Free McKinsey 3 Horizons PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Define time horizons appropriate to your industry

- 2Place current core business in Horizon 1

- 3Identify emerging opportunities for Horizon 2

- 4Plot future bets and innovations in Horizon 3

- 5Show resource allocation across horizons

- 6Write action title stating portfolio balance recommendation

When to Use This Template

- Corporate strategy presentations

- Annual planning sessions

- Innovation portfolio reviews

- Board strategy discussions

- M&A strategy planning

- Digital transformation roadmaps

Common Mistakes to Avoid

- Neglecting Horizon 1 while chasing Horizon 3

- Using fixed time periods across all industries

- Treating horizons as sequential rather than parallel

- Failing to resource all three horizons

- Not updating horizon placement as markets evolve

Use This Template in PowerPoint

Get the McKinsey 3 Horizons Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

McKinsey 3 Horizons Template FAQs

Common questions about the mckinsey 3 horizons template

Related Templates

Strategic Growth with McKinsey's 3 Horizons

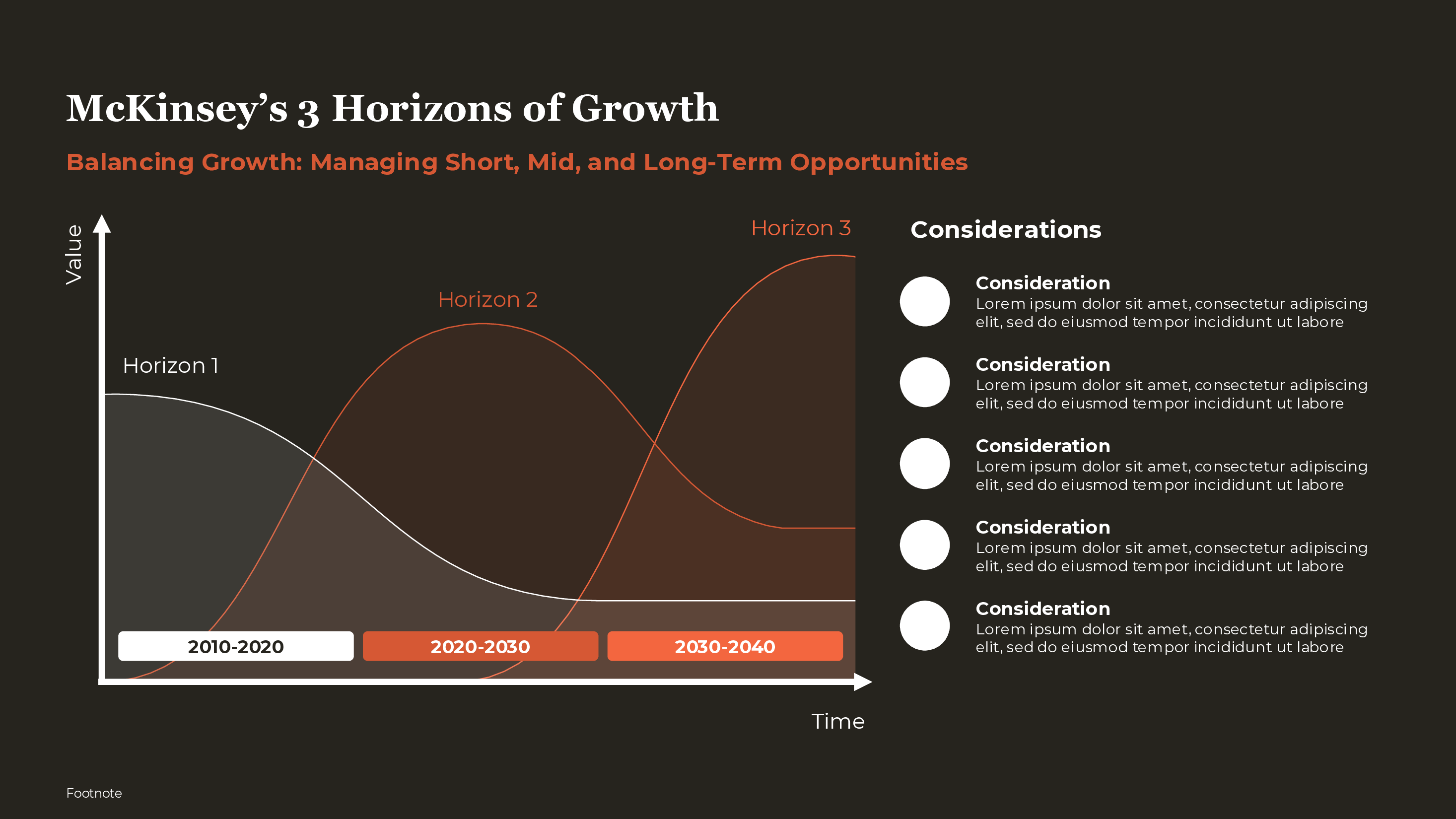

Every company faces the same fundamental tension: performing today while preparing for tomorrow. The businesses generating current profits will eventually mature or decline. The innovations that will drive future growth need investment before they're profitable. McKinsey's 3 Horizons framework provides a structure for managing this tension systematically.

Developed by Mehrdad Baghai, Stephen Coley, and David White in "The Alchemy of Growth," the framework has become a standard tool in corporate strategy. It visualizes growth opportunities as three overlapping S-curves, each representing a different time horizon and maturity level.

Understanding the Three Horizons

Horizon 1: Defend and Extend the Core

Horizon 1 contains your current core business—the products, services, and markets generating today's revenue and profit. These businesses are mature, with established operations, known competitors, and predictable economics.

Strategic focus in Horizon 1: operational excellence, incremental improvement, market share defense, and margin optimization. The goal is to maximize cash generation while the business remains healthy.

Horizon 1 businesses eventually decline. Technology shifts, market preferences change, new competitors emerge. The S-curve flattens and begins to drop. This isn't failure; it's the natural lifecycle of any business. The question is whether Horizon 2 businesses are ready to take over.

Horizon 2: Build Emerging Businesses

Horizon 2 contains businesses that are past the experimental stage but not yet mature. They have proven product-market fit, demonstrated growth potential, and require investment to scale. These are tomorrow's Horizon 1 businesses.

Strategic focus in Horizon 2: scaling operations, capturing market share, building competitive moats, and proving unit economics. The goal is to grow these businesses to the point where they can eventually replace declining Horizon 1 revenues.

Horizon 2 is where execution separates winners from also-rans. The opportunity is validated; the question is whether you can capture it at scale before competitors do.

Horizon 3: Create Options for the Future

Horizon 3 contains early-stage initiatives, experiments, and emerging opportunities. These are bets on possible futures—some will succeed, most will fail. The portfolio approach is essential.

Strategic focus in Horizon 3: exploration, experimentation, learning, and option creation. The goal isn't profit; it's developing the understanding and capabilities that might become Horizon 2 businesses.

Horizon 3 requires different management approaches than the core business. Traditional ROI metrics don't apply to experiments. Success is measured by learning velocity and option value, not quarterly returns.

The S-Curve Visualization

The framework visualizes each horizon as an S-curve showing growth over time:

- Horizon 1 curve: Mature, possibly plateauing or declining

- Horizon 2 curve: Rising steeply through growth phase

- Horizon 3 curve: Early stage, just beginning to emerge

The curves overlap. As Horizon 1 declines, Horizon 2 should be growing to replace it. As Horizon 2 matures into the new Horizon 1, former Horizon 3 bets should be scaling into the new Horizon 2.

Companies that manage all three horizons simultaneously maintain continuous growth. Companies that focus only on Horizon 1 eventually face a growth cliff when the core business declines with nothing ready to replace it.

Setting Time Horizons

The framework's horizons are defined by business maturity, not calendar time. Different industries move at different speeds:

Fast-moving industries (tech, digital media):

- Horizon 1: 0-12 months

- Horizon 2: 12-36 months

- Horizon 3: 3-5 years

Moderate-pace industries (consumer goods, financial services):

- Horizon 1: 0-2 years

- Horizon 2: 2-5 years

- Horizon 3: 5-10 years

Slow-moving industries (utilities, infrastructure, heavy manufacturing):

- Horizon 1: 0-5 years

- Horizon 2: 5-10 years

- Horizon 3: 10-20 years

Set horizons based on how quickly your industry changes, not arbitrary calendar periods. In crypto or AI, a 5-year Horizon 3 might be too conservative; in nuclear energy, it might be too aggressive.

Resource Allocation Across Horizons

The classic allocation guideline is 70-20-10:

- 70% of resources to Horizon 1 (core business)

- 20% of resources to Horizon 2 (emerging businesses)

- 10% of resources to Horizon 3 (future bets)

This is a starting point, not a prescription. Adjust based on:

Competitive pressure: If your core business faces disruption, shift more resources to Horizons 2-3.

Market maturity: In mature industries with stable Horizon 1, you can afford patient Horizon 3 investment. In rapidly evolving markets, you need faster cycling.

Risk tolerance: Conservative organizations weight toward Horizon 1. Growth-oriented organizations accept Horizon 3 failure rates in exchange for breakthrough potential.

Current portfolio health: If Horizon 2 pipeline is empty, that's an urgent problem requiring immediate attention regardless of theoretical allocation.

Managing Each Horizon Differently

Each horizon requires different management approaches:

Horizon 1 Management:

- Tight operational metrics

- Efficiency and margin focus

- Incremental innovation

- Traditional planning cycles

- Experienced operators

Horizon 2 Management:

- Growth metrics (revenue, market share)

- Scaling playbooks

- Competitive positioning

- Milestone-based funding

- Entrepreneurial leaders with scaling experience

Horizon 3 Management:

- Learning metrics (experiments run, hypotheses tested)

- Portfolio approach (expect failures)

- Exploration over execution

- Small, fast teams

- Entrepreneurs and intrapreneurs

Applying Horizon 1 management to Horizon 3 kills innovation. Applying Horizon 3 management to Horizon 1 destroys operational excellence. Match management approach to horizon.

Common Pitfalls

Horizon 1 addiction: Over-investing in the core while starving future growth. Feels safe but creates a growth cliff.

Horizon 3 theater: Funding innovation labs that produce demos but never graduate to Horizon 2. Innovation without commercialization path is waste.

Horizon 2 neglect: The hardest horizon to manage. Not as exciting as Horizon 3, not as profitable as Horizon 1. But scaling emerging businesses is where growth actually happens.

Static thinking: Horizons shift over time. Today's Horizon 3 becomes tomorrow's Horizon 2 becomes next year's Horizon 1. The framework requires continuous updating, not annual review.

Presenting the 3 Horizons

Use the overlapping S-curve visualization to show:

- Current state of each horizon (where each curve is today)

- Key initiatives in each horizon

- Resource allocation across horizons

- Required investments or decisions

The action title should state the strategic recommendation: "Accelerate Horizon 2 scaling to offset Horizon 1 margin pressure" or "Current portfolio imbalanced—increase Horizon 3 investment to build future options."

For related strategic frameworks, see our Ansoff matrix template for growth direction options, BCG matrix template for portfolio analysis, and strategic pillars template for strategy communication.