How to Create a Venn Diagram in PPT: 3 Methods Compared

How to create a Venn diagram in PPT using SmartArt, manual shapes, or templates. Step-by-step instructions with formatting best practices for consultants.

Most Venn diagram tutorials teach you which buttons to click in PowerPoint. That part takes three minutes. What takes three hours is deciding what belongs in the overlap zone and what that overlap means for the business decision your audience needs to make.

After building Venn diagrams for 80+ strategy presentations -- post-merger integrations, competitive positioning analyses, market segmentation exercises -- we have found that the diagram's value lives entirely in the strategic framing, not the formatting. A perfectly formatted Venn with vague labels like "synergies" in the overlap zone is useless. A rough Venn with "$18M in SG&A redundancy across 7 shared capabilities" changes the conversation.

This guide covers the mechanics quickly, then spends the real time on three worked consulting examples with specific numbers, strategic implications, and the formatting decisions that made each one land with executives. For the broader strategic toolkit, see our Strategic Frameworks Guide.

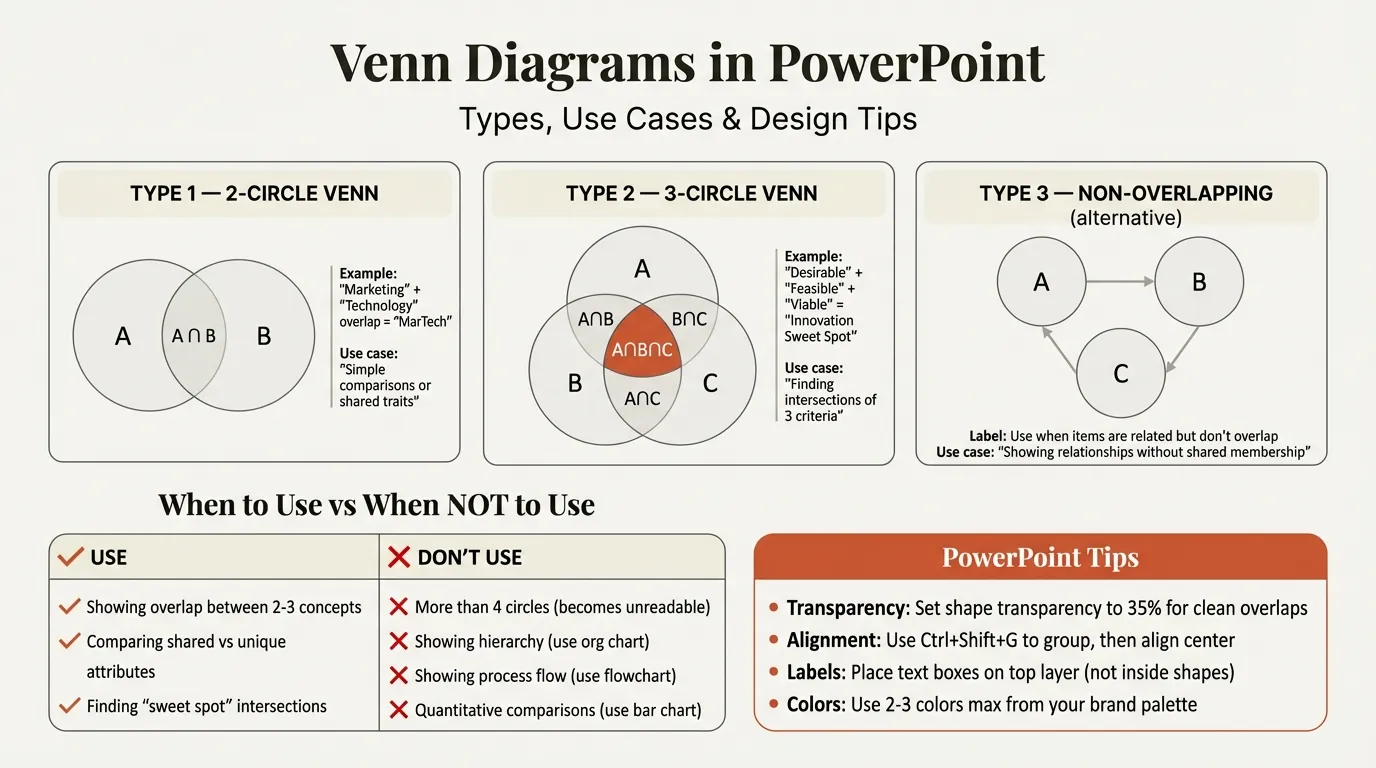

Building the Diagram: Three Methods in Brief#

SmartArt (2 Minutes, Limited Control)#

Go to Insert > SmartArt > Relationship > Basic Venn. Type labels in the text pane -- each bullet becomes a circle. The critical limitation: SmartArt does not let you type in overlap regions, so you must layer text boxes over the intersections manually. SmartArt also locks all circles to the same size and controls overlap depth automatically, which makes it unsuitable for client deliverables where proportional overlap matters.

Manual Shapes (10 Minutes, Full Control)#

Insert an Oval shape (hold Shift for a perfect circle), set fill transparency to 35%, duplicate it, change the duplicate's color, and drag them into position with roughly 25-30% overlap. Use Align Middle to center vertically. This is the method to use for any slide leaving your team -- you control circle sizing, overlap depth, and individual section colors. For maximum control, select all circles and use Shape Format > Merge Shapes > Fragment to make each overlap zone a separately formattable shape.

Templates and Add-ins (Under 2 Minutes, Consistent Quality)#

A Venn Diagram Template provides pre-formatted circles with transparency, color, and text placeholders already positioned in overlap regions. Add-ins like Deckary include consulting-grade Venn layouts that maintain formatting consistency across your deck. For teams producing strategy deliverables regularly, the time savings compound -- building a 3-circle Venn from scratch takes 10-15 minutes versus under 2 minutes with a template.

| Criteria | SmartArt | Manual Shapes | Template / Add-in |

|---|---|---|---|

| Time to create | 2-3 min | 10-15 min | 1-2 min |

| Overlap text | Text box workaround | Text box workaround | Built-in placeholders |

| Circle size control | None | Full | Pre-set, adjustable |

| Best for | Internal meetings | Client deliverables | Repeated use across decks |

Example 1: Post-Merger Capability Overlap#

Scenario: A private equity firm is evaluating the acquisition of a regional logistics company (Company B) by a national distributor (Company A). The integration committee needs to see where capabilities overlap to estimate synergies and plan integration.

The Venn setup: Two circles -- Company A (blue, 35% transparency) and Company B (orange, 35% transparency). Size each circle proportional to total capability count if the difference is significant. Here, Company A has 12 capabilities and Company B has 14, so the circles are close to equal.

What goes in each zone:

| Zone | Count | Capabilities |

|---|---|---|

| Company A only | 5 | National carrier contracts, cross-dock network (22 facilities), customs brokerage, ERP integration platform, dedicated fleet (340 trucks) |

| Company B only | 7 | Last-mile residential delivery, cold chain certification, white-glove installation service, same-day metro fulfillment, returns processing center, on-site inventory management, specialized hazmat handling |

| Overlap | 7 | Warehousing, freight forwarding, LTL consolidation, route optimization software, customer portal, real-time tracking API, B2B fulfillment |

The strategic insight (this goes in the slide subtitle or a callout box): "Redundancy in 7 overlapping areas suggests $18M in annual SG&A synergies through consolidation of warehousing, freight forwarding, and shared technology platforms. The 12 unique capabilities across both entities require dedicated integration workstreams -- particularly cold chain and hazmat, which carry regulatory complexity."

Formatting decisions that mattered: We made the overlap zone green (the natural blend of blue and orange at 35% transparency) and used bold text in that zone to draw the eye to the synergy number first. The exclusive zones used regular weight text. The slide title read "7 Shared Capabilities Drive $18M Synergy Target" -- action-oriented, specific, and answering the question the PE partners actually had.

Why this works as a Venn and not a table: A comparison table lists capabilities side by side and forces the reader to scan for matches. The Venn makes the overlap -- the entire point of the analysis -- visually immediate. The partner glances at the slide and sees three distinct zones: what we are buying that is new (right), what we already have (left), and what we can consolidate (center). That spatial logic maps directly to the three integration workstreams.

Continue reading: Agenda Slide PowerPoint · Flowchart in PowerPoint · Pitch Deck Guide

Free consulting slide templates

SWOT, competitive analysis, KPI dashboards, and more — ready-made PowerPoint templates built to consulting standards.

Example 2: Market Segment Intersection#

Scenario: A B2B SaaS company selling project management software wants to understand which product features serve multiple customer segments versus which are segment-specific. The output will drive the product roadmap prioritization for the next four quarters.

The Venn setup: Three circles -- Enterprise (blue), Mid-Market (green), SMB (orange). This is a classic three-circle Venn with seven zones: three exclusive, three pairwise overlaps, and the center where all three meet.

What goes in each zone with adoption data:

Enterprise only (480 accounts): Custom SLA dashboards (92% adoption), SSO/SAML integration (88%), dedicated CSM portal, audit logging with 7-year retention

Mid-Market only (2,100 accounts): Department-level permissions (74% adoption), quarterly business review templates (68%), usage-based billing calculator

SMB only (11,400 accounts): Self-serve onboarding wizard (91% adoption), in-app chat support, monthly billing with no contract, quick-start project templates

Enterprise + Mid-Market overlap: Resource capacity planning (Enterprise 86%, Mid-Market 71%), portfolio-level reporting, API access for BI tool integration

Mid-Market + SMB overlap: Kanban board view (Mid-Market 79%, SMB 83%), time tracking module, Slack/Teams integration

Enterprise + SMB overlap: Mobile app access (Enterprise 67%, SMB 72%) -- a surprising pairing that revealed field teams at enterprise accounts share usage patterns with small business owners who work from mobile devices

All three (center): Core task management, file sharing, Gantt charts. These features have above 85% adoption across all segments.

The strategic insight: "Features in the center zone (core task management, file sharing, Gantt) are table stakes -- invest in reliability, not differentiation. The highest-ROI roadmap investments sit in the pairwise overlaps: resource capacity planning serves 2,580 accounts across Enterprise and Mid-Market segments, while Kanban and time tracking serve 13,500 accounts across Mid-Market and SMB. Segment-specific features like SSO justify their cost only through Enterprise ACV ($48K vs. $6K Mid-Market)."

Formatting decisions that mattered: We kept the center zone clean -- just three items, bold, large font. The pairwise overlaps included adoption percentages in parentheses because the product team needed to see relative usage, not just presence. Each exclusive zone used a lighter shade of its parent color to reduce visual noise. The slide worked because it answered one question: "Where do we invest to serve the most accounts?"

Example 3: Competitive Positioning Overlap#

Scenario: A cybersecurity startup preparing for a Series B needs to show investors where its product sits relative to the two dominant incumbents. The goal is to demonstrate differentiated positioning and identify the whitespace opportunity.

The Venn setup: Three circles -- Your Product (blue), CrowdStrike (red), Palo Alto Networks (green). The circles are deliberately not equal-sized: CrowdStrike and Palo Alto are larger (3-inch diameter) to reflect their broader product surface, while your product is slightly smaller (2.5 inches) but positioned to highlight the unique zone.

What goes in each zone:

| Zone | Capabilities |

|---|---|

| Your product only | AI-driven insider threat behavioral scoring, automated compliance evidence generation (SOC 2, ISO 27001, HIPAA in under 48 hours), non-agent architecture (zero endpoint footprint), mid-market pricing ($8/endpoint/month vs. $15-24 for incumbents) |

| CrowdStrike only | Threat intelligence marketplace (180+ feeds), incident response retainer services, nation-state attribution engine, FedRAMP High authorization |

| Palo Alto only | Hardware firewall integration, SD-WAN fabric, IoT/OT security modules, 14 global SOC locations |

| Your product + CrowdStrike | Endpoint detection and response, cloud workload protection |

| Your product + Palo Alto | SIEM integration, vulnerability management |

| CrowdStrike + Palo Alto | XDR platform, managed detection and response (MDR), zero trust network access |

| All three | Malware prevention, email security gateway |

The strategic insight: "The whitespace -- AI behavioral insider threat detection combined with automated compliance evidence -- is unaddressed by either incumbent. This is not a gap they overlooked; it requires a fundamentally different data architecture (behavioral modeling vs. signature matching) that cannot be bolted onto their existing platforms. The 87% of mid-market CISOs in our pipeline who cite compliance automation as their number one pain point are currently using 3-4 separate tools. Our $8/endpoint price point further differentiates against CrowdStrike's $18 and Palo Alto's $15 average endpoint cost."

Formatting decisions that mattered: We colored the "your product only" zone in solid blue (no transparency in that zone) to make the whitespace visually dominant. The overlap zones used standard 35% transparency. We added a small callout arrow from the whitespace zone to a text box reading "TAM: $4.2B by 2027 (Gartner)" -- connecting the visual positioning to a market-sizing claim. The slide title read "Differentiated Position in $4.2B Insider Threat Market" and the entire investor narrative clicked into place from a single slide.

When NOT to Use a Venn Diagram#

Venn diagrams are overused in consulting. In roughly a third of the decks we review, a Venn would communicate better as something else. Here are the specific situations where you should reach for a different framework.

Switch to a comparison matrix when the overlap has more than 3 items. If your post-merger capability analysis finds 15 shared capabilities, a Venn physically cannot hold that information. A feature comparison matrix with check marks, color coding, and grouping by functional area handles high-item-count comparisons cleanly. The same applies to any competitive analysis with more than three capabilities per zone.

Switch to a 2x2 positioning map when you care about degree, not just presence. A Venn shows that two things overlap -- it does not show by how much. If your competitive analysis needs to show that Competitor A is "high capability, high price" while you are "high capability, low price," a positioning map on two axes communicates the relative position far more precisely. A SWOT analysis similarly benefits from a matrix format rather than trying to force overlaps between strengths and opportunities.

Switch to a Sankey or flow diagram when the relationship is directional. Venn diagrams show static overlap. If customers move between segments, if capabilities feed into outcomes, or if there is any process logic involved, a flow-based visualization tells the story that a Venn cannot.

Switch to a bar chart when the overlap is quantitative. If you can say "35% of Enterprise customers also buy our SMB product," a bar chart communicates the precision that a Venn circle cannot. Venn circles suggest proportionality through their visual overlap area, but audiences rarely read overlap area accurately -- they read numbers on axes.

The 3-bullet test: If any single zone of your Venn diagram requires more than 3 bullet points, switch to a different framework. The Venn's power is its simplicity -- overloading the intersections defeats the purpose.

Common Mistakes That Undermine the Slide#

Vague overlap labels. Writing "synergies" or "shared value" in the overlap zone wastes the most valuable real estate on the slide. Every overlap label should be specific enough that the audience could act on it: "$18M SG&A consolidation" tells a story; "synergies" does not.

Equal-sized circles when magnitude matters. If Company A has $2B in revenue and Company B has $200M, drawing equal circles implies equal scale. Either size circles proportionally or add a footnote clarifying that circle size does not represent magnitude. Unintentional visual implications erode credibility with analytical audiences.

Using SmartArt for client deliverables. SmartArt Venn diagrams have a distinct "default PowerPoint" look that experienced executives recognize instantly. The uniform spacing, auto-generated colors, and inability to customize overlaps signal low effort. Manual shapes or templates take longer but produce slides that meet consulting slide standards.

Skipping the "so what." A Venn diagram without an action-oriented title or callout is a taxonomy exercise, not a strategic argument. Every Venn should answer: "Given this overlap pattern, what should we do?" The diagram shows the what; the title and subtitle must deliver the so what.

Key Takeaways#

- The mechanics of building a Venn in PowerPoint take minutes -- SmartArt for speed, manual shapes for control, templates like our Venn Diagram Template for both

- The strategic value of a Venn comes from what you put in each zone, not how you format the circles -- every zone needs specific items, not vague labels

- Size circles proportionally when the entities differ in magnitude; keep them equal only when the categories are genuinely comparable

- Keep overlap text to 3 items maximum; if you need more, switch to a comparison matrix

- Set transparency to 30-40% and choose colors that blend readably (blue/yellow produces green; blue/red produces purple; avoid two dark colors)

- Always include the "so what" -- the slide title should state the strategic implication of the overlap pattern, not just describe the diagram

For more frameworks that pair well with Venn diagrams in strategy presentations, see our Strategic Frameworks Guide and How to Create Org Chart in PowerPoint.

Build consulting slides in seconds

Describe what you need. AI generates structured, polished slides — charts and visuals included.

Try Free