WACC Calculator

Calculate Weighted Average Cost of Capital instantly. The standard discount rate for DCF valuations and capital budgeting decisions.

WACC Formula: (E/V × Re) + (D/V × Rd × (1-Tc))

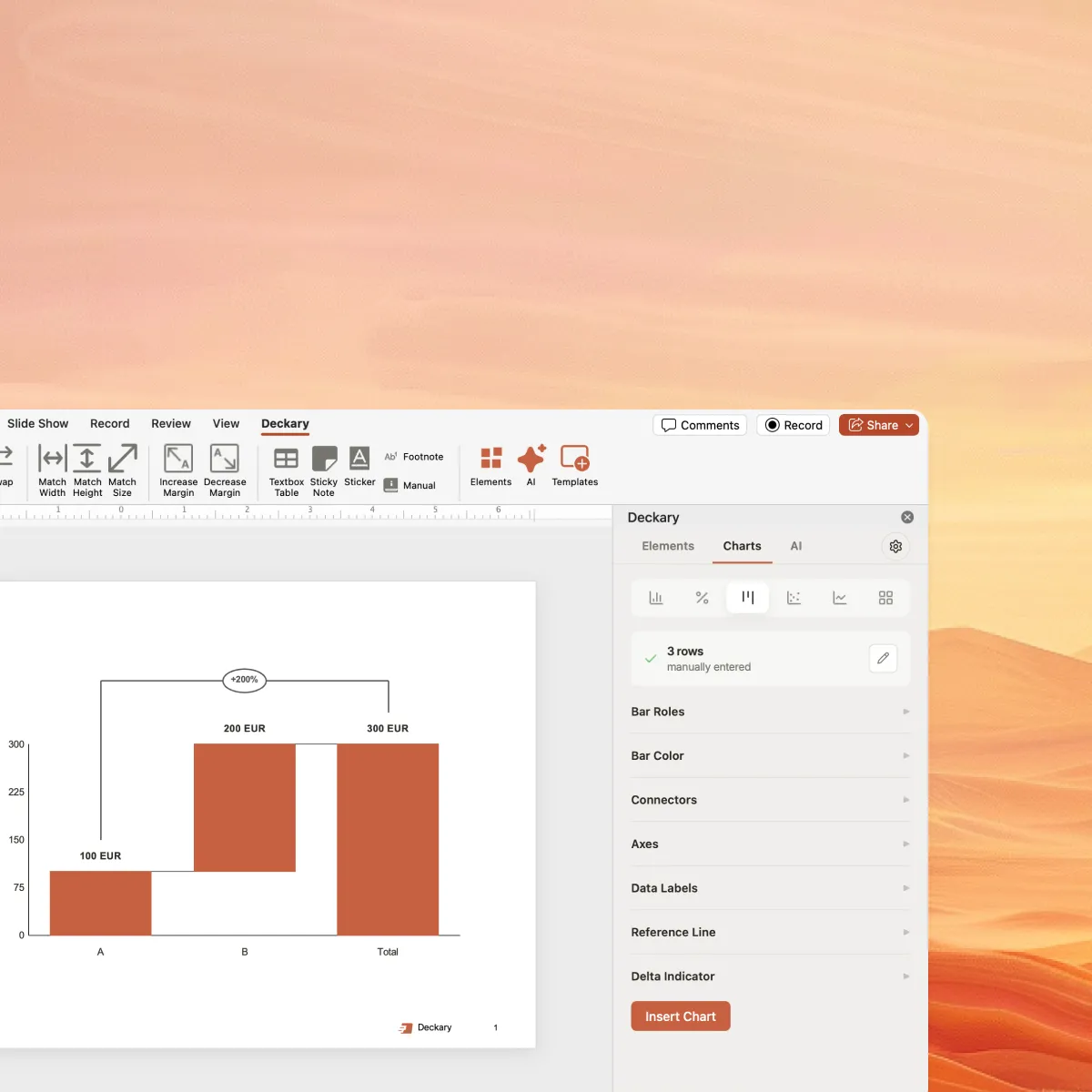

Now visualize it in PowerPoint

Create professional financial charts and DCF models with Deckary. Build consulting-grade waterfall charts and sensitivity analyses.

What is WACC?

WACC (Weighted Average Cost of Capital) is the average rate of return a company must earn on its existing assets to satisfy its creditors, owners, and other capital providers. It blends the cost of equity and cost of debt, weighted by their proportions in the capital structure.

WACC is essential for financial analysis because it:

- Serves as the discount rate in DCF (Discounted Cash Flow) valuations

- Helps evaluate whether projects exceed the minimum required return

- Enables comparison of investment opportunities across different risk levels

- Informs optimal capital structure decisions

Example WACC Calculation

A company has $500M equity (cost: 10%) and $200M debt (cost: 5%) with a 25% tax rate:

Total Value (V) = $500M + $200M = $700M

Equity Weight = $500M / $700M = 71.43%

Debt Weight = $200M / $700M = 28.57%

After-tax Cost of Debt = 5% × (1 - 0.25) = 3.75%

WACC = (71.43% × 10%) + (28.57% × 3.75%)

WACC = 7.14% + 1.07% = 8.21%

This means the company must earn at least 8.21% on its investments to satisfy all capital providers.

When to Use WACC

WACC is fundamental to corporate finance, valuation, and investment analysis

DCF Valuation

WACC is the discount rate used to calculate the present value of future free cash flows. It's the foundation of enterprise value calculations in M&A and equity research.

Capital Budgeting

Compare project returns against WACC to determine if investments create value. Projects with returns exceeding WACC increase shareholder value.

Hurdle Rate Setting

Use WACC as the minimum acceptable return for investment decisions. Adjust upward for higher-risk projects to account for additional uncertainty.

Capital Structure Optimization

Analyze how different debt-to-equity ratios affect WACC to find the optimal capital structure that minimizes the cost of capital.

WACC Benchmarks by Industry

| Industry | Typical WACC | Notes |

|---|---|---|

| Utilities | 5-7% | Stable cash flows, high leverage capacity |

| Consumer Staples | 6-8% | Defensive sector, moderate risk |

| Healthcare | 7-9% | Mix of stable and growth segments |

| Industrial | 8-10% | Cyclical exposure, capital intensive |

| Technology | 9-12% | Higher growth, higher equity costs |

| Biotech / Early-Stage | 12-18% | High risk, often all-equity financed |

Note: These are indicative ranges. Actual WACC depends on company-specific factors including beta, credit rating, and capital structure.

How to Calculate WACC in Excel

While this calculator provides instant results, financial models often require building WACC calculations in Excel. Here's how to structure it:

Step 1: Input Section

Create clearly labeled input cells for each WACC component:

A1: Equity Value B1: 500,000,000

A2: Debt Value B2: 200,000,000

A3: Cost of Equity B3: 10%

A4: Cost of Debt B4: 5%

A5: Tax Rate B5: 25%

Step 2: Calculate Capital Weights

Calculate the proportion of debt and equity in the capital structure:

Total Capital: =B1+B2

Equity Weight: =B1/(B1+B2)

Debt Weight: =B2/(B1+B2)

Step 3: WACC Formula

Combine components into the final WACC calculation:

=(B1/(B1+B2))*B3 + (B2/(B1+B2))*B4*(1-B5)This formula directly calculates WACC by multiplying weights by their respective costs, with the tax shield applied to debt.

Pro Tip: Cost of Equity with CAPM

Calculate cost of equity using CAPM: =Risk_Free_Rate + Beta * (Market_Return - Risk_Free_Rate). Use 10-year Treasury for risk-free rate and company beta from financial data providers.

Ready to build better financial slides?

Calculate WACC here, then present your DCF analysis with professional charts in PowerPoint using Deckary.

Free to use. No credit card required.

Frequently Asked Questions

Everything you need to know about WACC calculations

Related Calculators

ROI Calculator

Return on Investment for business cases and project justification.

Use calculatorCAGR Calculator

Compound Annual Growth Rate for measuring growth over time.

Use calculatorNPV Calculator

Net Present Value for capital budgeting and investment analysis.

Use calculatorIRR Calculator

Internal Rate of Return to evaluate project attractiveness.

Use calculatorTAM SAM SOM Calculator

Total Addressable Market for strategy and due diligence.

Use calculator