Free Stock Performance Dashboard PowerPoint Template

Part of our 143 template library. Install the free add-in to use it directly in PowerPoint.

What's Included

How to Use This Template

- 1Input your stock price data into the line chart

- 2Mark 2-4 key events that explain price movements

- 3Update KPI boxes with current metrics

- 4Add event descriptions explaining the business drivers

- 5Customize date range to match reporting period

- 6Include source footnote for data credibility

When to Use This Template

- Quarterly earnings presentations

- Annual shareholder meetings

- Investor relations updates

- Board of directors briefings

- IPO roadshow materials

- Equity research reports

Common Mistakes to Avoid

- Showing stock price without explaining key movements

- Using too short or too long a time horizon

- Missing comparison to market index or peers

- Forgetting to include the reporting currency

- Cluttering the chart with too many annotations

Use This Template in PowerPoint

Get the Stock Performance Dashboard Template and 142 other consulting-grade templates with the free Deckary add-in.

Get Started FreeFree plan available. No credit card required.

Stock Performance Dashboard Template FAQs

Common questions about the stock performance dashboard template

Related Templates

Connecting Stock Price to Business Performance

A stock performance dashboard transforms share price movements into a business narrative. Investors want more than a line chart—they want to understand what drove the price up or down. An annotated stock chart connects financial performance to the strategic decisions that created it.

Our stock performance dashboard template provides an investor-ready layout combining a time series line chart with annotated events and supporting KPIs. The dark theme ensures the chart is the visual focal point while the event callouts tell the story behind the numbers.

The Anatomy of an Effective Stock Dashboard

The line chart: The centerpiece displays stock price over your chosen time period. Use a clean line style—avoid area fills or multiple overlapping series that obscure the trend. Include Y-axis price labels and X-axis time markers at appropriate intervals.

Event annotations: Vertical markers on the chart connect specific dates to business events. These explain why the price moved, not just that it moved. Number each event and link it to a description panel.

Event descriptions: Adjacent to the chart, explain each annotated event with a brief narrative. Include the date, event name, and price impact. Keep descriptions to 2-3 sentences—enough to explain causation without overwhelming.

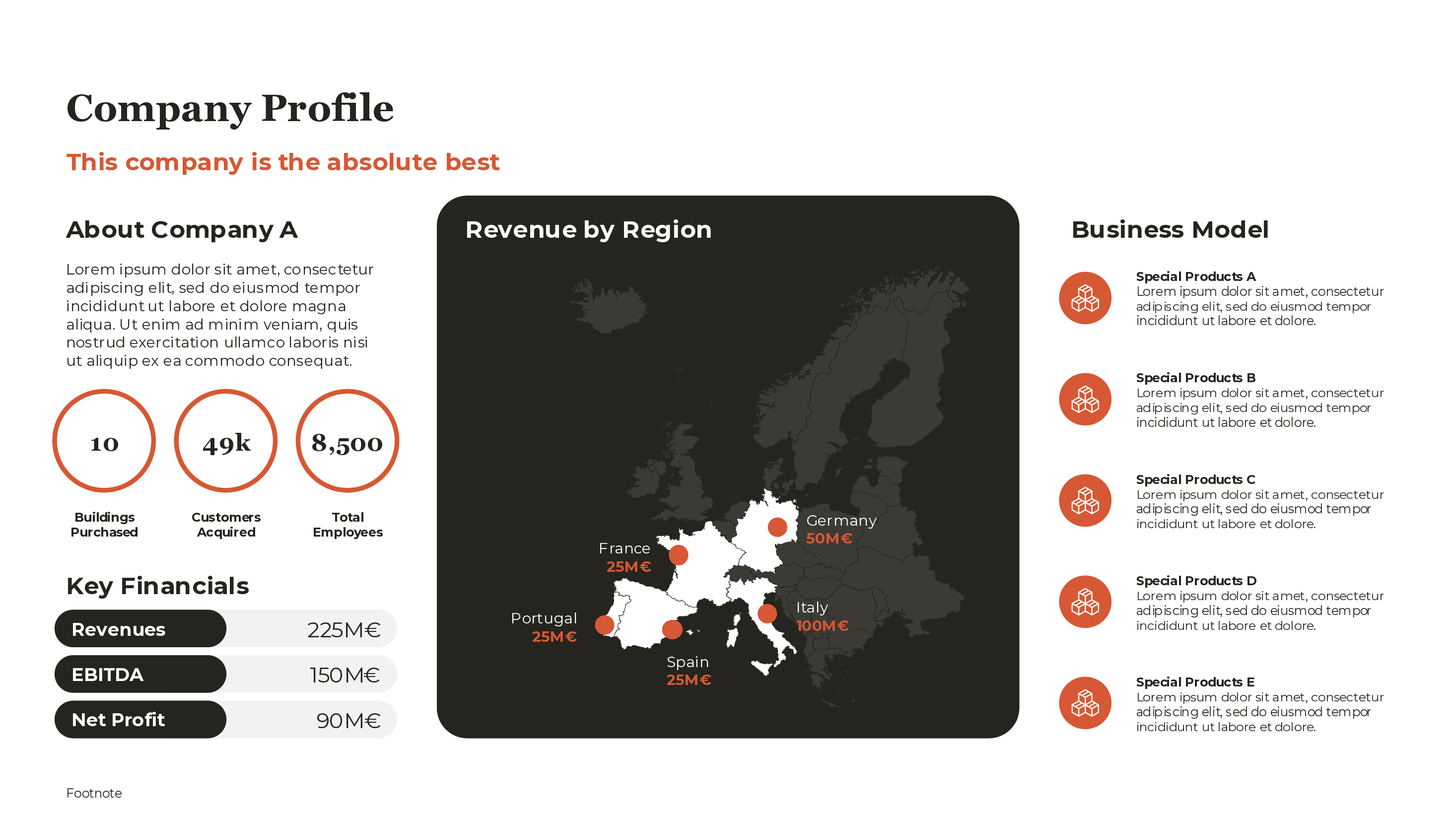

KPI boxes: Below the chart, display key metrics that give context to the stock price. Standard metrics include closing price, 52-week range, annual return, trading volume, and a valuation ratio.

Selecting Events to Annotate

Not every price movement deserves annotation. Focus on material events where management decisions drove stock performance.

Good candidates for annotation:

- Major product launches or announcements

- Acquisition or divestiture announcements

- Earnings surprises (beat or miss)

- Leadership changes (CEO, CFO)

- Regulatory approvals or setbacks

- Strategic partnerships or contract wins

Avoid annotating:

- Market-wide movements (unless you significantly outperformed)

- Minor fluctuations within normal trading range

- Events outside management control (unless explaining underperformance)

The goal is to demonstrate that management understands what drives shareholder value—and is actively managing toward it.

Providing Honest Context

Sophisticated investors expect honest context, not cheerleading. If your stock underperformed the market, acknowledge it and explain why. Attempting to hide poor performance by truncating the time axis or omitting comparisons damages credibility.

Include when relevant:

- Comparison to sector index (S&P 500, industry ETF)

- Note on overall market conditions during the period

- Acknowledgment of underperformance with remediation plans

- Forward-looking catalysts that may improve performance

Transparency builds trust. Investors assume you will present favorable information; they value management teams that also address challenges directly.

KPI Selection for Investor Audiences

The KPI boxes below your chart should answer the questions investors care about. Standard metrics for public company presentations include:

Current price: The most recent closing price, clearly labeled with the as-of date.

52-week range: Shows where current price sits relative to annual trading range. Investors use this to gauge whether the stock looks "cheap" or "expensive" relative to recent history.

Annual return: Year-to-date or trailing twelve-month return expressed as a percentage. Include comparison to relevant index if favorable.

Trading volume: Average daily trading volume indicates liquidity. Important for institutional investors who need to enter or exit large positions.

Valuation ratio: P/E ratio is most common, but growth companies may use EV/Revenue or EV/EBITDA. Include the comparison to sector average if you trade at a premium or discount worth explaining.

Market capitalization: Helps position the company within peer group and indicates which investor segments might be interested.

Design Best Practices

Dark theme for financial data: Financial presentations often use dark backgrounds because they reduce eye strain during long meetings and make data visualization pop. The template uses a dark theme optimized for conference room projection.

Consistent color coding: Use a consistent accent color for positive movements and a contrasting color for negative ones. The template uses warm orange tones that work well on dark backgrounds.

Clean typography: Stock data demands precision. Use consistent decimal places, clear currency symbols, and adequate spacing between KPI boxes.

Source attribution: Include a footnote citing your data source (company filings, Bloomberg, Yahoo Finance). This is expected in investor presentations and adds credibility.

Adapting for Different Audiences

Board of directors: Focus on long-term performance (3-5 year view), strategic drivers, and comparison to industry peers. Board members want big-picture context.

Quarterly earnings calls: Show trailing 12 months with focus on events in the most recent quarter. Analysts will ask about specific price movements—be prepared.

IPO roadshows: Show the historical private valuation trajectory leading to IPO pricing, then projected public company metrics. Different data but similar structure.

Internal communications: Employees care about stock performance if they have equity compensation. Include how this translates to their holdings.

For more financial presentation templates, see our KPI dashboard template and executive summary template. Deckary's AI Slide Builder can generate financial dashboard layouts from a description of your metrics.