Free Industry Cost Structure PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Populate key financial metrics in the highlights panel

- 2Write narrative insights explaining the numbers

- 3Add executive perspective via quote callout

- 4Compare against 2-4 industry peers

- 5Include year-over-year trends where relevant

- 6Write a title that states the strategic insight

When to Use This Template

- Industry analysis presentations

- Due diligence reports

- Competitive benchmarking

- Board financial reviews

- Investment thesis development

- Strategic planning sessions

Common Mistakes to Avoid

- Showing metrics without context or benchmarks

- Using inconsistent time periods across comparisons

- Missing the 'so what' connection to strategy

- Overcrowding with too many metrics

- No clear hierarchy of importance among metrics

Use This Template in PowerPoint

Get the Industry Cost Structure Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Industry Cost Structure Template FAQs

Common questions about the industry cost structure template

Related Templates

Understanding Industry Economics Through Cost Structure Analysis

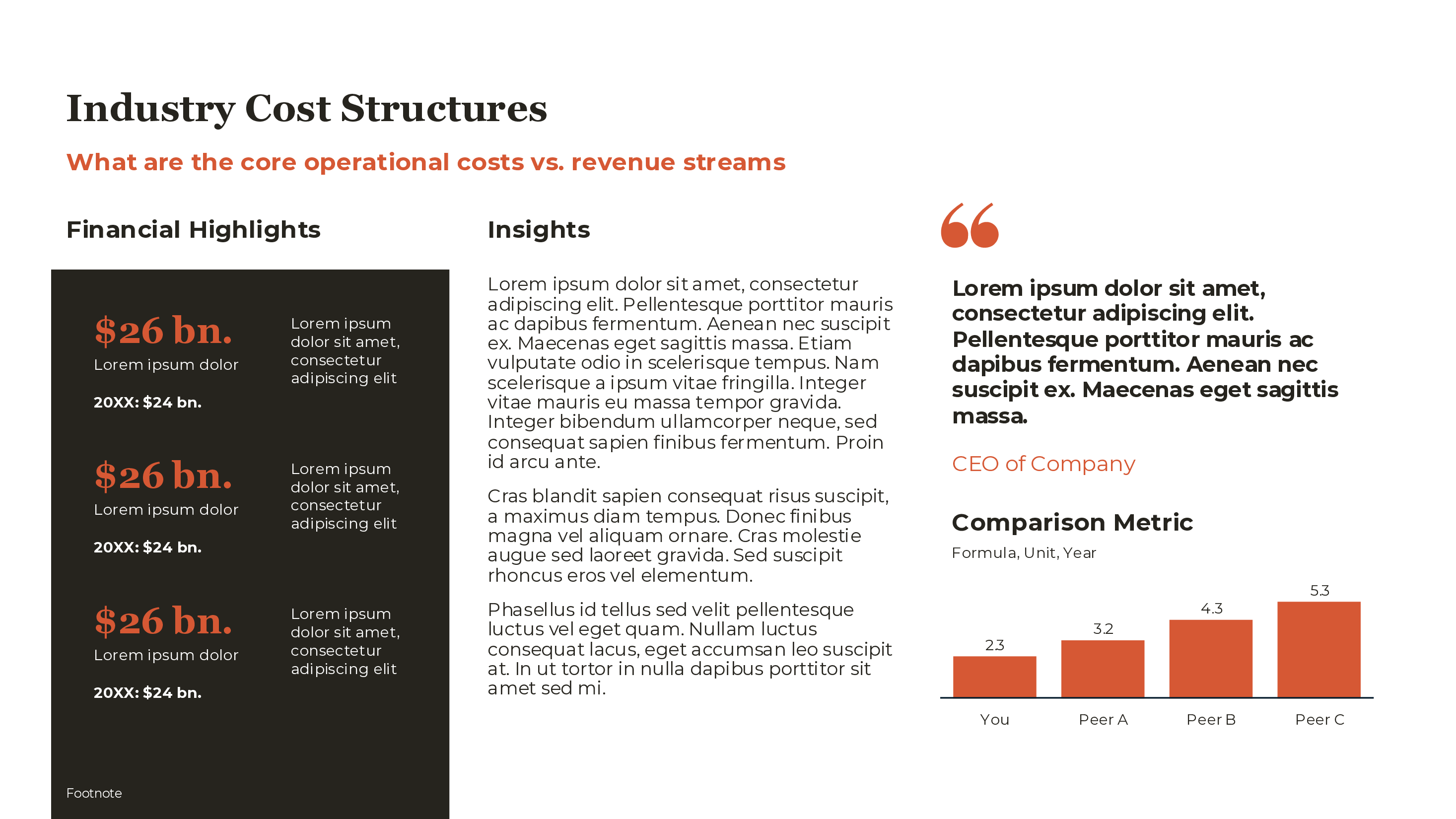

Industry cost structure analysis reveals the economic fundamentals that determine profitability and competitive position. By examining how costs break down and how your organization compares to peers, you can identify operational advantages, investment priorities, and strategic vulnerabilities.

Our industry cost structure template combines financial highlights, narrative insights, and peer benchmarking into a single executive-ready slide. This layout follows the consulting standard for financial analysis: lead with headline metrics, explain what they mean, and show competitive context.

The Financial Highlights Panel

The left section of the template presents 3-4 key financial metrics in a dashboard format. These should be the numbers that define industry economics for your analysis.

Common metrics to include:

- Revenue: Total or relevant segment revenue

- EBITDA/Operating Margin: Core profitability measure

- Gross Margin: Product or service economics

- Growth Rate: Year-over-year or CAGR

- Efficiency Ratio: Revenue per employee, cost per unit, etc.

Formatting standards:

- Use consistent notation ($26 bn. not $26,000,000,000)

- Include year and prior-year comparison where relevant (20XX: $24 bn.)

- Add descriptive labels that non-financial audiences understand

- Create visual hierarchy with larger font for primary metrics

The goal is immediate comprehension. An executive should grasp the financial picture in 5 seconds.

The Insights Narrative

The center section provides context that transforms data into understanding. Numbers without narrative are ambiguous; the same 15% margin could be excellent or concerning depending on context.

Effective narrative elements:

- What do these numbers mean in industry context?

- What's driving performance (positive or negative)?

- How does this compare to historical trends?

- What implications follow for strategy?

Example narrative: "Revenue growth of 12% reflects successful penetration of enterprise segment, partially offset by pricing pressure in SMB. EBITDA margins held despite investment in product development, indicating operational leverage. Cost structure remains competitive versus peers, though labor costs trending above industry average."

Avoid:

- Simply restating the numbers in paragraph form

- Generic observations ("revenues are growing")

- Unsubstantiated claims without data backing

The Executive Quote

The quote callout adds credibility and human perspective to financial analysis. When available, include a relevant statement from a CEO, CFO, or industry analyst.

Effective quotes:

- Provide strategic context for the numbers

- Come from credible sources (executives, analysts, industry publications)

- Add insight beyond what the data shows

- Are concise (2-3 sentences maximum)

Example: "Our cost discipline over the past three years has positioned us to invest aggressively in AI capabilities while maintaining industry-leading margins. We expect this operating leverage to accelerate as automation benefits scale." — CEO of Company

If no appropriate quote is available, this space can be used for a key takeaway or strategic implication instead.

Peer Benchmarking

The right section compares your organization (or analysis subject) against industry peers. Visual benchmarking immediately answers: "How do we compare?"

Structure:

- Bar chart format: Easy comparison of 3-5 entities

- Consistent metric: Same measure across all bars

- Clear labeling: Company names and values

- Your position highlighted: Use color or callout to identify focal company

Metric selection for benchmarking:

- Choose metrics where comparison is meaningful

- Ensure data is from the same time period

- Use ratios or percentages when companies differ in scale

- Include industry average as a reference line when available

Example benchmarking metrics:

- EBITDA margin (%)

- Revenue per employee ($K)

- R&D as percentage of revenue

- Customer acquisition cost

- Net revenue retention

Writing Actionable Titles

Your slide title should state the strategic insight from the cost structure analysis, not describe the slide contents.

Weak titles:

- "Industry Cost Structures"

- "Financial Analysis"

- "Cost Benchmarking"

Strong titles:

- "What are the core operational costs vs. revenue streams"

- "Operating margins 400bps above peer average enable reinvestment"

- "Cost structure competitive; labor efficiency lags industry by 15%"

The title tells executives what to conclude from the analysis. They should understand the strategic implication before examining the supporting data.

Sources for Cost Structure Data

For public companies:

- SEC filings (10-K, 10-Q): Comprehensive financial data

- Investor presentations: Management's view on performance

- Earnings call transcripts: Context and forward guidance

- Analyst reports: Comparative analysis and industry context

For private companies:

- Industry databases (PitchBook, CB Insights)

- Trade publications and industry surveys

- Benchmarking services (Gartner, industry associations)

- Primary research (interviews, expert networks)

For industry benchmarks:

- Industry association reports

- Consulting firm publications (McKinsey, BCG, Bain)

- Government statistics (BLS, Census)

- Academic research

Always cite sources and specify the data period. Unstated assumptions about data quality undermine credibility.

Cost Structure Analysis Applications

Investment evaluation: Understanding cost structure reveals whether margins are sustainable, what operational improvements are possible, and how sensitive profitability is to volume or price changes.

Competitive positioning: Benchmarking against peers shows whether you have cost advantages or disadvantages. This informs pricing strategy, investment priorities, and competitive response.

M&A due diligence: Acquirers analyze target cost structures to identify synergy opportunities and assess whether the target's margins are achievable post-acquisition.

Strategic planning: Cost structure analysis reveals where the business is operationally strong or weak, informing decisions about where to invest, cut, or restructure.

Connecting Cost Structure to Strategy

The analysis should lead to strategic conclusions:

If margins exceed peers:

- Is this sustainable, or are you under-investing?

- Can you leverage this advantage for market share?

- Where does the advantage come from (scale, efficiency, pricing)?

If margins lag peers:

- What's driving the gap?

- Is catch-up possible through operational improvement?

- Do you need different strategic positioning (compete on differentiation, not cost)?

If cost structure is changing:

- What's driving the shift?

- Is this positive (planned investment) or negative (loss of efficiency)?

- How does trajectory compare to peers?

A cost structure slide without strategic implications is incomplete. The "so what" belongs in the title, narrative section, or a follow-up recommendation slide.

Presenting to Different Audiences

CFO/Finance audiences: Can handle more metrics and technical detail. Focus on methodology credibility and analytical rigor.

CEO/Board audiences: Need fewer metrics with clearer strategic implications. Focus on competitive position and strategic options.

Operational audiences: Want to know what actions drive the numbers. Connect cost structure to operational levers they control.

External audiences (investors, partners): Need context about industry norms and competitive position. Include benchmarking and trend context.

Tailor depth and emphasis to your audience's analytical sophistication and strategic focus.

For examples of how cost structure analysis fits into business cases, see our Business Case Examples. For the broader strategy toolkit, explore the Strategic Frameworks Guide.

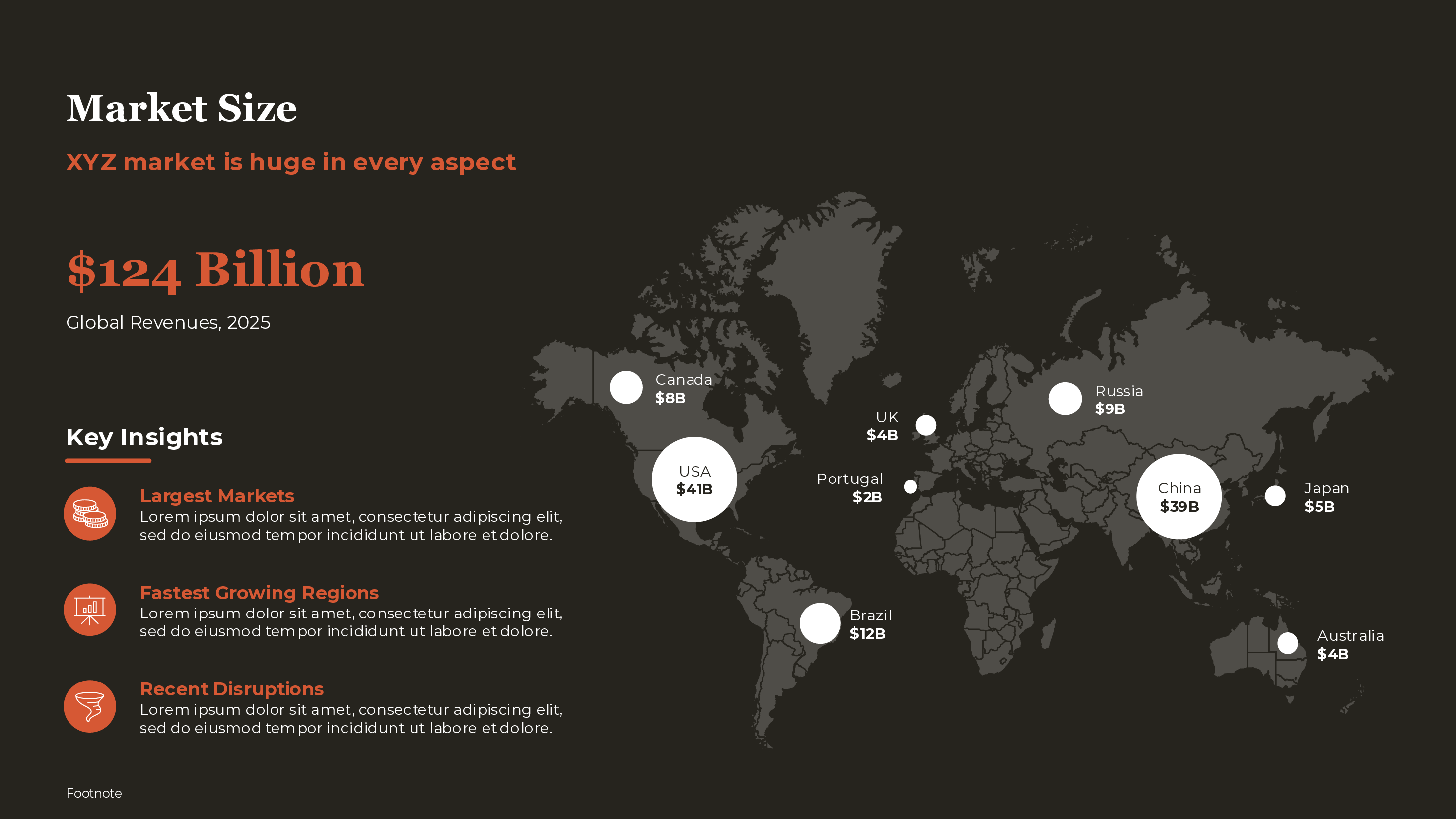

For related financial and competitive analysis templates, see our competitive analysis template, KPI dashboard template, and market size template. Deckary's AI Slide Builder can generate financial analysis slides from a description of your business context.