Free Market Trends PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Identify 3-5 new market entrants or disruptors

- 2Document recent M&A activity with buyer, target, and deal value

- 3List 4-6 impactful trends reshaping the market

- 4Add company logos or placeholders for visual recognition

- 5Include total deal value as a headline metric

- 6Write a title that synthesizes what trends mean for strategy

When to Use This Template

- Quarterly board updates

- Strategic planning sessions

- Investment due diligence

- Competitive intelligence briefings

- Market entry analysis

- Annual industry reviews

Common Mistakes to Avoid

- Listing trends without assessing strategic impact

- Missing recent M&A that reshapes competitive dynamics

- Treating all trends as equally important

- No connection between trends and recommended action

- Outdated information in fast-moving markets

Use This Template in PowerPoint

Get the Market Trends Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Market Trends Template FAQs

Common questions about the market trends template

Related Templates

Tracking the Forces Reshaping Your Market

Markets don't stand still. New entrants emerge with disruptive models. Incumbents acquire competitors or adjacent players. Technological shifts change how value is created and captured. Understanding these trends is essential for strategic planning, investment decisions, and competitive positioning.

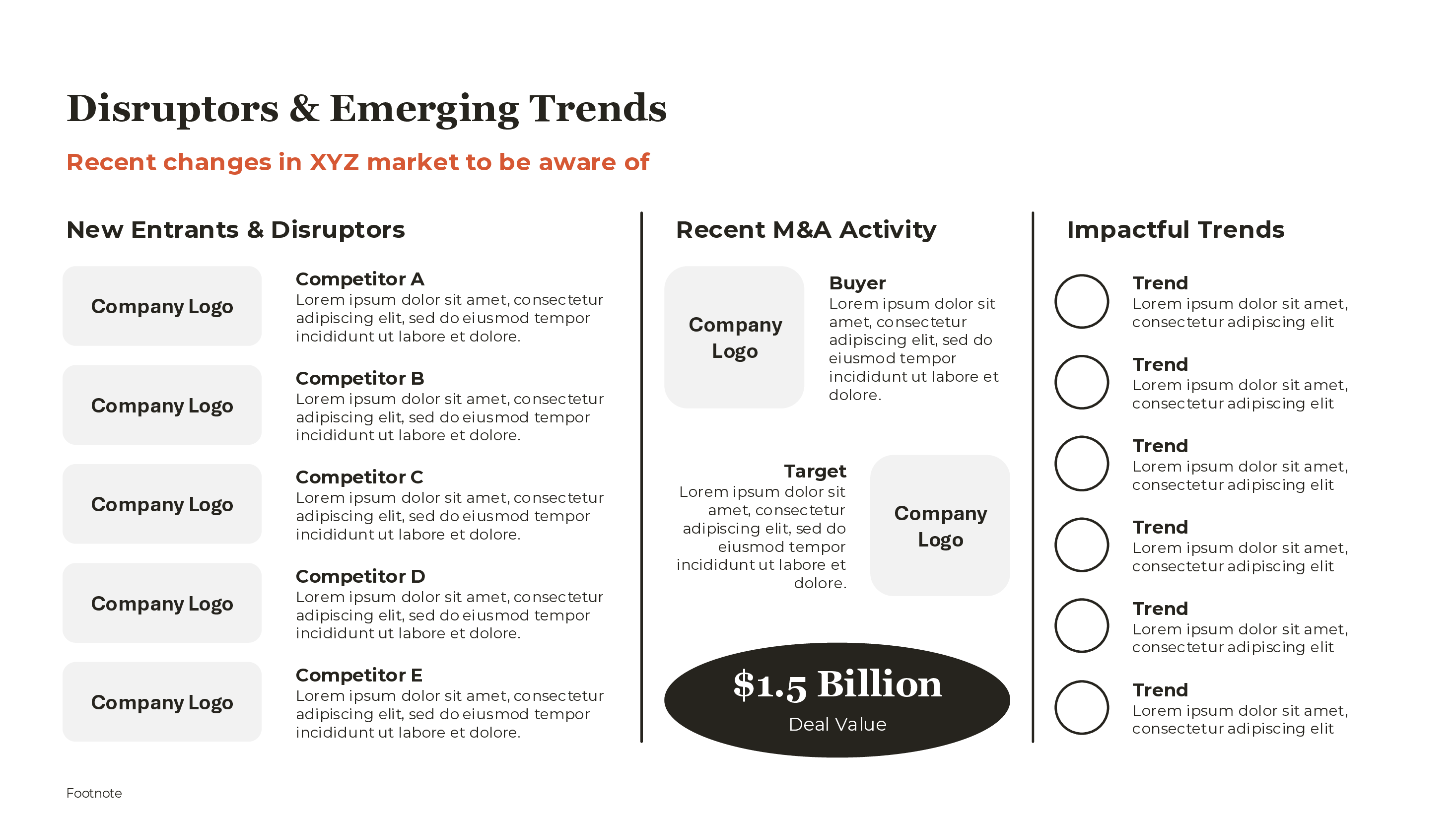

Our market trends template organizes this intelligence into three sections: new entrants and disruptors who are changing competitive dynamics, recent M&A activity that reshapes the industry landscape, and emerging trends that will define the market's future direction.

New Entrants and Disruptors

The left section of the template focuses on companies entering or reshaping the market. These aren't just new competitors; they're players whose approach challenges existing ways of doing business.

What to include:

- Company name and logo

- Brief description of their approach or model

- What makes them disruptive (pricing, technology, business model)

- Recent traction or funding that signals momentum

Examples of disruptors:

- A startup applying AI to automate a traditionally service-based process

- A large tech company entering an adjacent market with established infrastructure

- An international player expanding into your geography

- A new business model (marketplace, subscription, freemium) in a traditional market

The goal is not to list every new competitor but to highlight those whose success would materially change the competitive landscape.

M&A Activity Section

The center section tracks mergers and acquisitions that signal where the market is heading. M&A activity reveals strategic intent; when companies acquire, they're betting on where value will shift.

Structure each deal as:

- Buyer: The acquiring company

- Target: The company being acquired

- Deal value: If disclosed (indicate "undisclosed" if not)

- Strategic rationale: Why this deal matters (1-2 sentences)

Look for patterns:

- Consolidation: Multiple acquisitions by the same player building scale

- Vertical integration: Companies acquiring up or down the value chain

- Capability acquisition: Acqui-hires or technology purchases

- Geographic expansion: International players buying local presence

- Defensive moves: Incumbents acquiring potential disruptors

A summary metric ("$1.5B in disclosed deal value, 2024") provides headline context for M&A intensity.

Impactful Trends

The right section lists the broader trends reshaping market dynamics. These go beyond individual company moves to identify the forces affecting all players.

Effective trend descriptions:

- Are specific enough to be actionable

- Include evidence or data points

- Connect to strategic implications

Strong trend examples:

- "AI-powered automation reducing service delivery costs by 40-60%"

- "Enterprise buyers consolidating vendors from 12 to 3-4 strategic partners"

- "Subscription models displacing perpetual licenses across the category"

- "ESG requirements becoming procurement criteria for Fortune 500 buyers"

Weak trend examples:

- "Digital transformation" (too vague)

- "Technology is changing things" (obvious)

- "Competition is increasing" (generic)

Each trend should pass the "so what" test: If this trend continues, what does it mean for strategy?

Connecting Trends to Strategy

A market trends slide that simply lists developments without connecting to strategic implications is incomplete. The slide should answer: "What do these trends mean for us?"

Integration approaches:

- Title synthesis: The slide title states the strategic implication of combined trends

- Callout box: A "What this means" box summarizes implications

- Follow-up slide: The trends slide sets up a strategy response slide

Example title synthesis: Instead of "Market Trends" or "Industry Developments":

- "Recent changes in XYZ market to be aware of"

- "Consolidation and AI disruption create urgency for platform investment"

- "Three well-funded entrants threaten pricing stability in core segment"

Sources for Market Intelligence

Quality market trends slides require quality intelligence. Here's where to find it:

For new entrants and disruptors:

- Crunchbase, PitchBook for funding announcements

- TechCrunch, industry trade publications for startup coverage

- LinkedIn for hiring patterns that signal strategic priorities

- Product launches and feature announcements

For M&A activity:

- PitchBook, Mergermarket for deal data

- Company press releases and investor communications

- Industry analyst commentary on deal rationale

- Regulatory filings for deal terms and conditions

For emerging trends:

- Industry analyst reports (Gartner, Forrester, IDC)

- Conference presentations and keynotes

- Expert interviews and podcasts

- Customer conversations about changing needs

Update frequency:

- Fast-moving markets (tech, healthcare): Monthly monitoring, quarterly updates

- Stable industries (utilities, heavy manufacturing): Quarterly monitoring, semi-annual updates

- Major developments: Immediate updates regardless of schedule

Visual Design Principles

Three-column layout: Divide the slide into disruptors (left), M&A (center), and trends (right). This creates clear visual separation between different types of intelligence.

Company cards: Use consistent card layouts for disruptors and M&A parties. Include placeholder boxes for logos when images aren't available; empty logo spaces look better than inconsistent formatting.

Icon consistency: If using icons for trends, maintain consistent style and sizing. Random icon styles distract from content.

Deal value prominence: If M&A values are significant, feature the total as a headline callout. "$2.3B in announced deals" immediately signals market intensity.

Common Analytical Mistakes

Recency bias: Focusing only on the last quarter's developments while missing longer-term trends that matter more strategically.

Completeness over relevance: Listing every small acquisition when only the significant ones reshape competitive dynamics.

Missing the pattern: Presenting individual data points without synthesizing what they collectively mean.

No strategic connection: Documenting trends without explaining what they mean for the organization's strategy.

Outdated intelligence: Presenting six-month-old trends in fast-moving markets where the landscape has already shifted.

When Market Trends Matter Most

Board meetings: Directors want to know what's changing in the competitive environment. Market trends slides provide context for strategic discussions.

Strategic planning: Annual planning should start with "what's different now" before moving to strategy. Trends set that context.

Investment decisions: Whether evaluating acquisitions, new products, or market entry, understanding trends informs risk assessment.

Competitive response: When a significant development occurs (major acquisition, well-funded entrant), leadership needs rapid briefing on implications.

The market trends template serves all these contexts by providing a structured, comprehensive view of how the competitive landscape is evolving.

For frameworks that complement trend analysis, see our PESTLE Analysis Examples and Competitive Analysis Examples.

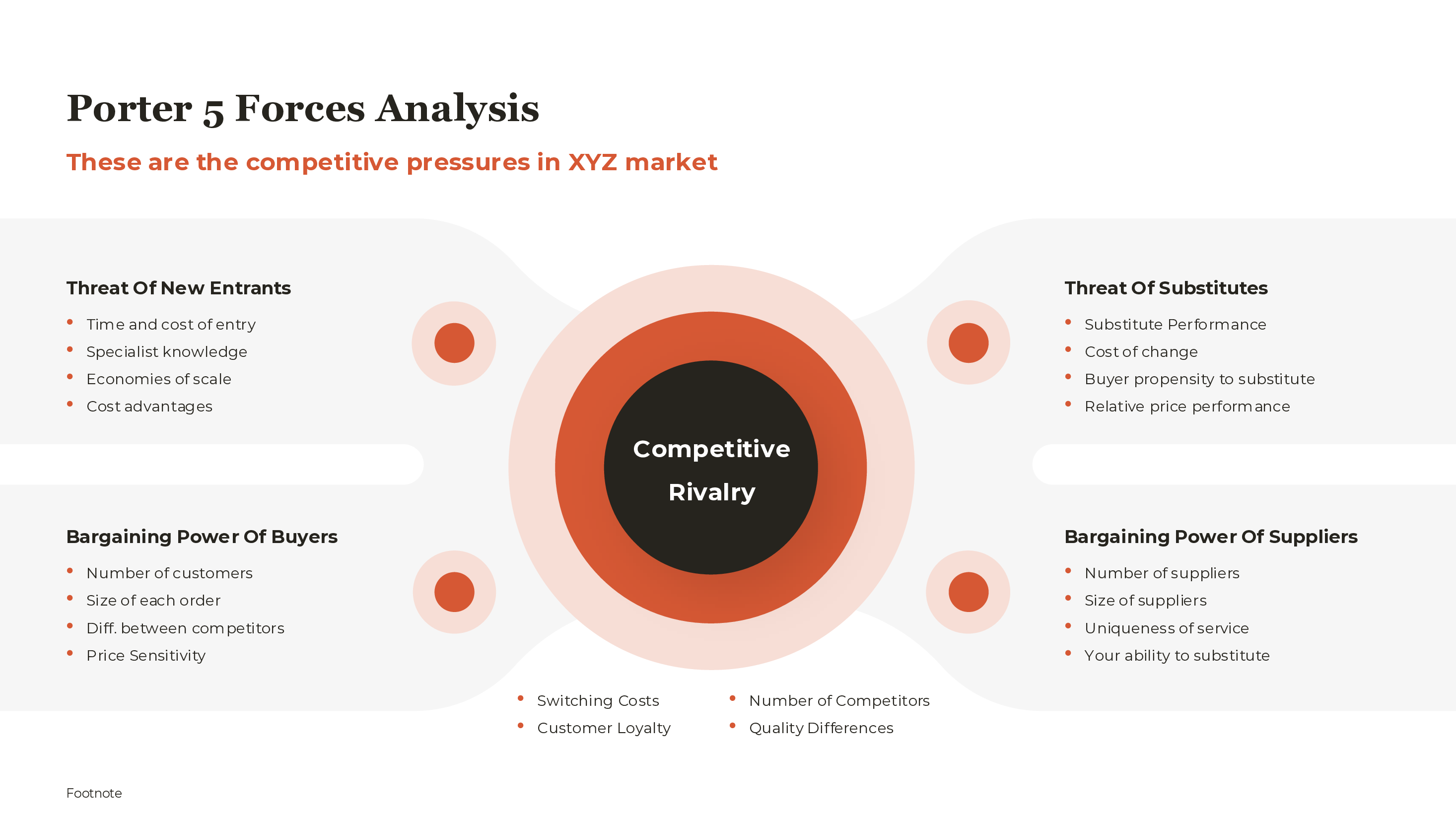

For related competitive intelligence templates, see our competitive analysis template, Porter's Five Forces template, and PESTLE analysis template. Deckary's AI Slide Builder can generate market analysis slides from a description of your industry.