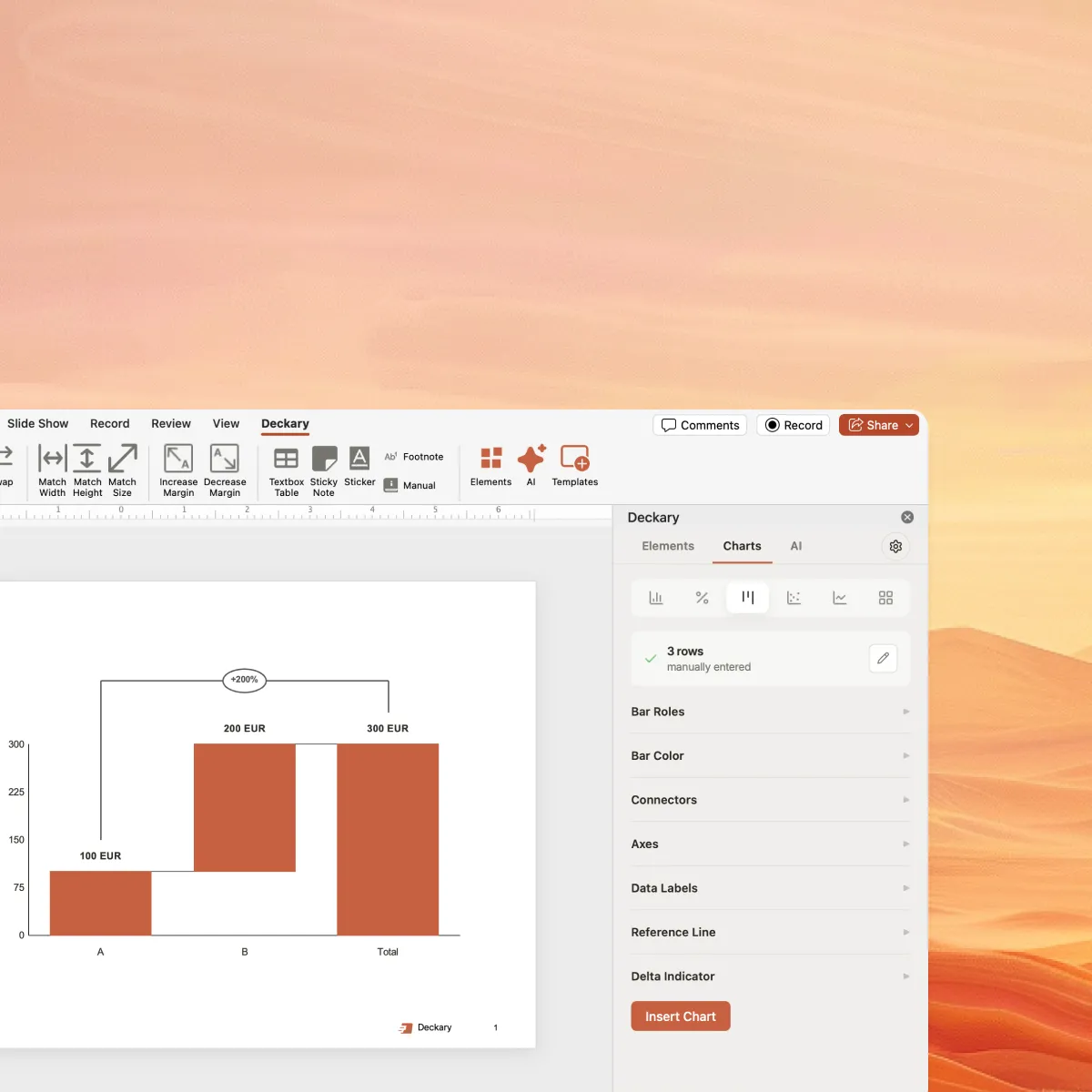

Now build your market slide

Create professional TAM SAM SOM visualizations in PowerPoint. Consulting-grade templates used by MBB, PE firms, and investors.

What is TAM SAM SOM?

TAM SAM SOM is the standard framework for market sizing. Consultants use it for market entry analysis, PE firms for due diligence, and corporate strategy teams for growth planning. Here's what each term means:

Total Addressable Market

The total market demand if you had 100% share. The theoretical maximum. Shows the size of the opportunity.

Serviceable Addressable Market

The portion of TAM your product can serve. Filtered by geography, segment, or capability. Shows focus.

Serviceable Obtainable Market

What you can realistically capture in 1-5 years. Accounts for competition. Shows credibility.

Pro Tip: Bottom-Up vs Top-Down

Investors prefer bottom-up calculations (# of customers × price per customer) over top-down (industry reports). Bottom-up shows you understand your unit economics. Best practice: show both and explain the difference.

How to Calculate Each Metric

Step-by-step approaches for credible market sizing

Calculating TAM

Top-down: Use industry reports (Gartner, IBISWorld, Statista). "The global CRM market is $80B."

Bottom-up: Total potential customers × Annual contract value. "30M SMBs × $500/year = $15B."

Value-theory: Total value created by solving the problem. Useful for new categories.

Calculating SAM

Geographic filter: "We're launching in North America first" → 40% of global TAM.

Segment filter: "We serve mid-market only (50-500 employees)" → 25% of TAM.

Capability filter: "Our product only works for e-commerce" → 15% of TAM.

Multiply filters together if they're independent.

Calculating SOM

Market entry: 1-5% of SAM is realistic for new market entrants in years 1-3.

Established player: 5-15% of SAM with proven go-to-market and brand.

Market leader: 15-30% of SAM with category leadership and scale.

Base SOM on sales capacity and realistic win rates, not aspirational targets.

Common Market Sizing Mistakes That Kill Credibility

VCs and PE investors see these errors constantly. Avoid them to build trust in your analysis.

Claiming Your Customer's Revenue as TAM

If you sell software to grocery stores, your TAM is not $765B in grocery sales—it's what grocery stores spend on software like yours. Your TAM is what you can earn, not what your customers earn.

Top-Down Only Without Bottom-Up Validation

"Gartner says the market is $50B" is a starting point, not a conclusion. Investors want to see bottom-up math: (# customers × ACV) that triangulates with top-down. If they don't match, explain why.

"We Just Need 1% of a Giant Market"

This signals you haven't done the work. Investors want to see how you'll get that 1%: sales capacity, CAC, win rates, competitive dynamics. Build SOM from the bottom up, not as a percentage of TAM.

Conflating TAM and SAM

If you only sell in North America to mid-market, don't use global enterprise numbers. Investors will ask: "What's the SAM for your actual go-to-market?" If you can't answer, you haven't done the segmentation.

No Source Attribution

Every number needs a source: Gartner, IBISWorld, Census data, your own customer data. Unsourced claims are red flags. Footnote your methodology—it shows rigor and builds trust.

The Credibility Test

Before presenting, ask: "Could a skeptical analyst poke holes in this?" If yes, address it proactively. Show conservative, base, and aggressive scenarios. Investors respect founders who acknowledge uncertainty rather than those who present optimistic-only projections.

Ready to build your market sizing slide?

Calculate your market size here, then create professional slides with Deckary's consulting-grade templates and charts.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about market sizing

Related Calculators

ROI Calculator

Return on Investment for business cases and project justification.

Use calculatorCAGR Calculator

Compound Annual Growth Rate for measuring growth over time.

Use calculatorNPV Calculator

Net Present Value for capital budgeting and investment analysis.

Use calculatorIRR Calculator

Internal Rate of Return to evaluate project attractiveness.

Use calculatorWACC Calculator

Weighted Average Cost of Capital for DCF valuations.

Use calculator