Includes 2 slide variations

Free Market Size PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Start with the headline market size figure

- 2Show regional breakdown on the world map

- 3Add growth projections with stacked bar chart

- 4Include 3-4 key insights explaining the data

- 5List growth drivers with supporting evidence

- 6Write an action title stating market opportunity

When to Use This Template

- Investor pitch decks

- Market entry analysis

- Board strategy presentations

- Due diligence reports

- Annual planning sessions

- Partnership proposals

Common Mistakes to Avoid

- Showing market size without source attribution

- Missing growth rate context

- Regional breakdown that doesn't sum to total

- Overly optimistic projections without basis

- Confusing market size with market opportunity

Use This Template in PowerPoint

Get the Market Size Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Market Size Template FAQs

Common questions about the market size template

Related Templates

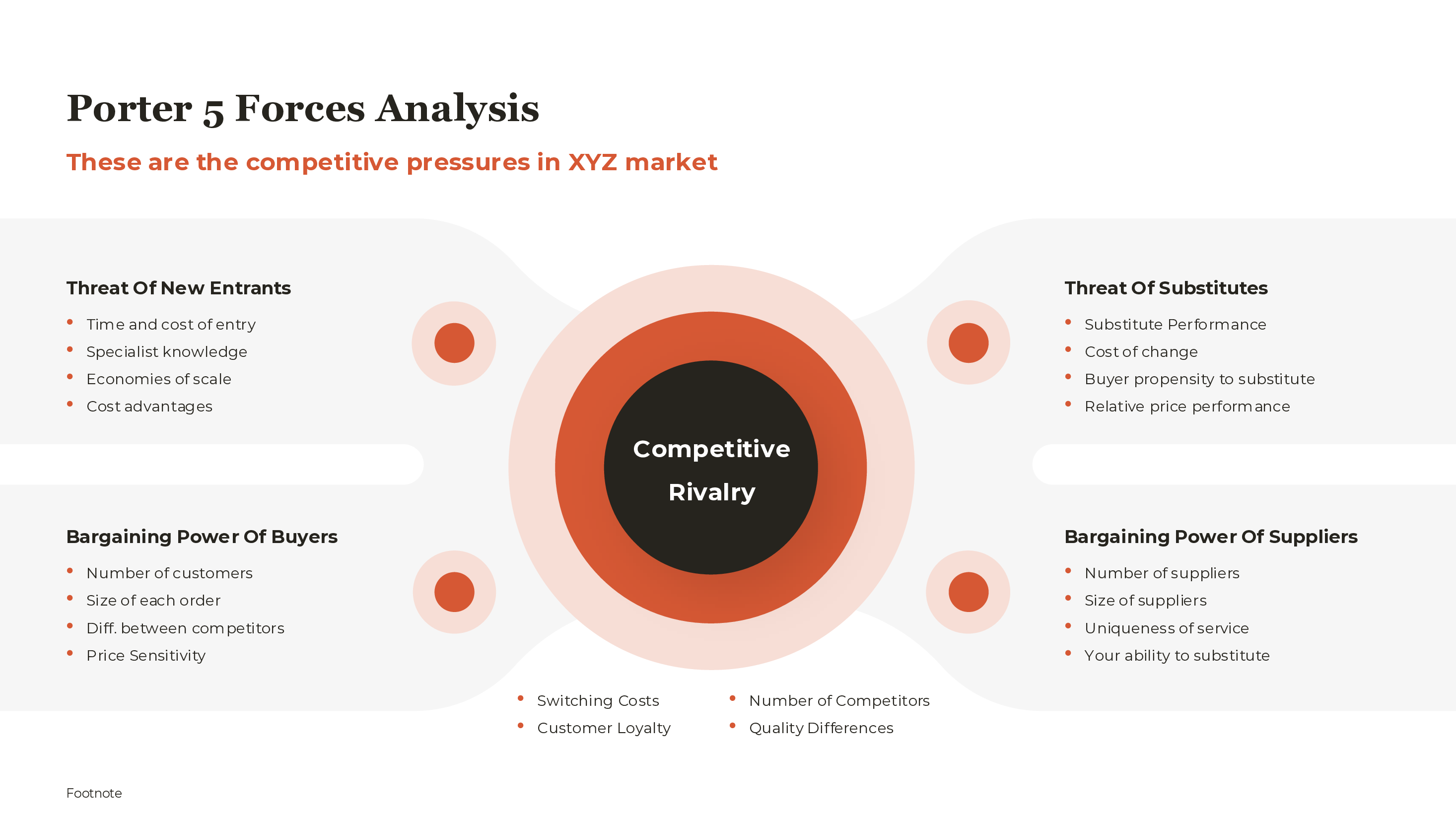

Communicating Market Opportunity Effectively

Market size slides serve a critical function in business presentations: they establish the scale of opportunity that justifies investment, strategic focus, or partnership interest. Whether you're raising capital, presenting to your board, or evaluating market entry, the market size visualization sets the context for everything that follows.

Our market size template pack includes two complementary layouts: a global market map showing regional breakdown and a growth trends chart showing projections over time. Together, they answer the questions investors and executives care about: How big is this market? Where is the opportunity concentrated? And how fast is it growing?

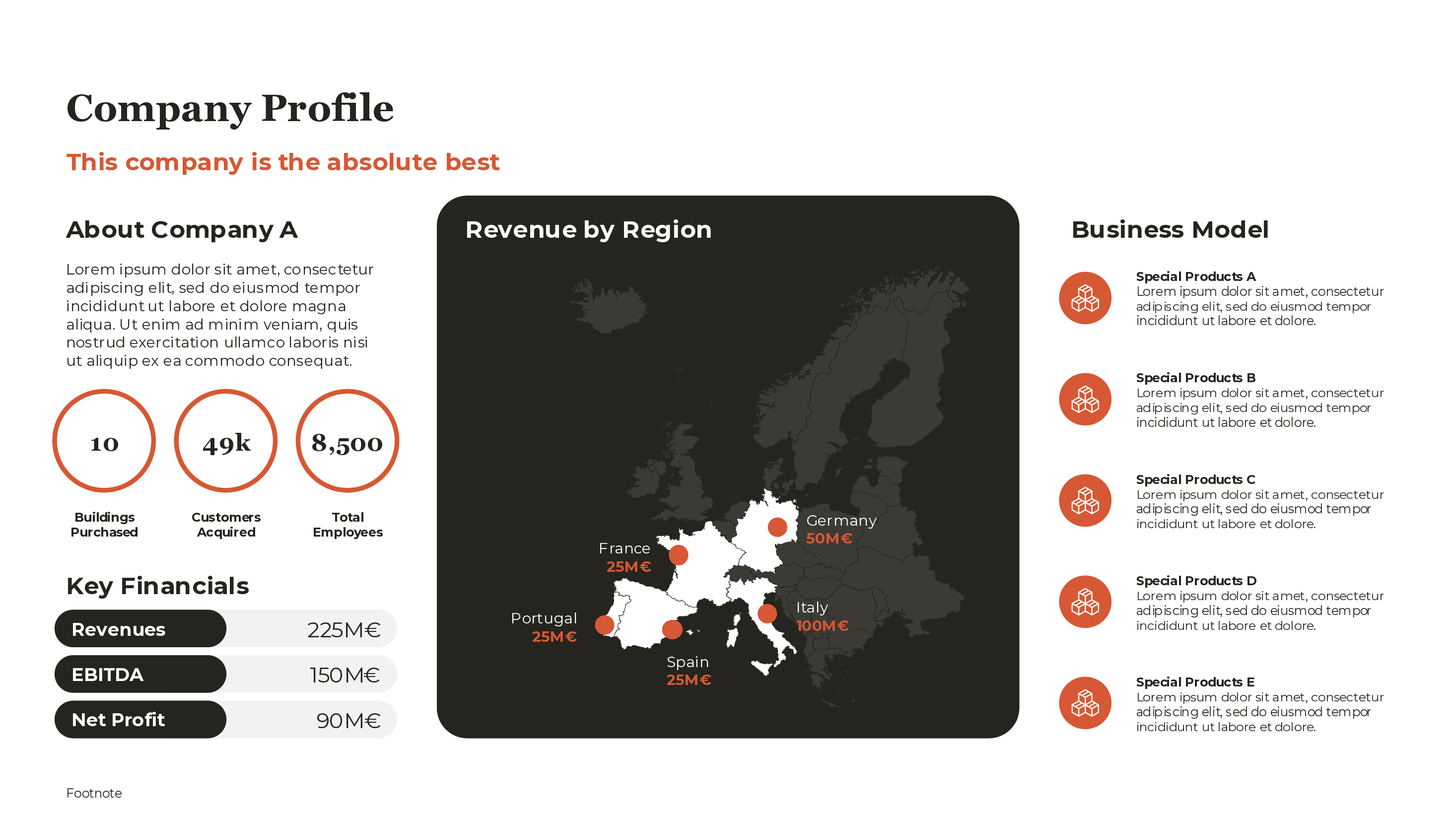

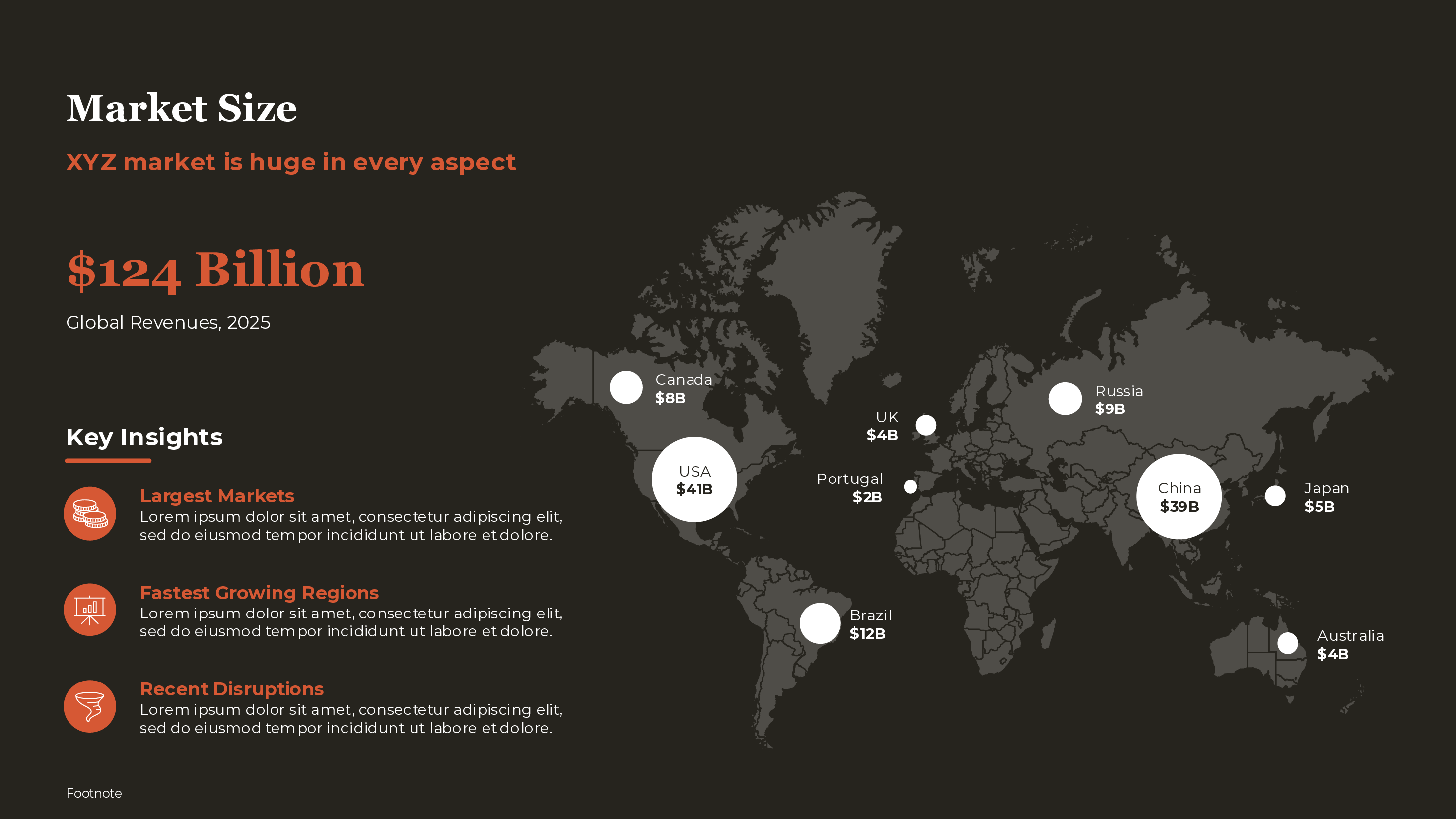

The Global Market Map Layout

The world map visualization works best when regional differences matter. If you're presenting a market where the US represents 60% of revenue, or where Asia-Pacific is the fastest-growing region, the map makes those dynamics immediately visible.

Key elements:

- Headline figure: The total market size displayed prominently (e.g., "$124 Billion, Global Revenues 2025")

- Regional bubbles: Sized proportionally to regional market size, placed geographically

- Key insights panel: 3-4 bullet points explaining what the data means

- Source citation: Bottom of slide with analyst firm, year, and scope

The map doesn't need to be geographically precise. It's a visualization aid, not a cartography exercise. The goal is pattern recognition: which regions dominate, which are emerging, where should attention focus.

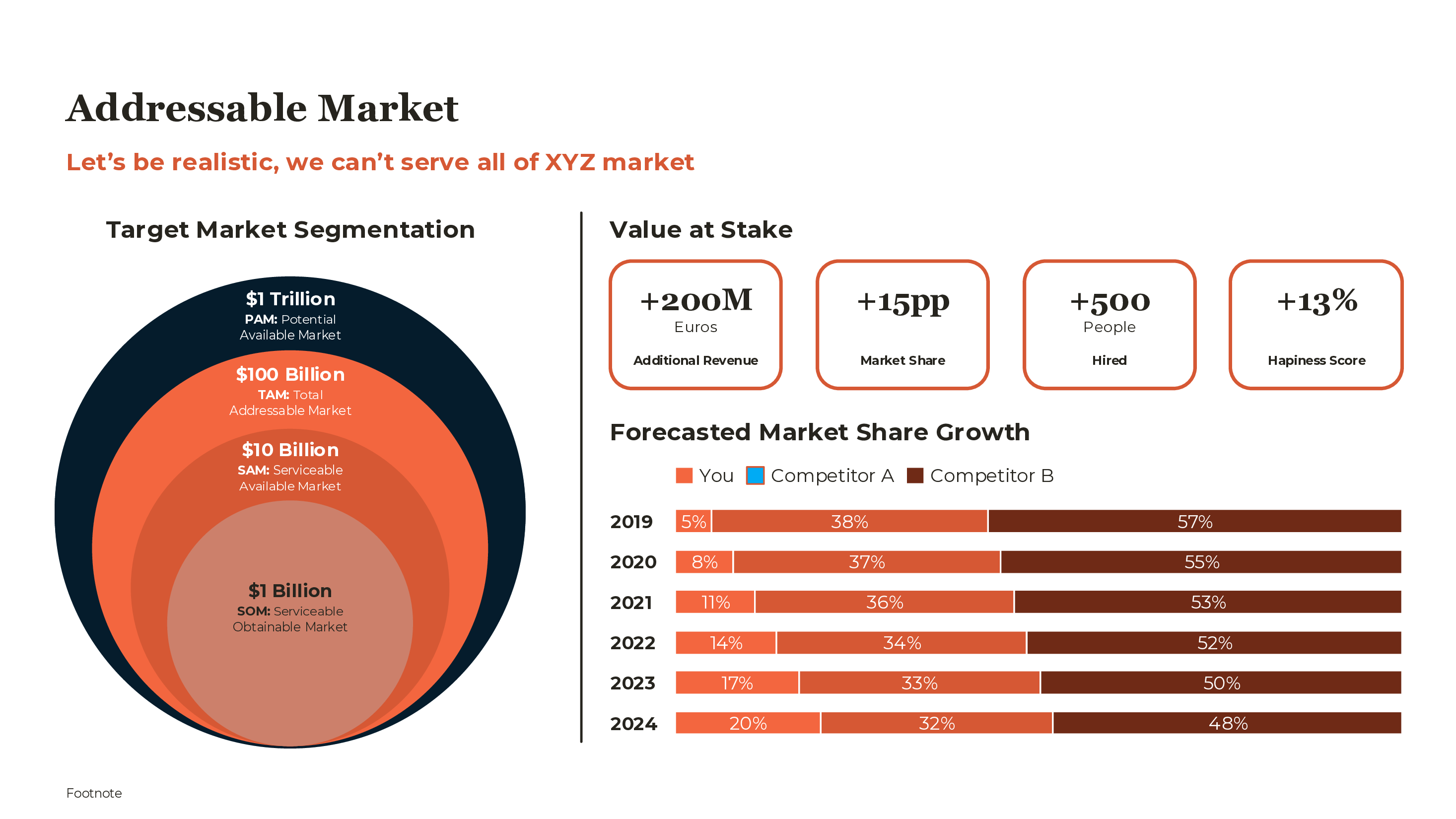

The Growth Trends Layout

Growth projections require a different visualization. The stacked bar chart shows how the market expands over time, with segments that reveal where growth concentrates.

Structure:

- X-axis: Years (typically 3-5 year range)

- Y-axis: Market size in consistent units

- Stacked segments: Regions, product categories, or customer segments

- Growth callouts: CAGR percentages and milestone markers

- Context panels: Global context and growth drivers

The growth trends slide answers the trajectory question. A $50B market growing at 3% tells a different story than a $50B market growing at 15%. The stacked segments reveal whether growth is broad-based or concentrated in specific areas.

Writing Effective Market Size Headlines

Your slide title should communicate the strategic implication, not just describe the chart.

Weak titles:

- "Market Size"

- "Global Market Overview"

- "Industry Analysis"

Strong titles:

- "XYZ market is huge in every aspect at $124B globally"

- "Asia-Pacific drives 45% of growth while US market matures"

- "Market growing at 20% CAGR creates entry window for new players"

The title tells the audience what to conclude from the data. They should understand the strategic message before reading any details.

Regional Breakdown Best Practices

When showing regional market breakdown, consistency matters:

- Use consistent currency: Convert all regions to USD or EUR for comparison

- Include the same year: Don't mix 2024 US data with 2023 European data

- Account for total: Regional figures should sum to the headline number (or explain the gap)

- Show relative scale: Bubbles should be proportional to actual values

A common error is cherry-picking favorable regional data while hiding less impressive regions. Sophisticated audiences notice when the pieces don't add up. Transparency builds credibility even when the story isn't uniformly positive.

Growth Projections: Show Your Work

Market growth projections are the most scrutinized element of market size slides. Investors and executives have seen too many hockey-stick projections that never materialized. Build credibility by showing your methodology.

Elements that add credibility:

- Source attribution: "Grand View Research 2025" or "Company analysis based on industry reports"

- Assumption callout: Key drivers and constraints behind the projection

- Bottom-up validation: Customer counts times average spend as a sanity check

- Historical context: What was the growth rate in the past 3-5 years?

If your projections significantly exceed analyst consensus, you need to explain why. "We project 25% CAGR versus analyst consensus of 12% because..." followed by specific reasoning.

Connecting Market Size to Your Opportunity

Market size slides are not endpoints; they're foundations for the analysis that follows. The market size should connect logically to your TAM/SAM/SOM analysis, competitive positioning, and financial projections.

Logical flow:

- Market size slide: Here's the total market ($124B globally)

- TAM/SAM/SOM slide: Here's our addressable portion ($12B SAM)

- Competitive slide: Here's our position relative to competitors

- Financial slide: Here's how we capture share over time

Each slide builds on the previous. The market size establishes context; subsequent slides narrow to your specific opportunity.

Common Visualization Mistakes

Bubble size errors: Bubbles should be sized by area, not radius. A $50B region should have a bubble with area 5x a $10B region, not diameter 5x. Most audiences don't notice, but analytically sophisticated viewers will.

Misleading axes: Starting the y-axis at a non-zero value can exaggerate growth rates. If your market grew from $90B to $100B, starting the axis at $85B makes it look dramatic; starting at $0 shows the true proportion.

Crowded legends: If you need 8 colors in a stacked bar chart, the visualization isn't working. Consolidate smaller segments into "Other" and keep the legend to 4-5 items maximum.

Missing context: A $50B market sounds large until you learn the market leader has $48B in revenue. Add context that helps audiences calibrate the opportunity.

When Market Size Slides Matter Most

Market size slides carry different weight in different contexts:

Investor pitches: Critical. Investors need to see a market large enough to support venture-scale returns. The market size establishes whether the opportunity is worth pursuing.

Board presentations: Important for context. Board members want to understand the competitive arena, but they're more interested in your specific strategy than market-level statistics.

Internal strategy: Useful but secondary. Your team already knows the market. Internal slides should focus more on competitive dynamics and growth levers than market sizing.

Partnership proposals: Valuable for alignment. Partners want to know they're entering a market worth their investment of resources and attention.

Tailor the depth and emphasis of your market size content to the audience and decision context.

For a step-by-step market sizing methodology with worked examples, see our Market Sizing Template Guide.

For related market analysis templates, see our TAM SAM SOM template, pitch deck template, and competitive analysis template. Deckary's AI Slide Builder can generate market size slides from a description of your market.