IRR Calculator

Calculate Internal Rate of Return instantly. The essential metric for investment analysis and capital budgeting decisions.

This is the upfront cost (treated as a negative cash flow)

Compare IRR against your minimum required return (%)

IRR Definition: Rate where NPV = ∑(CFt / (1+r)t) = 0

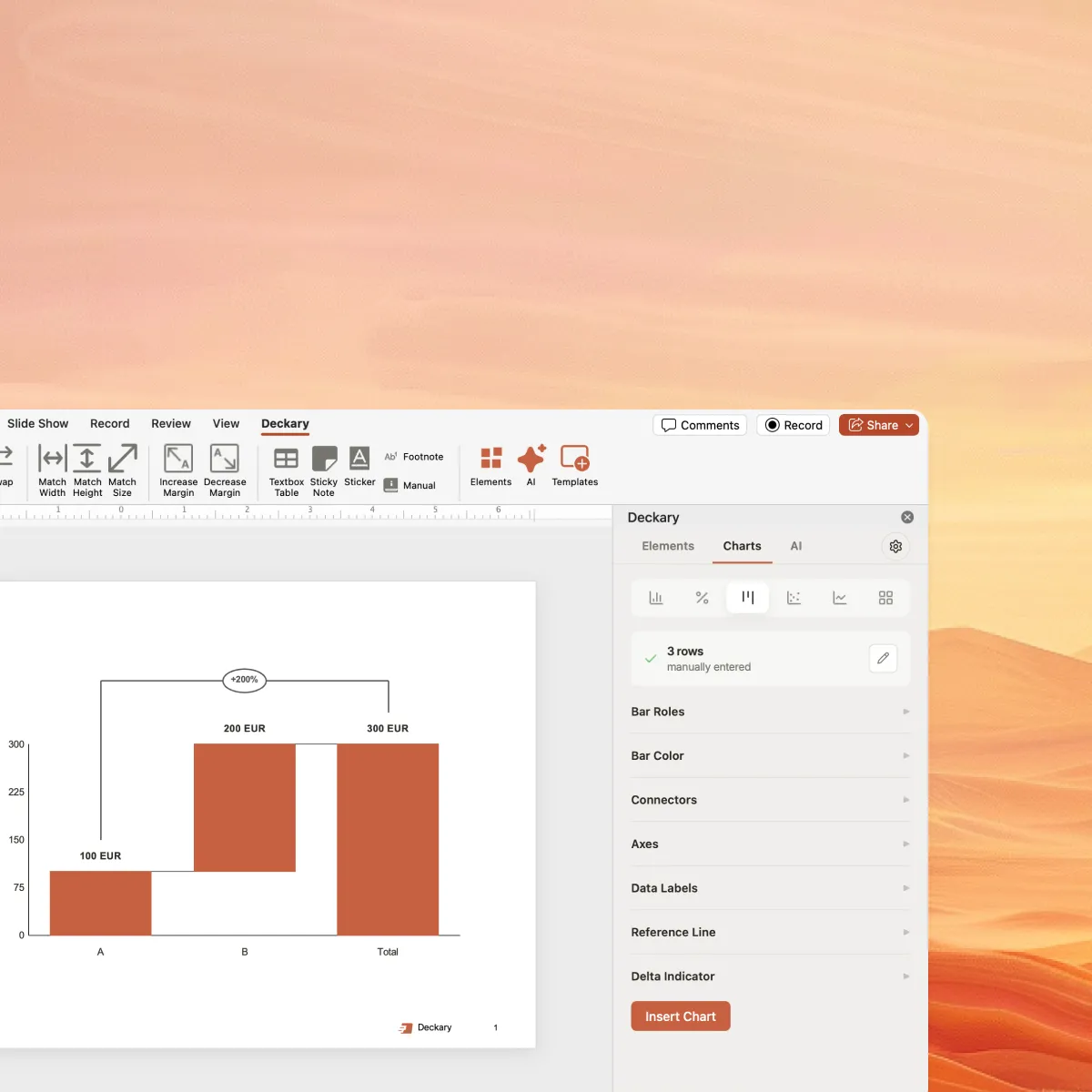

Now visualize it in PowerPoint

Present investment analysis with professional charts. Build waterfall charts, cash flow diagrams, and sensitivity analyses.

What is IRR?

IRR (Internal Rate of Return) is the discount rate that makes the Net Present Value (NPV) of an investment equal to zero. It represents the expected compound annual rate of return that the investment will generate over its lifetime.

IRR is widely used in finance because it:

- Expresses returns as a single percentage that's easy to understand and compare

- Accounts for the time value of money across all cash flows

- Enables comparison against hurdle rates and cost of capital (WACC)

- Works for investments with irregular cash flow patterns

Example IRR Calculation

An investment of $100,000 generates cash flows of $40,000, $45,000, and $50,000 over 3 years:

Year 0: -$100,000 (initial investment)

Year 1: +$40,000

Year 2: +$45,000

Year 3: +$50,000

Find r where: -100,000 + 40,000/(1+r) + 45,000/(1+r)² + 50,000/(1+r)³ = 0

IRR ≈ 17.1%

If the company's WACC is 10%, this investment creates value because IRR (17.1%) exceeds the cost of capital.

IRR vs NPV: When to Use Each

Both metrics measure investment attractiveness, but serve different purposes

Use IRR When...

- • Comparing against a hurdle rate or WACC

- • Communicating returns to stakeholders who prefer percentages

- • Evaluating single projects on a go/no-go basis

- • Cash flows are conventional (one sign change)

Use NPV When...

- • Ranking mutually exclusive projects of different sizes

- • You need to know absolute dollar value created

- • Cash flows have multiple sign changes

- • Making capital allocation decisions across projects

The Decision Rule

Accept a project if IRR > WACC (or your hurdle rate). This is equivalent to NPV > 0. When ranking multiple projects, always use NPV because a 100% IRR on a $1,000 project creates less value than 20% IRR on a $1,000,000 project.

When to Use IRR

IRR is fundamental to investment analysis across industries

Private Equity & VC

IRR is the primary performance metric for funds. LPs evaluate GPs based on net IRR, and deal teams calculate projected IRR for each investment opportunity.

Capital Budgeting

Companies use IRR to evaluate capital projects like equipment purchases, facility expansions, and R&D investments against their cost of capital.

Real Estate Development

Property developers calculate levered and unlevered IRR to evaluate deals, structure financing, and compare opportunities across different markets and asset classes.

M&A Analysis

Acquirers calculate IRR of potential acquisitions based on projected synergies and exit assumptions. IRR helps determine maximum bid prices and deal structures.

How to Calculate IRR in Excel

Excel provides built-in functions for IRR calculation. Here are the most common methods:

Method 1: IRR Function (Regular Periods)

Use when cash flows occur at regular intervals (monthly, annually):

=IRR(values, [guess])Example: =IRR(A1:A5) where A1 = -100000, A2:A5 contain positive cash flows

Method 2: XIRR Function (Irregular Periods)

Use when cash flows occur on specific dates (more realistic for most investments):

=XIRR(values, dates, [guess])Example: =XIRR(B1:B5, A1:A5) where column A has dates and column B has cash flows

Method 3: MIRR Function (Modified IRR)

Addresses reinvestment rate assumption by using separate finance and reinvestment rates:

=MIRR(values, finance_rate, reinvest_rate)Example: =MIRR(A1:A5, 0.10, 0.08) with 10% borrowing cost and 8% reinvestment rate

Pro Tip: Convergence Issues

If IRR returns an error, try providing a guess parameter (e.g., 0.1 for 10%). This helps Excel converge when there are multiple possible IRRs or the solution is far from the default guess.

Ready to present your analysis?

Calculate IRR here, then build professional investment presentations with Deckary's consulting-grade charts.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about IRR calculations

Related Calculators

ROI Calculator

Return on Investment for business cases and project justification.

Use calculatorCAGR Calculator

Compound Annual Growth Rate for measuring growth over time.

Use calculatorNPV Calculator

Net Present Value for capital budgeting and investment analysis.

Use calculatorWACC Calculator

Weighted Average Cost of Capital for DCF valuations.

Use calculatorTAM SAM SOM Calculator

Total Addressable Market for strategy and due diligence.

Use calculator