ROI Calculator

Calculate Return on Investment instantly. The standard metric for business cases, capital expenditure analysis, and corporate investment decisions.

ROI Formula: (Final Value - Initial Investment) / Initial Investment × 100

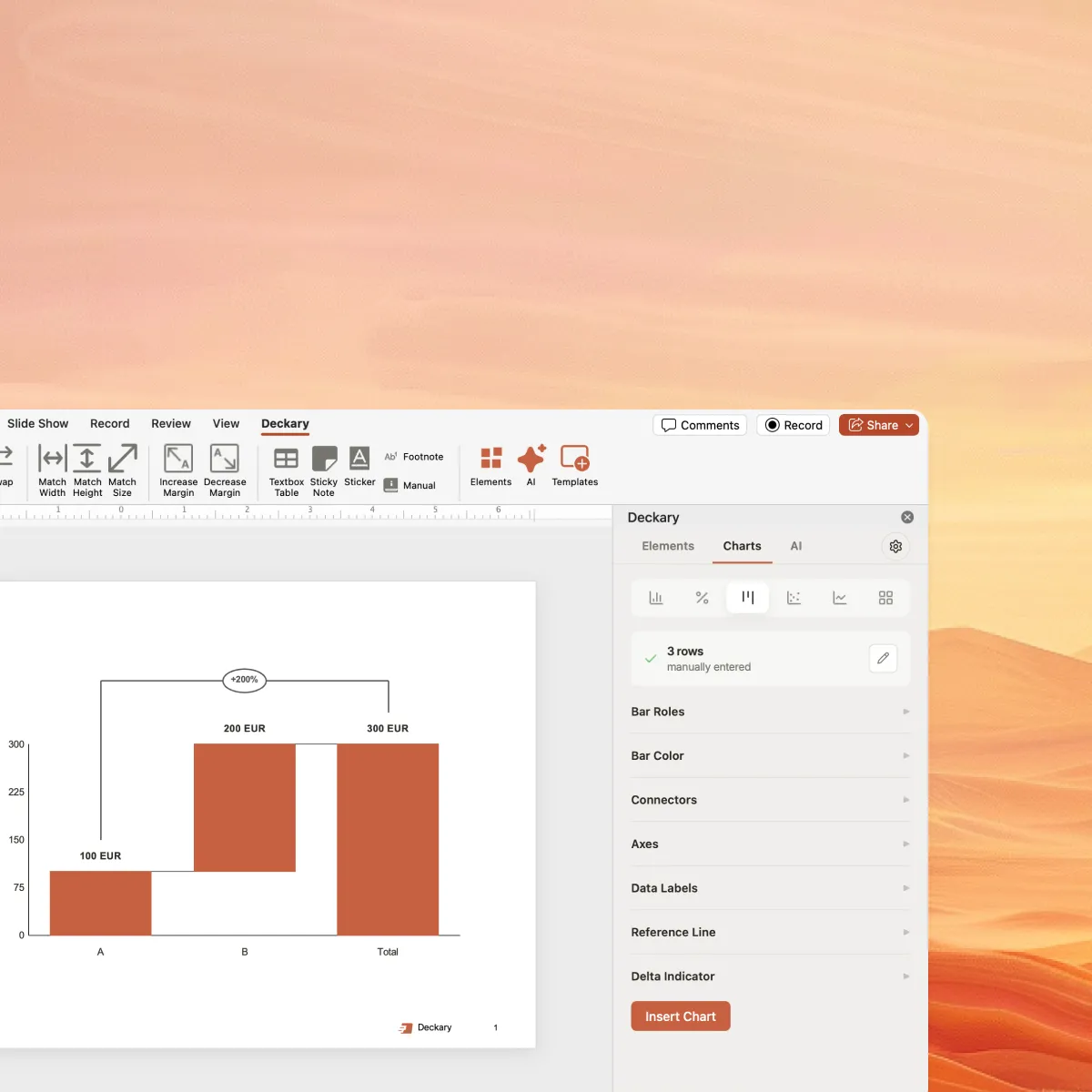

Present ROI in your business case

Create professional waterfall charts and bar charts to visualize ROI, costs, and benefits in your presentations.

What is ROI?

ROI (Return on Investment) is a financial metric that measures the profitability of an investment relative to its cost. It answers the fundamental question: "For every dollar invested, how much did I get back?"

ROI is the go-to metric in business for evaluating investments because it's simple, universal, and directly comparable. Whether you're analyzing a marketing campaign, capital expenditure, or technology investment, ROI provides a standardized way to measure success.

- Comparing different investment opportunities objectively

- Justifying project funding in business cases

- Measuring the success of completed initiatives

- Setting performance targets and benchmarks

Example ROI Calculation

A company invests $100,000 in a new software system and gains $150,000 in value (cost savings + revenue):

ROI = (150,000 - 100,000) / 100,000 × 100

ROI = 50,000 / 100,000 × 100

ROI = 50%

This means for every $1 invested, the company received $1.50 back—a 50% return.

When to Use ROI

ROI is the standard metric for investment decisions in consulting, finance, and business strategy

Business Case Development

Justify technology investments, process improvements, or new initiatives. Present ROI alongside payback period to secure stakeholder buy-in.

Capital Allocation & Budgeting

Compare competing projects for limited capital. Use ROI alongside hurdle rates to prioritize investments that exceed cost of capital (WACC).

Capital Investment Decisions

Compare equipment purchases, real estate investments, or expansion projects. Use annualized ROI to fairly compare investments with different time horizons.

M&A Synergy Analysis

Quantify expected synergies and integration costs. Calculate ROI on acquisition premium to support due diligence and board presentations.

ROI Benchmarks by Category

| Investment Type | Typical ROI | Notes |

|---|---|---|

| Capex Hurdle Rate | 10-15% | Minimum ROI required for capital approval |

| IT/Digital Transformation | 15-30% | Enterprise software, automation projects |

| Process Improvement | 20-50% | Lean, Six Sigma, operational efficiency |

| M&A Synergies | 10-25% | Cost synergies, revenue synergies |

| Cost Reduction Programs | 30-50% | Sourcing, consolidation, automation |

| Training & Development | 30-50% | Employee productivity gains |

How to Present ROI in Business Cases

In consulting and corporate settings, ROI is typically presented as part of an executive summary "value sandwich" that includes the investment cost, expected benefits, and calculated ROI.

Cost-Benefit Slides

Use waterfall charts to show how individual benefits add up to total value, compared against investment cost.

Payback Timeline

Visualize when the investment breaks even with a timeline chart showing cumulative cash flow.

The Executive Summary Format

When presenting to leadership, structure your ROI slide with these elements:

- Recommendation: Clear ask (approve/invest/proceed)

- Problem/Opportunity: 1-2 sentence context

- Investment Required: Total cost with breakdown

- Expected Returns: Quantified benefits over time

- ROI & Payback: Headline metrics with sensitivity analysis

- Next Steps: Immediate actions if approved

ROI vs. NPV vs. IRR vs. Payback Period

Understanding when to use each metric for capital allocation and investment decisions

| Metric | What It Measures | Best For | Limitation |

|---|---|---|---|

| ROI | Total return as % of investment | Quick comparison, executive communication | Ignores time value of money |

| NPV | Present value of future cash flows minus investment | Large capital decisions, comparing absolute value | Requires discount rate assumption |

| IRR | Discount rate that makes NPV = 0 | Comparing projects of different sizes | Can give multiple results; assumes reinvestment at IRR |

| Payback | Time to recover initial investment | Liquidity assessment, risk screening | Ignores cash flows after payback |

When to Use ROI

- • Executive summaries needing quick, intuitive metrics

- • Comparing investments of similar time horizons

- • Early-stage project screening

- • Marketing and training program evaluation

When to Use NPV + IRR

- • Large capital expenditures ($1M+)

- • Long-term investments (5+ years)

- • Board presentations and investment committee reviews

- • Projects with irregular cash flow patterns

Consulting Best Practice

McKinsey, BCG, and Bain typically present all four metrics for major capital decisions: ROI for intuitive communication, NPV for absolute value, IRR for comparing differently-sized projects, and payback period for risk assessment. Use our calculator for ROI and payback, then build NPV/IRR in Excel for the full picture.

Ready to build your business case?

Calculate ROI here, then create professional charts to visualize your investment analysis in PowerPoint with Deckary.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about ROI calculations

Related Calculators

CAGR Calculator

Compound Annual Growth Rate for measuring growth over time.

Use calculatorNPV Calculator

Net Present Value for capital budgeting and investment analysis.

Use calculatorIRR Calculator

Internal Rate of Return to evaluate project attractiveness.

Use calculatorWACC Calculator

Weighted Average Cost of Capital for DCF valuations.

Use calculatorTAM SAM SOM Calculator

Total Addressable Market for strategy and due diligence.

Use calculator